11 minute read

Exness Review South Africa: Is a good broker?

The forex trading landscape in South Africa has grown exponentially, with more traders seeking reliable brokers to navigate the volatile financial markets. Among the top contenders is Exness, a globally recognized broker that has made significant inroads in the South African market. But is Exness the right choice for South African traders? In this detailed Exness review South Africa, we’ll explore its features, benefits, drawbacks, and everything you need to know to make an informed decision. Whether you’re a beginner or an experienced trader, this guide will help you understand why Exness stands out and where it might fall short.

💥 Trade with Exness now: Open An Account or Visit Brokers

What is Exness? An Overview of the Broker

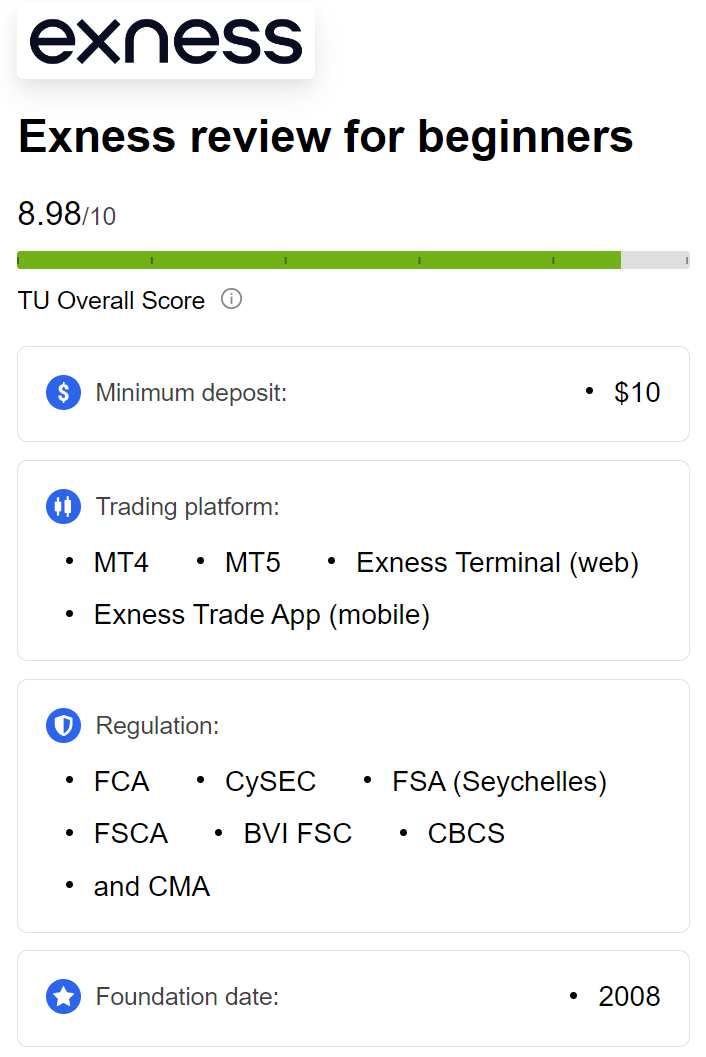

Exness is a Cyprus-based forex and CFD broker founded in 2008. With over a decade of experience, it has grown into one of the largest retail brokers globally, boasting a monthly trading volume exceeding $2 trillion. In South Africa, Exness operates under the regulation of the Financial Sector Conduct Authority (FSCA), ensuring compliance with local financial laws. This regulatory oversight provides South African traders with a layer of security, knowing their funds are protected by a reputable authority.

Exness offers a wide range of trading instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies. Its competitive spreads, flexible leverage, and robust trading platforms make it a popular choice for traders worldwide, including in South Africa. But what makes Exness unique for South Africans? Let’s dive into the specifics.

Why Exness Appeals to South African Traders

South Africa’s forex market is unique, with traders seeking brokers that offer low costs, accessibility, and support for local payment methods. Exness ticks many of these boxes, making it a go-to platform for both novice and seasoned traders. Here’s why:

1. FSCA Regulation for Trust and Safety

For South African traders, regulation is a top priority. Exness is licensed by the FSCA under license number 51024, ensuring it adheres to strict standards for transparency, fund security, and client protection. This regulation instills confidence, as traders know their investments are safeguarded against malpractice.

Additionally, Exness holds licenses from other top-tier regulators, such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). This multi-jurisdictional oversight enhances its credibility, making it a trusted choice for South Africans.

2. Low Minimum Deposit and ZAR Support

One of Exness’s standout features is its low entry barrier. The minimum deposit for a Standard account is just $10 (approximately 190 ZAR), making it accessible to beginners. South African traders can also set their account base currency to ZAR, avoiding costly currency conversion fees. This flexibility is a significant advantage in a market where affordability matters.

3. Wide Range of Trading Instruments

Exness offers over 160 trading instruments, catering to diverse trading strategies. South African traders can speculate on:

Forex: Over 100 currency pairs, including ZAR-based pairs like USD/ZAR, EUR/ZAR, and GBP/ZAR.

Commodities: Gold, silver, crude oil, and more.

Indices: Major global indices like the S&P 500 and FTSE 100.

Stocks: CFDs on popular stocks like Apple, Tesla, and Netflix.

Cryptocurrencies: Bitcoin, Ethereum, and other altcoins with high leverage.

This variety allows traders to diversify their portfolios, a key consideration for South Africans looking to hedge against currency volatility.

4. Competitive Spreads and Low Fees

Exness is known for its tight spreads, starting at 0.3 pips for Standard accounts and 0.0 pips for professional accounts. For South African traders, low spreads translate to reduced trading costs, especially for high-frequency traders. Standard accounts also incur no commission fees, while professional accounts have low commissions tailored to advanced traders.

5. High Leverage Options

Exness offers some of the highest leverage in the industry, up to 1:2000 or even unlimited leverage for certain account types. While high leverage can amplify profits, it also increases risk, making it crucial for traders to use it wisely. South African traders, accustomed to navigating volatile markets, appreciate this flexibility but must exercise caution.

6. Local Payment Methods

Exness supports deposits and withdrawals via methods popular in South Africa, including:

Bank transfers (local banks like FNB, Standard Bank, and Absa)

Credit/debit cards (Visa and Mastercard)

E-wallets like Skrill and Neteller

Cryptocurrency wallets

Deposits are typically instant, and withdrawals are processed within 24 hours, ensuring quick access to funds. The ability to transact in ZAR further enhances convenience.

Exness Account Types: Which One Suits You?

Exness offers a range of account types tailored to different trading styles and experience levels. Here’s a breakdown of the options available to South African traders:

1. Standard Account

Minimum Deposit: $10 (190 ZAR)

Spreads: From 0.3 pips

Commission: None

Leverage: Up to 1:2000

Best For: Beginners and casual traders

The Standard account is ideal for those new to forex trading. Its low deposit and commission-free structure make it cost-effective, while the flexible leverage allows traders to experiment with different strategies.

2. Standard Cent Account

Minimum Deposit: $10 (190 ZAR)

Spreads: From 0.3 pips

Commission: None

Leverage: Up to 1:2000

Best For: Micro-trading and risk-averse traders

This account uses cent-based lots, allowing traders to trade smaller volumes. It’s perfect for beginners who want to practice with minimal risk.

3. Pro Account

Minimum Deposit: $200 (approximately 3,800 ZAR)

Spreads: From 0.1 pips

Commission: Low, based on trading volume

Leverage: Up to 1:2000

Best For: Experienced traders seeking tighter spreads

The Pro account caters to traders who prioritize low spreads and fast execution. It’s suitable for scalpers and those with advanced strategies.

4. Zero Account

Minimum Deposit: $200 (approximately 3,800 ZAR)

Spreads: From 0.0 pips

Commission: From $0.05 per lot

Leverage: Up to 1:2000

Best For: High-frequency traders and scalpers

The Zero account offers near-zero spreads on major instruments, making it ideal for traders who execute large volumes daily.

5. Raw Spread Account

Minimum Deposit: $200 (approximately 3,800 ZAR)

Spreads: From 0.0 pips

Commission: Up to $3.50 per lot

Leverage: Up to 1:2000

Best For: Professional traders seeking transparency

This account provides raw market spreads with a fixed commission, ensuring no hidden costs. It’s designed for traders who value pricing clarity.

💥 Trade with Exness now: Open An Account or Visit Brokers

Trading Platforms: MetaTrader and Beyond

Exness supports industry-leading platforms that cater to South African traders’ needs. Here’s what you can expect:

1. MetaTrader 4 (MT4)

MT4 remains a favorite for its simplicity and robust features. South African traders benefit from:

Advanced charting tools and 50+ technical indicators

Support for Expert Advisors (EAs) for automated trading

Customizable interface

Mobile, desktop, and web versions

2. MetaTrader 5 (MT5)

MT5 is the modern successor to MT4, offering enhanced features like:

More timeframes and chart types

Economic calendar integration

Advanced order types

Support for additional asset classes

Both platforms are available in ZAR, ensuring seamless trading without currency conversion hassles.

3. Exness Terminal and Mobile App

Exness also offers its proprietary web-based terminal and mobile app, designed for traders who prefer a streamlined experience. The app supports real-time market monitoring, one-tap trading, and account management, making it convenient for South Africans on the go.

4. TradingView Integration

Exness’s integration with TradingView allows traders to execute trades directly from advanced charts. With customizable indicators and a vibrant community, TradingView enhances the trading experience for South Africans seeking in-depth analysis.

Exness Fees and Spreads: A Closer Look

Cost is a critical factor for South African traders, and Exness delivers competitive pricing. Here’s a detailed breakdown:

Spreads: Start at 0.3 pips for Standard accounts and 0.0 pips for professional accounts. Major pairs like EUR/USD and USD/ZAR have tight spreads, reducing trading costs.

Commissions: Standard and Standard Cent accounts are commission-free. Professional accounts (Pro, Zero, Raw Spread) have commissions ranging from $0.05 to $3.50 per lot, depending on the account type.

Swap Fees: Exness offers swap-free accounts for Islamic traders, a significant advantage for South Africa’s Muslim trading community.

Inactivity Fees: No inactivity fees, ensuring traders aren’t penalized for taking breaks.

Deposit/Withdrawal Fees: Exness covers most transaction fees, though third-party charges (e.g., bank fees) may apply.

Compared to competitors like IG or XM, Exness’s low spreads and commission-free Standard accounts make it a cost-effective choice for South Africans.

Leverage and Risk Management

Exness’s high leverage (up to 1:2000 or unlimited for eligible traders) is a double-edged sword. For South African traders, it offers the potential for significant profits with small capital. However, it also amplifies losses, especially in volatile markets like ZAR pairs.

To mitigate risks, Exness provides tools like:

Negative Balance Protection: Ensures traders don’t lose more than their account balance.

Stop Loss and Take Profit Orders: Helps automate risk management.

Margin Call Alerts: Notifies traders when their account equity falls below required levels.

South African traders should approach high leverage cautiously, starting with lower ratios (e.g., 1:100) until they gain experience.

Deposits and Withdrawals: Fast and Convenient

Exness excels in payment processing, a crucial factor for South African traders. Key features include:

Instant Deposits: Most methods, including bank cards and e-wallets, reflect funds immediately.

Fast Withdrawals: Processed within 24 hours, with some methods (e.g., e-wallets) offering instant payouts.

ZAR Support: Eliminates currency conversion fees.

No Deposit/Withdrawal Fees: Exness covers transaction costs, though bank charges may apply for large transfers.

Popular methods include local bank transfers, Skrill, Neteller, and cryptocurrencies, ensuring flexibility for South Africans.

Customer Support: Responsive and Accessible

Exness offers 24/7 customer support in multiple languages, including English, which is essential for South African traders. Contact options include:

Live Chat: Quick responses, typically within minutes.

Email: Detailed queries are addressed within 24 hours.

Phone: Direct support for urgent issues.

Help Center: A comprehensive resource with guides, FAQs, and troubleshooting tips.

South African traders report positive experiences with Exness’s support team, praising its professionalism and efficiency.

Education and Resources for South African Traders

Exness provides a wealth of educational resources, helping South African traders improve their skills:

Webinars: Cover topics like technical analysis, risk management, and market trends.

Tutorials: Step-by-step guides on using MT4, MT5, and the Exness app.

Demo Accounts: Unlimited reloadable accounts for risk-free practice.

Market Analysis: Daily updates and Trading Central insights for informed decisions.

These resources are particularly valuable for beginners navigating South Africa’s complex forex market.

Exness Social Trading: Passive Income Potential

For South African traders interested in passive income, Exness offers a social trading platform. This feature allows users to copy the trades of experienced “strategy providers.” Key benefits include:

Accessibility: No advanced skills required to start copying trades.

Transparency: Detailed performance metrics for strategy providers.

Flexibility: Traders can adjust risk levels and stop copying at any time.

Social trading is ideal for busy South Africans who want to earn without actively trading.

Pros of Trading with Exness in South Africa

Regulated by FSCA: Ensures safety and compliance.

Low Minimum Deposit: $10 entry point for Standard accounts.

ZAR Support: Avoids conversion fees.

Tight Spreads: From 0.0 pips for professional accounts.

High Leverage: Up to 1:2000 for flexible trading.

Fast Withdrawals: Processed within 24 hours.

Swap-Free Accounts: Caters to Islamic traders.

Robust Platforms: MT4, MT5, TradingView, and proprietary apps.

Cons of Trading with Exness in South Africa

High Leverage Risks: Can lead to significant losses if mismanaged.

Limited Local Presence: No physical office in South Africa.

Professional Account Costs: Higher minimum deposits ($200) and commissions.

Learning Curve: Advanced platforms may overwhelm beginners.

How Exness Compares to Other Brokers in South Africa

To provide context, let’s compare Exness to two popular brokers in South Africa: IG and XM.

Exness vs. IG

Regulation: Both are FSCA-regulated, but IG has a stronger global presence.

Minimum Deposit: Exness ($10) is lower than IG ($0 but higher practical entry).

Spreads: Exness offers tighter spreads (0.3 pips vs. IG’s 0.6 pips for EUR/USD).

Leverage: Exness (1:2000) surpasses IG (1:200).

Platforms: IG’s proprietary platform is user-friendly, but Exness’s MT4/MT5 are more customizable.

Verdict: Exness is better for cost-conscious traders, while IG suits those prioritizing platform simplicity.

Exness vs. XM

Regulation: Both are FSCA-regulated, with additional global licenses.

Minimum Deposit: Exness ($10) matches XM’s Micro account.

Spreads: Exness (0.3 pips) is slightly tighter than XM (0.6 pips for Standard accounts).

Leverage: Exness (1:2000) exceeds XM (1:888).

Bonuses: XM offers deposit bonuses, which Exness does not.

Verdict: Exness wins for low costs and leverage, but XM’s bonuses may appeal to some traders.

Is Exness Safe for South African Traders?

Safety is paramount, and Exness delivers on multiple fronts:

Regulation: FSCA, FCA, and CySEC licenses ensure compliance.

Fund Security: Client funds are segregated from company assets.

Negative Balance Protection: Prevents debt during market crashes.

Transparency: Clear fee structures and no hidden charges.

While no broker is risk-free, Exness’s robust safeguards make it a reliable choice for South Africans.

Tips for South African Traders Using Exness

To maximize your experience with Exness, consider these tips:

Start with a Demo Account: Practice strategies without risking real money.

Use Low Leverage Initially: Begin with 1:50 or 1:100 to manage risks.

Trade ZAR Pairs: Take advantage of USD/ZAR and EUR/ZAR to align with local market trends.

Monitor Economic News: South Africa’s economy impacts ZAR volatility—stay informed.

Leverage Education Resources: Use Exness’s webinars and tutorials to improve your skills.

Conclusion: Is Exness the Right Broker for You?

Exness is a compelling choice for South African traders, offering low costs, high leverage, and a wide range of instruments. Its FSCA regulation, ZAR support, and fast withdrawals make it particularly appealing in the local market. Whether you’re trading forex, commodities, or cryptocurrencies, Exness provides the tools and flexibility to succeed.

However, high leverage and the complexity of professional accounts may challenge beginners. Traders must weigh these factors against their goals and risk tolerance. For cost-conscious traders seeking a reliable, regulated broker, Exness is hard to beat.

Ready to explore Exness? Sign up for a demo account today and experience its features firsthand. Share your thoughts or questions in the comments below—we’d love to hear from South African traders!

Read more: