11 minute read

Top 10 Best Forex Brokers in Pakistan

from Exness Global

Forex trading has surged in popularity across Pakistan, with traders seeking opportunities to capitalize on global currency markets. As the financial landscape evolves, choosing the right forex broker is critical for success. With countless options available, selecting a reliable, user-friendly, and cost-effective platform can be daunting. This comprehensive guide explores the top 10 best forex brokers in Pakistan for 2025, spotlighting Exness as the top choice for Pakistani traders. Whether you're a beginner or a seasoned trader, this list will help you navigate the forex market with confidence.

Top 4 Best Forex Brokers in Pakistan

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

Why Choosing the Right Forex Broker Matters

The forex market is the largest and most liquid financial market globally, with daily trading volumes exceeding $7.5 trillion. For Pakistani traders, the right broker ensures access to competitive spreads, robust platforms, and secure transactions. A reliable broker offers:

Regulation and Security: Protection of funds through top-tier regulatory oversight.

Low Costs: Competitive spreads and minimal fees to maximize profits.

User-Friendly Platforms: Intuitive interfaces for seamless trading.

Diverse Instruments: Access to forex pairs, commodities, indices, and more.

Customer Support: Responsive assistance, ideally in local languages like Urdu.

Islamic Accounts: Swap-free options for Muslim traders adhering to Sharia law.

With these factors in mind, let’s dive into our carefully curated list of the top 10 forex brokers in Pakistan, starting with the standout leader, Exness.

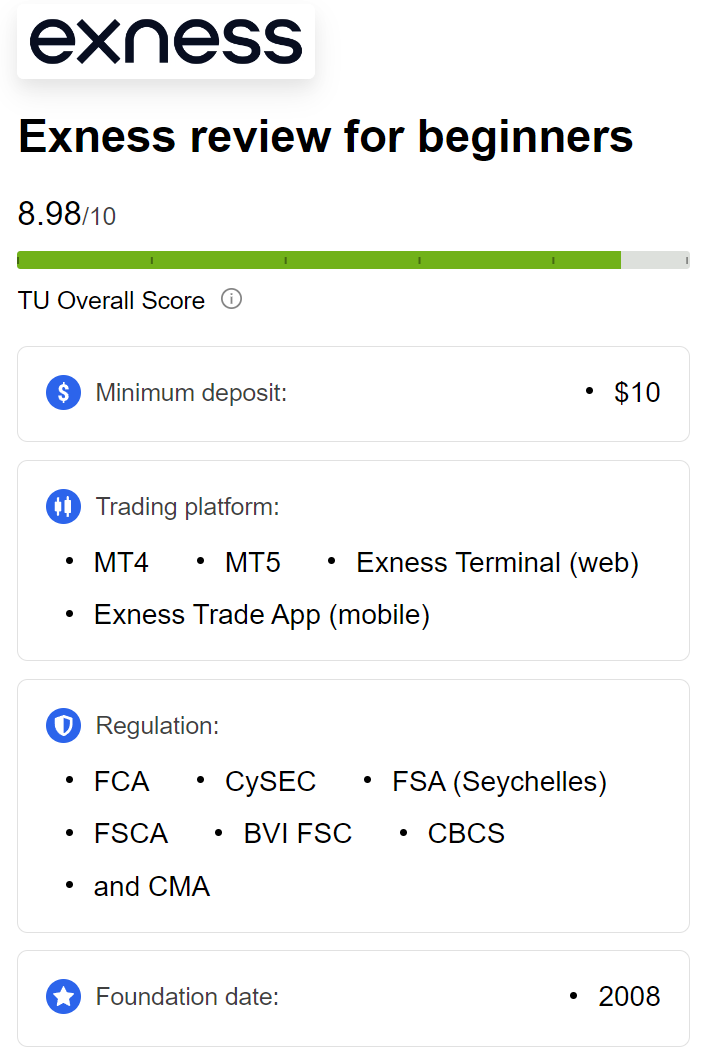

1. Exness – The Best Forex Broker in Pakistan

Why Exness Ranks #1

Exness stands head and shoulders above the competition, earning its place as the top forex broker for Pakistani traders in 2025. Established in 2008, Exness has built a stellar reputation for transparency, innovation, and client-centric services. Its tailored offerings make it an ideal choice for both novice and experienced traders in Pakistan.

Key Features of Exness

Ultra-Low Spreads: Exness offers some of the tightest spreads in the industry, starting from 0.0 pips on major pairs like EUR/USD. This minimizes trading costs, allowing traders to keep more of their profits.

High Leverage: With leverage up to 1:2000 (subject to account type and experience), Exness empowers traders to control larger positions with minimal capital. However, high leverage requires cautious risk management.

Fast Execution: Exness boasts lightning-fast order execution, with speeds averaging under 25 milliseconds, ensuring trades are placed without delays.

Multiple Account Types: From Standard accounts for beginners to Raw Spread and Zero accounts for professionals, Exness caters to all trading styles.

Islamic Accounts: Swap-free accounts are available, making Exness compliant with Sharia law—a crucial feature for Pakistan’s Muslim traders.

Seamless Withdrawals: Exness supports local payment methods, including bank transfers and e-wallets, with instant withdrawals processed in seconds.

Robust Platforms: Traders can choose between MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the proprietary Exness Terminal, all optimized for desktop, web, and mobile.

Educational Resources: Exness Academy provides webinars, tutorials, and market analysis to help traders hone their skills.

Regulation: Licensed by top-tier regulators like the Financial Services Authority (FSA) and Cyprus Securities and Exchange Commission (CySEC), Exness ensures fund security.

💥 Trade with Exness now: Open An Account or Visit Brokers

Why Pakistani Traders Love Exness

Exness excels in addressing the unique needs of Pakistani traders. Its low minimum deposit of $10 makes it accessible to beginners, while advanced tools like VPS hosting and one-click trading appeal to professionals. The platform’s multilingual support, including Urdu, ensures seamless communication. Additionally, Exness’s commitment to transparency—no hidden fees or commissions on most accounts—builds trust among users.

Drawbacks

While Exness is near-perfect, it’s worth noting that its high leverage may pose risks for inexperienced traders. Additionally, the range of non-forex instruments, while diverse, is slightly narrower compared to some competitors.

Verdict

Exness combines affordability, reliability, and cutting-edge technology, making it the best forex broker in Pakistan. Whether you’re scalping, day trading, or holding long-term positions, Exness delivers an unmatched trading experience.

2. IC Markets – Best for Low Spreads

Overview

IC Markets is a favorite among Pakistani traders for its ultra-low spreads and ECN (Electronic Communication Network) pricing model. Founded in 2007, this Australian broker is renowned for its transparency and advanced trading infrastructure.

Key Features

Tight Spreads: Spreads start from 0.0 pips on major pairs, ideal for high-frequency traders.

Fast Execution: IC Markets uses NY4 data servers for near-instantaneous trade execution.

Diverse Instruments: Over 2,250 tradable assets, including forex, commodities, indices, stocks, and cryptocurrencies.

Flexible Platforms: Supports MT4, MT5, and cTrader, all customizable for automated trading.

Islamic Accounts: Swap-free options are available for Muslim traders.

Regulation: Licensed by the Australian Securities and Investments Commission (ASIC) and CySEC.

Why It’s Great for Pakistan

IC Markets offers a low-cost trading environment, with commissions as low as $6 per lot (round turn) on Raw Spread accounts. Its support for local payment methods simplifies deposits and withdrawals for Pakistani users.

Drawbacks

The $200 minimum deposit may deter beginners, and customer support, while reliable, isn’t available 24/7.

Verdict

IC Markets is a top pick for traders prioritizing low costs and fast execution, making it a strong contender in Pakistan’s forex market.

3. AvaTrade – Best for Beginners

Overview

AvaTrade, established in 2006, is celebrated for its beginner-friendly platform and extensive educational resources. It’s a trusted choice for Pakistani traders new to forex.

Key Features

User-Friendly Interface: AvaTradeGO and AvaWebTrader are intuitive, mobile-optimized platforms.

Commission-Free Trading: No commissions on forex trades, with competitive spreads starting at 0.9 pips.

Wide Instrument Range: Over 1,250 assets, including forex, stocks, commodities, and cryptocurrencies.

Copy Trading: AvaSocial allows beginners to mimic expert traders’ strategies.

Regulation: Licensed by multiple authorities, including the Central Bank of Ireland and ASIC.

Islamic Accounts: Swap-free accounts cater to Pakistan’s Muslim traders.

Why It’s Great for Pakistan

AvaTrade’s low minimum deposit of $100 and comprehensive trading academy make it ideal for novices. Its Urdu-language support enhances accessibility.

Drawbacks

Spreads can be higher than ECN brokers like IC Markets, and advanced traders may find the platform less customizable.

Verdict

AvaTrade is perfect for Pakistani beginners seeking a supportive and regulated trading environment.

4. Pepperstone – Best for Advanced Traders

Overview

Pepperstone, founded in 2010, is a go-to broker for experienced traders due to its ECN trading model and advanced tools. It’s regulated by top-tier authorities like the FCA and ASIC.

Key Features

Low Spreads: Raw spreads start at 0.0 pips with a $7 commission per lot.

Fast Execution: Equinix servers ensure minimal latency.

Trading Platforms: Supports MT4, MT5, and cTrader, with advanced charting tools.

Social Trading: Integrates with Myfxbook and DupliTrade for copy trading.

Islamic Accounts: Swap-free options are available.

Regulation: Licensed by FCA, ASIC, and DFSA.

Why It’s Great for Pakistan

Pepperstone’s robust infrastructure and low-latency trading suit scalpers and algorithmic traders. Local bank transfers make funding accounts convenient.

Drawbacks

The $200 minimum deposit may be a barrier for beginners, and educational resources are less extensive than AvaTrade’s.

Verdict

Pepperstone is ideal for Pakistani traders with experience seeking precision and speed.

5. XM – Best for Education

Overview

XM, founded in 2009, is renowned for its educational offerings and high leverage, making it a popular choice in Pakistan.

Key Features

Low Minimum Deposit: Start trading with just $5.

High Leverage: Up to 1:1000, though caution is advised.

Educational Resources: Webinars, videos, and market analysis cater to all skill levels.

Platforms: MT4 and MT5 with full Expert Advisor (EA) support.

Islamic Accounts: Swap-free accounts are available.

Regulation: Licensed by CySEC, ASIC, and IFSC.

Why It’s Great for Pakistan

XM’s low entry barrier and Urdu support make it accessible to Pakistani traders. Its copy-trading feature is perfect for beginners.

Drawbacks

Spreads can be wider than ECN brokers, averaging 1.6 pips on standard accounts.

Verdict

XM is a solid choice for Pakistani traders seeking education and flexibility.

6. FXTM (ForexTime) – Best for Account Variety

Overview

FXTM, established in 2011, offers a range of account types to suit different trading styles, making it versatile for Pakistani traders.

Key Features

Flexible Accounts: Micro, Advantage, and ECN accounts cater to various needs.

Low Spreads: Advantage accounts offer spreads from 0.0 pips.

High Leverage: Up to 1:2000, subject to restrictions.

Platforms: MT4 and MT5 with mobile trading support.

Islamic Accounts: Swap-free options are available.

Regulation: Licensed by FCA, CySEC, and FSCA.

Why It’s Great for Pakistan

FXTM’s $10 minimum deposit and local payment options make it accessible. Its copy-trading platform, FXTM Invest, is great for passive traders.

Drawbacks

Inactivity fees apply, and customer support isn’t 24/7.

Verdict

FXTM is excellent for traders seeking diverse account options in Pakistan.

7. HFM (HotForex) – Best for Customer Support

Overview

HFM, formerly HotForex, is known for its exceptional customer service and competitive trading conditions.

Key Features

Low Minimum Deposit: Start with $5.

Tight Spreads: From 0.0 pips on Zero Spread accounts.

Platforms: MT4, MT5, and HFM’s proprietary app.

Islamic Accounts: Swap-free accounts with no hidden fees.

Regulation: Licensed by FCA, CySEC, and FSCA.

Why It’s Great for Pakistan

HFM’s multilingual support, including Urdu, and local payment methods ensure a smooth experience. Its loyalty program rewards active traders.

Drawbacks

Spreads on standard accounts can be higher than competitors.

Verdict

HFM is a top choice for Pakistani traders valuing support and affordability.

8. Octa – Best for Commission-Free Trading

Overview

Octa, founded in 2011, focuses on simplicity and cost-effectiveness, offering commission-free trading.

Key Features

No Commissions: Trade forex without extra fees.

Low Spreads: Starting from 0.6 pips.

Platforms: MT4, MT5, and OctaTrader.

Islamic Accounts: Swap-free accounts for Muslim traders.

Regulation: Licensed by CySEC and FSCA.

Why It’s Great for Pakistan

Octa’s $25 minimum deposit and copy-trading platform make it beginner-friendly. Local bank deposits are supported.

Drawbacks

The range of non-forex instruments is limited compared to larger brokers.

Verdict

Octa is ideal for cost-conscious Pakistani traders.

9. Tickmill – Best for Scalping

Overview

Tickmill specializes in low-cost trading, making it a favorite for scalpers and high-frequency traders.

Key Features

Low Spreads: From 0.0 pips with a $3 commission per lot.

Fast Execution: VPS hosting for minimal latency.

Platforms: MT4 and MT5.

Islamic Accounts: Swap-free options available.

Regulation: Licensed by FCA, CySEC, and FSCA.

Why It’s Great for Pakistan

Tickmill’s $100 minimum deposit is reasonable, and its focus on scalping suits active traders.

Drawbacks

Educational resources are limited, and customer support isn’t 24/7.

Verdict

Tickmill is perfect for Pakistani scalpers seeking low costs.

10. Plus500 – Best for CFD Trading

Overview

Plus500 is a global CFD broker offering a sleek platform and a wide range of instruments.

Key Features

User-Friendly Platform: Intuitive web and mobile apps.

Commission-Free Trading: Competitive spreads with no extra fees.

Diverse Instruments: Forex, stocks, commodities, and cryptocurrencies.

Regulation: Licensed by FCA, ASIC, and CySEC.

Why It’s Great for Pakistan

Plus500’s low spreads and simple interface appeal to CFD traders. However, it lacks MT4/MT5 support.

Drawbacks

No swap-free accounts, which may deter Muslim traders.

Verdict

Plus500 is a strong choice for Pakistani CFD traders but less ideal for forex purists.

How We Selected the Top 10 Forex Brokers

Our ranking is based on extensive research and hands-on testing, focusing on factors critical to Pakistani traders:

Regulation: All brokers are licensed by reputable authorities like FCA, ASIC, or CySEC.

Trading Costs: We prioritized low spreads and minimal fees.

Platforms: Support for MT4, MT5, or proprietary platforms with mobile access.

Accessibility: Low minimum deposits and local payment methods.

Support: Availability of Urdu support and responsiveness.

Islamic Accounts: Swap-free options for Sharia-compliant trading.

User Feedback: Insights from Pakistani traders on forums and review sites.

Tips for Choosing a Forex Broker in Pakistan

Verify Regulation: Ensure the broker is licensed by a trusted authority to protect your funds.

Test with a Demo Account: Practice trading without risking real money.

Check Payment Methods: Confirm support for local banks or e-wallets like Easypaisa.

Understand Fees: Compare spreads, commissions, and withdrawal costs.

Prioritize Education: Opt for brokers with tutorials and webinars if you’re a beginner.

Evaluate Leverage: Choose a broker offering flexible leverage to match your risk tolerance.

Read Reviews: Check user feedback for insights into reliability and support.

Is Forex Trading Legal in Pakistan?

Yes, forex trading is legal in Pakistan, regulated by the Securities and Exchange Commission of Pakistan (SECP). However, most international brokers operate under offshore licenses, which are also acceptable. The State Bank of Pakistan (SBP) oversees currency exchange, but speculative trading requires an online broker. Always choose a regulated broker to avoid scams, which have been reported in Pakistan.

Why Exness Stands Out in Pakistan

Exness’s combination of low costs, high leverage, and Sharia-compliant accounts makes it uniquely suited for Pakistan. Its instant withdrawals and Urdu support further enhance its appeal. For traders seeking a broker that balances affordability with advanced features, Exness is unmatched.

Conclusion

Forex trading offers immense opportunities for Pakistani traders, but success hinges on choosing the right broker. Exness leads our list as the best forex broker in Pakistan for 2025, thanks to its low spreads, fast execution, and tailored features. Whether you’re a beginner exploring AvaTrade’s educational tools or a scalper leveraging Tickmill’s tight spreads, this list has something for everyone.

Before diving in, test your strategy with a demo account and prioritize risk management. The forex market is dynamic, and with the right broker, Pakistani traders can thrive in 2025 and beyond.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: