12 minute read

Is Exness legal in Pakistan? Review Broker 2025

Forex trading has surged in popularity across the globe, and Pakistan is no exception. With the rise of online trading platforms, Pakistani traders now have unprecedented access to international financial markets. Among the many brokers vying for attention, Exness stands out as a prominent name. Known for its competitive spreads, advanced trading tools, and global reputation, Exness has attracted a significant user base worldwide. However, one critical question looms large for Pakistani traders: Is Exness legal in Pakistan?

💥 Trade with Exness now: Open An Account or Visit Brokers

This article aims to provide a definitive answer by exploring the legal landscape of forex trading in Pakistan, Exness’s regulatory status, its features, and the implications for local traders. Whether you’re a beginner or an experienced trader, this comprehensive guide will equip you with the knowledge to make informed decisions about using Exness in Pakistan.

Understanding Forex Trading in Pakistan

Before diving into the legality of Exness, it’s essential to understand the broader context of forex trading in Pakistan. Forex, or foreign exchange trading, involves buying and selling currencies to profit from fluctuations in exchange rates. It’s a decentralized market that operates 24/5, offering immense opportunities for traders worldwide.

In Pakistan, forex trading has gained traction over the past decade. The accessibility of online platforms, coupled with growing financial literacy, has fueled this trend. Traders in Pakistan are drawn to forex due to its potential for high returns, flexibility, and the ability to diversify investment portfolios beyond traditional avenues like stocks or real estate.

However, forex trading in Pakistan operates within a unique regulatory framework. Unlike countries with well-established forex markets, such as the UK or the US, Pakistan’s financial regulations are still evolving. This creates a complex environment for traders using international brokers like Exness.

The Regulatory Framework for Forex Trading in Pakistan

To determine whether Exness is legal in Pakistan, we must first examine the country’s regulatory bodies and laws governing forex trading.

1. Securities and Exchange Commission of Pakistan (SECP)

The Securities and Exchange Commission of Pakistan (SECP) is the primary authority overseeing financial markets in the country. Established under the Securities and Exchange Commission of Pakistan Act of 1997, the SECP regulates securities, commodities, and other financial activities, including forex trading. Its mission is to ensure transparency, protect investors, and maintain the integrity of Pakistan’s financial system.

While forex trading is not explicitly banned in Pakistan, the SECP has not issued specific regulations tailored to online forex brokers. Instead, it focuses on regulating local financial institutions and brokerage firms. This leaves a gray area for international brokers operating in Pakistan without direct SECP oversight.

2. State Bank of Pakistan (SBP)

The State Bank of Pakistan (SBP), the country’s central bank, plays a complementary role in regulating forex-related activities. The SBP oversees foreign exchange policies, manages currency reserves, and enforces rules related to capital flows. Under the Foreign Exchange Regulation Act of 1947, the SBP imposes restrictions on foreign currency transactions to maintain economic stability.

For Pakistani traders, this means that while forex trading is permissible, transferring funds to international brokers must comply with SBP guidelines. Traders are generally allowed to use local bank accounts or payment methods for deposits and withdrawals, but large capital outflows may attract scrutiny.

3. Legal Status of Forex Trading

Forex trading itself is legal in Pakistan, provided it adheres to the existing financial regulations. However, the lack of a clear framework for online forex brokers creates ambiguity. The SECP encourages traders to work with locally regulated brokers, but many Pakistanis opt for international platforms like Exness due to their advanced features and global reach.

This regulatory gap raises an important question: Can Pakistani traders legally use an international broker like Exness that isn’t registered with the SECP? Let’s explore Exness’s background and regulatory status to find out.

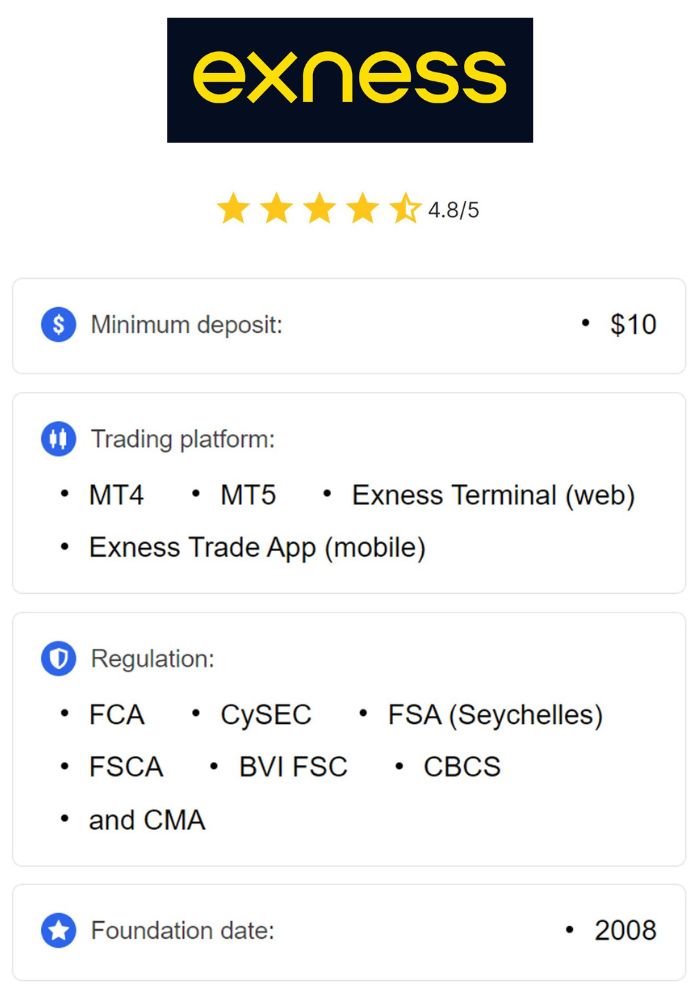

What Is Exness? An Overview of the Broker

Founded in 2008, Exness is a globally recognized forex and CFD (Contracts for Difference) broker headquartered in Cyprus. Over the years, it has grown into one of the most trusted names in the industry, serving millions of clients across more than 200 countries. Exness offers a wide range of financial instruments, including:

Forex: Major, minor, and exotic currency pairs.

CFDs: Stocks, indices, commodities, and cryptocurrencies.

Metals: Gold and silver trading.

Exness is renowned for its competitive trading conditions, such as tight spreads (starting from 0.0 pips), high leverage (up to 1:2000 or unlimited in some cases), and fast order execution. The broker supports popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal, making it accessible to traders of all levels.

Exness’s Global Reputation

Exness has built a strong reputation for transparency and reliability. It publishes monthly financial reports detailing trading volumes, client withdrawals, and partner rewards, audited by Deloitte, one of the “Big Four” accounting firms. This level of transparency sets Exness apart from many competitors and instills confidence among traders worldwide.

But how does this global reputation translate to its operations in Pakistan? To answer this, we need to examine Exness’s regulatory licenses and their relevance to Pakistani traders.

Is Exness Regulated? A Look at Its Licenses

Exness operates under multiple regulatory bodies across different jurisdictions, which is a key factor in assessing its legality and safety. Here are the primary regulators overseeing Exness:

1. Cyprus Securities and Exchange Commission (CySEC)

Exness Europe Limited is regulated by CySEC in Cyprus under license number 178/12. CySEC is a Tier-1 regulator within the European Union, adhering to the Markets in Financial Instruments Directive (MiFID). This ensures strict compliance with rules on client fund segregation, transparency, and investor protection.

2. Financial Conduct Authority (FCA)

Exness (UK) Ltd is licensed by the FCA in the United Kingdom, one of the world’s most respected financial regulators. The FCA imposes rigorous standards on brokers, including negative balance protection and participation in the Financial Services Compensation Scheme (FSCS), which compensates clients up to £85,000 in case of broker insolvency.

3. Financial Services Authority (FSA) – Seychelles

Exness (SC) Ltd, the entity most relevant to Pakistani traders, is regulated by the FSA in Seychelles with license number SD025. While the FSA is considered a Tier-3 regulator (less stringent than CySEC or FCA), it still enforces standards for client safety and operational integrity.

4. Other Regulatory Licenses

Exness also holds licenses from:

Financial Sector Conduct Authority (FSCA) in South Africa.

Capital Markets Authority (CMA) in Kenya.

Central Bank of Curaçao and Sint Maarten (CBCS).

Financial Services Commission (FSC) in Mauritius and the British Virgin Islands.

This multi-layered regulatory framework demonstrates Exness’s commitment to operating legally and securely across various markets. However, none of these licenses come from Pakistani authorities like the SECP or SBP.

Is Exness Legal in Pakistan? The Verdict

So, is Exness legal in Pakistan? The answer is nuanced and depends on how we interpret the regulatory landscape.

Exness’s Status in Pakistan

Exness is not directly regulated by the SECP or SBP, meaning it does not hold a local license to operate within Pakistan. However, this does not automatically render it illegal. Forex trading with international brokers is a common practice in countries with underdeveloped regulatory frameworks, and Pakistan is no exception.

Exness operates in Pakistan through its Seychelles entity (Exness SC Ltd), which is regulated by the FSA. Pakistani traders can legally access Exness’s services as long as they comply with local laws, such as SBP guidelines on foreign exchange transactions. There is no official ban on Exness in Pakistan, and the broker has not faced any regulatory actions from Pakistani authorities.

Legal Implications for Pakistani Traders

While Exness itself is not banned, traders must consider the following:

Compliance with SBP Rules: Deposits and withdrawals must align with SBP regulations. Using authorized payment channels (e.g., local bank accounts or e-wallets) is typically allowed, but traders should avoid unregulated methods to stay compliant.

Lack of Local Oversight: Since Exness isn’t regulated by the SECP, Pakistani traders may have limited recourse in disputes. However, Exness’s international licenses provide a layer of protection, including segregated client funds and dispute resolution mechanisms.

Taxation: Forex profits in Pakistan are subject to taxation under the Income Tax Ordinance of 2001. Traders must report their earnings to the Federal Board of Revenue (FBR) to avoid legal issues.

In summary, Exness is legal for Pakistani traders to use, provided they adhere to local financial regulations. The absence of an SECP license does not prohibit its use but highlights the importance of due diligence.

💥 Trade with Exness now: Open An Account or Visit Brokers

Benefits of Using Exness in Pakistan

Despite the regulatory ambiguity, Exness offers several advantages that make it appealing to Pakistani traders. Here’s why it remains a popular choice:

1. Low Minimum Deposit

Exness requires a minimum deposit as low as $1 for Standard accounts, making it accessible to beginners with limited capital. Professional accounts (e.g., Raw Spread or Zero) require a higher deposit (starting at $200), but the flexibility caters to diverse trading needs.

2. High Leverage

Exness offers leverage up to 1:2000 or even unlimited leverage under certain conditions. This allows traders to maximize their potential returns, though it also increases risk—a factor Pakistani traders must manage carefully.

3. Wide Range of Trading Instruments

With over 200 trading instruments, including forex pairs, cryptocurrencies (e.g., Bitcoin, Ethereum), commodities (e.g., oil, gold), and indices, Exness provides ample opportunities for portfolio diversification.

4. Fast Withdrawals and Deposits

Exness processes 95% of withdrawal requests instantly, a standout feature for traders in Pakistan where payment delays can be a concern. Supported payment methods include bank cards, e-wallets (e.g., Skrill, Neteller), and local bank transfers.

5. Advanced Trading Platforms

Exness supports MT4, MT5, and its Exness Trade App, offering robust tools for technical analysis, automated trading (via Expert Advisors), and mobile accessibility—ideal for Pakistan’s tech-savvy traders.

6. Islamic Accounts

As a Muslim-majority country, Pakistan has a high demand for swap-free (Islamic) accounts. Exness caters to this need by offering Sharia-compliant accounts with no overnight interest charges, making it suitable for Pakistani traders adhering to Islamic finance principles.

Risks of Trading with Exness in Pakistan

While Exness offers compelling benefits, there are risks to consider, particularly in the Pakistani context:

1. Lack of Local Regulation

Without SECP oversight, traders rely on Exness’s international licenses for protection. In case of disputes, resolving issues through foreign regulators may be challenging for Pakistan-based clients.

2. Currency Exchange Risks

Fluctuations in the Pakistani Rupee (PKR) against major currencies (e.g., USD) can affect trading costs and profits. Exness does not support PKR as a base currency, requiring conversions that may incur fees.

3. High Leverage Risks

While high leverage is a draw, it amplifies both gains and losses. Inexperienced traders in Pakistan may face significant financial risks without proper risk management.

4. Limited Investor Protection

Exness provides investor protection (e.g., compensation schemes) under CySEC and FCA jurisdictions, but these do not extend to clients under the FSA (Seychelles) entity, which serves Pakistani traders.

How to Start Trading with Exness in Pakistan

If you’re convinced that Exness is a viable option, here’s a step-by-step guide to get started:

Step 1: Open an Account

Visit the Exness website and click “Open Account.”

Provide your email, phone number, and country (Pakistan).

Choose an account type (e.g., Standard, Pro, or Islamic).

Step 2: Verify Your Identity

Submit a government-issued ID (e.g., CNIC) and proof of address (e.g., utility bill) for KYC (Know Your Customer) verification.

This process complies with international anti-money laundering (AML) standards and typically takes a few hours.

Step 3: Deposit Funds

Log in to your Exness account and navigate to the “Deposit” section.

Select a payment method (e.g., bank transfer, Visa/Mastercard, or e-wallets).

Enter the amount and confirm the transaction. Funds are usually credited instantly.

Step 4: Start Trading

Download MT4, MT5, or the Exness Trade App.

Log in with your credentials, analyze the markets, and place your first trade.

Step 5: Withdraw Profits

Go to the “Withdrawal” section, choose your preferred method, and request a payout.

Most withdrawals are processed instantly, though bank transfers may take 1-3 days.

Alternatives to Exness for Pakistani Traders

If the lack of local regulation concerns you, consider these SECP-regulated alternatives:

AKD Securities: A well-established Pakistani brokerage offering forex and other investment services.

Topline Securities: Known for competitive trading conditions and SECP compliance.

SMC Brokers: A local firm providing forex trading with robust customer support.

While these brokers offer greater local legal protection, they may lack the global reach, low spreads, or advanced tools provided by Exness.

User Experiences: What Pakistani Traders Say About Exness

Feedback from Pakistani traders highlights both the strengths and challenges of using Exness:

Positive Reviews: Many praise the low spreads, fast withdrawals, and user-friendly platforms. The availability of Islamic accounts is a significant plus.

Concerns: Some traders note the absence of local regulation as a drawback, citing difficulties in contacting customer support for complex issues.

Overall, Exness enjoys a loyal following in Pakistan, particularly among those who prioritize trading conditions over local oversight.

Tips for Safe Trading with Exness in Pakistan

To maximize your experience and minimize risks, follow these tips:

Start Small: Begin with a low deposit to test the platform and build confidence.

Use Risk Management Tools: Set stop-loss orders and avoid over-leveraging.

Stay Compliant: Ensure your transactions align with SBP regulations.

Educate Yourself: Leverage Exness’s free educational resources (webinars, tutorials) to improve your skills.

Monitor Tax Obligations: Keep records of your trades for tax reporting.

Conclusion: Should You Trade with Exness in Pakistan?

So, is Exness legal in Pakistan? Yes, it is—with caveats. Exness operates legally under international regulations and is not banned in Pakistan. Pakistani traders can use its services without violating local laws, provided they comply with SBP and tax requirements. However, the lack of SECP regulation means traders must rely on Exness’s global licenses for protection, which may not offer the same recourse as a locally regulated broker.

💥 Trade with Exness now: Open An Account or Visit Brokers

For those willing to navigate this ambiguity, Exness offers a compelling package: low costs, high leverage, diverse instruments, and instant withdrawals. It’s particularly appealing to beginners and traders seeking Sharia-compliant options. However, if local oversight is a priority, SECP-regulated brokers might be a safer bet.

Ultimately, the decision rests on your risk tolerance, trading goals, and comfort with international platforms. Conduct thorough research, weigh the pros and cons, and start with a demo account to test Exness firsthand. In the ever-evolving world of forex trading, staying informed is your greatest asset.