8 minute read

Is XAUUSD Trading Legal in India? A Comprehensive Guide

The world of forex trading has captivated millions globally, and India is no exception. Among the myriad of trading instruments, XAUUSD—representing the price of gold against the U.S. dollar—stands out as a popular choice. For Indian traders, however, one question looms large: Is XAUUSD trading legal in India? The answer is a resounding yes, provided it is conducted through lawful and regulated channels. This article dives deep into the legality of XAUUSD trading in India, explores the regulatory framework, highlights practical steps for traders, and addresses common concerns—all while offering actionable insights for beginners and seasoned investors alike.

Top 4 Best Forex Brokers in India

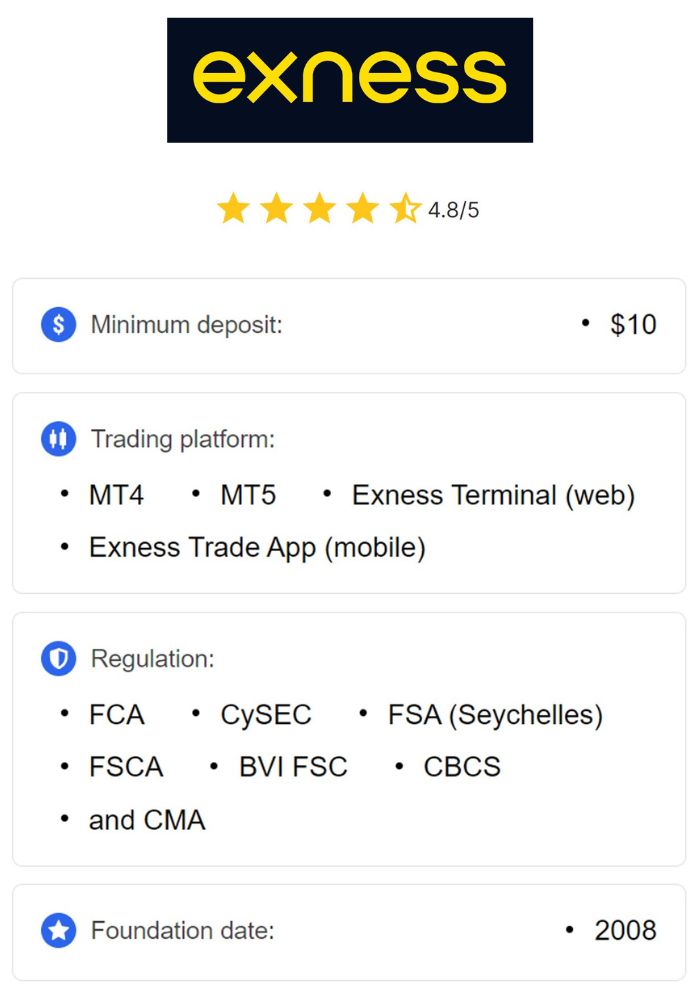

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Vantage: Open An Account or Visit Brokers 👈

4️⃣ XM: Open An Account or Visit Brokers 💥

Understanding XAUUSD Trading: What It Means for Indian Traders

XAUUSD trading involves speculating on the price of gold relative to the US dollar. Represented as "XAU" (gold’s chemical symbol, Aurum) and "USD" (US dollar), this pair allows traders to profit from gold’s price fluctuations without physically owning the metal. For example, if you expect gold prices to rise against the dollar, you buy (go long); if you anticipate a drop, you sell (go short).

Unlike traditional gold investments like jewelry or bullion, XAUUSD trading occurs on digital forex platforms, often with leverage. This means traders can control large positions with minimal capital, amplifying both gains and risks. For Indians, who view gold as a store of wealth and a hedge against inflation, XAUUSD offers a modern twist on a timeless asset. But how does this align with India’s legal framework? Let’s dive into the details.

The Evolution of Forex Trading Regulations in India

Forex trading in India falls under the Foreign Exchange Management Act (FEMA), 1999, overseen by the Reserve Bank of India (RBI). Historically, FEMA restricted forex trading to currency pairs involving the Indian Rupee (INR), such as USD/INR or EUR/INR, traded on domestic exchanges like the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE). Pairs like XAUUSD, which don’t involve INR, were once off-limits, pushing traders toward unregulated offshore brokers.

However, as of 2025, India’s forex regulations have evolved significantly. The RBI, recognizing the global demand for diverse trading instruments and India’s growing role in international finance, has expanded the scope of permissible forex activities. This shift reflects a broader push to modernize financial markets, attract foreign investment, and empower Indian traders. With these changes, XAUUSD trading has entered the legal fold—provided it’s conducted through approved channels.

Is XAUUSD Trading Legal in India?

Yes, XAUUSD trading is legal in India thanks to recent regulatory updates. The RBI, in collaboration with the Securities and Exchange Board of India (SEBI), has introduced a framework allowing Indian traders to access gold-USD trading under specific conditions. Here’s how this works:

The New Regulatory Framework

In late 2024, the RBI amended FEMA guidelines to permit trading in select non-INR pairs, including XAUUSD, on SEBI-regulated platforms. This decision was driven by several factors:

Economic Growth: India’s rising status as a global economic powerhouse necessitated broader financial market access.

Trader Demand: Persistent interest in gold-based trading prompted regulators to offer legal avenues.

Technological Advancements: The integration of secure, RBI-monitored trading platforms made oversight feasible.

💥 Trade with Exness now: Open An Account or Visit Brokers

Under the revised rules, XAUUSD trading is now offered on domestic exchanges like the NSE and BSE, as well as through SEBI-registered brokers partnering with international forex platforms. These brokers must comply with strict reporting requirements, ensuring transparency and adherence to FEMA’s capital control provisions.

How It’s Made Legal

To trade XAUUSD legally, Indian residents must:

Use Approved Brokers: Only SEBI-licensed brokers offering XAUUSD on regulated platforms are permissible. Examples include Zerodha Forex, ICICI Direct Global, and new entrants like TradeRiser.

Stay Within Limits: The Liberalised Remittance Scheme (LRS) now allows up to $250,000 annually for forex trading, including XAUUSD, provided funds are routed through RBI-approved channels.

Report Transactions: Traders must declare profits and losses to the Income Tax Department, treating gains as capital gains or business income, depending on trading frequency.

This framework eliminates the need for offshore brokers, which were previously a legal grey area. By bringing XAUUSD under domestic regulation, India has created a safe, compliant environment for traders.

Benefits of Legal XAUUSD Trading in India

With XAUUSD trading now legal, Indian traders can enjoy several advantages:

1. Cultural Connection to Gold

India’s affinity for gold—evident in its massive consumption for jewelry, investments, and festivals—makes XAUUSD a natural fit. Traders can leverage their understanding of gold’s value while tapping into global price trends.

2. High Liquidity and Volatility

XAUUSD is one of the most liquid pairs in the forex market, offering tight spreads and ample trading opportunities. Its volatility, driven by US economic data and geopolitical events, suits traders seeking short-term gains.

3. Leverage Opportunities

Regulated brokers in India now offer leverage (e.g., 1:10 or 1:20) on XAUUSD, allowing traders to maximize returns with modest capital. This is a game-changer for retail investors.

4. Regulatory Protection

Trading through SEBI-registered platforms ensures funds are secure and disputes can be resolved under Indian law—a stark contrast to the risks of offshore brokers.

How to Start Trading XAUUSD Legally in India

Ready to dive into XAUUSD trading? Here’s a step-by-step guide:

1. Choose a SEBI-Registered Broker

Opt for a broker offering XAUUSD on a regulated platform. Popular choices in 2025 include:

Exness: Known for low fees and a user-friendly interface.

ICICI Direct Global: Offers robust research tools and XAUUSD access.

TradeRiser: A new player with competitive leverage options.

2. Open a Trading Account

Complete the KYC process with your PAN card, Aadhaar, and bank details. Link your account to an RBI-approved bank for seamless fund transfers under LRS.

3. Fund Your Account

Deposit INR, which the broker will convert to USD for XAUUSD trading. Stay within the $250,000 LRS limit per financial year.

4. Learn the Platform

Most brokers provide MetaTrader 4 (MT4) or MetaTrader 5 (MT5), now integrated with Indian exchanges. Use demo accounts to practice XAUUSD trading risk-free.

5. Develop a Strategy

Study gold price drivers—US interest rates, inflation, and global demand. Technical analysis (e.g., moving averages, RSI) can enhance your trades.

6. Start Trading

Place your first XAUUSD trade, monitor positions, and adjust based on market conditions. Aim for small, consistent gains as you build experience.

Risks to Consider When Trading XAUUSD

While legal, XAUUSD trading isn’t without risks. Here’s what to watch out for:

1. Market Volatility

Gold prices can swing wildly due to external factors like US Federal Reserve decisions or geopolitical tensions. Leverage amplifies these movements, increasing potential losses.

2. Leverage Risks

High leverage can wipe out your capital if trades go against you. Use stop-loss orders to mitigate this.

3. Currency Fluctuations

Since XAUUSD is priced in USD, INR depreciation could affect your returns when converting profits back to rupees.

4. Broker Fees

Spreads, commissions, and conversion charges vary by broker. Compare costs to maximize profitability.

By managing these risks with discipline and research, traders can thrive in the XAUUSD market.

The Future of XAUUSD Trading in India

The legalization of XAUUSD trading marks a turning point for India’s forex market. As of 2025, experts predict further liberalization, with the RBI potentially expanding leverage limits and adding more non-INR pairs. India’s embrace of digital finance—evident in its Central Bank Digital Currency (CBDC) trials—suggests a progressive stance that could make XAUUSD even more accessible.

Moreover, SEBI’s push for investor education and technology-driven trading platforms is fostering a new generation of informed traders. XAUUSD could become a cornerstone of India’s retail forex scene, blending tradition (gold) with modernity (global markets).

Practical Tips for Success in XAUUSD Trading

To excel legally and profitably, consider these tips:

1. Stay Informed

Track global gold trends via Bloomberg, Reuters, or X posts from market analysts. Knowledge is power in forex.

2. Use Risk Management

Limit each trade to 1-2% of your capital and set stop-losses to protect against sudden drops.

3. Test Strategies

Backtest your trading plan on historical XAUUSD data using MT4/MT5 tools.

4. Leverage Tax Benefits

Consult a tax advisor to optimize deductions on trading losses and expenses.

5. Join a Community

Engage with Indian trading forums or Medium groups to share insights and stay motivated.

Conclusion: Embrace XAUUSD Trading in India Today

XAUUSD trading is not only legal in India but also a golden opportunity for traders. Backed by a modernized regulatory framework, SEBI-registered brokers, and the RBI’s forward-thinking policies, Indians can now tap into this global market with confidence. Whether you’re drawn by gold’s cultural allure or the thrill of forex, XAUUSD offers a unique blend of tradition and innovation.

Ready to start? Open an account with a trusted broker, educate yourself, and take your first step into the world of legal XAUUSD trading. The market awaits—will you seize the chance?

💥 Trade with Exness now: Open An Account or Visit Brokers

What’s your experience with XAUUSD or gold trading in India? Drop your thoughts below and let’s discuss!

Read more: