8 minute read

How to Open Forex Account in Pakistan: A Step-by-Step Guide

Forex trading, also known as foreign exchange trading, has gained immense popularity worldwide, including in Pakistan. With the potential to earn profits by speculating on currency price movements, many Pakistanis are eager to dive into this dynamic financial market. However, for beginners, the process of opening a Forex account can seem daunting. How do you get started? What regulations apply in Pakistan? Which brokers should you trust? This comprehensive guide will walk you through everything you need to know about opening a Forex account in Pakistan, ensuring you’re well-equipped to begin your trading journey confidently.

Top 4 Best Forex Brokers in Pakistan

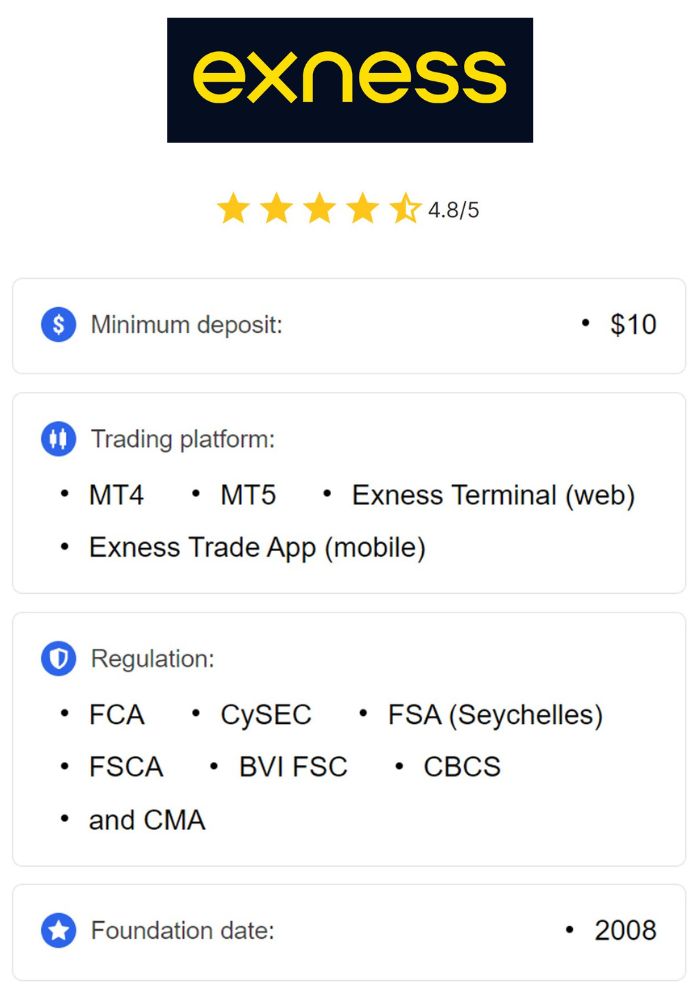

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

In this article, we’ll cover the basics of Forex trading, legal considerations in Pakistan, step-by-step instructions to open an account, tips for choosing the right broker, and practical advice to succeed as a beginner trader. Whether you’re in Karachi, Lahore, Islamabad, or any other part of the country, this guide is tailored to help you navigate the process seamlessly.

What is Forex Trading and Why is it Popular in Pakistan?

Before diving into the steps, let’s clarify what Forex trading entails. Forex trading involves buying and selling currencies in pairs (e.g., USD/PKR, EUR/USD) to profit from fluctuations in their exchange rates. The Forex market operates 24/5, making it accessible to traders globally, including those in Pakistan.

In Pakistan, Forex trading has surged in popularity due to several factors:

Accessibility: With just a computer or smartphone and an internet connection, anyone can participate.

Low Entry Barrier: Many brokers allow you to start with a small initial deposit, sometimes as low as $10.

Economic Opportunities: Amid inflation and currency depreciation (e.g., the Pakistani Rupee’s volatility), Forex offers a way to diversify income.

Educational Resources: The rise of online courses, YouTube tutorials, and trading communities has made learning easier for Pakistanis.

However, Forex trading isn’t a get-rich-quick scheme. It requires knowledge, discipline, and a reliable setup—starting with opening the right Forex account.

Is Forex Trading Legal in Pakistan?

A common question among beginners is whether Forex trading is legal in Pakistan. The short answer is yes, but with caveats. The State Bank of Pakistan (SBP) regulates financial activities in the country, and while Forex trading isn’t explicitly banned for individuals, there are no locally licensed Forex brokers operating under SBP oversight. This means Pakistani traders typically use international brokers.

Here’s what you need to know about the legal landscape:

Individual Trading: Pakistani residents can trade Forex using offshore brokers, provided they comply with SBP’s foreign exchange regulations.

Fund Transfers: The SBP imposes limits on transferring money abroad (e.g., $200,000 per year for individuals under the Foreign Exchange Manual). For Forex, smaller amounts are usually sufficient, but you must use legal channels like bank cards or wire transfers.

Taxation: Profits from Forex trading are considered income and may be subject to taxation under the Income Tax Ordinance 2001. Consult a tax professional to ensure compliance.

To stay safe, avoid unregulated brokers and ensure your funds are transferred legally. Now, let’s move on to the practical steps of opening a Forex account.

Step-by-Step Guide to Open a Forex Account in Pakistan

Opening a Forex account is straightforward if you follow these steps. Below is a detailed breakdown tailored to the Pakistani context.

Step 1: Educate Yourself About Forex Trading

Before opening an account, build a foundational understanding of Forex. Learn key concepts like:

Currency Pairs: Major pairs (e.g., EUR/USD), minor pairs, and exotic pairs (e.g., USD/PKR).

Leverage: Borrowing funds from a broker to amplify trades (e.g., 1:100 leverage).

Pips: The smallest price movement in Forex, crucial for calculating profits/losses.

Risk Management: Strategies to protect your capital, like stop-loss orders.

Resources like Babypips, YouTube channels by Pakistani traders, or local trading forums can help. Spend at least a few weeks learning to avoid costly mistakes.

Step 2: Choose a Reputable Forex Broker

Selecting the right broker is critical. Since Pakistan lacks local Forex brokers, you’ll rely on international platforms. Here’s what to look for:

Regulation: Choose brokers regulated by reputable authorities like the FCA (UK), ASIC (Australia), or CySEC (Cyprus). Examples include XM, Exness, and IC Markets.

Low Deposit: Opt for brokers with low minimum deposits (e.g., $10-$100) suitable for beginners.

Payment Methods: Ensure they support payment options accessible in Pakistan, such as Visa/Mastercard, Skrill, or bank transfers. Some brokers also accept JazzCash or EasyPaisa indirectly via third-party services.

Spreads and Fees: Look for competitive spreads (e.g., 1-2 pips on major pairs) and low withdrawal fees.

Customer Support: 24/7 support in English (or Urdu, if available) is a plus.

Popular brokers among Pakistani traders include:

Exness: Known for low spreads and fast withdrawals.

XM: Offers a $30 no-deposit bonus for new users.

FBS: Beginner-friendly with a variety of account types.

💥 Trade with Exness now: Open An Account or Visit Brokers

Research broker reviews on platforms like Forex Peace Army or X (Twitter) to confirm their reliability.

Step 3: Gather Required Documents

To open an account, brokers require identity verification to comply with anti-money laundering (AML) laws. Prepare these documents:

CNIC: A scanned copy of your Computerized National Identity Card.

Proof of Address: A utility bill (electricity, gas, or water) or bank statement with your name and address, issued within the last 3-6 months.

Email and Phone: A valid email address and mobile number for account verification.

Bank Card/Details: If funding via card or wire transfer, have your details ready.

Ensure your documents are clear and in English (or translated if needed).

Step 4: Register with the Broker

Once you’ve chosen a broker, visit their official website (e.g., www.exness.com) and follow these steps:

Sign Up: Click “Open Account” or “Register” and fill in your details (name, email, phone number).

Select Account Type: Choose between a demo account (for practice) or a live account. Options include:

Micro Account: Small lot sizes, ideal for beginners.

Standard Account: Higher volumes for experienced traders.

ECN Account: Direct market access with tighter spreads.

Verify Your Identity: Upload your CNIC and proof of address in the broker’s portal.

Set Up Trading Platform: Download the broker’s platform (e.g., MetaTrader 4 or 5) on your PC or phone.

Verification typically takes 24-48 hours. You’ll receive a confirmation email once approved.

Step 5: Fund Your Account

After verification, deposit funds to start trading. In Pakistan, options include:

Debit/Credit Cards: Widely accepted by brokers like XM and Exness.

E-Wallets: Skrill, Neteller, or Perfect Money (check broker compatibility).

Bank Wire: Slower but secure; coordinate with your bank (e.g., HBL, MCB) for international transfers.

Local Payment Apps: Some brokers partner with third-party exchangers to accept JazzCash or EasyPaisa.

Start with a small amount (e.g., $50-$100) to test the waters. Be mindful of conversion rates (PKR to USD) and any bank fees.

Step 6: Practice with a Demo Account

Most brokers offer free demo accounts with virtual funds (e.g., $10,000). Use this to:

Test trading strategies.

Familiarize yourself with MetaTrader tools (charts, indicators).

Understand how leverage and margin work.

Spend at least 1-2 months on a demo account until you’re consistently profitable.

Step 7: Start Trading Live

Once confident, switch to your live account. Begin with small trades (e.g., 0.01 lots) and focus on major pairs like EUR/USD due to their liquidity and lower volatility. Use risk management tools like stop-loss orders to protect your capital.

Choosing the Best Forex Broker in Pakistan: Key Factors

With hundreds of brokers available, narrowing down your choice can be overwhelming. Here are additional tips to ensure you pick the best one:

Withdrawal Speed: Check reviews for brokers with fast, hassle-free withdrawals (e.g., Exness processes within 24 hours).

Islamic Accounts: If you’re a Muslim trader, opt for brokers offering swap-free (Sharia-compliant) accounts, like XM or FBS.

Local Reputation: Search X or Pakistani trading groups (e.g., Forex Pakistan on Facebook) for broker recommendations.

Demo Account Quality: A good demo should mirror live trading conditions.

Avoid brokers with a history of delayed payments or poor customer service.

Common Challenges for Pakistani Forex Traders and How to Overcome Them

Forex trading in Pakistan comes with unique hurdles. Here’s how to tackle them:

Internet Connectivity: Unstable connections in rural areas can disrupt trades. Use a reliable ISP (e.g., PTCL, Nayatel) or mobile data as a backup.

Payment Restrictions: Limited e-wallet options can complicate funding. Stick to card payments or trusted local exchangers.

Currency Volatility: The PKR’s fluctuations can affect deposit/withdrawal values. Plan trades with USD-based accounts to minimize this.

Scams: Beware of unregulated brokers promising guaranteed profits. Always verify regulation and read user reviews.

Tips for Success as a Forex Trader in Pakistan

To thrive in Forex trading, adopt these habits:

Start Small: Risk only what you can afford to lose (e.g., 1-2% of your account per trade).

Keep Learning: Follow Pakistani traders on X or join webinars by brokers like XM.

Track Performance: Use a trading journal to analyze wins and losses.

Stay Disciplined: Avoid emotional trading after losses; stick to your strategy.

Conclusion: Your Forex Journey Begins Here

Opening a Forex account in Pakistan is your gateway to participating in the world’s largest financial market. By choosing a regulated broker, understanding the legal framework, and starting with a solid plan, you can trade confidently and responsibly. Whether you aim to supplement your income or pursue trading full-time, the steps outlined in this guide—education, broker selection, verification, funding, and practice—will set you on the right path.

Ready to take the plunge? Pick a broker, open a demo account, and start practicing today. Forex trading rewards patience and persistence, and with the right approach, you can turn opportunities into profits from the comfort of your home in Pakistan.

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: