11 minute read

How much can i make with $10 in forex in Kenya?

from Exness Global

Forex trading, or foreign exchange trading, has become a buzzword in Kenya, capturing the attention of many looking to turn small investments into significant profits. With just $10 in your pocket, you might wonder: How much can I really make trading forex in Kenya? This question is both exciting and complex, as the answer depends on multiple factors like strategy, leverage, risk management, and market conditions. In this comprehensive guide, we’ll explore the potential of starting forex trading with $10 in Kenya, break down the realities, and provide actionable steps to maximize your chances of success.

Top 4 Best Forex Brokers in Kenya

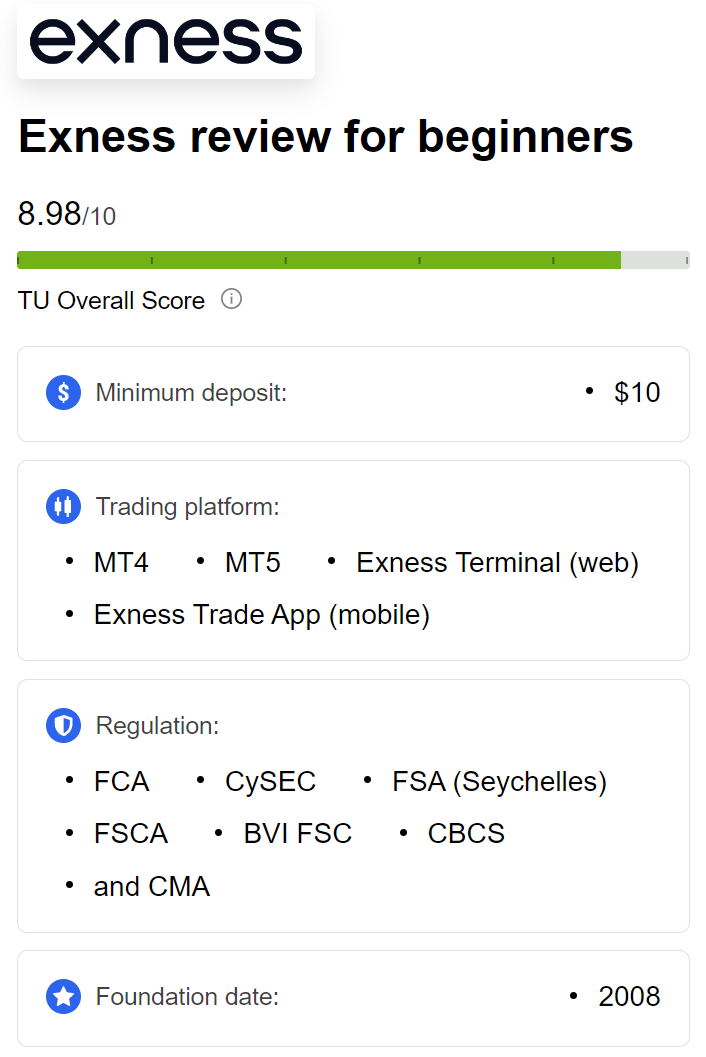

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

Whether you’re a beginner in Nairobi, Mombasa, or a small town, this article will walk you through the opportunities, risks, and practical tips for trading forex with minimal capital. Let’s dive in!

What Is Forex Trading, and Why Is It Popular in Kenya?

Forex trading involves buying and selling currency pairs (e.g., USD/KES, EUR/USD) to profit from fluctuations in exchange rates. It’s the largest financial market globally, with a daily trading volume exceeding $7 trillion. In Kenya, forex trading has surged in popularity due to:

Accessibility: Online platforms and mobile apps make it easy to start trading with as little as $5 or $10.

Low Entry Barrier: Unlike traditional investments like real estate, forex allows Kenyans to begin with small amounts.

Economic Opportunities: With the Kenyan shilling (KES) fluctuating against major currencies, traders see potential for profit.

Digital Growth: High smartphone penetration and internet access enable Kenyans to trade from anywhere.

But can you really make money starting with just $10? Let’s break it down.

Understanding the $10 Starting Point

Starting with $10 in forex trading is entirely possible, thanks to brokers offering micro accounts and high leverage. However, a small starting capital comes with limitations and risks. Here’s what you need to know:

The Power of Micro Accounts

Many brokers in Kenya, such as Exness, XM, and HotForex, offer micro accounts where you can trade micro lots (1,000 units of currency). With $10, you can open positions in currency pairs like EUR/USD or USD/KES, controlling small trade sizes to minimize risk.

Leverage: A Double-Edged Sword

Leverage allows you to control larger positions with a small amount of capital. For example:

With 1:100 leverage, your $10 can control a $1,000 position.

A 1% price movement in your favor could yield a $10 profit (doubling your investment), but a 1% move against you could wipe out your account.

In Kenya, brokers regulated by the Capital Markets Authority (CMA) typically offer leverage from 1:100 to 1:400. While leverage boosts potential profits, it also amplifies losses, so caution is key.

Realistic Expectations

With $10, you’re not going to become a millionaire overnight. Forex trading is a skill that takes time to master. Your potential earnings depend on:

Trading Strategy: Are you scalping, day trading, or swing trading?

Risk Management: How much of your capital are you risking per trade?

Market Conditions: Volatility can create opportunities but also increase risks.

Let’s explore how these factors play out.

How Much Can You Make with $10? A Practical Example

To understand the potential, let’s consider a realistic scenario for a Kenyan trader starting with $10.

Scenario: Trading EUR/USD with $10

Broker: You choose a CMA-regulated broker like FXTM, offering 1:100 leverage and micro accounts.

Currency Pair: EUR/USD, one of the most liquid pairs with low spreads (e.g., 1 pip).

Trade Size: You trade 0.01 micro lots (1,000 units), requiring just $0.10 of margin with 1:100 leverage.

Price Movement: The EUR/USD pair moves 20 pips in your favor (e.g., from 1.0800 to 1.0820).

Profit Calculation:

1 pip = $0.10 for 0.01 micro lots.

20 pips = 20 × $0.10 = $2 profit.

Return: Your $10 account grows to $12, a 20% gain.

Scaling Up

If you consistently make 20 pips per day:

Daily Profit: $2.

Weekly Profit (5 trading days): $10.

Monthly Profit (20 trading days): $40.

This assumes no losses, perfect execution, and stable market conditions—rare in reality. Most traders face losses, so let’s factor in risk management.

Risk Management Impact

A common rule is to risk no more than 1-2% of your account per trade. With $10:

1% risk = $0.10 per trade.

You set a stop-loss at 10 pips, meaning a loss of $0.10 if the trade goes against you.

This approach protects your capital, but it limits your trade size and potential profits. Over time, disciplined trading can compound your account, but losses are inevitable.

Factors Influencing Your Earnings with $10

Several variables determine how much you can make with $10 in forex trading in Kenya:

1. Trading Strategy

Your approach to trading significantly impacts your results. Common strategies include:

Scalping: Making quick trades to capture small price movements (e.g., 5-10 pips). Suitable for $10 accounts but requires focus and low spreads.

Day Trading: Holding trades for a few hours within a day. Less stressful than scalping but still demands market analysis.

Swing Trading: Holding trades for days or weeks. Less practical with $10 due to overnight fees (swaps).

For small accounts, scalping and day trading are more feasible, as they allow frequent trades to grow your capital gradually.

2. Leverage and Lot Size

High leverage (e.g., 1:200) lets you control larger positions, but it’s risky. With $10:

A 0.01 micro lot trade on USD/KES with 1:100 leverage uses minimal margin.

A 10-pip move earns $0.10, but a 10-pip loss costs the same.

Choose brokers with competitive spreads and reasonable leverage to balance risk and reward.

3. Risk Management

Without proper risk management, a $10 account can vanish quickly. Key practices include:

Stop-Loss Orders: Automatically close trades at a predefined loss level.

Risk-Reward Ratio: Aim for trades where potential profit is at least twice the risk (e.g., risk $0.10 to gain $0.20).

Position Sizing: Never risk your entire account on one trade.

4. Market Volatility

Forex markets are influenced by economic news, geopolitical events, and central bank policies. For example:

A US Federal Reserve interest rate decision can cause EUR/USD to move 50-100 pips.

A Central Bank of Kenya (CBK) policy shift might affect USD/KES.

Volatility creates opportunities but also risks. With $10, focus on high-liquidity pairs like EUR/USD to avoid high spreads.

5. Broker Fees

Broker costs can eat into your profits, especially with a small account:

Spreads: The difference between buy and sell prices. EUR/USD typically has spreads of 0.5-2 pips.

Commissions: Some brokers charge per trade, though many micro accounts are commission-free.

Swap Fees: Charged for holding trades overnight, which can affect swing trading.

Choose a broker with low fees, such as Exness or XM, to maximize your $10.

6. Trading Psychology

Emotions like greed, fear, and overconfidence can derail your trading. With $10:

A single loss can feel devastating, tempting you to “revenge trade.”

Small wins might lead to overconfidence, causing you to risk too much.

Discipline and a clear trading plan are essential for long-term success.

💥 Trade with Exness now: Open An Account or Visit Brokers

Challenges of Trading with $10 in Kenya

While $10 makes forex accessible, it comes with hurdles:

1. Limited Capital

A small account restricts your ability to diversify or absorb losses. A single bad trade can deplete your funds, making recovery difficult.

2. High Risk of Overleveraging

To make meaningful profits with $10, you might be tempted to use high leverage (e.g., 1:400). This increases the risk of margin calls or account wipeouts.

3. Emotional Pressure

With such a small amount, every pip movement feels significant. Staying calm and sticking to your strategy is challenging but crucial.

4. Broker Limitations

Not all brokers are suitable for $10 accounts. Some have high minimum deposits or wide spreads that erode profits.

5. Learning Curve

Forex trading requires knowledge of technical analysis, fundamental analysis, and market dynamics. Beginners often lose money while learning, which is tough with limited capital.

Steps to Start Forex Trading with $10 in Kenya

Ready to trade forex with $10? Follow these steps to get started:

Step 1: Educate Yourself

Before risking your money, learn the basics:

Read Books: “Forex Trading for Beginners” by Matthew Driver is a good start.

Watch Tutorials: YouTube channels like Kenya Forex Firm offer free lessons.

Join Communities: Engage with Kenyan traders on forums or Telegram groups for tips.

Step 2: Choose a Regulated Broker

Select a CMA-regulated or internationally trusted broker:

Exness: Low spreads, micro accounts, and instant withdrawals.

XM: Offers bonuses and educational resources.

HotForex: Competitive leverage and local support in Kenya.

Verify the broker’s license and read reviews to ensure reliability.

💥 Trade with Exness now: Open An Account or Visit Brokers

Step 3: Open a Demo Account

Practice with a demo account to:

Test strategies without risking real money.

Familiarize yourself with the trading platform (e.g., MetaTrader 4 or 5).

Build confidence in your skills.

Spend at least 1-2 months on a demo account before going live.

Step 4: Fund Your Account

Deposit your $10 via:

M-Pesa: Most Kenyan brokers support mobile payments.

Bank Transfer: For brokers like FXTM.

E-Wallets: Skrill or Neteller for international brokers.

Start with an amount you can afford to lose.

Step 5: Develop a Trading Plan

Your plan should include:

Goals: E.g., earn $2 per week.

Strategy: Scalping EUR/USD with 10-pip targets.

Risk Management: Risk 1% per trade, use stop-loss orders.

Schedule: Trade during high-liquidity sessions (e.g., London-New York overlap, 1:00-5:00 PM GMT).

Step 6: Start Trading

Begin with small trades:

Trade 0.01 micro lots to keep risks low.

Focus on major pairs like EUR/USD or GBP/USD for tight spreads.

Track your trades in a journal to analyze performance.

Step 7: Keep Learning

Forex markets evolve, so stay updated:

Follow economic news on platforms like Bloomberg or Reuters.

Learn technical indicators (e.g., Moving Averages, RSI).

Attend webinars or courses by Kenyan traders like Patrick Mahinge.

Success Stories: Kenyans Trading with Small Capital

While $10 is modest, some Kenyans have grown small accounts into substantial sums through discipline and skill. Here are two examples:

Peter Mwangi

Peter, a 25-year-old from Thika, started with $20 in 2020. He focused on scalping EUR/USD, risking 1% per trade. After six months of learning and consistent trading, he grew his account to $200. Today, he trades full-time and mentors new traders.

Grace Njeri

Grace, a teacher from Kisumu, began with $15 in 2021. She used a demo account for three months before going live. By trading USD/JPY and following strict risk management, she turned her $15 into $150 in a year. Grace now supplements her income with forex.

These stories highlight that success is possible, but it requires patience, education, and discipline.

Tips to Maximize Profits with $10

To make the most of your $10, consider these strategies:

1. Focus on High-Liquidity Pairs

Trade pairs like EUR/USD, USD/JPY, or USD/KES, which have:

Low spreads (0.5-2 pips).

High liquidity, reducing slippage.

2. Use Low Leverage

While 1:400 leverage is tempting, stick to 1:50 or 1:100 to minimize risk.

3. Trade During Active Sessions

The forex market is most active during:

London Session: 8:00 AM–5:00 PM GMT.

New York Session: 1:00 PM–10:00 PM GMT.

Overlap: 1:00 PM–5:00 PM GMT (ideal for volatility).

4. Avoid Overtrading

With $10, it’s easy to chase quick profits. Limit yourself to 1-2 trades per day to stay focused.

5. Reinvest Profits

Instead of withdrawing small gains, let your account grow. Compounding can turn $10 into $50 over time.

6. Stay Informed

Monitor economic calendars for events like:

CBK Interest Rate Decisions.

US Non-Farm Payrolls (first Friday of each month).

These can create profitable opportunities or risks.

Common Mistakes to Avoid

Beginners with $10 accounts often fall into these traps:

1. Overleveraging

Using 1:400 leverage to chase big profits can lead to margin calls or account wipeouts.

2. No Risk Management

Failing to set stop-loss orders exposes your entire $10 to losses.

3. Emotional Trading

Greed or fear can lead to impulsive trades. Stick to your plan.

4. Choosing Unregulated Brokers

Unregulated brokers may scam you or delay withdrawals. Always verify CMA or international licenses.

5. Expecting Quick Riches

Forex is not a get-rich-quick scheme. Treat your $10 as a learning investment.

Taxes and Withdrawals in Kenya

Forex profits in Kenya are taxable as business income by the Kenya Revenue Authority (KRA). Here’s what to know:

Tax Rates: 10-35% based on your income bracket.

Installment Taxes: Paid quarterly (April, June, September, December).

Record-Keeping: Track all trades to report gains/losses accurately.

When withdrawing profits:

Use M-Pesa for convenience (most brokers support it).

Check for withdrawal fees, which can reduce your $10 account.

Convert USD profits to KES at favorable rates (monitor USD/KES trends).

Is $10 Enough to Succeed in Forex?

Starting with $10 in forex trading in Kenya is a viable way to learn the ropes, but it’s not a path to instant wealth. Your potential earnings depend on:

Skill: Mastering analysis and strategy takes months or years.

Discipline: Sticking to a plan prevents emotional mistakes.

Patience: Growing a $10 account requires compounding small gains.

Realistically, you might earn $1-$5 per week with $10 if you trade conservatively and win consistently. Over time, reinvesting profits and increasing your capital can lead to larger returns.

Conclusion: Your Forex Journey Starts Here

Forex trading with $10 in Kenya is an exciting opportunity to enter the world’s largest financial market. While the potential to make money exists, it’s tempered by risks, learning curves, and the need for discipline. By educating yourself, choosing a reliable broker, practicing on a demo account, and managing risks, you can turn your $10 into a stepping stone for bigger goals.

Ready to start? Open a micro account with a trusted broker like Exness or XM, practice your strategy, and join Kenya’s growing forex community. Share your progress in the comments below, and let’s learn together!

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: