8 minute read

Is Exness available to investors in South Africa?

The world of online trading has exploded in popularity, with platforms like Exness gaining attention for their robust features and global reach. For South African investors, the question often arises: Is Exness available to investors in South Africa? The answer is a resounding yes, but there’s much more to uncover about how Exness operates in the region, its offerings, and why it’s a compelling choice for traders. In this in-depth guide, we’ll explore Exness’s availability, features, regulatory status, and everything South African investors need to know to make informed decisions.

💥 Trade with Exness now: Open An Account or Visit Brokers

The FSCA’s oversight gives South African traders peace of mind, knowing their investments are safeguarded against malpractice. Additionally, Exness employs advanced security measures like SSL encryption and negative balance protection to enhance user safety.

2. Competitive Trading Conditions

Exness is known for its low spreads, starting from 0 pips on certain account types, and fast execution speeds. For South African traders, this translates to cost-effective trading, especially in volatile markets like forex and cryptocurrencies. The platform also offers high leverage options, allowing traders to maximize their positions with minimal capital—though leverage comes with risks that require careful management.

3. Diverse Range of Instruments

Exness provides access to a broad array of financial instruments, including:

Forex: Over 100 currency pairs, including majors, minors, and exotics.

Commodities: Gold, silver, oil, and other popular assets.

Cryptocurrencies: Bitcoin, Ethereum, and other digital currencies.

Stocks and Indices: CFDs on global companies and major indices like the US30 and FTSE 100.

This variety allows South African investors to diversify their portfolios and explore multiple markets from a single platform.

4. Flexible Account Types

Exness offers several account types to suit different trading styles and experience levels:

Standard Account: Ideal for beginners, with no commissions and competitive spreads.

Standard Cent Account: Designed for micro-trading with smaller lot sizes.

Pro Account: Tailored for experienced traders, offering lower spreads and advanced features.

Raw Spread Account: Features raw spreads from 0 pips with a fixed commission.

Zero Account: Provides zero spreads on major pairs for most of the trading day, with commissions.

South African traders can choose accounts in ZAR or other currencies like USD or EUR, making it easy to align with their financial preferences.

5. User-Friendly Platforms

Exness supports MT4 and MT5, two of the most popular trading platforms globally. These platforms offer advanced charting tools, technical indicators, and automated trading via Expert Advisors (EAs). Additionally, Exness provides a proprietary mobile app and web terminal for trading on the go, ensuring South African traders can stay connected to the markets at all times.

How to Get Started with Exness in South Africa

Opening an account with Exness is straightforward for South African investors. Here’s a step-by-step guide to help you begin:

Step 1: Visit the Exness Website

Go to the official Exness website: Open An Account or Visit Brokers

Step 2: Register Your Details

Provide your email address, phone number, and select South Africa as your country of residence. You’ll also need to verify your identity by submitting documents like a passport or ID card and proof of address, as required by FSCA regulations.

Step 3: Choose an Account Type

Select the account type that best suits your trading goals. Beginners may prefer the Standard or Standard Cent account, while professionals might opt for the Pro, Raw Spread, or Zero account.

Step 4: Deposit Funds

Exness offers multiple deposit methods for South African traders, including:

Bank Transfers: Direct deposits from local banks like Standard Bank, FNB, or Absa.

Cards: Visa and Mastercard for instant deposits.

E-Wallets: Skrill, Neteller, and other digital payment systems.

Deposits are typically processed instantly, and Exness does not charge deposit fees, though your payment provider may apply charges.

Step 5: Start Trading

Once your account is funded, download MT4, MT5, or use the Exness web terminal to start trading. Explore the platform’s educational resources, such as webinars and tutorials, to enhance your skills.

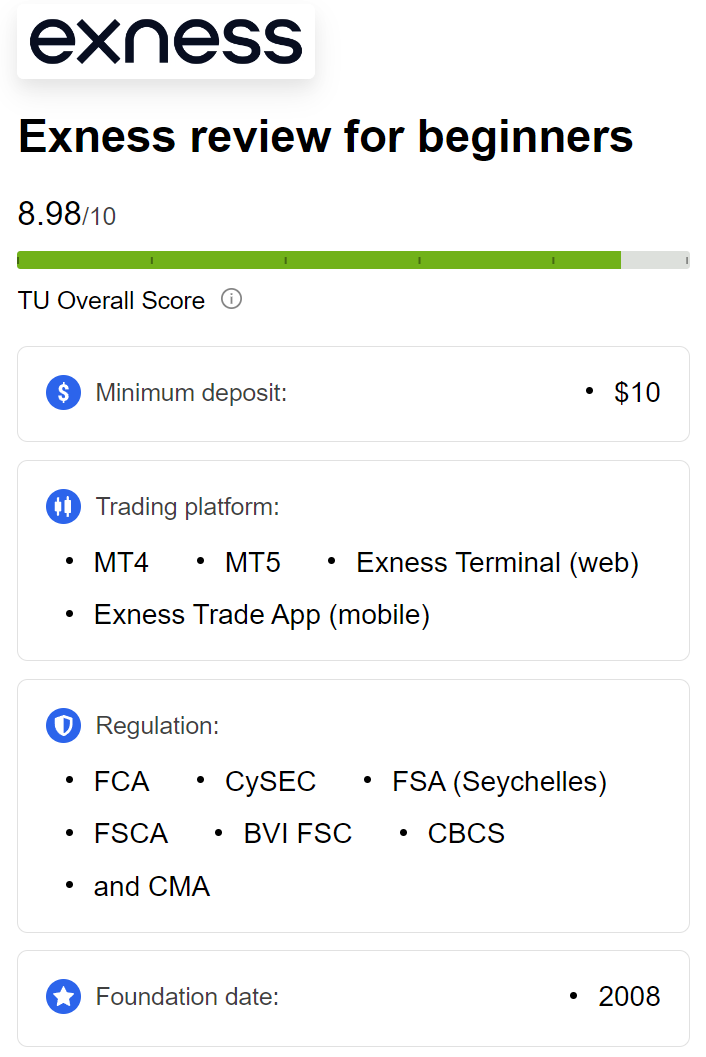

Exness’s Regulatory Framework in South Africa

Regulation is a cornerstone of trust in online trading, and Exness excels in this area. In South Africa, Exness operates as Exness ZA (PTY) Ltd, authorized by the FSCA. The FSCA ensures that financial service providers maintain adequate capital, segregate client funds, and adhere to ethical practices.

Beyond South Africa, Exness holds licenses from other top-tier regulators, including:

Cyprus Securities and Exchange Commission (CySEC): For European operations.

Financial Conduct Authority (FCA): In the United Kingdom.

Financial Services Authority (FSA): In Seychelles.

Capital Markets Authority (CMA): In Kenya.

This multi-jurisdictional regulation underscores Exness’s commitment to global standards, providing South African traders with confidence in the platform’s reliability.

Benefits of Trading with Exness in South Africa

South African investors enjoy several advantages when trading with Exness:

1. Low-Cost Trading

Exness’s tight spreads and commission-free accounts (like the Standard Account) reduce trading costs, making it accessible for traders with varying budgets.

2. High Leverage Options

Exness offers leverage up to 1:2000 on certain accounts, allowing traders to amplify their positions. However, high leverage increases risk, and South African traders should use it cautiously.

3. Fast Withdrawals

Exness processes withdrawals quickly, often within hours, depending on the payment method. This ensures South African traders can access their profits without delays.

4. Islamic Accounts

For Muslim traders in South Africa, Exness provides swap-free (Islamic) accounts that comply with Sharia law, eliminating overnight interest charges.

5. Educational Resources

Exness offers webinars, tutorials, and market analysis to help traders improve their skills. This is particularly valuable for beginners in South Africa’s growing trading community.

Challenges and Risks of Trading with Exness

While Exness is a robust platform, trading always involves risks, and South African investors should be aware of the following:

1. Market Volatility

Forex, cryptocurrencies, and CFDs are highly volatile, and losses can occur rapidly, especially with high leverage. Traders should use risk management tools like stop-loss orders.

2. Leverage Risks

While high leverage can amplify profits, it also magnifies losses. South African traders should assess their risk tolerance before using leverage.

3. Payment Provider Fees

Although Exness doesn’t charge deposit or withdrawal fees, some payment providers may impose charges, affecting overall costs.

4. Learning Curve

Beginners may find trading platforms like MT4 or MT5 complex initially. Exness’s demo accounts are an excellent way to practice without risking real money.

💥 Trade with Exness now: Open An Account or Visit Brokers

Exness vs. Other Brokers in South Africa

To understand Exness’s value, let’s compare it to other popular brokers in South Africa, such as Plus500 and IG Markets:

Exness vs. Plus500: Exness offers lower spreads and more account types than Plus500, which focuses on CFD trading. However, Plus500 has a simpler platform for beginners.

Exness vs. IG Markets: IG Markets provides a broader range of instruments, but Exness excels in forex trading with tighter spreads and higher leverage.

Exness stands out for its FSCA regulation, low-cost trading, and tailored services for South African traders, making it a strong contender in the market.

Exness’s Social Trading and Partnership Programs

Exness offers additional features that enhance its appeal for South African investors:

Social Trading

Exness’s social trading platform allows users to copy the strategies of experienced traders. This is ideal for beginners who want to learn from professionals without actively managing trades. However, as of 2024, social trading has restrictions in South Africa, and investors should check availability on the Exness website.

Partnership Programs

Exness provides two partnership programs for South Africans:

Introducing Broker (IB) Program: Earn up to 40% of Exness’s revenue by referring active traders.

Affiliate Program: Earn commissions (up to $1850 per referred trader) based on trading activity.

These programs offer opportunities for entrepreneurs and influencers in South Africa to generate passive income.

Tips for South African Traders Using Exness

To maximize your experience with Exness, consider these tips:

Start with a Demo Account: Practice trading strategies risk-free before using real funds.

Use Risk Management Tools: Set stop-loss and take-profit orders to protect your capital.

Stay Informed: Follow Exness’s market analysis and global economic news to make informed decisions.

Choose the Right Account: Align your account type with your trading goals and experience level.

Verify Payment Methods: Confirm the fees and processing times of your chosen deposit/withdrawal method.

The Future of Exness in South Africa

South Africa’s online trading market is expanding, driven by increased internet access and financial literacy. Exness is well-positioned to capitalize on this growth, with plans for further expansion in Africa. Its FSCA license, acquired in 2021, marked a significant milestone, and the platform continues to invest in localized services and customer support.

As South Africa’s economy evolves, Exness’s focus on low-cost trading, regulatory compliance, and diverse instruments will likely attract more investors. Whether you’re trading forex, crypto, or stocks, Exness offers a reliable platform to navigate global markets.

Conclusion: Is Exness the Right Choice for South African Investors?

Exness is not only available to investors in South Africa but also stands out as a trusted, regulated, and versatile platform. With FSCA oversight, competitive trading conditions, and tailored features like ZAR accounts and local payment methods, Exness caters effectively to the needs of South African traders. Whether you’re a novice exploring forex or an experienced trader diversifying into CFDs, Exness provides the tools and support to succeed.

However, trading involves risks, and South African investors should approach it with caution, leveraging Exness’s educational resources and demo accounts to build confidence. By choosing Exness, you’re partnering with a global leader committed to transparency and innovation in online trading.

Ready to start your trading journey? Visit Exness’s official website, open an account, and explore the opportunities awaiting South African investors today.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: