10 minute read

Is Exness Trading Legal in India? A Comprehensive Guide for Traders

Forex trading has taken the financial world by storm, and India is no exception. With millions of aspiring traders looking to tap into global markets, platforms like Exness have gained significant attention. But one question looms large for Indian traders: Is Exness trading legal in India? This topic remains a hot debate, blending curiosity with caution due to India’s complex regulatory landscape. In this in-depth guide, we’ll explore every facet of Exness’s legality in India, unpack the rules governing forex trading, and provide actionable insights to help you trade confidently and compliantly.

💥 Trade with Exness now: Open An Account or Visit Brokers

Whether you’re a beginner dipping your toes into forex or an experienced trader seeking clarity, this article will answer your burning questions. From Exness’s global reputation to India’s forex laws under the Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI), we’ll leave no stone unturned. Let’s dive in!

What is Exness? Understanding the Platform

Before tackling the legality question, let’s first understand what Exness is and why it’s a popular choice among traders worldwide, including in India.

A Global Forex Giant

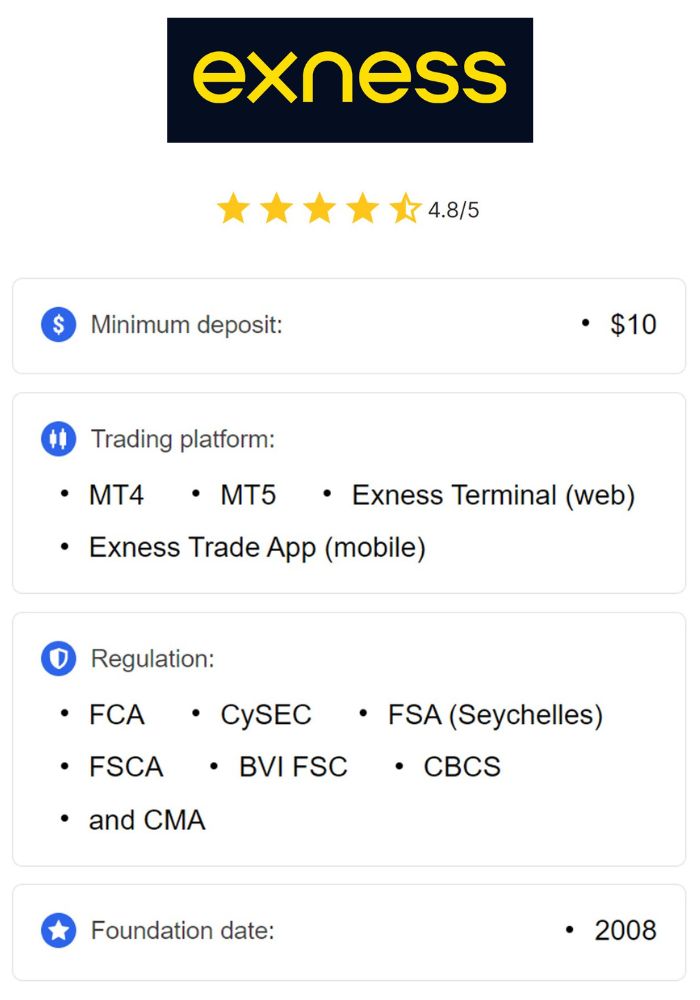

Founded in 2008, Exness is a Cyprus-based online trading platform specializing in forex, commodities, indices, cryptocurrencies, and stocks via Contracts for Difference (CFDs). With over 700,000 active clients and a staggering monthly trading volume exceeding $4 trillion, Exness has cemented its status as a global leader. Its headquarters in Limassol, Cyprus, and operations across 190+ countries make it a household name in the trading community.

Why Indian Traders Love Exness

Exness offers a suite of features that resonate with Indian traders:

Low Spreads: Starting at 0.0 pips on premium accounts, Exness minimizes trading costs, a major draw for cost-conscious traders.

High Leverage: With leverage up to 1:2000, traders can amplify profits with small capital—though this comes with heightened risk.

Localized Payment Options: Support for UPI, bank cards, and e-wallets ensures seamless deposits and withdrawals for Indian users.

Multilingual Support: 24/7 customer service in Hindi and other regional languages caters to India’s diverse population.

Flexible Accounts: From Standard to Pro and Zero accounts, Exness accommodates traders of all levels.

These perks, combined with access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), make Exness a compelling option. But popularity doesn’t automatically equate to legality. So, is Exness trading legal in India? Let’s explore the regulatory framework to find out.

Forex Trading in India: The Legal Landscape

To determine whether Exness is legal, we must first understand the rules governing forex lxtrading in India. The country has a tightly regulated financial system designed to protect investors and maintain economic stability.

The Role of RBI and SEBI

Forex trading in India falls under the purview of two key regulatory bodies:

Reserve Bank of India (RBI): The RBI oversees foreign exchange transactions and enforces the Foreign Exchange Management Act (FEMA), 1999. Its primary goal is to regulate currency flows and prevent speculative trading that could destabilize the Indian Rupee (INR).

Securities and Exchange Board of India (SEBI): SEBI regulates financial markets, including forex trading on recognized exchanges like the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). It ensures transparency and protects retail investors.

FEMA Guidelines: What’s Allowed?

Under FEMA, forex trading is legal in India, but with strict conditions:

INR-Based Currency Pairs Only: Indian residents can only trade currency pairs involving the INR, such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading non-INR pairs (e.g., EUR/USD) is prohibited for retail traders.

Authorized Channels: Trading must occur through RBI-approved brokers or exchanges like NSE, BSE, or Metropolitan Stock Exchange (MSE). Offshore brokers fall into a gray area.

Fund Movement: Deposits and withdrawals must use RBI-regulated methods (e.g., bank accounts, UPI, debit/credit cards), and profits must be repatriated to India.

Tax Compliance: Forex earnings are taxable as "Income from Business or Profession" or "Capital Gains," depending on trading frequency.

These rules aim to curb illegal capital outflows and speculative trading. But where does Exness fit into this framework?

Is Exness Regulated? A Look at Its Global Credentials

Exness isn’t registered with SEBI or RBI, which raises eyebrows among Indian traders. However, its global regulatory status offers some reassurance.

Exness’s Licenses

Exness operates under multiple international licenses, including:

Cyprus Securities and Exchange Commission (CySEC): A top-tier regulator in the European Union, ensuring transparency and client fund protection.

Financial Conduct Authority (FCA): The UK’s FCA imposes strict standards on financial firms, bolstering Exness’s credibility.

Seychelles Financial Services Authority (FSA): A lighter regulatory body, but still enforces basic compliance.

South African Financial Sector Conduct Authority (FSCA): Adds another layer of oversight for African markets.

These licenses mandate segregated client funds, regular audits, and fair trading practices. Exness is also a member of the Financial Commission, offering up to €20,000 in compensation per client in disputes or insolvency cases.

Does Lack of SEBI Registration Matter?

While Exness isn’t SEBI-registered, this doesn’t automatically make it illegal in India. FEMA focuses on trader compliance rather than requiring offshore brokers to register locally. In other words, the legality of trading with Exness hinges on how Indian traders use the platform, not Exness’s origin.

Is Exness Trading Legal in India? The Verdict

So, is Exness trading legal in India? The answer is yes, but with a crucial caveat: it’s legal only if you comply with India’s forex regulations. Here’s why:

Compliance with INR-Based Pairs

Exness offers INR-based pairs like USD/INR and EUR/INR, aligning with FEMA’s requirement that retail forex trading involve the INR. If you stick to these pairs, you’re within legal boundaries.

Payment Methods

Exness supports RBI-regulated payment methods—Indian bank accounts, UPI, and debit/credit cards. This ensures all funds move legally within India’s financial system, satisfying FEMA’s repatriation rules.

💥 Trade with Exness now: Open An Account or Visit Brokers

The Gray Area: Non-INR Pairs

Here’s where things get tricky. Exness also offers non-INR pairs (e.g., EUR/USD, GBP/USD), which Indian residents are prohibited from trading under FEMA. While the platform doesn’t restrict access to these pairs, trading them could violate Indian law, exposing you to legal risks like fines or penalties.

Practical Takeaway

Exness itself isn’t illegal in India. Its legality depends on your actions as a trader. Stick to INR pairs and approved payment methods, and you’re in the clear. Venture into non-INR pairs, and you’re stepping into a regulatory minefield.

How to Trade Legally with Exness in India

Want to use Exness without breaking the law? Follow these steps to stay compliant:

1. Choose INR-Based Pairs

Focus exclusively on pairs like USD/INR, EUR/INR, GBP/INR, or JPY/INR. Exness provides these options, so there’s no need to stray into restricted territory.

2. Use Approved Payment Channels

Deposit funds via UPI, Indian bank accounts, or debit/credit cards. Withdraw profits to the same RBI-regulated accounts to ensure transparency and compliance.

3. Declare Your Earnings

Forex profits are taxable in India. Report them under "Income from Business or Profession" (for frequent traders) or "Capital Gains" (for occasional trades). Consult a tax professional to avoid surprises.

4. Start with a Demo Account

Exness offers a free demo account to practice trading INR pairs. It’s a risk-free way to familiarize yourself with the platform and refine your strategy.

5. Monitor Leverage

High leverage (e.g., 1:2000) can amplify gains but also losses. Use it cautiously, especially given India’s volatile forex market.

By following these steps, you can leverage Exness’s benefits while staying on the right side of the law.

Benefits of Trading with Exness in India

Assuming you trade legally, Exness offers compelling advantages for Indian traders:

Competitive Trading Conditions

Tight Spreads: Low costs mean more of your profits stay in your pocket.

Fast Execution: Instant order processing minimizes slippage, crucial in fast-moving markets.

High Leverage: Boosts profit potential, though it requires careful risk management.

User-Friendly Platform

Exness’s MT4 and MT5 platforms are intuitive, with advanced charting tools, technical indicators, and automated trading options via Expert Advisors (EAs).

Accessibility

The mobile app and localized payment methods make trading convenient, whether you’re in Mumbai, Delhi, or a rural village with internet access.

Transparency and Security

Segregated accounts, regular audits, and international regulation ensure your funds are safe—a critical factor for Indian traders wary of scams.

Risks of Trading with Exness in India

While Exness is a solid platform, there are risks to consider:

Regulatory Uncertainty

Trading non-INR pairs could attract scrutiny from the RBI, even if Exness itself isn’t targeted. Enforcement is rare, but the risk exists.

Leverage Risks

High leverage can wipe out your account in volatile markets. India’s forex market, influenced by RBI interventions, can be unpredictable.

Tax Complexity

Calculating and reporting forex income can be daunting without professional help, especially for high-volume traders.

Offshore Broker Limitations

As an offshore entity, Exness doesn’t offer SEBI-backed investor protection. Disputes must be resolved through international channels, which may be less accessible.

Exness vs. Indian Brokers: A Comparison

How does Exness stack up against SEBI-regulated brokers like Zerodha or Angel One?

Exness Advantages

Global Exposure: Access to international markets beyond what local brokers offer.

Lower Costs: Tighter spreads and no commission on many accounts.

Flexibility: Higher leverage and a wider range of instruments.

Indian Broker Advantages

Full Compliance: SEBI registration ensures alignment with Indian laws.

Local Support: Easier dispute resolution and customer service in India.

INR Focus: No risk of accidentally trading non-INR pairs.

For traders prioritizing compliance and simplicity, local brokers win. For those seeking global opportunities and advanced features, Exness shines—provided they stick to legal pairs.

Real Experiences: What Indian Traders Say About Exness

To get a fuller picture, I scoured forums, social media, and reviews for Indian traders’ experiences with Exness. Here’s what stood out:

Positive Feedback: Many praised the low spreads, fast withdrawals (often instant via e-wallets), and responsive support. “Exness feels like a global platform tailored for India,” one trader noted on Reddit.

Concerns: Some worried about the lack of SEBI regulation. “I love Exness, but I only trade USD/INR to stay safe,” a Quora user shared.

Mixed Feelings: A few reported confusion over tax reporting, with one saying, “The platform is great, but figuring out taxes is a headache.”

These insights highlight Exness’s appeal but underscore the importance of legal awareness.

Alternatives to Exness for Indian Traders

Not sold on Exness? Here are some SEBI-regulated alternatives:

Zerodha: Offers forex trading via NSE’s currency derivatives segment, fully compliant with RBI rules.

Angel One: Provides INR-based forex trading with robust local support.

ICICI Direct: A trusted name for INR pair trading through recognized exchanges.

These brokers eliminate offshore risks but may lack Exness’s global reach and low-cost structure.

The Future of Exness in India

Exness remains a viable option for Indian traders who navigate the regulatory landscape carefully. However, the future could shift:

Stricter Enforcement: The RBI might crack down on offshore brokers, though no major moves have occurred yet.

Local Partnerships: Exness could partner with SEBI-registered entities to offer fully compliant services.

Trader Education: Growing awareness of legal forex trading could boost Exness’s adoption among rule-abiding Indians.

For now, Exness’s legality rests in your hands as a trader.

Conclusion: Should You Trade with Exness in India?

So, is Exness trading legal in India? Yes, it’s legal if you trade INR-based pairs, use approved payment methods, and declare your earnings. Exness offers a world-class platform with low costs, high leverage, and global access—perfect for ambitious Indian traders. However, the temptation of non-INR pairs and the lack of SEBI oversight introduce risks that require caution.

If you’re ready to trade forex legally, Exness is a strong contender. Start with a demo account, stick to INR pairs, and consult a tax expert to cover all bases. The forex market is full of opportunities, and with the right approach, Exness can help you seize them—safely and legally.

What’s your take? Have you used Exness in India? Share your thoughts below—I’d love to hear your experiences!

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: