13 minute read

Is forex trading profitable in Kenya? A Comprehensive Guide

from Exness Global

Forex trading has gained significant traction in Kenya over the past decade, attracting thousands of individuals eager to explore the potential of the global currency markets. With the promise of financial freedom and the rise of online trading platforms, many Kenyans are asking: Is forex trading profitable in Kenya? The answer isn’t straightforward—it depends on knowledge, strategy, discipline, and market conditions. In this in-depth guide, we’ll explore the profitability of forex trading in Kenya, the opportunities it presents, the risks involved, and practical steps to succeed in this dynamic financial market.

Top 4 Best Forex Brokers in Kenya

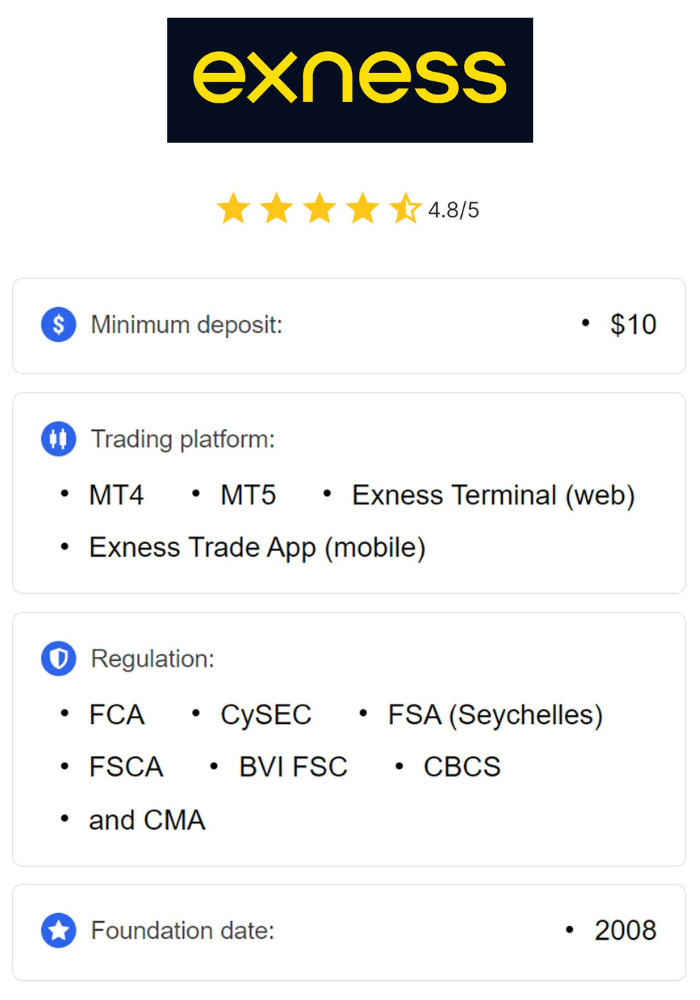

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

What is Forex Trading?

Forex, short for foreign exchange, involves trading one currency for another in the global marketplace. For example, you might buy US dollars (USD) with Kenyan shillings (KES) or trade the euro (EUR) against the Japanese yen (JPY). The forex market is the largest financial market in the world, with a daily trading volume exceeding $7 trillion, according to the Bank for International Settlements (2022).

In Kenya, forex trading has become accessible thanks to internet penetration, affordable smartphones, and the rise of online brokers. Kenyans can trade forex pairs like USD/KES, EUR/USD, or GBP/JPY from the comfort of their homes using platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

Why Forex Trading Appeals to Kenyans

Several factors make forex trading attractive in Kenya:

· Low Entry Barriers: You can start trading with as little as $10, depending on the broker.

· 24/5 Market Access: The forex market operates 24 hours a day, five days a week, allowing flexibility for traders with busy schedules.

· High Liquidity: Major currency pairs have high liquidity, meaning you can buy and sell without significant price delays.

· Leverage Opportunities: Brokers offer leverage, enabling traders to control larger positions with smaller capital (though this increases risk).

· Economic Potential: With Kenya’s growing economy and increasing financial literacy, forex trading offers a way to diversify income streams.

However, profitability depends on more than just market access—it requires education, discipline, and a clear strategy.

The Profit Potential of Forex Trading in Kenya

So, is forex trading profitable in Kenya? Let’s break it down by examining the factors that influence profitability.

1. Success Stories in Kenya

Kenya has produced several successful forex traders who’ve turned modest investments into significant returns. For example, traders like Silas Nyakundi and Esther Mofwo have shared their journeys online, inspiring others. These traders often emphasize the importance of learning technical analysis, risk management, and staying updated on global economic events.

While these stories are motivating, they represent a small percentage of traders. According to industry data, only about 10-20% of forex traders consistently make profits, while the majority either break even or lose money. Success in Kenya is possible but not guaranteed.

2. Leverage and High Returns

Forex brokers in Kenya often offer leverage, which allows traders to amplify their positions. For instance, with a 1:100 leverage, a $100 deposit can control a $10,000 position. If the market moves in your favor by 1%, you could earn $100—a 100% return on your initial investment.

However, leverage is a double-edged sword. A 1% move against you could wipe out your account if not managed properly. Profitable traders in Kenya use leverage cautiously, often sticking to ratios like 1:10 or 1:20 to minimize risk.

3. Scalability

Unlike traditional businesses, forex trading allows you to scale your income as your skills and capital grow. A trader who masters strategies like scalping, swing trading, or position trading can increase their lot sizes and trade frequency, potentially earning thousands of shillings daily. However, scalability requires consistent profitability, which takes time to achieve.

4. Passive Income Potential

For Kenyans with full-time jobs or businesses, forex trading can serve as a side hustle. Automated trading systems, known as Expert Advisors (EAs), allow traders to set rules for buying and selling, reducing the need for constant monitoring. While EAs aren’t foolproof, they offer a way to generate passive income if programmed correctly.

Challenges to Profitability in Kenya

Despite its potential, forex trading in Kenya comes with significant challenges that can hinder profitability.

1. Lack of Education

Many Kenyan traders enter the market with little knowledge, lured by promises of quick riches. Without understanding concepts like pip movement, candlestick patterns, or risk-reward ratios, beginners often lose money. A 2021 study by the Capital Markets Authority (CMA) found that over 60% of Kenyan retail traders lacked formal forex training.

2. High Risk of Loss

Forex trading is inherently risky. Currency prices are influenced by unpredictable factors like interest rate changes, geopolitical events, and economic data releases. For example, a US Federal Reserve rate hike could strengthen the USD, impacting USD/KES trades. Without proper risk management, traders can lose their entire capital.

3. Scams and Unregulated Brokers

The rise of forex trading in Kenya has attracted unscrupulous brokers and Ponzi schemes promising guaranteed returns. In 2023, the CMA warned against unlicensed platforms targeting Kenyans. Always verify that a broker is regulated by reputable bodies like the CMA, FCA (UK), or ASIC (Australia) before depositing funds.

4. Emotional Trading

Fear and greed often lead to poor decisions, such as chasing losses or overtrading after a win. Profitable traders in Kenya emphasize discipline, sticking to a trading plan even during volatile markets.

5. Limited Capital

Many Kenyans start with small accounts, which can limit profitability. While it’s possible to grow a $10 account, it requires exceptional skill and patience. Larger accounts provide more flexibility to absorb losses and trade conservatively.

How to Make Forex Trading Profitable in Kenya

Profitability in forex trading isn’t about luck—it’s about preparation and execution. Here’s a step-by-step guide to improve your chances of success.

1. Get Educated

Invest time in learning the basics of forex trading. Key topics include:

· Technical Analysis: Study chart patterns, indicators (e.g., RSI, MACD), and support/resistance levels.

· Fundamental Analysis: Understand how economic events like inflation reports or central bank policies affect currencies.

· Risk Management: Learn to set stop-loss orders, calculate position sizes, and maintain a risk-reward ratio of at least 1:2.

Free resources like Babypips.com, YouTube channels (e.g., The Trading Channel), and local forex communities in Nairobi and Mombasa are excellent starting points. Some brokers also offer demo accounts to practice without risking real money.

2. Choose a Reputable Broker

Selecting the right broker is critical. Look for:

· Regulation: Ensure the broker is licensed by the CMA or international regulators.

· Low Spreads: Tight spreads on major pairs like EUR/USD reduce trading costs.

· Fast Execution: Reliable platforms prevent slippage during volatile markets.

· Local Support: Brokers like Exness, XM, and HotForex offer Kenyan bank deposits and M-Pesa withdrawals, making transactions seamless.

Popular brokers in Kenya for 2025 include:

· Exness: Known for low spreads and fast withdrawals.

· XM: Offers bonuses and educational webinars.

· FBS: Beginner-friendly with micro accounts.

Always read reviews and test a broker’s demo account before committing funds.

💥 Trade with Exness now: Open An Account or Visit Brokers

3. Develop a Trading Plan

A trading plan outlines your goals, risk tolerance, and strategies. For example:

· Goal: Earn 5% monthly returns.

· Risk: Risk no more than 1% of your account per trade.

· Strategy: Trade breakouts on the 1-hour chart using the 200-period moving average.

Test your plan on a demo account for at least three months to ensure consistency before trading live.

4. Master Risk Management

Risk management separates profitable traders from gamblers. Key practices include:

· Position Sizing: Calculate lot sizes based on your account balance and stop-loss distance.

· Stop-Loss Orders: Always set a stop-loss to limit losses if the market moves against you.

· Diversification: Avoid putting all your capital into one trade or currency pair.

For example, if you have a $100 account and risk 1% per trade, your maximum loss per trade is $1. This approach preserves your capital during losing streaks.

5. Stay Disciplined

Discipline is the backbone of profitability. Avoid:

· Overtrading: Stick to your plan and avoid impulsive trades.

· Revenge Trading: Don’t chase losses by increasing your position size.

· Ignoring News: Monitor economic calendars to avoid trading during high-impact events like US Non-Farm Payrolls.

Journaling your trades can help identify mistakes and reinforce good habits.

6. Leverage Technology

Modern forex trading relies on technology. Use tools like:

· TradingView: For advanced charting and technical analysis.

· Economic Calendars: Websites like ForexFactory.com provide real-time updates on market-moving events.

· Mobile Apps: Monitor trades on the go with apps like MT4 or cTrader.

Automated trading systems can also enhance efficiency, but ensure you understand their logic before using them.

7. Join a Community

Kenya has vibrant forex trading communities on platforms like Telegram, WhatsApp, and X. Groups like Kenya Forex Firm and Nairobi School of Forex offer mentorship, signals, and networking opportunities. Engaging with experienced traders can accelerate your learning curve.

The Role of Regulation in Kenya

The Capital Markets Authority (CMA) regulates forex trading in Kenya, ensuring consumer protection and market integrity. In 2017, the CMA introduced licensing requirements for online forex brokers, reducing the prevalence of scams. By 2025, the CMA continues to crack down on unregulated platforms, making it safer for Kenyans to trade.

When choosing a broker, verify its CMA license or check for oversight from tier-1 regulators like the FCA or CySEC. Regulated brokers are required to segregate client funds, provide transparent pricing, and offer dispute resolution mechanisms.

Common Forex Trading Strategies for Kenyans

To maximize profitability, adopt a strategy that suits your personality and schedule. Here are three popular approaches:

1. Scalping

Scalping involves making multiple trades daily to capture small price movements (e.g., 5-10 pips per trade). It’s ideal for traders with time to monitor charts actively. Scalpers in Kenya often focus on low-spread pairs like EUR/USD during the London-New York session overlap (11 AM–3 PM EAT).

Pros: Quick profits, high trade frequency.Cons: Requires focus, incurs higher transaction costs.

2. Swing Trading

Swing traders hold positions for days or weeks, aiming to profit from larger price swings. This strategy suits Kenyans with limited time, as it requires less screen time. Popular tools include Fibonacci retracements and trendlines.

Pros: Less time-intensive, captures bigger moves.Cons: Overnight risks from news events.

3. Day Trading

Day traders open and close positions within the same day, avoiding overnight exposure. They use 15-minute or 1-hour charts to identify intraday trends. This approach works well for volatile pairs like GBP/JPY.

Pros: No overnight risk, clear daily goals.Cons: Demands focus and fast decision-making.

Experiment with these strategies on a demo account to find what works best for you.

Economic Factors Affecting Forex Trading in Kenya

Kenya’s economic landscape influences forex profitability. Key factors include:

1. Kenyan Shilling (KES) Volatility

The KES is subject to fluctuations based on inflation, government policies, and export performance (e.g., tea, coffee). For example, a strong US dollar due to Federal Reserve tightening can weaken the KES, impacting USD/KES trades. Traders must monitor Kenya’s Central Bank (CBK) announcements for insights.

2. Global Market Trends

Major economies like the US, EU, and China drive forex markets. For instance, a US recession could weaken the USD, affecting pairs like EUR/USD. Kenyan traders should follow global news via platforms like Bloomberg or Reuters.

3. Internet and Infrastructure

Reliable internet is crucial for forex trading. While Kenya’s internet penetration reached 83% in 2024 (Communications Authority of Kenya), rural traders may face connectivity issues. Urban centers like Nairobi and Mombasa offer better infrastructure for seamless trading.

Real-Life Example: A Kenyan Trader’s Journey

Let’s consider John, a 30-year-old Nairobi-based trader. In 2023, John started forex trading with $50 after attending a free seminar. He lost his initial capital due to overleveraging and lack of a plan. Determined to succeed, John spent six months learning technical analysis on Babypips and joined a local Telegram group. By 2024, he opened a $200 account with a CMA-regulated broker, risking 1% per trade. Using a swing trading strategy, John averaged 4% monthly returns, growing his account to $320 by early 2025.

John’s story highlights the importance of education, discipline, and realistic expectations. While he’s not a millionaire, his consistent profits prove that forex trading can be profitable in Kenya with the right approach.

Myths About Forex Trading in Kenya

Several misconceptions deter Kenyans from trading profitably. Let’s debunk them:

Myth 1: Forex is a Get-Rich-Quick Scheme

Forex trading requires time and effort. Overnight success is rare—most profitable traders spend years honing their skills.

Myth 2: You Need a Lot of Money to Start

While larger accounts offer flexibility, you can start with $10-$50 using micro accounts. The key is to grow your capital gradually.

Myth 3: Forex is Gambling

Unlike gambling, forex trading relies on analysis and strategy. Profitable traders treat it as a business, not a game of chance.

Myth 4: Signals Guarantee Profits

Paid signals or copy trading services often underperform. It’s better to develop your own skills than rely on others’ trades.

The Future of Forex Trading in Kenya

By 2025, forex trading in Kenya is poised for growth, driven by:

· Financial Inclusion: Mobile money platforms like M-Pesa make funding accounts easier.

· Youth Engagement: Kenya’s young population is tech-savvy and eager to explore alternative income sources.

· Regulatory Improvements: The CMA’s oversight ensures a safer trading environment.

· AI and Automation: Tools like AI-driven analysis and algorithmic trading are becoming accessible to retail traders.

However, challenges like scams and misinformation persist. Staying informed and cautious will be key to thriving in this evolving market.

Conclusion: Is Forex Trading Profitable in Kenya?

Forex trading can be profitable in Kenya, but it’s not a guaranteed path to wealth. Success depends on education, discipline, risk management, and choosing the right broker. While stories of Kenyan traders earning millions inspire hope, they’re the exception, not the rule. For every winner, many lose money due to lack of preparation or unrealistic expectations.

If you’re considering forex trading, start small, learn continuously, and treat it as a long-term journey. With the right mindset and tools, you can tap into the potential of the global currency markets and build a sustainable income stream from Kenya.

Ready to start? Open a demo account with a regulated broker, join a local forex community, and take the first step toward financial empowerment in 2025.

FAQs

1. How much money do I need to start forex trading in Kenya?You can start with as little as $10 using a micro account, though $100-$200 offers more flexibility.

2. Is forex trading legal in Kenya?Yes, forex trading is legal in Kenya, provided you use a broker regulated by the CMA or reputable international bodies.

3. Can I trade forex part-time in Kenya?Absolutely. Strategies like swing trading and automated systems suit part-time traders with busy schedules.

4. What are the best forex brokers in Kenya?Popular choices include Exness, XM, and FBS, known for low spreads and local payment options like M-Pesa.

5. How long does it take to become profitable?It varies, but most traders need 6-12 months of practice to achieve consistent profits.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: