8 minute read

How much can you make with $1000 in forex?

Forex trading, or foreign exchange trading, has become a popular way for individuals to potentially grow their wealth. With just $1,000, many aspiring traders wonder how much profit they can realistically make. The allure of forex lies in its high liquidity, 24/5 market availability, and the potential for leveraged gains. But how much can you actually make with $1,000 in forex? Is it enough to turn a small investment into a fortune, or is it merely a starting point for learning the ropes?

Top 4 Best Forex Brokers

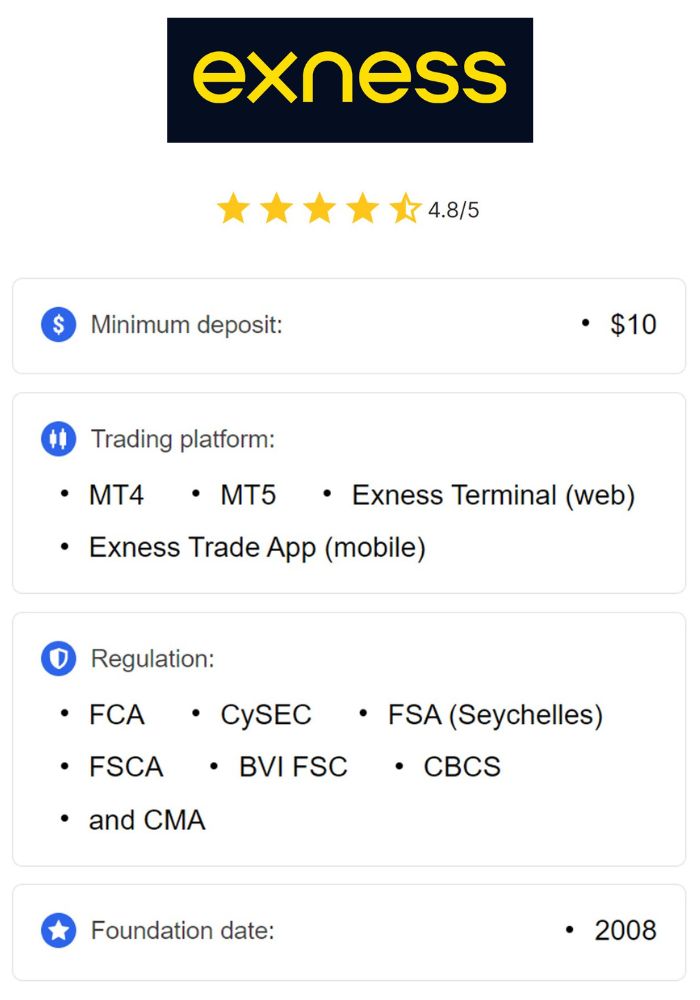

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

In this in-depth guide, we’ll explore the factors that determine your forex trading profits, realistic expectations for a $1,000 account, strategies to maximize returns, and the risks you need to manage. Whether you’re a beginner or an experienced trader looking to scale a small account, this article will provide actionable insights to help you succeed.

What Is Forex Trading, and Why Start with $1,000?

Forex trading involves buying and selling currency pairs (e.g., EUR/USD, GBP/JPY) to profit from fluctuations in exchange rates. It’s the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike stocks or real estate, forex offers low entry barriers, making it accessible to people with limited capital—like $1,000.

Starting with $1,000 is a practical choice for many. It’s enough to test strategies, use leverage, and learn the market without risking life savings. However, your earning potential depends on several variables: leverage, risk management, trading strategy, market conditions, and your skill level. Let’s break these down step-by-step to estimate how much you can make.

Key Factors That Determine Your Forex Profits with $1,000

Before diving into numbers, it’s crucial to understand the elements that shape your forex earnings. Here are the primary factors:

1. Leverage: Amplifying Your $1,000

Leverage allows you to control a larger position with a small amount of capital. For example, with 1:100 leverage, your $1,000 can control $100,000 in the market. This magnifies both profits and losses.

Example: If you trade EUR/USD with $100,000 (using 1:100 leverage) and the price moves 1% in your favor, you earn $1,000—doubling your initial investment in one trade.

Risk: A 1% move against you wipes out your $1,000.

Most brokers offer leverage from 1:10 to 1:500, depending on regulations (e.g., 1:30 in the EU, 1:50 in the US). Higher leverage increases potential returns but also risk.

2. Risk Management: Protecting Your Capital

Successful traders rarely risk more than 1-2% of their account per trade. With $1,000, that’s $10-$20 per trade. Proper risk management ensures you survive losing streaks and stay in the game long enough to profit.

3. Trading Strategy: Your Blueprint for Success

Your strategy dictates how often you trade, the size of your positions, and your win rate. Common approaches include:

Scalping: Small, frequent profits (e.g., 5-10 pips per trade).

Day Trading: Holding trades for hours within a day.

Swing Trading: Holding positions for days or weeks for larger gains (e.g., 50-200 pips).

A strategy with a high win rate and consistent gains can grow your $1,000 faster.

4. Market Volatility: Timing Matters

Forex markets fluctuate daily. Major pairs like EUR/USD might move 50-100 pips, while exotic pairs can swing 200+ pips. Your profits depend on catching these moves.

5. Skill and Experience

Beginners often lose money due to emotional decisions or lack of knowledge. Experienced traders with tested systems can compound gains over time.

Realistic Profit Scenarios with $1,000 in Forex

Now, let’s calculate how much you could make with $1,000 under different scenarios. These are estimates based on common trading conditions—no guarantees in forex!

Scenario 1: Conservative Trading (1% Monthly Gain)

Account Size: $1,000

Risk per Trade: 1% ($10)

Leverage: 1:10

Profit Target: 10 pips per trade

Trades per Month: 10 winning trades

Win Rate: 50%

With 1:10 leverage, $1,000 controls $10,000. A 10-pip move on a standard lot (1 pip = $1 with this leverage) earns $10 per trade. Ten winning trades net $100, but with a 50% win rate, you might break even or gain $10-$20 after losses. Over a year, compounding 1% monthly grows $1,000 to $1,126—a modest 12.6% return.

Scenario 2: Moderate Trading (5% Monthly Gain)

Account Size: $1,000

Risk per Trade: 2% ($20)

Leverage: 1:50

Profit Target: 20 pips per trade

Trades per Month: 15 winning trades

Win Rate: 60%

With 1:50 leverage, $1,000 controls $50,000. A 20-pip move earns $20 per trade. Fifteen winning trades net $300, and with a 60% win rate, you might clear $50-$100 after losses. Compounding 5% monthly turns $1,000 into $1,795 in a year—a solid 79.5% return.

Scenario 3: Aggressive Trading (10% Monthly Gain)

Account Size: $1,000

Risk per Trade: 5% ($50)

Leverage: 1:100

Profit Target: 50 pips per trade

Trades per Month: 10 winning trades

Win Rate: 70%

With 1:100 leverage, $1,000 controls $100,000. A 50-pip move earns $50 per trade. Ten winning trades net $500, and a 70% win rate could yield $100-$200 after losses. Compounding 10% monthly grows $1,000 to $3,138 in a year—a whopping 213.8% return.

Key Takeaway

Conservative: $100-$200 annual profit.

Moderate: $500-$1,000 annual profit.

Aggressive: $1,000-$2,000+ annual profit.

Aggressive trading offers higher rewards but risks blowing your account. Most professional traders aim for 5-10% monthly gains—ambitious yet achievable with discipline.

💥 Trade with Exness now: Open An Account or Visit Brokers

How to Maximize Your $1,000 in Forex: Proven Strategies

Turning $1,000 into a substantial sum requires a smart approach. Here are strategies to boost your profits:

1. Start with a Demo Account

Practice with virtual money to refine your strategy. Most brokers offer free demo accounts mirroring real market conditions.

2. Choose the Right Broker

Look for:

Low spreads (e.g., 0.1-1 pip on EUR/USD).

High leverage (if allowed in your region).

Regulation (e.g., FCA, ASIC, CFTC).

Popular options include XM, Pepperstone, and IC Markets.

3. Focus on Major Pairs

Trade liquid pairs like EUR/USD or USD/JPY. They have tighter spreads and predictable movements, ideal for small accounts.

4. Use a Risk-Reward Ratio

Aim for a 1:2 or 1:3 ratio—risk $10 to make $20-$30. This ensures profits outweigh losses over time.

5. Compound Your Gains

Reinvest profits to grow your account exponentially. A $1,000 account earning 5% monthly becomes $1,050, then $1,102.50 the next month, and so on.

6. Avoid Overtrading

Limit trades to high-probability setups. Overtrading increases fees and emotional stress, eroding your $1,000.

Risks of Trading Forex with $1,000

Forex isn’t a get-rich-quick scheme. Here’s what could go wrong:

1. Leverage Misuse

High leverage can wipe out your account in one bad trade. A 1% move against a $100,000 position (1:100 leverage) loses $1,000—your entire capital.

2. Emotional Trading

Fear or greed can lead to impulsive decisions, like chasing losses or risking too much.

3. Market Unpredictability

News events (e.g., interest rate changes) can cause sudden volatility, triggering stop-losses or margin calls.

4. Broker Fees

Spreads, swaps, and commissions eat into profits, especially on small accounts.

To mitigate risks, use stop-loss orders, trade small positions, and never invest money you can’t afford to lose.

Success Stories: Turning $1,000 into More

While rare, some traders have grown small accounts into fortunes:

George Soros: Started with modest capital and famously made $1 billion in a single day (not $1,000, but inspiring nonetheless).

Retail Trader Example: A trader on Reddit’s r/Forex claimed to turn $500 into $10,000 in two years with disciplined swing trading.

These stories highlight the power of skill, patience, and compounding—though luck plays a role too.

How Long Does It Take to Grow $1,000 in Forex?

The timeline depends on your goals and consistency:

Short-Term (1-3 Months): A 10% gain turns $1,000 into $1,100-$1,331.

Medium-Term (1 Year): 5-10% monthly compounds to $1,795-$3,138.

Long-Term (5 Years): 5% monthly grows $1,000 to $11,467; 10% reaches $45,259.

Patience is key. Forex rewards those who treat it as a marathon, not a sprint.

Tools and Resources to Succeed with $1,000

Equip yourself with:

Trading Platforms: MetaTrader 4/5 (MT4/MT5).

Economic Calendar: Track news at ForexFactory.com.

Education: Books like Currency Trading for Dummies or Babypips.com courses.

Journal: Log trades to analyze performance.

Final Thoughts: Can $1,000 Make You Rich in Forex?

With $1,000, forex offers a chance to earn meaningful profits—anywhere from $100 to $2,000+ annually—depending on your approach. It won’t make you a millionaire overnight, but it’s a stepping stone. Success requires education, discipline, and realistic expectations.

Start small, master your strategy, and let compounding work its magic. How much can you make with $1,000 in forex? The answer lies in your hands. Ready to trade? Open a demo account today and take your first step toward financial growth.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: