13 minute read

Exness or Binance Compared: Which is better?

In the fast-paced world of online trading, choosing the right platform can make or break your financial journey. Two names often dominate discussions among traders: Exness or Binance. Both platforms are industry giants, but they cater to different markets and offer distinct features. Exness is a leading forex and CFD broker, while Binance reigns supreme as the world’s largest cryptocurrency exchange. So, which one is better for you? This in-depth comparison dives into their histories, services, fees, security, user experience, and more to help you decide.

💥 Trade with Exness now: Open An Account or Visit Brokers

Whether you’re a forex enthusiast, a crypto trader, or someone exploring diverse financial markets, this article will break down the strengths and weaknesses of Exness or Binance. By the end, you’ll have a clear picture of which platform aligns with your trading goals. Let’s get started.

Understanding Exness and Binance: A Brief Overview

Before diving into the comparison, let’s establish what each platform offers and who they serve.

Exness: The Forex and CFD Powerhouse

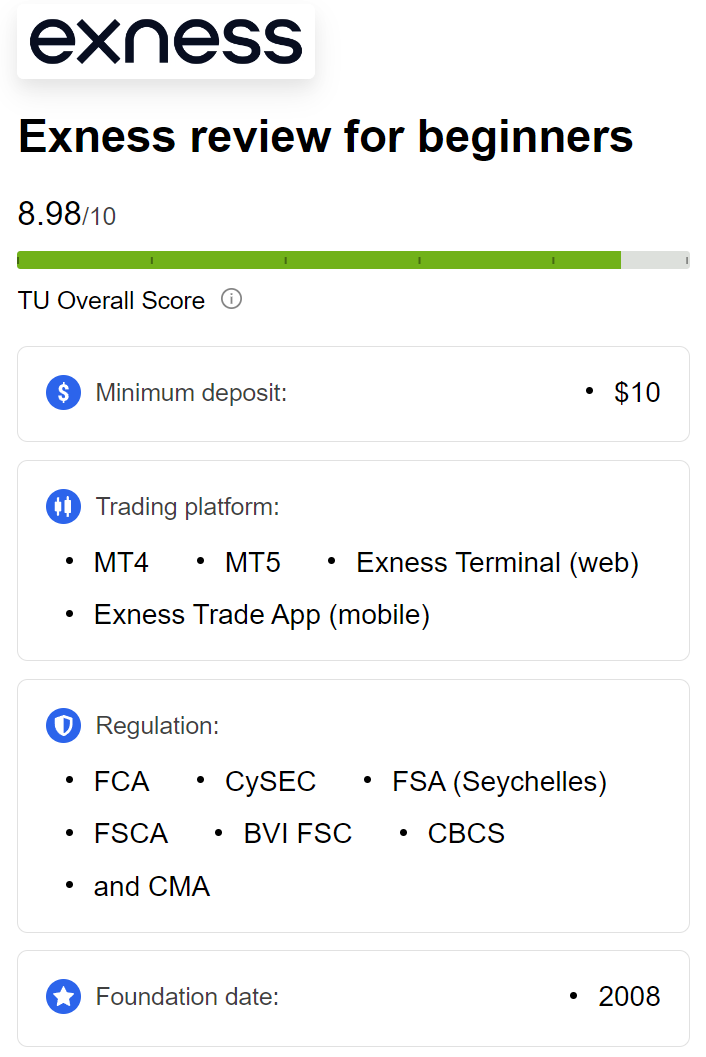

Founded in 2008, Exness is a Cyprus-based brokerage firm that has grown into a global leader in forex and contracts for difference (CFDs). With over 15 years of experience, Exness focuses on providing retail and institutional traders with access to a wide range of financial instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies.

Exness is known for its transparency, tight spreads, and high leverage options (up to 1:2000 or even unlimited in some regions). It serves millions of traders worldwide through a variety of account types, such as Standard, Pro, Raw Spread, and Zero accounts. Regulated by top-tier authorities like the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC), Exness prioritizes security and reliability.

Binance: The Crypto Titan

Launched in 2017 by Changpeng Zhao, Binance quickly rose from a small startup to the world’s largest cryptocurrency exchange by trading volume. Initially based in China, Binance has since expanded globally, with operations in Malta, the Bahamas, and other jurisdictions. It offers an extensive ecosystem that includes spot trading, futures, margin trading, staking, lending, and even its own blockchain, Binance Smart Chain (BSC).

Binance supports over 350 cryptocurrencies, making it a go-to platform for crypto enthusiasts. Known for low fees, high liquidity, and advanced trading features, Binance appeals to both beginners and seasoned traders. While its regulatory journey has been complex, Binance has secured licenses in multiple regions, enhancing its legitimacy as of 2025.

Key Factors to Compare Exness or Binance

To determine which platform is better, we’ll evaluate Exness and Binance across several critical factors: trading instruments, fees, platforms, user experience, security, regulation, customer support, and educational resources. Each section provides a detailed analysis to help you make an informed decision.

1. Trading Instruments: What Can You Trade?

The range of assets available on a platform is a key consideration for traders. Let’s see how Exness or Binance stack up.

Exness: Diverse Financial Instruments

Exness offers a robust selection of over 100 financial instruments, including:

Forex: Over 100 currency pairs, including majors, minors, and exotics.

Commodities: Precious metals like gold and silver, as well as energy products like oil.

Indices: Major global indices such as the S&P 500, FTSE 100, and Nikkei 225.

Stocks: CFDs on popular stocks like Apple, Tesla, and Amazon.

Cryptocurrencies: A growing selection, including Bitcoin (BTC), Ethereum (ETH), and Tether (USDT).

Exness is ideal for traders who want exposure to multiple asset classes. Its focus on forex and CFDs makes it particularly appealing for those who prefer leveraged trading or want to diversify beyond cryptocurrencies.

Binance: Crypto-Centric with Broad Options

Binance is a crypto-first platform, offering:

Cryptocurrencies: Over 350 coins and tokens, including Bitcoin, Ethereum, Binance Coin (BNB), and altcoins like Solana and Cardano.

Crypto Pairs: Hundreds of trading pairs, including crypto-to-crypto and crypto-to-fiat options.

Derivatives: Futures, options, and margin trading for advanced traders.

Other Products: Staking, lending, and savings accounts for passive income.

Binance excels for traders focused exclusively on cryptocurrencies. However, it lacks the diversity of traditional financial instruments like forex, stocks, or commodities, which limits its appeal for those seeking a broader portfolio.

Verdict: Exness wins for asset diversity, offering a wide range of instruments across multiple markets. Binance is the better choice for crypto enthusiasts who want access to an extensive selection of digital assets.

2. Fees and Costs: Which Platform Is More Cost-Effective?

Trading fees can significantly impact your profitability. Let’s compare the cost structures of Exness and Binance.

Exness: Low Spreads and Flexible Fees

Exness is renowned for its competitive pricing:

Spreads: Tight spreads starting at 0.0 pips on Raw Spread and Zero accounts. Standard accounts have spreads from 0.3 pips.

Commissions: No commissions on Standard accounts; Raw Spread and Zero accounts charge $3.50 per lot per side.

Bitcoin Trading: Costs as low as $24 per trade, making it highly competitive.

Deposits and Withdrawals: No fees for most deposit methods; withdrawals are typically free, though some payment processors may charge small fees.

Swap Fees: Overnight financing fees apply for positions held open past market hours, but these vary by instrument.

Exness offers low-cost trading, especially for forex and CFDs. Its commission-based accounts (Raw Spread and Zero) are ideal for high-volume traders, while Standard accounts suit beginners with no commission charges.

Binance: Industry-Leading Crypto Fees

Binance is known for its low trading fees:

Spot Trading: Maker and taker fees of 0.1% or lower (0.075% with BNB payments).

Futures Trading: Fees as low as 0.02% (maker) and 0.04% (taker).

Deposits: Free for most cryptocurrencies.

Withdrawals: Fees vary by asset and network (e.g., $1–$15 for Bitcoin depending on the blockchain).

Discounts: Using Binance Coin (BNB) reduces fees by up to 25%. VIP tiers offer further reductions for high-volume traders.

Binance’s fee structure is highly competitive within the crypto space. However, withdrawal fees can add up for frequent transfers, and futures trading carries additional risks due to leverage.

Verdict: Exness has an edge for forex and CFD traders with its ultra-low spreads and minimal fees. Binance is more cost-effective for crypto trading, especially for users leveraging BNB discounts. Your choice depends on the assets you trade.

3. Trading Platforms: Functionality and Accessibility

A platform’s usability and features are crucial for executing trades efficiently. Let’s explore the trading platforms offered by Exness or Binance.

Exness: MetaTrader and Proprietary Platforms

Exness supports industry-standard and proprietary platforms:

MetaTrader 4 (MT4): A popular choice for forex traders, offering advanced charting, automated trading via Expert Advisors (EAs), and customizable interfaces.

MetaTrader 5 (MT5): An upgraded version with more timeframes, indicators, and support for additional asset classes.

Exness Trade App: A mobile app for iOS and Android, providing real-time trading, account management, and market updates.

Exness Terminal: A web-based platform for quick access without downloads.

Exness Social Trading: Allows beginners to copy trades from experienced traders.

Exness’s platforms are intuitive and cater to all experience levels. MT4 and MT5 are particularly appealing for technical traders, while the Exness Trade app ensures mobility.

Binance: Custom-Built Crypto Platform

Binance offers a proprietary platform tailored for crypto trading:

Web Platform: A user-friendly interface with basic and advanced views, supporting spot, futures, and margin trading.

Mobile App: Available for iOS and Android, offering full functionality, including staking, lending, and portfolio management.

Binance Desktop: A downloadable app for traders who prefer a standalone experience.

API Access: For algorithmic traders building custom bots or strategies.

Binance Lite: A simplified version for beginners, focusing on basic buy/sell functions.

Binance’s platform is sleek and feature-rich, with advanced charting tools powered by TradingView. However, it’s designed specifically for crypto, which may feel limiting for traders accustomed to forex platforms like MT4.

Verdict: Exness offers more platform variety, with MT4 and MT5 being versatile for technical analysis and automation. Binance’s platform is excellent for crypto trading but lacks the flexibility of Exness’s options. Choose Exness for platform diversity; choose Binance for a crypto-optimized experience.

💥 Trade with Exness now: Open An Account or Visit Brokers

4. User Experience: Ease of Use for Beginners and Pros

A platform’s user experience can determine how quickly you adapt to trading. Let’s assess Exness or Binance for usability.

Exness: Intuitive and Beginner-Friendly

Exness prioritizes simplicity without sacrificing depth:

Interface: Clean and straightforward, with easy navigation across accounts, markets, and tools.

Account Types: Options like Standard Cent and Standard accounts cater to beginners, while Pro and Zero accounts suit professionals.

Demo Accounts: Free demo accounts allow practice trading without risk.

Onboarding: Quick account setup with minimal verification for small deposits.

Customization: MT4 and MT5 allow personalized workspaces for advanced traders.

Exness balances accessibility for novices with advanced features for experts. However, beginners may find MT4’s interface dated compared to modern platforms.

Binance: Streamlined but Crypto-Focused

Binance offers a polished user experience:

Interface: Modern and responsive, with customizable dashboards for spot and futures trading.

Binance Lite: Simplifies the platform for new users, hiding complex features.

Onboarding: Fast sign-up with email or phone, though full verification (KYC) is required for higher limits.

Learning Curve: Spot trading is easy, but futures and margin trading can overwhelm beginners.

Accessibility: Available in multiple languages and optimized for global users.

Binance excels for crypto traders but may feel restrictive for those unfamiliar with digital assets. Its advanced features require a steeper learning curve than Exness’s Standard accounts.

Verdict: Exness is more beginner-friendly due to its demo accounts and simple account options. Binance suits crypto-savvy users but may intimidate newcomers to futures or margin trading.

5. Security and Regulation: Can You Trust Them?

Trust is paramount when entrusting your money to a trading platform. Let’s examine the security and regulatory frameworks of Exness and Binance.

Exness: Stringent Regulation and Transparency

Exness is a highly regulated broker:

Regulators: Licensed by the FCA (UK), CySEC (Cyprus), Financial Services Authority (FSA) in Seychelles, and others.

Client Funds: Segregated accounts ensure your money is separate from company funds.

Negative Balance Protection: Prevents losses exceeding your deposit.

Audits: Regular audits by firms like Deloitte enhance transparency.

Security Features: Two-factor authentication (2FA), SSL encryption, and instant withdrawal processing for verified users.

Exness’s multi-jurisdictional regulation and focus on transparency make it one of the most trusted brokers in the industry.

Binance: Improving Regulatory Compliance

Binance’s regulatory journey has been more complex:

Regulators: Licensed in jurisdictions like Malta, the Bahamas, and France (AMF). It also complies with local laws in regions like Dubai and Japan.

Challenges: Faced scrutiny in the past for operating in unregulated markets, but has since strengthened compliance.

Security Features: 2FA, cold storage for most funds, and a Secure Asset Fund for Users (SAFU) to cover losses from hacks.

Proof of Reserves: Uses Merkle Tree and zk-SNARKs for transparent asset verification.

Incidents: Suffered a $570 million hack in 2022 but reimbursed users via SAFU.

Binance has made strides in regulation and security, but its history of regulatory hurdles may concern cautious traders.

Verdict: Exness is the safer bet for regulatory compliance and client fund protection. Binance is secure for crypto trading but carries a slightly higher risk due to its regulatory past.

6. Customer Support: Who Responds Faster?

Reliable customer support is essential for resolving issues quickly. Let’s compare the support systems of Exness or Binance.

Exness: 24/7 Multilingual Support

Exness offers robust support:

Channels: Live chat, email, phone, and a comprehensive help center.

Availability: 24/7 in 15 languages, including English, Chinese, Arabic, and Hindi.

Response Time: Live chat responses are typically instant; email replies take a few hours.

Knowledge Base: Extensive FAQs, tutorials, and articles for self-help.

Exness’s around-the-clock support is a standout feature, especially for global traders in different time zones.

Binance: Improving but Inconsistent

Binance provides multiple support options:

Channels: 24/7 live chat, email, and a detailed help center.

Availability: Supports multiple languages, but response times vary.

Response Time: Live chat can take minutes to hours, especially during peak trading periods.

Community: Active forums and social media channels for peer assistance.

Criticism: Users have reported delays during high-traffic periods, though Binance has improved staffing in recent years.

Binance’s support is adequate but less consistent than Exness’s, particularly under heavy demand.

Verdict: Exness offers faster and more reliable support, making it the better choice for traders who value quick assistance.

7. Educational Resources: Learning to Trade

Education is crucial for developing trading skills. Let’s see how Exness and Binance empower their users.

Exness: Limited but Practical

Exness provides:

Trading Academy: Webinars, tutorials, and articles on forex, risk management, and market analysis.

Market Insights: Daily updates and economic calendars to inform trading decisions.

Demo Accounts: Practice trading with virtual funds.

Weakness: Lacks interactive webinars or structured courses compared to competitors like eToro.

Exness’s educational offerings are practical but underwhelming for beginners seeking comprehensive learning.

Binance: Extensive Crypto Education

Binance excels in education:

Binance Academy: A vast library of articles, videos, and courses on crypto, blockchain, and trading strategies.

Webinars: Regular sessions with industry experts.

Community: Forums and social media groups for shared learning.

Tutorials: Guides on platform features, from spot trading to staking.

Binance Academy is a goldmine for crypto traders, catering to all experience levels with engaging content.

Verdict: Binance wins for education, offering a richer and more diverse set of resources. Exness’s materials are useful but lack depth and interactivity.

Exness vs. Binance: Which Is Better for You?

Choosing between Exness or Binance depends on your trading goals, experience level, and preferred markets. Here’s a breakdown to help you decide:

Choose Exness If:

You want to trade forex, CFDs, commodities, indices, or stocks.

You value tight spreads, low fees, and high leverage.

You prefer industry-standard platforms like MT4 and MT5.

Regulatory compliance and client fund protection are top priorities.

You’re a beginner looking for simple accounts or a pro seeking advanced tools.

Choose Binance If:

You’re focused on cryptocurrencies and want access to over 350 coins.

You’re interested in spot, futures, or margin trading.

Low crypto trading fees and BNB discounts matter to you.

You want extensive educational resources via Binance Academy.

You’re comfortable with a crypto-only platform and its regulatory nuances.

Critical Considerations: What the Platforms Don’t Tell You

While both platforms are leaders in their fields, they’re not perfect. Here are some critical points to consider:

Exness: Its focus on forex and CFDs means crypto offerings are limited compared to Binance. High leverage (e.g., 1:2000) can be a double-edged sword, amplifying profits but also losses. Educational resources need improvement to compete with modern brokers.

Binance: Its crypto-only focus excludes traditional markets, limiting diversification. Past regulatory issues raise questions about long-term stability, despite recent improvements. Withdrawal fees and support delays during peak times can frustrate users.

Always weigh these factors against your risk tolerance and trading strategy.

Final Thoughts: Exness or Binance in 2025?

Exness or Binance are both exceptional platforms, but they serve different audiences. Exness is the better choice for traders seeking a regulated, versatile broker with access to forex, CFDs, and multiple asset classes. Its low fees, reliable platforms, and strong regulatory framework make it ideal for beginners and professionals alike. Binance, on the other hand, is unmatched for crypto trading, offering a vast ecosystem, low fees, and top-tier educational resources. If cryptocurrencies are your focus, Binance is hard to beat.

Ultimately, the “better” platform depends on what you want to achieve. Are you building a diversified portfolio across markets? Go with Exness. Are you diving deep into the crypto world? Binance is your best bet. Whatever you choose, ensure it aligns with your financial goals and risk appetite.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: