12 minute read

Does Exness have negative balance protection?

from Exness Global

In the fast-paced world of online trading, one question looms large for both novice and seasoned traders: Does Exness have negative balance protection? This feature is critical for anyone navigating the volatile forex and CFD markets, as it can mean the difference between a manageable loss and financial ruin. In this in-depth guide, we’ll explore Exness’ negative balance protection (NBP) policy, how it works, why it matters, and what traders need to know to trade confidently in 2025. Whether you’re new to trading or a professional looking to refine your strategy, this article will provide clarity and actionable insights.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Negative Balance Protection?

Before diving into Exness’ specific policies, let’s clarify what negative balance protection means. Negative balance protection (NBP) is a risk management feature offered by some brokers to ensure traders cannot lose more money than they have deposited in their trading accounts. In volatile markets, rapid price movements can lead to losses that exceed a trader’s account balance, potentially leaving them in debt to the broker. NBP acts as a safety net, resetting the account balance to zero in such scenarios, so traders don’t owe additional funds.

Why Is Negative Balance Protection Important?

The importance of NBP cannot be overstated, especially for traders using leverage. Leverage allows traders to control larger positions with smaller capital, amplifying both potential profits and losses. In extreme market conditions—such as during major economic announcements, geopolitical events, or “black swan” events like the 2015 Swiss Franc crisis—prices can move so quickly that losses surpass the account balance before a stop-loss order can be executed.

Without NBP, traders could face:

Debt to the Broker: Losses exceeding the account balance could require traders to deposit additional funds to cover the deficit.

Financial Stress: Unexpected debts can lead to significant financial and emotional strain.

Barriers to Trading: A negative balance could prevent traders from continuing to trade until the debt is cleared.

NBP mitigates these risks, offering peace of mind and making trading safer, particularly for retail traders with limited capital.

Does Exness Offer Negative Balance Protection?

The short answer is yes, Exness does offer negative balance protection to all its clients, regardless of account type or region. This feature is a cornerstone of Exness’ commitment to providing a secure and trader-friendly environment. Whether you’re trading forex, cryptocurrencies, metals, or indices, Exness ensures that your losses will never exceed your deposited funds.

How Does Exness’ Negative Balance Protection Work?

Exness’ NBP policy is designed to be straightforward and automatic. Here’s how it functions:

Automatic Reset to Zero: If a trade results in a negative balance due to a stop-out (when margin levels drop to zero, triggering automatic closure of positions), Exness resets the account balance to zero. Traders don’t need to take any action—Exness handles it immediately after the stop-out occurs.

No Additional Deposits Required: Unlike brokers without NBP, Exness does not require traders to deposit funds to cover a negative balance. For example, if your account balance is $100 and a trade results in a $150 loss, Exness will absorb the $50 deficit, setting your balance back to $0.

Applies to All Account Types: Whether you’re using a Standard, Standard Cent, Pro, Zero, or Raw Spread account, NBP is available. This universality makes Exness appealing to traders of all experience levels.

Protection Across Market Conditions: Exness’ NBP applies even during extreme market volatility, such as during major news events or unexpected price gaps, ensuring traders are safeguarded in all scenarios.

Example of Negative Balance Protection in Action

To illustrate, imagine a trader with a $500 balance in their Exness Standard account. They open a leveraged position on a forex pair, but a sudden market crash causes a stop-out, resulting in a $700 loss. Without NBP, the trader would owe Exness $200. However, with Exness’ NBP, the account balance is automatically reset to $0, and the trader can either deposit new funds to continue trading or pause without any financial obligation.

Why Exness’ Negative Balance Protection Stands Out

While many brokers offer NBP, Exness distinguishes itself through its transparency, reliability, and client-centric approach. Here are some reasons why Exness’ NBP is particularly noteworthy:

1. Regulatory Compliance

Exness operates under multiple regulatory authorities, including the Cyprus Securities and Exchange Commission (CySEC), the UK’s Financial Conduct Authority (FCA), and the Financial Services Authority (FSA) in Seychelles. In regions like the EU and UK, NBP is a mandatory requirement for regulated brokers, ensuring Exness adheres to strict standards. Even for clients registered under less stringent jurisdictions, Exness extends NBP universally, showcasing its commitment to fairness.

2. Instant and Automatic Process

Unlike some brokers that require traders to contact support or wait for manual adjustments, Exness’ NBP is fully automated. The “null operation” (the term Exness uses for resetting a negative balance to zero) typically happens immediately after a stop-out, minimizing delays and allowing traders to resume trading quickly.

3. No Hidden Conditions

Exness’ NBP policy is clear and free of hidden terms. Traders don’t need to meet specific criteria or opt-in—protection is applied by default across all accounts. This transparency builds trust, especially for beginners wary of fine print.

4. Support for High Leverage

Exness offers some of the highest leverage ratios in the industry, up to 1:2000 or even unlimited leverage for certain accounts. High leverage increases the risk of significant losses, making NBP even more critical. Exness’ robust NBP policy ensures that traders using high leverage are protected from catastrophic losses.

5. Stop-Out Protection Complement

In addition to NBP, Exness offers Stop-Out Protection, a feature that delays stop-outs during volatile market conditions by keeping trades open longer. This gives traders more time to add funds, close positions manually, or wait for the market to recover. When combined with NBP, Stop-Out Protection enhances Exness’ risk management ecosystem, making it one of the safest platforms for traders.

Comparing Exness’ NBP to Other Brokers

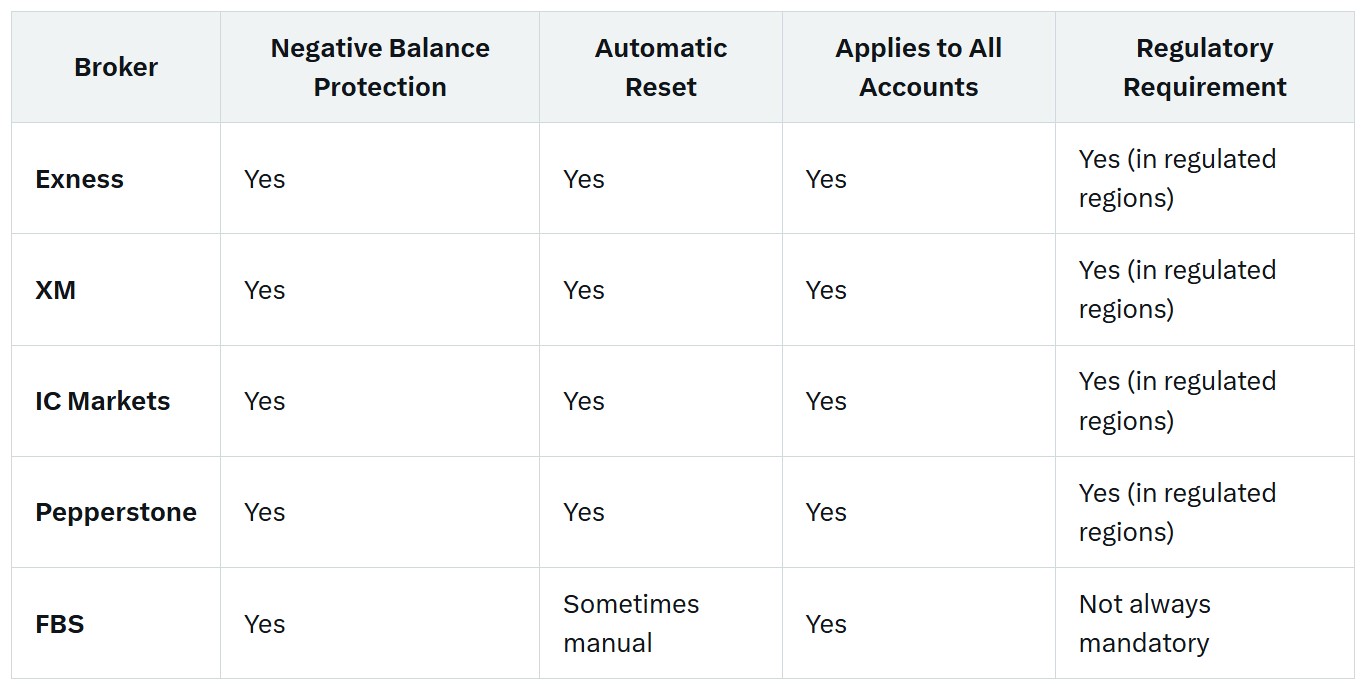

To understand how Exness stacks up, let’s compare its NBP policy to other popular brokers:

Exness’ NBP is competitive, offering automatic resets and universal coverage without the need for manual intervention, which some brokers like FBS may require. Additionally, Exness’ global regulatory oversight ensures compliance with NBP standards where applicable, providing an extra layer of security.

Who Benefits Most from Exness’ Negative Balance Protection?

Exness’ NBP is valuable for a wide range of traders, but certain groups benefit the most:

1. Beginner Traders

New traders often lack the experience to navigate volatile markets or manage leverage effectively. NBP protects them from unexpected losses, allowing them to learn and experiment without the fear of debt.

2. High-Leverage Traders

Traders using Exness’ high leverage options (e.g., 1:1000 or 1:2000) face amplified risks. NBP ensures that even if a trade goes drastically wrong, losses are capped at the account balance.

3. Scalpers and Day Traders

Scalpers and day traders open multiple positions daily, often in fast-moving markets. NBP safeguards them during sudden price spikes or gaps, which are common in intraday trading.

4. Traders in Volatile Markets

Those trading volatile instruments like cryptocurrencies or exotic forex pairs benefit from NBP, as these markets are prone to rapid, unpredictable movements.

5. Retail Traders with Limited Capital

Retail traders with smaller account balances rely on NBP to protect their finances. Exness’ low minimum deposit requirements ($10 for Standard accounts) combined with NBP make it accessible and safe for budget-conscious traders.

💥 Trade with Exness now: Open An Account or Visit Brokers

Limitations and Considerations of Exness’ Negative Balance Protection

While Exness’ NBP is robust, there are a few considerations traders should keep in mind:

1. Negative Equity with Open Trades

If a trader has open hedged positions and negative equity (but a positive balance), depositing funds may not trigger NBP. In such cases, the negative equity is deducted from the new deposit. For example, if your balance is $1,000 with a hedged position resulting in -$50 equity, depositing $100 would adjust the equity to $50 ($1,100 - $1,050), not reset it to zero. Traders should wait for all positions to close before depositing to ensure NBP applies fully.

2. Extreme Market Anomalies

In rare cases, extreme market gaps or liquidity issues could delay stop-outs, potentially leading to a temporary negative balance. While Exness commits to resetting these to zero, the process assumes the broker’s financial stability. Traders should be aware that no broker can guarantee absolute protection in catastrophic scenarios, though Exness’ strong capitalization reduces this risk.

3. Not a Substitute for Risk Management

NBP is a safety net, not a strategy. Traders must still use tools like stop-loss orders, position sizing, and leverage management to minimize risks. Relying solely on NBP could lead to reckless trading, draining accounts quickly.

How to Maximize Safety with Exness’ Negative Balance Protection

To make the most of Exness’ NBP, traders can adopt these best practices:

1. Use Stop-Loss Orders

Set stop-loss orders for every trade to limit potential losses before they reach critical levels. This complements NBP by reducing the likelihood of a stop-out.

2. Monitor Margin Levels

Keep an eye on your account’s margin level to avoid stop-outs. Exness provides real-time margin monitoring tools in its trading platforms (MT4, MT5, and Exness Terminal).

3. Trade Responsibly with Leverage

Choose leverage levels that align with your risk tolerance. Exness allows customizable leverage, so adjust it based on your experience and market conditions.

4. Stay Informed About Market Events

Be aware of upcoming economic announcements or events that could spike volatility. Exness offers market news and analysis to help traders prepare.

5. Practice on a Demo Account

Exness’ demo account replicates live market conditions with a $10,000 virtual balance. Use it to test strategies and understand how NBP works without risking real money.

6. Avoid Premature Deposits

If your account approaches a stop-out, wait for the null operation to complete before depositing new funds. This ensures NBP resets your balance to zero without complications.

Exness’ Broader Safety Features

Beyond NBP, Exness implements several measures to protect traders:

Segregated Accounts: Client funds are kept separate from Exness’ operational funds, ensuring they’re safe even if the broker faces financial difficulties.

Advanced Encryption: Exness uses SSL encryption and multi-factor authentication to secure transactions and personal data.

Regular Audits: Independent audits by firms like Deloitte verify Exness’ financial practices, enhancing transparency.

24/7 Customer Support: Exness offers round-the-clock support via live chat, email, and phone, helping traders resolve issues quickly.

Stop-Out Protection: As mentioned earlier, this feature delays stop-outs, giving traders more control during volatile periods.

These features create a holistic safety ecosystem, making Exness a trusted choice for traders worldwide.

Is Exness the Right Broker for You?

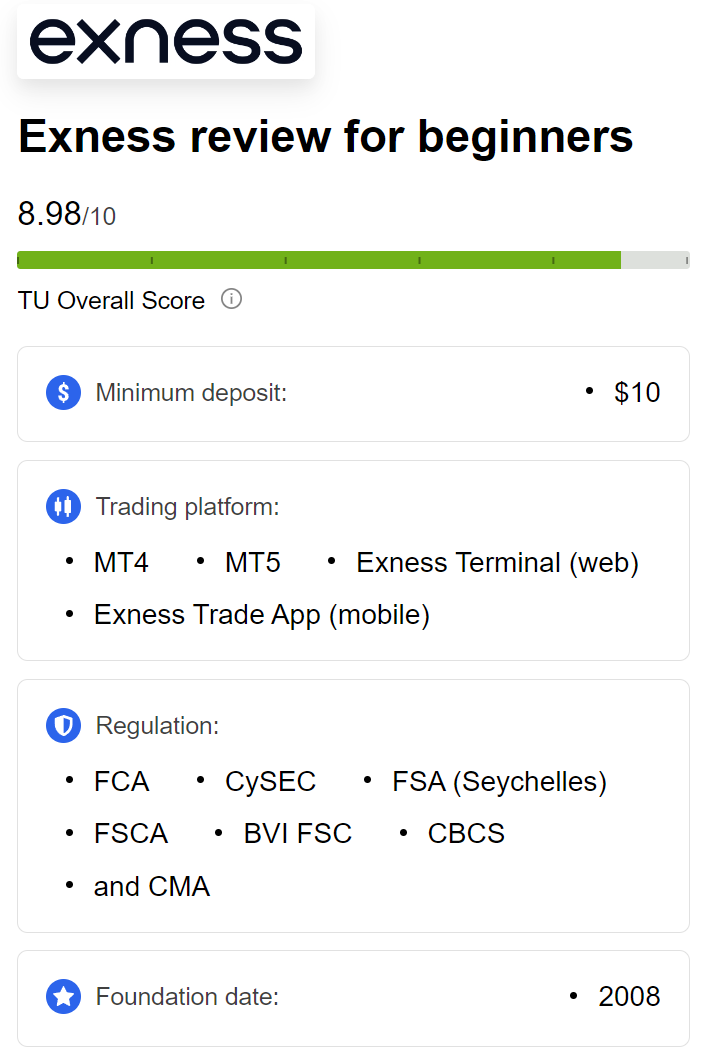

Exness’ negative balance protection is a significant advantage, but choosing a broker involves considering multiple factors. Here’s a quick overview of Exness’ pros and cons to help you decide:

Pros

Robust NBP: Automatic and universal protection across all accounts.

High Leverage: Up to 1:2000 or unlimited, ideal for experienced traders.

Low Minimum Deposit: Start trading with as little as $10.

Wide Range of Instruments: Forex, cryptocurrencies, metals, indices, and more.

Fast Withdrawals: Instant withdrawals for most payment methods.

Multiple Platforms: Supports MT4, MT5, and a proprietary mobile app.

Global Regulation: Licensed by CySEC, FCA, FSA, and others.

Cons

Limited Investor Protection: Only professional clients in the EU/UK qualify for investor compensation schemes.

No Guaranteed Stop-Loss: Unlike some brokers, Exness doesn’t offer guaranteed stop-loss orders.

Learning Curve for Beginners: The platform’s advanced features may overwhelm new traders.

For traders prioritizing safety and flexibility, Exness is a strong contender, especially with its NBP and competitive trading conditions.

Common Myths About Negative Balance Protection

Let’s debunk a few misconceptions about NBP that may confuse traders:

Myth 1: NBP Guarantees No Losses

NBP doesn’t prevent losses—it only ensures you don’t owe money beyond your deposit. You can still lose your entire account balance if trades go against you.

Myth 2: All Brokers Offer NBP

Not all brokers provide NBP, especially unregulated ones. Always verify a broker’s NBP policy before opening an account.

Myth 3: NBP Makes Trading Risk-Free

While NBP reduces financial risk, trading remains inherently risky. Market volatility, leverage, and poor strategy can still lead to significant losses within your account balance.

Myth 4: NBP Is Only for Beginners

NBP benefits all traders, including professionals, as even experienced traders can face unexpected market movements.

How to Verify Exness’ Negative Balance Protection

If you’re considering Exness and want to confirm its NBP policy:

Check the Official Website: Exness’ Help Center and terms of service clearly outline NBP details.

Contact Support: Reach out via live chat or email to ask specific questions about NBP.

Read Reviews: Platforms like ForexBrokers.com and BrokerChooser provide independent insights into Exness’ features.

Test with a Demo Account: Simulate trading scenarios to understand how stop-outs and NBP work in practice.

Exness’ Reputation in 2025

As of 2025, Exness enjoys a strong reputation in the trading community, with over 800,000 active clients and $4.5 trillion in monthly trading volume (as of late 2023). Its commitment to transparency, innovation, and client protection—evidenced by NBP and other safety features—has earned it high trust scores from reviewers like ForexBrokers.com (81/99) and positive feedback from traders on platforms like Forex Factory.

However, no broker is immune to criticism. Some traders have reported delays in account verification or misunderstandings about trading conditions. Exness typically addresses these proactively through its responsive support team, reinforcing its reliability.

Conclusion: Should You Trade with Exness?

Exness’ negative balance protection is a powerful tool for traders seeking safety in the unpredictable world of forex and CFD trading. By ensuring losses never exceed your deposited funds, Exness provides a secure environment for beginners and professionals alike. Combined with its high leverage options, low fees, and robust regulatory framework, Exness is a compelling choice for traders in 2025.

However, NBP is just one piece of the puzzle. To succeed, traders must complement Exness’ safety features with disciplined risk management, continuous learning, and strategic planning. If you’re ready to trade with confidence, Exness’ NBP offers a solid foundation to build your trading journey.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: