12 minute read

How much to learn forex trading in Nigeria?

from Exness Global

Forex trading has gained immense popularity in Nigeria over the past decade, driven by the promise of financial independence and the accessibility of global markets. For many Nigerians, the allure of trading currencies online offers a pathway to generating income, especially in a country where economic challenges often push individuals to seek alternative revenue streams. However, one of the most common questions beginners ask is: How much does it cost to learn forex trading in Nigeria?

Top 4 Best Forex Brokers in Nigeria

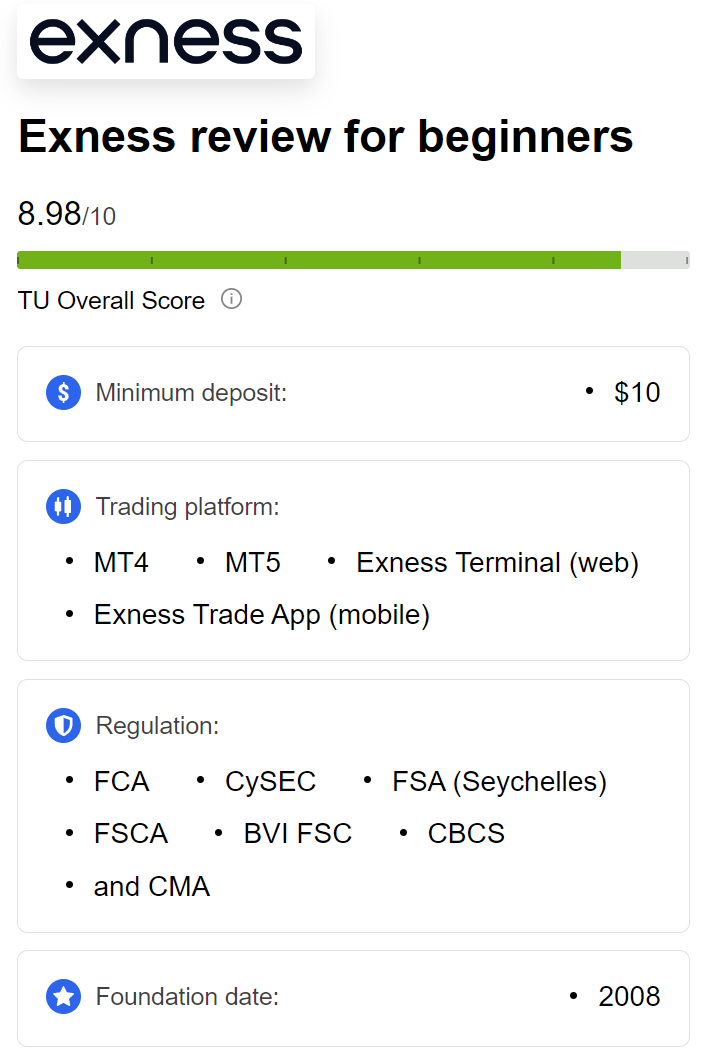

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

This comprehensive guide will break down the costs associated with learning forex trading, from free resources to paid courses, mentorship programs, and the tools you’ll need to succeed. We’ll also explore the Nigerian context, including local challenges, opportunities, and practical tips to help you make informed decisions without breaking the bank. Whether you’re a complete beginner or someone looking to refine your skills, this article will provide clarity on the financial investment required to master forex trading.

Understanding Forex Trading in Nigeria

Before diving into the costs, let’s clarify what forex trading entails and why it’s relevant in Nigeria. Forex, short for foreign exchange, involves trading one currency for another in a global decentralized market. For example, you might trade the Nigerian Naira (NGN) against the US Dollar (USD) or the Euro (EUR) against the British Pound (GBP). The goal is to profit from fluctuations in exchange rates.

In Nigeria, forex trading has become a viable side hustle or full-time career for many due to several factors:

High unemployment rates: With limited job opportunities, many Nigerians turn to forex trading as a way to earn income.

Internet penetration: Affordable smartphones and internet access have made online trading platforms accessible to millions.

Economic volatility: The fluctuating value of the Naira encourages Nigerians to explore ways to hedge against inflation and currency devaluation.

However, forex trading is not a get-rich-quick scheme. It requires education, discipline, and practice. The cost of learning forex trading in Nigeria depends on how you choose to acquire knowledge and the resources you invest in.

Breaking Down the Costs of Learning Forex Trading

The cost of learning forex trading in Nigeria varies widely based on your approach. Below, we’ll categorize the expenses into several key areas: education (free and paid), tools and software, practice accounts, mentorship, and ongoing learning. Let’s explore each in detail.

1. Free Resources for Learning Forex Trading

One of the biggest advantages of forex trading is the abundance of free educational resources available online. If you’re disciplined and willing to put in the effort, you can learn the basics of forex trading without spending a dime. Here’s a look at some free options:

YouTube Tutorials: Platforms like YouTube are treasure troves of forex trading content. Channels like Babypips, Trading 212, and Nigerian traders such as No Nonsense Forex offer free tutorials on topics like technical analysis, risk management, and trading psychology. Estimated cost: ₦0 (assuming you have internet access).

Forex Blogs and Websites: Websites like Babypips.com provide comprehensive beginner guides, including the famous “School of Pipsology.” Other platforms like Investopedia and DailyFX offer free articles on forex strategies and market analysis. Estimated cost: ₦0.

Free Ebooks and PDFs: Many brokers and trading communities share free ebooks on forex trading. A quick Google search for “free forex trading ebooks” will yield plenty of results. Estimated cost: ₦0.

Social Media Communities: Platforms like Twitter (X), Instagram, and Telegram have active forex trading communities in Nigeria. Groups like “Forex Nigeria” on Telegram or accounts run by local traders share tips, signals, and strategies for free. Estimated cost: ₦0.

However, free resources come with challenges:

Information overload: With so much content available, it’s easy to feel overwhelmed or confused by conflicting advice.

Lack of structure: Free resources often lack a clear learning path, requiring you to piece together information yourself.

Risk of scams: Some “free” resources may push shady brokers or signal services that charge hidden fees.

To make the most of free resources, create a study plan, focus on one topic at a time (e.g., candlestick patterns, then risk management), and verify information from multiple sources.

Cost Estimate for Free Resources: ₦0 (plus internet data costs, approximately ₦1,000–₦5,000/month depending on your provider).

2. Paid Forex Courses in Nigeria

If you prefer a structured learning experience, paid forex courses can be a great investment. In Nigeria, forex courses are offered both online and offline, with prices varying based on the provider, duration, and depth of content. Here’s a breakdown:

Online Courses: Platforms like Udemy, Coursera, and Nigerian-based academies like JarusHub offer forex trading courses for beginners and intermediates. Prices typically range from ₦5,000 to ₦50,000. For example:

A beginner’s course on Udemy might cost ₦10,000 during a sale.

A comprehensive course by a Nigerian trader could cost ₦30,000–₦50,000.

Local Forex Academies: In cities like Lagos, Abuja, and Port Harcourt, forex training schools like The Forex Academy Nigeria or FXTM Nigeria run in-person classes. These programs often include hands-on trading sessions and networking opportunities. Prices range from ₦50,000 to ₦200,000 for a 1–3-month course.

International Certifications: Advanced traders may opt for certifications like the Chartered Market Technician (CMT) or Certified Financial Technician (CFTe). These programs are expensive, costing $500–$2,000 (₦800,000–₦3,200,000 at current exchange rates), but they’re rarely necessary for beginners.

When choosing a paid course, consider:

Reputation: Research the provider’s track record. Check reviews on platforms like Trustpilot or ask for recommendations in Nigerian forex communities.

Content: Ensure the course covers essential topics like technical analysis, fundamental analysis, risk management, and trading psychology.

Support: Look for courses that offer post-training support, such as Q&A sessions or access to a community.

Cost Estimate for Paid Courses: ₦5,000–₦200,000, depending on the course type and provider.

3. Mentorship Programs

Mentorship is a popular option in Nigeria, where experienced traders offer one-on-one coaching or group mentorship programs. A mentor can provide personalized guidance, help you avoid common mistakes, and accelerate your learning curve. However, mentorship comes at a premium.

Group Mentorship: Many Nigerian traders run group classes via WhatsApp, Telegram, or Zoom. These programs typically cost ₦20,000–₦100,000 for 1–3 months. Examples include mentorships by traders like Uche Paragon or FX Goat.

One-on-One Coaching: Personalized coaching is more expensive, ranging from ₦100,000 to ₦500,000 for a few weeks or months. High-profile mentors may charge even more.

Signal Services: Some mentors offer trading signals (buy/sell recommendations) as part of their packages. These services cost ₦10,000–₦50,000/month but are risky, as they may encourage dependency rather than independent trading.

Pros of Mentorship:

Tailored advice based on your skill level.

Access to a mentor’s experience and strategies.

Motivation and accountability.

Cons:

High costs, especially for one-on-one sessions.

Risk of encountering fake “gurus” who overpromise results.

Not all mentors are transparent about their trading performance.

To avoid scams, verify a mentor’s credibility by checking their trading history (if shared), reading reviews, and starting with a group program before committing to expensive one-on-one coaching.

Cost Estimate for Mentorship: ₦10,000–₦500,000, depending on the format and mentor’s reputation.

💥 Trade with Exness now: Open An Account or Visit Brokers

4. Trading Tools and Software

Learning forex trading isn’t just about education—you’ll also need tools to practice and analyze the markets. While some tools are free, others require a financial investment. Here’s what you’ll need:

Trading Platform: Most brokers offer free platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). These platforms allow you to analyze charts, place trades, and test strategies. Estimated cost: ₦0.

Charting Software: For advanced analysis, you might invest in premium charting tools like TradingView. A TradingView subscription costs $14.95–$59.95/month (₦24,000–₦96,000 at current rates). However, the free version is sufficient for beginners. Estimated cost: ₦0–₦96,000/month.

Economic Calendar: Staying updated on market-moving events (e.g., US Non-Farm Payrolls) is crucial. Free economic calendars are available on sites like ForexFactory.com. Estimated cost: ₦0.

VPS (Virtual Private Server): If you use automated trading systems (Expert Advisors), a VPS ensures your platform runs 24/7. VPS services cost ₦5,000–₦20,000/month. Estimated cost: ₦0–₦20,000/month.

Internet and Hardware: Reliable internet is essential for trading. Monthly data plans in Nigeria cost ₦1,000–₦10,000, depending on your provider (MTN, Airtel, Glo). You’ll also need a smartphone, laptop, or desktop, which most Nigerians already own. Estimated cost: ₦1,000–₦10,000/month for data.

Cost Estimate for Tools: ₦1,000–₦126,000/month, depending on whether you opt for premium services.

5. Demo Accounts for Practice

Before risking real money, every beginner should practice with a demo account. A demo account simulates real market conditions using virtual funds, allowing you to test strategies without financial risk. Most brokers, such as XM, HotForex, and OANDA, offer free demo accounts with virtual balances of $10,000–$100,000.

Benefits of Demo Accounts:

Learn how to use trading platforms like MT4/MT5.

Test strategies in a risk-free environment.

Build confidence before transitioning to live trading.

Cost Estimate for Demo Accounts: ₦0.

6. Initial Trading Capital

While not directly related to learning, many beginners want to know how much money they need to start trading. In Nigeria, brokers like XM and FBS allow you to open accounts with as little as $5 (₦8,000). However, starting with a small account can be challenging due to:

Spread costs: Brokers charge spreads (the difference between buy and sell prices), which can eat into small accounts.

Risk management: To avoid blowing your account, you should risk only 1–2% per trade, which is difficult with a tiny balance.

Leverage risks: High leverage (e.g., 1:500) can amplify both profits and losses.

For beginners, a starting capital of ₦50,000–₦200,000 is more realistic, allowing you to trade micro-lots and manage risks effectively. However, you don’t need to deposit money until you’ve mastered demo trading.

Cost Estimate for Initial Capital: ₦0 (if you stick to demo accounts) or ₦8,000–₦200,000 for live trading.

7. Ongoing Learning and Market Updates

Forex trading is a lifelong learning journey. Even after mastering the basics, you’ll need to stay updated on market trends, economic news, and new strategies. Ongoing learning costs include:

Books: Forex trading books like “Trading in the Zone” by Mark Douglas or “Japanese Candlestick Charting Techniques” by Steve Nison cost ₦5,000–₦20,000 each in Nigeria.

News Subscriptions: Premium news services like Bloomberg or Reuters cost $30–$100/month (₦48,000–₦160,000), but free alternatives like Yahoo Finance or Investing.com are sufficient for most traders.

Webinars and Workshops: Nigerian brokers like FXTM and AvaTrade host free webinars, but paid workshops by local traders may cost ₦10,000–₦50,000.

Cost Estimate for Ongoing Learning: ₦0–₦160,000/month, depending on your preferences.

Total Cost of Learning Forex Trading in Nigeria

Let’s summarize the potential costs based on different learning paths:

Self-Taught (Free Resources):

Education: ₦0

Tools: ₦1,000–₦10,000/month (internet data)

Demo Account: ₦0

Total: ₦1,000–₦10,000/month

Structured Learning (Paid Courses):

Education: ₦5,000–₦200,000 (one-time or recurring)

Tools: ₦1,000–₦126,000/month

Demo Account: ₦0

Total: ₦6,000–₦326,000 (initial investment + monthly costs)

Mentorship Route:

Education: ₦10,000–₦500,000

Tools: ₦1,000–₦126,000/month

Demo Account: ₦0

Total: ₦11,000–₦626,000 (initial investment + monthly costs)

These estimates assume you’re starting from scratch and include both one-time and recurring expenses. Your actual costs will depend on your learning style, budget, and goals.

Challenges of Learning Forex Trading in Nigeria

While the costs above provide a clear picture, learning forex trading in Nigeria comes with unique challenges that can impact your budget and progress:

Economic Instability: The Naira’s volatility makes it harder to fund trading accounts or afford premium courses priced in USD.

Scams and Fake Gurus: Nigeria’s forex space is rife with fraudsters posing as mentors or signal providers. Always verify credentials before investing money.

Power Supply: Frequent power outages can disrupt trading, requiring investments in inverters or generators (₦50,000–₦500,000).

Internet Reliability: Slow or unstable internet connections can lead to missed trades or platform crashes. Backup data plans may increase costs.

Lack of Regulation: Nigeria’s forex industry is loosely regulated, increasing the risk of dealing with unscrupulous brokers.

To overcome these challenges:

Start with free resources to build a foundation.

Save gradually for paid courses or mentorship if needed.

Choose reputable brokers regulated by international bodies like the FCA, ASIC, or CySEC.

Invest in reliable internet and power backups to ensure uninterrupted trading.

Tips to Learn Forex Trading on a Budget

If you’re working with limited funds, here are practical tips to learn forex trading without overspending:

Leverage Free Resources: Dedicate time to studying Babypips, YouTube tutorials, and free ebooks. Create a daily learning schedule to stay consistent.

Join Communities: Engage with Nigerian forex groups on Telegram, WhatsApp, or Twitter (X) to learn from experienced traders and share knowledge.

Practice Religiously: Spend at least 3–6 months on a demo account before trading live. This builds skills without risking money.

Start Small: When ready to trade live, begin with a micro-account (₦8,000–₦50,000) to minimize losses while gaining real-world experience.

Avoid Get-Rich-Quick Promises: Be wary of mentors or courses promising instant profits. Focus on long-term skill development.

Track Your Progress: Keep a trading journal to analyze your trades and identify areas for improvement. This costs nothing but adds immense value.

Is Learning Forex Trading Worth the Cost?

The decision to invest in learning forex trading depends on your goals, discipline, and financial situation. Here are some pros and cons to consider:

Pros:

Potential for high returns if you master the skill.

Flexibility to trade from anywhere with an internet connection.

Opportunity to diversify income in Nigeria’s challenging economy.

Access to a global market with 24/5 trading hours.

Cons:

High risk of losing money, especially for beginners.

Time-intensive learning process (6 months to several years).

Emotional and psychological challenges, such as dealing with losses.

Ongoing costs for tools, data, and education.

Ultimately, forex trading is worth the cost if you approach it as a long-term skill rather than a quick way to make money. By starting with free resources, practicing diligently, and investing wisely in education, you can minimize expenses while maximizing your chances of success.

Conclusion

Learning forex trading in Nigeria is an achievable goal, regardless of your budget. With free resources, you can start at virtually no cost, while paid courses and mentorship programs offer structured guidance for those willing to invest. Tools, internet access, and practice accounts are essential but can be managed affordably with careful planning.

The total cost of learning forex trading ranges from ₦1,000/month (self-taught) to ₦626,000 (mentorship with premium tools). By combining free and paid resources, practicing on demo accounts, and staying cautious of scams, you can build a solid foundation without overspending.

Forex trading is a journey that requires patience, discipline, and continuous learning. In Nigeria’s dynamic economic landscape, it offers a pathway to financial empowerment—if you’re willing to put in the work. So, take the first step today: explore free resources, open a demo account, and start learning. Your forex trading success story could be just a few trades away.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: