10 minute read

Is Exness App Legal in India? A Comprehensive Guide for Traders

The world of forex trading has exploded in popularity, and India is no stranger to this financial revolution. With millions of Indians exploring opportunities in global markets, mobile trading apps like Exness have emerged as powerful tools for accessing forex, commodities, and cryptocurrencies. However, amidst this excitement, a critical question arises: Is the Exness app legal in India? This comprehensive guide dives deep into the legality of the Exness app in India, unraveling the regulatory maze, exploring compliance strategies, and offering actionable insights for traders. Whether you’re a beginner dipping your toes into forex or a seasoned investor seeking clarity, this article has you covered with everything you need to know.

💥 Trade with Exness now: Open An Account or Visit Brokers

What is the Exness App? An In-Depth Overview

Before tackling its legality, let’s explore what the Exness app brings to the table. Launched in 2008, Exness is a globally recognized forex and CFD (Contract for Difference) broker headquartered in Cyprus. The Exness app is its mobile trading platform, engineered to deliver a seamless experience for traders worldwide, including India. Available on Android and iOS, the app empowers users to trade forex pairs, stocks, indices, metals, and cryptocurrencies—all from the palm of their hand.

The app boasts an impressive suite of features: real-time market data, customizable charts, one-tap trade execution, and a multilingual interface supporting English and Hindi, catering to India’s diverse population. With spreads starting at 0.0 pips and leverage up to 1:2000, it’s designed for both cost-conscious traders and those chasing high returns. Exness also offers account types like Standard, Pro, and Zero, each tailored to different trading styles. But while its global appeal is undeniable, the app’s legality in India depends on how it aligns with the country’s strict financial regulations.

The Legal Framework of Forex Trading in India

To assess the Exness app’s legality, we must first understand India’s forex trading ecosystem. Forex activities in India are tightly regulated by two primary authorities: the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). These bodies operate under the Foreign Exchange Management Act (FEMA) of 1999, which governs all foreign exchange transactions. Let’s break down the key regulations shaping forex trading in India:

1. Currency Pair Restrictions

Indian residents are legally permitted to trade only currency pairs that include the Indian Rupee (INR). Examples include USD/INR, EUR/INR, GBP/INR, and JPY/INR. These trades must occur on SEBI-regulated exchanges like the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE). Trading cross-currency pairs like EUR/USD or GBP/JPY—common on international platforms—is prohibited for retail traders.

2. Authorized Dealers and Platforms

Forex trading is restricted to brokers or dealers authorized by the RBI or SEBI. This ensures oversight, transparency, and protection for Indian traders. Offshore brokers, including Exness, operate outside this framework, raising questions about their compliance.

3. Capital Movement Controls

FEMA imposes strict rules on transferring money abroad to prevent capital flight and maintain economic stability. Indian traders must use RBI-approved channels for deposits and withdrawals, and any unauthorized movement of funds can lead to penalties.

4. Taxation and Reporting Obligations

Forex trading profits are classified as business income under the Income Tax Act, subject to applicable tax slabs. Additionally, traders holding foreign assets—like funds in an Exness account—must report them in their annual tax filings under the Foreign Assets Schedule.

These rules create a structured yet restrictive environment for forex trading. The legality of the Exness app hinges on how it navigates this framework.

Exness’s Global Regulatory Standing

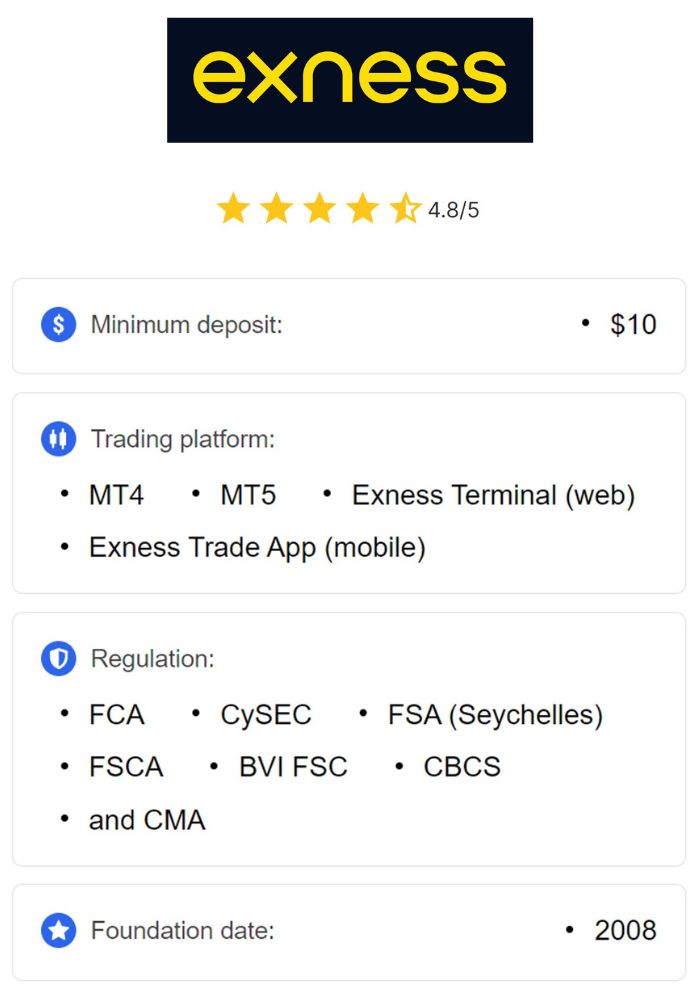

Exness isn’t just another forex broker—it’s a globally trusted name backed by multiple regulatory licenses. As of 2025, Exness holds authorizations from:

Financial Conduct Authority (FCA) – United Kingdom, known for its rigorous standards.

Cyprus Securities and Exchange Commission (CySEC) – Cyprus, a hub for forex brokers.

Financial Sector Conduct Authority (FSCA) – South Africa, expanding its African footprint.

Financial Services Authority (FSA) – Seychelles, catering to international clients.

These licenses require Exness to maintain segregated client accounts (keeping trader funds separate from company assets), offer negative balance protection, and use advanced security protocols like SSL encryption. Regular audits and compliance checks further solidify its credibility. While Exness isn’t registered with SEBI or RBI, its international oversight provides a strong case for its legitimacy when used responsibly in India.

Is Exness App Legal in India?

Yes, the Exness app is legal in India—but with a caveat. Its legality depends on traders using it within the boundaries of RBI and FEMA regulations. Let’s explore why and how it’s lawful.

Why Exness is Legal

No Direct Prohibition: Indian law does not explicitly ban the use of offshore platforms like Exness. The app operates legally under its international licenses, and there’s no regulation stating that Indian residents cannot access it.

INR-Based Trading Availability: Exness offers INR currency pairs like USD/INR and EUR/INR, which align with RBI’s permissible trading scope. By focusing on these pairs, traders stay within legal limits.

Global Compliance: Exness’s adherence to FCA, CySEC, and other standards ensures it’s not a fly-by-night operation. This reliability reduces the risk of fraud, a key concern for Indian regulators.

Trader Responsibility: The onus falls on Indian traders to comply with local laws. When used correctly—trading INR pairs and moving funds through approved channels—Exness fits within India’s legal framework.

💥 Trade with Exness now: Open An Account or Visit Brokers

Conditions for Legal Use

To ensure the Exness app remains a lawful tool, Indian traders must follow these guidelines:

Restrict Trading to INR Pairs: Avoid non-INR pairs like EUR/USD, which violate FEMA restrictions.

Use RBI-Approved Payment Methods: Deposit and withdraw funds via authorized banks or payment systems, steering clear of unregulated e-wallets or cryptocurrencies unless explicitly permitted.

Maintain Tax Compliance: Report all forex profits and foreign assets in your tax returns, keeping detailed records for transparency.

When these conditions are met, the Exness app transforms from a gray-area tool into a fully legal platform for Indian traders.

Debunking Myths About Exness in India

Misinformation often clouds the perception of offshore brokers like Exness. Let’s address common myths and set the record straight:

Myth 1: Offshore Brokers Are Illegal in India

Reality: Offshore brokers aren’t inherently illegal. While they lack SEBI registration, their use is permissible if traders adhere to RBI and FEMA rules. Exness’s global regulation further supports its legitimacy.

Myth 2: You Can’t Withdraw Funds from Exness

Reality: Indian traders regularly withdraw funds from Exness using compliant methods like bank transfers or UPI-linked accounts. Delays, if any, stem from bank policies, not Exness itself.

Myth 3: Trading on Exness Automatically Violates FEMA

Reality: FEMA violations occur only when traders engage in unauthorized activities—like trading non-INR pairs or transferring funds improperly. Legal usage avoids these pitfalls.

Myth 4: Exness Isn’t Safe for Indian Traders

Reality: With top-tier licenses and security features, Exness is as safe as any global broker. The lack of SEBI oversight doesn’t negate its reliability when used correctly.

Clearing up these misconceptions empowers traders to approach Exness with confidence and clarity.

Why Indian Traders Love the Exness App

The Exness app’s legality is just one part of its appeal. Here’s why it stands out for Indian traders:

1. Ultra-Low Spreads

Spreads starting at 0.0 pips on certain accounts make Exness cost-effective, especially for high-volume traders. This is a boon in India, where every rupee counts.

2. High Leverage Options

With leverage up to 1:2000, traders can amplify their capital—ideal for those with limited funds. However, this requires cautious risk management.

3. Lightning-Fast Execution

Trades execute in under 25 milliseconds, ensuring you don’t miss opportunities in fast-moving markets like forex or crypto.

4. Mobile-First Design

The app’s intuitive interface, available in English and Hindi, caters to India’s tech-savvy population, allowing trading on the go.

5. Diverse Asset Classes

Beyond forex, Exness offers stocks, indices, metals, and cryptocurrencies, enabling portfolio diversification—a rare feature among local brokers.

These benefits, paired with its legal usability, make Exness a compelling choice for Indian traders.

Step-by-Step Guide to Trading Legally on Exness

Ready to start? Here’s how to use the Exness app legally and effectively in India:

Step 1: Download and Register

Download the Exness app from Google Play or the App Store.

Sign up with your email and phone number, selecting India as your country.

Step 2: Verify Your Account

Submit KYC documents: a government-issued ID (e.g., Aadhaar, passport) and proof of address (e.g., utility bill).

Verification typically takes 24–48 hours.

Step 3: Fund Your Account

Link an RBI-approved bank account or payment method (e.g., UPI, NetBanking).

Deposit funds in INR, ensuring compliance with FEMA.

Step 4: Select INR Pairs

Navigate to the trading section and filter for INR-based pairs like USD/INR or EUR/INR.

Avoid non-INR pairs to stay legal.

Step 5: Start Trading

Use the app’s charting tools to analyze markets.

Place trades with your preferred leverage and monitor positions in real time.

Step 6: Withdraw Profits

Request withdrawals to your linked Indian bank account.

Keep records of all transactions for tax purposes.

Step 7: File Taxes

Declare profits as business income in your ITR (Income Tax Return).

Report foreign assets in Schedule FA if applicable.

Following this roadmap ensures your Exness experience is both profitable and lawful.

Potential Risks and Mitigation Strategies

Even with its legality established, trading on Exness carries risks if not approached carefully. Here’s how to address them:

Risk 1: Regulatory Non-Compliance

Issue: Trading non-INR pairs or using unauthorized payment methods could trigger FEMA penalties.

Solution: Stick to INR pairs and RBI-approved channels.

Risk 2: Bank Transaction Blocks

Issue: Some Indian banks flag offshore transfers, delaying deposits or withdrawals.

Solution: Use forex-friendly banks (e.g., HDFC, ICICI) or consult your bank beforehand.

Risk 3: Tax Oversights

Issue: Failing to report income or assets could lead to audits or fines.

Solution: Work with a chartered accountant to ensure accurate filings.

Risk 4: Market Volatility

Issue: High leverage amplifies losses in unpredictable markets.

Solution: Use stop-loss orders and trade conservatively.

By proactively managing these risks, traders can enjoy Exness’s benefits without legal or financial hiccups.

Exness vs. SEBI-Regulated Brokers: A Detailed Comparison

While Exness is legal, SEBI-regulated brokers offer a fully domestic alternative. Let’s compare:

Exness

Pros: Global reach, low spreads, high leverage, diverse assets.

Cons: Requires strict compliance, no SEBI oversight.

Best For: Traders seeking international exposure and advanced tools.

SEBI Brokers (e.g., Zerodha, Angel One)

Pros: Full regulatory protection, no legal gray areas, INR pair focus.

Cons: Limited asset variety, lower leverage, higher fees.

Best For: Risk-averse traders prioritizing local security.

For those comfortable navigating compliance, Exness offers unmatched flexibility while remaining legal.

What Indian Traders Say About Exness

Real-world feedback paints a vivid picture of Exness’s standing in India. On X, traders share experiences like, “Exness’s USD/INR spreads are unbeatable—legal and fast!” Others note, “Withdrawn ₹50,000 via UPI without issues.” Trustpilot reviews echo this, with a 4.5-star average praising reliability and support. Some caution about payment method scrutiny, but the consensus is clear: when used legally, Exness delivers.

Expanding Your Forex Journey with Exness

Beyond legality, Exness offers educational resources to sharpen your skills:

Webinars: Live sessions on forex strategies.

Demo Account: Practice trading with virtual funds.

Market Analysis: Daily updates to inform your trades.

These tools empower Indian traders to grow while staying within legal bounds.

Conclusion: Embrace Legal Forex Trading with Exness

The Exness app is legal in India when used responsibly—trading INR pairs and adhering to RBI and FEMA guidelines. Its global regulation, competitive features, and mobile convenience make it a standout platform for Indian traders seeking to explore forex markets. By following compliance steps—using approved payments, reporting income, and sticking to INR pairs—you can unlock Exness’s full potential without legal worries.

💥 Trade with Exness now: Open An Account or Visit Brokers

Download the app today, verify your account, and start trading with confidence. For added assurance, consult a financial advisor to tailor your approach. Forex trading is a gateway to wealth—make it a legal and rewarding journey with Exness.

FAQs

Does Exness comply with Indian laws?Yes, when traders use it for INR pairs and approved payment methods.

Can I use UPI to fund Exness?Yes, if linked to an RBI-authorized bank account.

What happens if I trade EUR/USD on Exness?It’s illegal for Indian residents and could violate FEMA.

Is Exness safer than local brokers?Its global licenses ensure safety, comparable to SEBI brokers when used legally.

Read more: