14 minute read

How to Trade Gold on Exness For Beginners

from Exness Global

Gold has always held a special place in the world of finance. Known as a safe-haven asset, it attracts investors and traders looking to diversify their portfolios, hedge against inflation, or capitalize on market volatility. For beginners, trading gold might seem daunting, but platforms like Exness make it accessible and straightforward. In this comprehensive guide, we’ll walk you through everything you need to know about trading gold on Exness, from setting up your account to executing your first trade and managing risks effectively.

💥 Trade with Exness now: Open An Account or Visit Brokers

Whether you’re new to trading or looking to explore gold as an asset, this article will provide actionable insights, practical tips, and strategies tailored for beginners. Let’s dive in!

Why Trade Gold? Understanding the Appeal of Gold Trading

Before we get into the specifics of trading gold on Exness, it’s worth understanding why gold is such a popular asset. Gold is not just a shiny metal; it’s a globally recognized store of value with unique characteristics that make it attractive to traders.

1. Safe-Haven Asset

Gold is often referred to as a “safe-haven” because it tends to retain or increase its value during times of economic uncertainty. When stock markets crash, currencies weaken, or geopolitical tensions rise, investors flock to gold, driving up its price.

2. Hedge Against Inflation

Unlike fiat currencies, which can lose value due to inflation, gold has intrinsic value. It’s a tangible asset that historically holds its worth, making it a reliable hedge against rising prices.

3. Portfolio Diversification

Gold’s price movements often have a low correlation with other asset classes like stocks and bonds. Adding gold to your trading portfolio can reduce overall risk and improve stability.

4. High Liquidity and Volatility

The gold market is highly liquid, meaning you can buy and sell gold easily without significantly affecting its price. Additionally, gold prices can be volatile, offering opportunities to profit from price swings.

5. Accessible Through Online Platforms

Thanks to modern trading platforms like Exness, you don’t need to own physical gold to trade it. You can speculate on price movements using Contracts for Difference (CFDs), which we’ll explore later.

Now that you understand why gold is worth trading, let’s explore how Exness makes it beginner-friendly.

What is Exness? A Beginner-Friendly Trading Platform

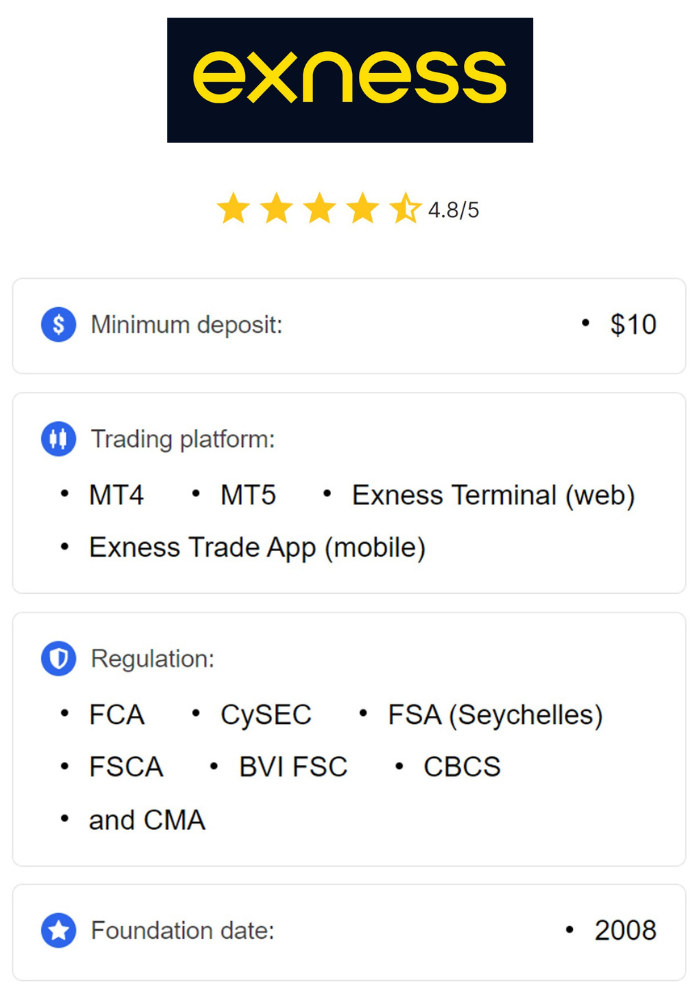

Exness, founded in 2008, is a globally recognized online trading platform known for its transparency, competitive spreads, and user-friendly interface. With millions of users worldwide and regulation by reputable authorities like the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), Exness is a trusted choice for both novice and experienced traders.

Why Choose Exness for Gold Trading?

Low Spreads: Exness offers some of the tightest spreads on gold (XAU/USD), starting as low as 0.3 pips, reducing trading costs.

Flexible Leverage: Beginners can use leverage to control larger positions with smaller capital, though caution is advised.

Advanced Tools: Access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Exness Terminal provides real-time data, charting tools, and technical indicators.

Educational Resources: Exness offers tutorials, webinars, and guides to help beginners learn the ropes.

Demo Accounts: Practice trading gold without risking real money using Exness’s demo accounts.

Fast Withdrawals: Exness processes withdrawals instantly, giving you quick access to your funds.

With these features, Exness creates a supportive environment for beginners looking to trade gold. Let’s move on to the practical steps.

How to Trade Gold on Exness For Beginners

Trading gold on Exness is straightforward, but it requires preparation and understanding. Follow these steps to get started.

Step 1: Sign Up for an Exness Account

The first step is to create an account on the Exness platform. Here’s how:

Visit the Exness Website: Go to the official Exness website: Open An Account or Visit Brokers

Fill in Your Details: Provide your email address, phone number, and personal information. Choose a strong password.

Select an Account Type: For beginners, the Standard Account is ideal due to its low minimum deposit (starting at $1 for some regions) and no commissions. Other options include the Raw Spread, Zero, or Pro accounts, which may suit more advanced traders.

Agree to Terms: Read and accept Exness’s terms and conditions.

Step 2: Verify Your Account

To comply with regulatory standards and ensure security, Exness requires account verification.

Submit Identification Documents: Upload a government-issued ID (e.g., passport or driver’s license) and proof of address (e.g., utility bill or bank statement).

Wait for Approval: Verification typically takes a few hours to a couple of days. You’ll receive an email once your account is verified.

Step 3: Fund Your Account

Before you can trade gold, you need to deposit funds into your Exness account.

Choose a Payment Method: Exness supports various options, including:

Bank transfers

Credit/debit cards (Visa, Mastercard)

E-wallets (Skrill, Neteller, WebMoney)

Cryptocurrencies (Bitcoin, USDT)

Deposit Funds: Log in to your Exness Personal Area, select “Deposit,” and follow the instructions. The minimum deposit for a Standard Account is low, making it accessible for beginners.

Confirm the Transaction: Most deposits are instant, except for bank transfers, which may take a few days.

Step 4: Download a Trading Platform

Exness offers multiple platforms for trading gold. Choose one that suits your needs:

MetaTrader 4 (MT4): Popular for its simplicity and wide range of tools.

MetaTrader 5 (MT5): Advanced features, including more timeframes and indicators.

Exness Terminal: A web-based platform for quick access without downloads.

Exness Trade App: Trade on the go using your smartphone.

Download your preferred platform from the Exness website or app store, then log in using your account credentials.

Step 5: Add Gold to Your Watchlist

Gold is traded against the US dollar on Exness, represented by the symbol XAU/USD. To trade it:

Open the Market Watch: In your trading platform, locate the Market Watch section.

Find XAU/USD: Search for “XAUUSD” or “Gold.” Right-click and select “Show” to add it to your watchlist.

Customize Charts: Adjust the timeframe (e.g., 1-hour, 4-hour, daily) and add indicators like Moving Averages or RSI for analysis.

Step 6: Analyze the Gold Market

Successful trading requires understanding market movements. Gold prices are influenced by factors like:

Economic Data: Interest rate decisions, inflation reports, and employment data can affect gold prices.

Geopolitical Events: Wars, trade disputes, or political instability often drive demand for gold.

US Dollar Strength: Since gold is priced in USD, a stronger dollar typically lowers gold prices, and vice versa.

Supply and Demand: Mining output and central bank purchases impact gold’s availability.

Use two types of analysis to make informed decisions:

Technical Analysis: Study price charts using tools like:

Moving Averages: Identify trends (e.g., a 50-day MA crossing above a 200-day MA signals a bullish trend).

Relative Strength Index (RSI): Spot overbought (above 70) or oversold (below 30) conditions.

Support and Resistance Levels: Predict where prices might reverse.

Fundamental Analysis: Monitor news and economic calendars (available on Exness) to stay updated on events affecting gold.

Step 7: Place Your First Gold Trade

Once you’ve analyzed the market, it’s time to trade. Here’s how to execute a trade on Exness:

Open a New Order: Click “New Order” or right-click XAU/USD and select “Trade.”

Choose Trade Size: For beginners, start with a micro-lot (0.01) to minimize risk. A micro-lot represents 100 ounces of gold.

Set Stop-Loss and Take-Profit:

Stop-Loss: Automatically closes your trade if the market moves against you, limiting losses.

Take-Profit: Closes your trade when your profit target is reached.

Select Buy or Sell:

Buy: If you expect gold prices to rise.

Sell: If you anticipate a price decline.

Execute the Trade: Review your order details and click “Place Order.”

Step 8: Monitor and Manage Your Trade

After placing your trade, keep an eye on market conditions:

Track Price Movements: Use the “Trade” tab in your platform to monitor open positions.

Adjust Orders: Modify stop-loss or take-profit levels if the market changes.

Close the Trade: Manually close your trade or let stop-loss/take-profit orders trigger automatically.

Step 9: Review and Learn

Trading is a learning process. After each trade:

Analyze Performance: Did you achieve your target? What went wrong or right?

Keep a Trading Journal: Record your trades, including entry/exit points, reasons for trading, and outcomes.

Learn from Mistakes: Identify areas for improvement, such as overtrading or ignoring risk management.

Understanding Gold Trading Instruments on Exness

Exness offers several ways to trade gold, each with its own characteristics. As a beginner, it’s important to understand these instruments to choose the one that aligns with your goals.

1. Spot Gold (XAU/USD)

Spot gold involves trading gold at its current market price, quoted against the US dollar. It’s the most popular instrument for beginners due to its simplicity and high liquidity. With Exness, you trade spot gold as a CFD, meaning you speculate on price movements without owning physical gold.

Pros: High liquidity, tight spreads, no expiration date.

Cons: Leverage can amplify losses if not managed properly.

2. Gold Futures

Futures contracts are agreements to buy or sell gold at a set price on a future date. They’re traded on exchanges and often require more capital and experience.

Pros: Standardized contracts, potential for higher returns.

Cons: Complex for beginners, expiration dates add pressure.

3. Gold CFDs

Contracts for Difference (CFDs) allow you to profit from gold price movements without owning the asset. Exness’s XAU/USD CFDs are beginner-friendly because they require less capital and offer flexibility.

Pros: Low entry barriers, ability to profit in rising or falling markets.

Cons: Leverage increases risk, overnight fees (swaps) may apply.

For most beginners, spot gold CFDs (XAU/USD) are the best starting point due to their accessibility and Exness’s competitive trading conditions.

Risk Management: Protecting Your Capital

Gold trading can be rewarding, but it’s not without risks. Effective risk management is crucial to long-term success, especially for beginners. Here are key strategies to protect your capital:

1. Use Stop-Loss Orders

Always set a stop-loss to limit potential losses. For example, if you buy XAU/USD at $1,900, you might set a stop-loss at $1,880 to cap your loss at $20 per ounce.

2. Set Take-Profit Orders

Lock in profits by setting take-profit levels. If you expect gold to rise from $1,900 to $1,950, set a take-profit at $1,950 to secure your gains.

3. Manage Leverage Carefully

Exness offers flexible leverage, sometimes up to 1:2000. While high leverage lets you control larger positions with less capital, it also magnifies losses. For beginners, start with low leverage (e.g., 1:10 or 1:20) to reduce risk.

4. Follow the 1% Rule

Never risk more than 1% of your account balance on a single trade. For example, if your account has $1,000, limit your risk to $10 per trade. This ensures you can withstand multiple losses without depleting your funds.

5. Avoid Overtrading

Trading too frequently or taking large positions can lead to emotional decisions and losses. Stick to a trading plan and only trade when your analysis supports it.

6. Diversify Your Portfolio

While gold is a great asset, don’t put all your capital into it. Trade other instruments like forex pairs or indices to spread risk.

7. Stay Informed

Gold prices are sensitive to global events. Use Exness’s economic calendar and news feeds to stay updated on factors like central bank announcements or geopolitical developments.

By prioritizing risk management, you’ll build confidence and protect your account from significant drawdowns.

Trading Strategies for Beginners

To trade gold effectively, you need a strategy that suits your risk tolerance and goals. Here are three beginner-friendly strategies to consider:

1. Trend Following

This strategy involves trading in the direction of the market trend.

How It Works: Use Moving Averages (e.g., 50-day and 200-day) to identify trends. If the 50-day MA crosses above the 200-day MA, it’s a bullish signal (buy). If it crosses below, it’s bearish (sell).

Best For: Longer-term trades (daily or weekly charts).

Tip: Confirm trends with indicators like the MACD or ADX to avoid false signals.

2. Range Trading

Range trading works when gold prices move within a defined range (support and resistance levels).

How It Works: Identify support (where prices stop falling) and resistance (where prices stop rising). Buy near support and sell near resistance.

Best For: Stable markets with low volatility.

Tip: Use oscillators like RSI to confirm overbought or oversold conditions.

3. News-Based Trading

Gold prices often react to economic data or geopolitical events.

How It Works: Monitor Exness’s economic calendar for events like US Federal Reserve meetings or inflation reports. Trade based on how the news impacts gold prices.

Best For: Short-term, high-volatility opportunities.

Tip: Be cautious of sudden price spikes and use stop-loss orders to manage risk.

Practice on a Demo Account

Before trading with real money, test your strategies on Exness’s demo account. It provides virtual funds to practice in real market conditions, helping you refine your approach without financial risk.

Common Mistakes to Avoid

Beginners often make mistakes that can hinder their progress. Here’s how to avoid them:

1. Ignoring Risk Management

Failing to set stop-loss orders or risking too much per trade can wipe out your account. Always prioritize capital preservation.

2. Overleveraging

High leverage is tempting, but it can lead to significant losses. Use leverage conservatively, especially as a beginner.

3. Emotional Trading

Fear and greed can cloud judgment. Stick to your trading plan and avoid impulsive decisions.

4. Neglecting Analysis

Trading without technical or fundamental analysis is like gambling. Base your trades on data and research.

5. Chasing Losses

After a losing trade, don’t try to “win back” your money by taking bigger risks. Accept losses as part of trading and move on.

6. Not Learning from Trades

Failing to review your trades prevents growth. Keep a journal to track what works and what doesn’t.

By avoiding these pitfalls, you’ll build a solid foundation for successful gold trading.

Exness Tools and Resources for Gold Trading

Exness equips beginners with tools to enhance their trading experience. Here’s how to make the most of them:

1. Economic Calendar

Stay ahead of market-moving events like interest rate decisions or GDP releases, which can impact gold prices.

2. Real-Time Charts

Access advanced charting tools on MT4, MT5, or the Exness Terminal to analyze price movements and apply indicators.

3. Educational Content

Exness offers webinars, tutorials, and articles on gold trading basics, technical analysis, and risk management.

4. Mobile Trading

The Exness Trade App lets you monitor gold prices, place trades, and manage your account from anywhere.

5. Customer Support

Exness provides 24/7 support via live chat, email, or phone. If you have questions about trading gold, their team is ready to help.

6. Social Trading

Explore Exness’s social trading feature to copy strategies from experienced gold traders, ideal for beginners seeking guidance.

Tips for Long-Term Success in Gold Trading

Trading gold is a journey that requires patience and continuous learning. Here are tips to stay on the right path:

Start Small: Begin with small trade sizes to build confidence and experience.

Stay Disciplined: Follow your trading plan and avoid deviating based on emotions.

Keep Learning: Study market trends, read books on trading psychology, and follow gold-related news.

Use Demo Accounts Regularly: Test new strategies or indicators before applying them to live trades.

Monitor Correlated Markets: Gold prices often move inversely to the US dollar. Keep an eye on USD-related assets like forex pairs or the US Dollar Index (DXY).

Be Patient: Success doesn’t come overnight. Focus on consistent progress rather than quick profits.

Network with Traders: Join online communities or forums to share ideas and learn from others’ experiences.

FAQs About Trading Gold on Exness

1. What is the minimum deposit to trade gold on Exness?

The minimum deposit varies by account type. For a Standard Account, it’s as low as $1 in some regions, making it accessible for beginners.

2. Can I trade gold on a demo account?

Yes, Exness offers demo accounts with virtual funds to practice gold trading risk-free.

3. What is XAU/USD?

XAU/USD is the trading symbol for gold priced against the US dollar. It’s the most common gold trading instrument on Exness.

4. Is leverage safe for beginners?

Leverage can amplify profits but also losses. Beginners should use low leverage (e.g., 1:10) and prioritize risk management.

5. How do I know when to buy or sell gold?

Use technical analysis (charts, indicators) and fundamental analysis (news, economic data) to make informed decisions.

6. Are there fees for trading gold on Exness?

Exness charges spreads (the difference between bid and ask prices) and may apply overnight fees (swaps) for positions held past market close.

Conclusion: Start Your Gold Trading Journey with Exness

Trading gold on Exness offers beginners an exciting opportunity to enter the financial markets. With its low spreads, flexible leverage, and robust tools, Exness creates an ideal environment for learning and growing as a trader. By following the steps outlined in this guide—setting up an account, analyzing the market, executing trades, and managing risks—you’ll be well-equipped to navigate the gold market confidently.

Remember, trading is a skill that improves with practice and discipline. Start with a demo account, experiment with strategies, and stay informed about global events that influence gold prices. Over time, you’ll develop the expertise to trade gold successfully and build a rewarding trading career.

Ready to begin? Sign up with Exness today, explore their platform, and take your first step toward mastering gold trading. Happy trading!

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: