8 minute read

How much capital required for forex trading?

from Exness Global

Forex trading, or foreign exchange trading, has exploded in popularity over the past decade. With promises of financial freedom, flexible hours, and the ability to work from anywhere, it’s no wonder millions of people worldwide are drawn to this dynamic market. However, one question looms large for anyone considering a dive into forex: How much capital is required to start trading? The answer isn’t as straightforward as you might think—it depends on your goals, trading style, risk tolerance, and the tools you plan to use.

Top 4 Best Forex Brokers

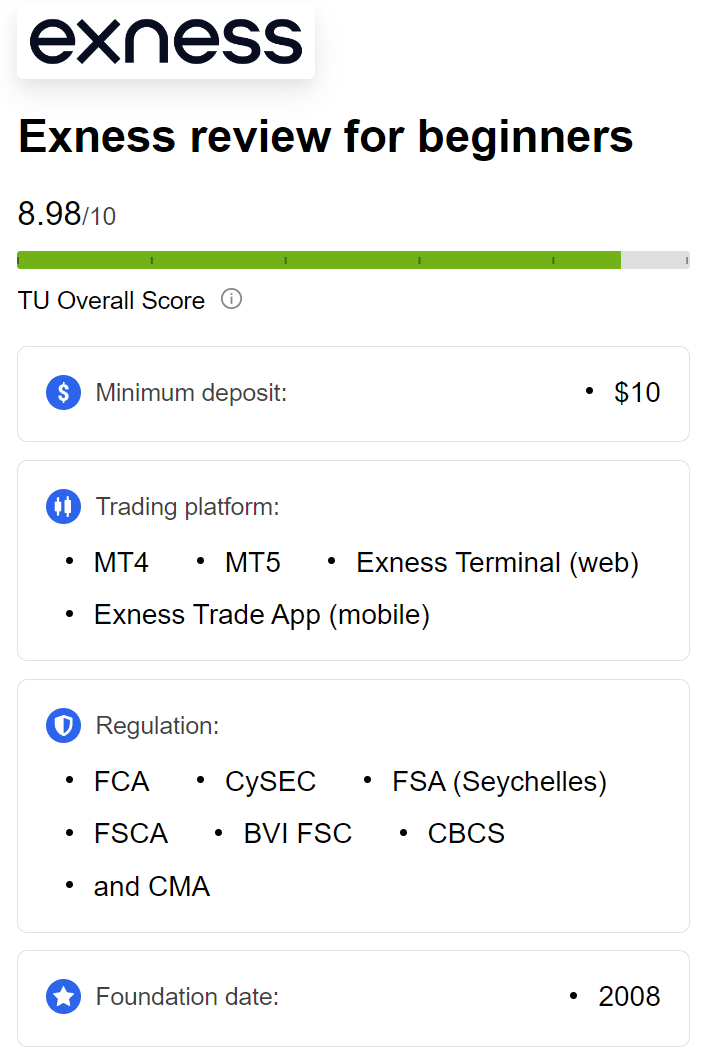

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

In this in-depth guide, we’ll explore every aspect of the capital needed for forex trading. Whether you’re a complete beginner or an experienced trader looking to scale up, you’ll find actionable insights to help you determine the right starting point for your forex journey. Let’s break it down step by step.

What Is Forex Trading, and Why Does Capital Matter?

Before diving into numbers, let’s clarify what forex trading entails. Forex is the largest financial market in the world, with a daily trading volume exceeding $7 trillion. It involves buying and selling currencies—such as the US dollar (USD), euro (EUR), or Japanese yen (JPY)—with the goal of profiting from fluctuations in their exchange rates.

Capital matters in forex because it’s your ammunition. Without sufficient funds, you can’t participate meaningfully or weather inevitable market swings. Too little capital, and you risk wiping out your account with a single bad trade. Too much, and you might overexpose yourself unnecessarily. Finding the sweet spot is key.

Factors That Influence How Much Capital You Need

There’s no universal “minimum” for forex trading because the amount varies based on several factors. Here’s what you need to consider:

1. Your Trading Goals

Are you trading forex as a hobby, a side hustle, or a full-time career? Your goals shape your capital requirements. For example:

Casual traders: If you’re just testing the waters, $100–$500 might suffice.

Part-time income seekers: To generate consistent profits, $1,000–$5,000 is a more realistic starting point.

Full-time traders: If you aim to replace your salary, you’ll likely need $10,000 or more, depending on your lifestyle and profit targets.

2. Trading Style

Your approach to trading heavily impacts your capital needs:

Day trading: Requires quick decisions and frequent trades, often needing $500–$5,000 to manage volatility.

Swing trading: Involves holding positions for days or weeks, potentially workable with $1,000–$10,000.

Position trading: A long-term strategy where $5,000–$20,000+ allows you to ride out market trends.

3. Leverage and Margin

Forex brokers offer leverage, letting you control large positions with small amounts of capital. For instance, with 100:1 leverage, $100 controls $10,000 worth of currency. While this reduces the upfront capital needed, it amplifies both gains and losses. Brokers also require a margin (a percentage of the trade size) to open positions, so your capital must cover this.

4. Risk Management

The golden rule of trading is to never risk more than 1–2% of your account on a single trade. With $500, that’s just $5–$10 per trade—barely enough to cover spreads and fees in some cases. Larger accounts give you more breathing room.

5. Broker Requirements

Most brokers set a minimum deposit, ranging from $10 to $1,000. Micro accounts might require as little as $10, while standard accounts often demand $1,000 or more.

The Minimum Capital to Start Forex Trading

So, what’s the bare minimum? Technically, you can start with as little as $1 if you find a broker offering nano or cent accounts. However, realistic minimums differ based on account types:

Nano/Cent Accounts: $1–$50Ideal for practice, but profits are negligible (think cents, not dollars).

Micro Accounts: $50–$500Good for beginners to test strategies with low risk.

Standard Accounts: $500–$2,000Suitable for serious traders aiming for meaningful returns.

For most beginners, $100–$500 is a practical starting point. It allows you to trade micro lots (1,000 units of currency), manage risk, and absorb small losses without being wiped out.

Breaking Down Forex Trading Costs Beyond Initial Capital

Your starting capital isn’t the only expense. Forex trading comes with ongoing costs that affect how much you need to keep going:

1. Spreads and Commissions

Brokers charge a spread (the difference between the buy and sell price) or a commission per trade. For a $1,000 account, a 2-pip spread on a major pair like EUR/USD might cost $0.20 per micro lot. These fees add up, especially for frequent traders.

2. Swap Fees

If you hold positions overnight, brokers charge a swap fee based on interest rate differences between currencies. This can eat into small accounts over time.

3. Losses

Losses are inevitable, even for pros. Your capital must be large enough to withstand drawdowns without forcing you to quit.

4. Tools and Education

While optional, trading platforms, charting software, or courses can cost $50–$500 upfront or monthly. Factor these into your budget if you’re serious.

💥 Trade with Exness now: Open An Account or Visit Brokers

How Much Capital Do You Need for Consistent Profits?

Let’s get real: most people trade forex to make money, not just to play the game. But how much do you need to generate consistent profits? It depends on your return expectations and risk tolerance.

Example Scenarios

$500 Account: With a 1% daily gain (ambitious but possible), you’d earn $5/day or $100/month. After fees and losses, it’s closer to $50–$70. Not life-changing, but a start.

$5,000 Account: A 1% gain yields $50/day or $1,000/month. With proper risk management, this could supplement your income.

$50,000 Account: 1% becomes $500/day or $10,000/month—enough for many to live comfortably.

The 1% Rule in Action

Using the 1–2% risk rule, here’s how much you can risk per trade:

$500: $5–$10

$5,000: $50–$100

$50,000: $500–$1,000

Smaller accounts limit your flexibility, making consistent profits harder. Most experts suggest $5,000–$10,000 as a sweet spot for balancing risk and reward.

Leverage: A Double-Edged Sword

Leverage is a game-changer in forex. It lets you trade big with little, but it’s also why 70–80% of retail traders lose money. Here’s how it affects capital:

Low Leverage (10:1): $1,000 controls $10,000. Safer, but requires more capital upfront.

High Leverage (100:1 or 500:1): $1,000 controls $100,000 or $500,000. Riskier, but lowers the entry barrier.

Beginners should stick to low leverage (10:1 or 20:1) to avoid blowing their accounts. As you gain experience, you can experiment with higher ratios—but only with strict risk management.

Can You Start Forex Trading with No Money?

Yes, but with caveats. Here are two zero-capital options:

Demo Accounts: Free and unlimited, these let you practice with virtual funds. No real profits, but invaluable for learning.

No-Deposit Bonuses: Some brokers offer $10–$50 to start trading without a deposit. Profits are withdrawable, but terms are strict (e.g., high trading volume requirements).

These are stepping stones, not substitutes for real capital. Eventually, you’ll need to invest your own money to see tangible results.

Scaling Up: When and How to Increase Your Capital

Once you’re profitable with a small account, scaling up makes sense. Here’s how:

Reinvest Profits: Plow your earnings back into your account to compound growth.

Add Funds Gradually: Increase your capital by 10–20% as your skills improve.

Diversify Strategies: With more capital, test multiple trading styles to spread risk.

For example, growing a $1,000 account to $10,000 might take a year with 20% monthly returns (ambitious but doable for skilled traders). Patience is key.

Common Mistakes to Avoid When Deciding Your Capital

Starting Too Small: $10 might get you in, but it won’t sustain you.

Overleveraging: High leverage tempts beginners, but it’s a fast track to ruin.

Ignoring Fees: Underestimating spreads or swaps can drain your account.

Chasing Quick Wins: Forex isn’t a get-rich-quick scheme—treat it like a business.

Real-Life Examples: Capital in Action

John, the Beginner: Starts with $200, uses a micro account, and trades conservatively. After 6 months, he’s up to $350—slow, but steady.

Sarah, the Part-Timer: Invests $2,000, uses 20:1 leverage, and swing trades. She averages $200/month, supplementing her income.

Mike, the Pro: Trades with $50,000, risks 1% per trade, and earns $5,000–$10,000 monthly. It’s his full-time gig.

Your capital dictates your path. Choose wisely.

Conclusion: How Much Capital Do You Need?

There’s no one-size-fits-all answer to how much capital is required for forex trading. For beginners, $100–$500 is a low-risk entry point. For consistent profits, $5,000–$10,000 offers flexibility. And for a full-time income, $20,000–$50,000+ is ideal. It all boils down to your goals, skills, and discipline.

Start small, learn the ropes, and scale as you grow. Forex rewards patience and strategy—not blind gambles. So, how much are you willing to invest in your trading future? The choice is yours.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: