12 minute read

What time is XAUUSD most volatile?

Gold, symbolized as XAUUSD in the forex market, is one of the most traded assets globally. Its price movements captivate traders, investors, and analysts alike due to its safe-haven status and sensitivity to global economic events. For traders looking to capitalize on price swings, understanding when XAUUSD is most volatile is critical. Volatility represents opportunity, but it also comes with risks. So, what time is XAUUSD most volatile, and why? In this in-depth guide, we’ll explore the factors driving gold’s price fluctuations, pinpoint the most volatile trading hours, and provide actionable insights for traders.

Top 4 Best Forex Brokers

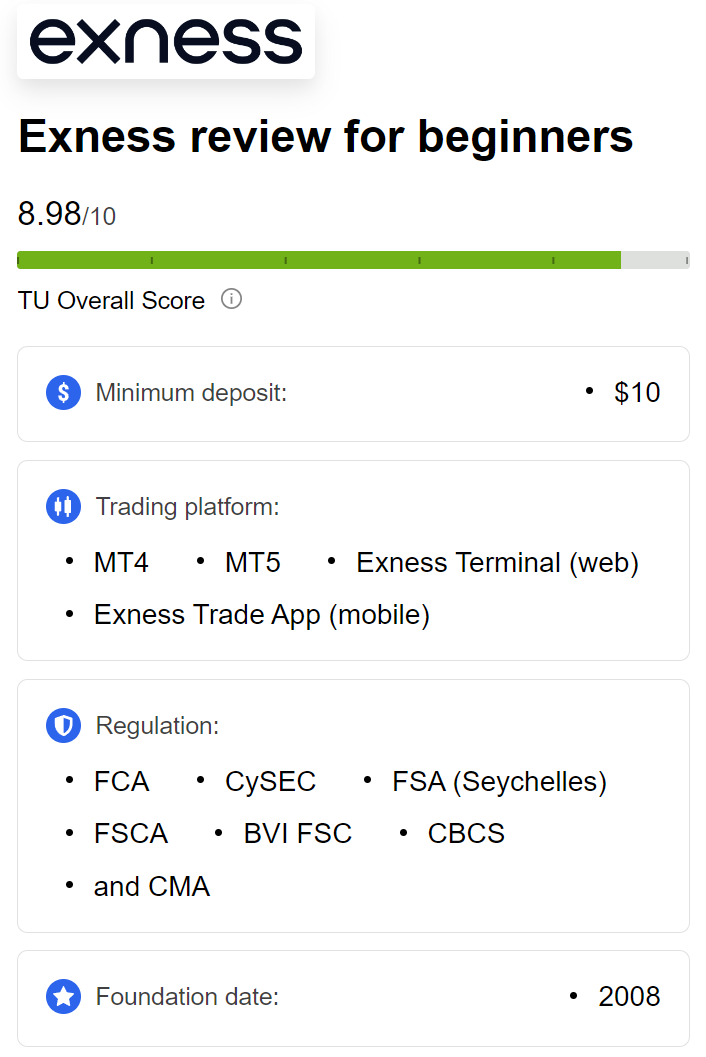

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

Introduction: Why Volatility Matters for XAUUSD Traders

Volatility in the XAUUSD market refers to the degree of price fluctuation over a given period. High volatility means larger price swings, which can lead to significant profits—or losses—if not managed properly. For day traders, scalpers, and swing traders, identifying the times when XAUUSD experiences the most movement is essential for crafting effective strategies.

Gold’s price is influenced by a complex interplay of economic data, geopolitical events, market sentiment, and trading session overlaps. Unlike stocks, which are tied to specific exchanges, XAUUSD trades 24 hours a day, five days a week, across global forex markets. However, not all hours are equal. Certain times of the day see heightened activity, driven by market openings, economic releases, and liquidity surges.

In this article, we’ll break down the key factors affecting XAUUSD volatility, analyze trading sessions, and highlight the hours when gold prices are most likely to spike. Whether you’re a beginner or an experienced trader, this guide will equip you with the knowledge to navigate gold’s dynamic market.

Understanding XAUUSD and Its Market Drivers

Before diving into the most volatile times, let’s establish what XAUUSD is and why it moves.

What is XAUUSD?

XAUUSD is the trading symbol for gold priced in U.S. dollars. In forex trading, it represents the exchange rate between one troy ounce of gold and the U.S. dollar. For example, if XAUUSD is trading at $2,000, it means one ounce of gold costs 2,000 USD. Gold is a commodity, a currency, and a store of value, making it a unique asset with diverse influences.

Key Drivers of XAUUSD Volatility

Gold’s price is shaped by multiple factors, each contributing to its volatility at different times. Understanding these drivers helps explain why certain hours see more price action.

Economic Data ReleasesEconomic indicators like U.S. Non-Farm Payrolls (NFP), Consumer Price Index (CPI), Gross Domestic Product (GDP), and Federal Reserve interest rate decisions significantly impact XAUUSD. Gold is sensitive to inflation expectations and monetary policy, as it’s often seen as an inflation hedge. When key data is released, traders react swiftly, causing sharp price movements.

Geopolitical EventsGold is a safe-haven asset, meaning its demand rises during times of uncertainty. Geopolitical tensions, such as conflicts, trade wars, or political instability, can trigger volatility as investors flock to gold for security.

U.S. Dollar StrengthSince XAUUSD is priced in USD, the U.S. dollar’s strength inversely affects gold prices. A stronger dollar typically suppresses gold prices, while a weaker dollar boosts them. Currency market movements, especially during active trading sessions, contribute to XAUUSD volatility.

Market Sentiment and SpeculationTrader psychology and speculative activity can amplify price swings. For instance, large institutional trades or sudden shifts in market sentiment can lead to rapid price changes, particularly during high-liquidity hours.

Interest Rates and Bond YieldsGold doesn’t pay interest, so rising interest rates or bond yields can make it less attractive compared to yield-bearing assets. Conversely, low rates support gold prices. Announcements from central banks, especially the Federal Reserve, often spark volatility.

Supply and Demand DynamicsWhile gold’s supply is relatively stable, demand from central banks, jewelry markets, and industrial applications can influence prices. Seasonal trends, like increased jewelry demand during holidays, may also play a role.

These factors don’t operate in isolation—they often overlap, creating periods of intense price movement. To pinpoint when XAUUSD is most volatile, we need to examine the global forex market’s structure and trading sessions.

The Forex Market’s 24-Hour Cycle: Trading Sessions Explained

The forex market operates 24/5, divided into four major trading sessions based on the world’s financial hubs: Sydney, Tokyo, London, and New York. Each session has unique characteristics, and their overlaps create periods of heightened activity. Since XAUUSD is a globally traded asset, its volatility is tied to these sessions.

1. Sydney Session (10:00 PM – 7:00 AM GMT)

The Sydney session kicks off the forex trading day. It’s the least active session due to lower participation from major financial centers. For XAUUSD, volatility during this session is typically low, as trading is driven primarily by Australian and New Zealand markets. However, unexpected news from Asia-Pacific regions, like Chinese economic data, can occasionally spark movement.

2. Tokyo Session (12:00 AM – 9:00 AM GMT)

The Tokyo session overlaps with Sydney for a few hours, increasing liquidity slightly. Japan, China, and other Asian economies influence gold prices, especially since China is a major gold consumer. Volatility may rise if Asian markets react to overnight news or if central banks in the region make announcements. Still, XAUUSD tends to remain relatively calm compared to later sessions.

3. London Session (8:00 AM – 5:00 PM GMT)

The London session is the heart of forex trading, accounting for the largest share of daily volume. London’s dominance stems from its role as a global financial hub and its overlap with other sessions. For XAUUSD, the London session often sees increased volatility due to high liquidity, institutional trading, and European economic data releases (e.g., Eurozone inflation or ECB statements).

4. New York Session (1:00 PM – 10:00 PM GMT)

The New York session is the second most active, driven by U.S. and Canadian markets. It’s particularly significant for XAUUSD because gold is priced in USD, and U.S. economic data heavily influences its price. Major reports like NFP, CPI, or Federal Reserve announcements often occur during this session, leading to sharp price swings.

Session Overlaps: The Volatility Sweet Spot

The most volatile periods occur when sessions overlap, as liquidity and trading volume surge. The two key overlaps are:

Tokyo-London Overlap (8:00 AM – 9:00 AM GMT)This brief overlap sees increased activity as European traders join Asian markets. While not as significant for XAUUSD, it can set the tone for the day, especially if Asian news triggers early momentum.

London-New York Overlap (1:00 PM – 5:00 PM GMT)This is the golden window for XAUUSD volatility. The overlap combines London’s high volume with New York’s economic influence, creating ideal conditions for large price movements. Major U.S. data releases, such as NFP (first Friday of each month at 1:30 PM GMT) or FOMC statements, often occur during this period, amplifying volatility.

When is XAUUSD Most Volatile? The Data-Driven Answer

Based on the forex market’s structure and gold’s price drivers, XAUUSD is most volatile during the London-New York overlap (1:00 PM – 5:00 PM GMT). Here’s why:

High LiquidityThe overlap sees participation from both European and U.S. traders, including institutions, hedge funds, and retail traders. Higher liquidity means tighter spreads and larger price swings as orders flood the market.

U.S. Economic Data ReleasesMany critical U.S. economic reports are released between 1:30 PM and 3:00 PM GMT. These include:

Non-Farm Payrolls (NFP): Impacts USD strength and gold prices.

Consumer Price Index (CPI): Signals inflation trends, affecting gold’s appeal.

Retail Sales and Industrial Production: Reflects economic health, influencing sentiment.

Gold often reacts sharply to these releases, with price movements of 50-100 pips or more in minutes.

Federal Reserve AnnouncementsThe Federal Open Market Committee (FOMC) typically releases statements or holds press conferences around 7:00 PM GMT, often during the New York session. Interest rate decisions or forward guidance can cause dramatic XAUUSD spikes.

Geopolitical NewsWhile unpredictable, geopolitical events often break during active market hours. The London-New York overlap ensures maximum trader participation, amplifying gold’s safe-haven response.

Technical Trading ActivityMany traders use technical analysis to trade XAUUSD. During high-volume periods, key levels like support, resistance, or moving averages are tested, leading to breakouts or reversals that drive volatility.

💥 Trade with Exness now: Open An Account or Visit Brokers

Other Volatile Periods

While the London-New York overlap is the peak, other times can also see significant XAUUSD movement:

London Session Open (8:00 AM GMT)The start of the London session often brings a surge in volume as European traders enter the market. If overnight news (e.g., Asian economic data or geopolitical developments) has built momentum, the London open can trigger volatility.

U.S. Data Outside OverlapSome U.S. reports, like the ADP Employment Report or ISM Manufacturing PMI, are released outside the overlap (e.g., 1:15 PM GMT). These can still move XAUUSD, though the impact is typically less pronounced without London’s liquidity.

Unexpected NewsVolatility can spike at any time due to unforeseen events, like a central bank surprise or a geopolitical crisis. Traders must stay vigilant, as gold’s safe-haven status makes it highly reactive.

Volatility by Day: Is There a Pattern?

Beyond hourly patterns, XAUUSD volatility varies by day. Historical data and trader anecdotes suggest certain days are more active:

Monday: Volatility is often lower unless significant weekend news (e.g., geopolitical events) spills over. Traders are cautious, setting the week’s tone.

Tuesday-Wednesday: Midweek sees steady volatility, driven by economic data like CPI or GDP releases. These days are ideal for swing trading.

Thursday: Often the most volatile day, as it coincides with major data (e.g., U.S. Jobless Claims) and FOMC announcements in some weeks.

Friday: Volatility spikes around NFP releases (first Friday) but may taper off later as traders close positions before the weekend.

How to Trade XAUUSD During Volatile Hours

Trading XAUUSD during peak volatility requires preparation and discipline. Here are practical tips to maximize opportunities while managing risks:

1. Plan Around Economic Calendars

Use an economic calendar to track high-impact releases like NFP, CPI, or FOMC meetings. Avoid entering trades just before major news, as spreads widen, and prices can whip-saw.

2. Focus on the London-New York Overlap

Set your trading schedule to align with 1:00 PM – 5:00 PM GMT. This window offers the best chance for large moves, but ensure your strategy accounts for fast markets.

3. Use Technical Analysis

Volatility often respects technical levels. Identify key support/resistance zones, trendlines, or Fibonacci retracements before volatile periods. Combine these with indicators like RSI or MACD for confirmation.

4. Manage Risk Strictly

High volatility means higher risk. Use stop-loss orders, keep leverage low (e.g., 1:10 or less), and risk no more than 1-2% of your account per trade.

5. Trade Breakouts or Reversals

Volatile periods are ideal for breakout strategies (e.g., trading above resistance) or reversal setups after news-driven spikes. Practice on a demo account to refine your approach.

6. Stay Informed

Monitor news feeds for real-time updates on geopolitical events or central bank actions. Tools like Bloomberg, Reuters, or forex news apps can keep you ahead of the curve.

7. Avoid Overtrading

Volatility can be tempting, but chasing every move leads to losses. Stick to high-probability setups and avoid trading during low-liquidity hours (e.g., late Sydney session).

Tools and Resources for Tracking XAUUSD Volatility

To trade effectively, leverage tools that help you monitor and anticipate volatility:

Economic Calendars: Websites like ForexFactory or Investing.com list upcoming data releases with expected impact levels.

Volatility Indicators: Use ATR (Average True Range) or Bollinger Bands to measure XAUUSD’s price range and identify volatile periods.

Trading Platforms: MetaTrader 4/5, TradingView, or cTrader offer real-time XAUUSD charts and news integration.

Broker Data: Some brokers provide session volatility reports or heatmaps showing XAUUSD’s active hours.

News Aggregators: Follow trusted sources for instant updates on market-moving events.

Common Mistakes to Avoid When Trading Volatile XAUUSD

Even seasoned traders can falter during volatile periods. Avoid these pitfalls:

Ignoring Spreads: Volatility widens spreads, eating into profits. Check your broker’s spread policy during news events.

Overleveraging: High leverage amplifies losses in fast markets. Stick to conservative leverage ratios.

Trading Without a Plan: Entering trades impulsively during spikes often leads to poor outcomes. Always have a strategy.

Neglecting Time Zones: Misjudging session times can leave you trading low-liquidity markets. Use GMT as your reference.

Chasing Losses: Volatile markets can trigger emotional trading. Accept losses and move to the next setup.

Advanced Insights: Seasonal and Long-Term Volatility Trends

While daily volatility is critical for short-term traders, understanding seasonal and long-term patterns can benefit swing traders and investors.

Seasonal Trends

Year-End Rally: Gold often sees increased demand in Q4 due to holiday jewelry purchases and portfolio rebalancing.

Summer Lull: July and August may have lower volatility as traders take vacations, though unexpected news can disrupt this.

Central Bank Cycles: Gold reacts to central bank policy shifts, which often follow quarterly or semi-annual schedules.

Long-Term Volatility

Over years, XAUUSD volatility is tied to macroeconomic cycles. For example:

Inflationary Periods: High inflation (e.g., 2021-2023) boosts gold’s appeal, increasing volatility.

Recessions: Economic downturns drive safe-haven flows, spiking prices.

Dollar Trends: Prolonged USD strength or weakness creates multi-month volatile trends.

Traders can use these patterns to anticipate volatile periods beyond daily sessions.

Conclusion: Mastering XAUUSD Volatility

So, what time is XAUUSD most volatile? The data points to the London-New York overlap (1:00 PM – 5:00 PM GMT) as the peak period, driven by high liquidity, U.S. economic releases, and institutional activity. However, volatility isn’t confined to these hours—London’s open, unexpected news, or midweek data can also spark significant moves.

To succeed in trading XAUUSD, align your strategy with these high-volatility windows, but always prioritize risk management. Use economic calendars, technical analysis, and real-time news to stay ahead. Whether you’re scalping for quick profits or swing trading for larger trends, understanding when and why gold moves empowers you to make informed decisions.

Gold’s allure lies in its ability to thrive in uncertainty. By mastering its volatile hours, you can turn price swings into opportunities. Happy trading!

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: