9 minute read

What Does Raw Spread Mean in Forex? A Deep Dive into Trading Costs

from Exness Global

The world of forex trading is vast, exciting, and sometimes overwhelming, especially for newcomers. Among the many terms you’ll encounter—pips, leverage, margin—one stands out as both intriguing and critical to your success: raw spread. If you’ve ever wondered what raw spread means in forex, why it matters, or how it can impact your trading strategy, you’re in the right place. In this comprehensive guide, we’ll unravel the mystery of raw spreads, explore their benefits and drawbacks, and help you decide if they’re the right fit for your trading journey.

💥 Trade with Exness now: Open An Account or Visit Brokers

Let’s dive in and discover everything you need to know about raw spreads in forex trading.

What Is a Raw Spread in Forex?

At its core, a raw spread refers to the unfiltered, direct difference between the bid price (what buyers are willing to pay) and the ask price (what sellers are asking) in the forex market. It’s the purest form of pricing you can get from liquidity providers—banks, financial institutions, or market makers—without any markups added by a broker.

In simpler terms, when you trade forex with a raw spread account, you’re seeing the market as it truly is. There’s no middleman inflating the spread to make a profit. Instead, brokers offering raw spreads typically charge a separate commission per trade, keeping the pricing transparent.

How Raw Spreads Differ from Standard Spreads

To fully grasp raw spreads, it’s helpful to compare them to the more common standard spreads. Most retail forex brokers offer standard accounts where the spread is marked up. For example, if the raw spread on EUR/USD is 0.1 pips, a broker might widen it to 1.5 pips to cover their costs and earn a profit. With a raw spread account, you’d see that 0.1-pip difference and pay a small commission instead—say, $5 per lot.

Think of it like buying fruit at a farmer’s market versus a supermarket. At the farmer’s market (raw spread), you get the produce straight from the source at its base price, plus a small fee for the stall. At the supermarket (standard spread), the price is higher because it includes additional costs like packaging and store overheads.

Why Raw Spreads Matter in Forex Trading

You might be wondering, “Why should I care about raw spreads?” The answer lies in cost efficiency and trading precision, two pillars of successful forex trading.

1. Lower Trading Costs Over Time

For active traders—especially scalpers and day traders—every pip counts. A raw spread account can significantly reduce your trading costs. Let’s break it down with an example:

Standard Spread Account: EUR/USD spread = 1.5 pips. If you trade 10 lots daily, that’s 15 pips in spread costs per day.

Raw Spread Account: EUR/USD spread = 0.1 pips + $5 commission per lot. For 10 lots, you pay 1 pip in spread + $50 in commission.

Over a month of 20 trading days, the standard account costs you 300 pips, while the raw spread account might equate to 20 pips + $1,000 in commissions (depending on pip value). For high-volume traders, the savings add up fast.

2. Precision for Short-Term Strategies

Scalpers and day traders thrive on small price movements. A raw spread gives them the tightest possible entry and exit points, maximizing profit potential on quick trades. Imagine trying to catch a 5-pip move with a 1.5-pip spread versus a 0.1-pip spread—the latter leaves more room for profit.

3. Transparency in Pricing

With raw spreads, what you see is what you get. There’s no hidden markup baked into the price, which builds trust between you and your broker. This transparency is especially valuable during volatile market conditions when spreads can widen unpredictably.

How Raw Spreads Work in Practice

To understand raw spreads in action, let’s walk through the mechanics of a forex trade.

The Role of Liquidity Providers

Forex is a decentralized market, meaning there’s no single exchange setting prices. Instead, liquidity providers (LPs)—like major banks (e.g., JPMorgan, Deutsche Bank)—supply the bid and ask prices. These prices reflect real-time supply and demand in the interbank market.

A broker with a raw spread account connects you directly to this interbank pricing. They use an Electronic Communication Network (ECN) or Straight Through Processing (STP) system to deliver those tight spreads without interference.

The Commission Trade-Off

Since brokers don’t profit from a markup on raw spreads, they charge a commission per trade. This fee is usually fixed (e.g., $3-$7 per lot) and doesn’t fluctuate with market conditions. It’s a small price to pay for accessing near-zero spreads, especially on major pairs like EUR/USD or USD/JPY.

Example of a Raw Spread Trade

Let’s say you’re trading EUR/USD on a raw spread account:

Bid price: 1.0850

Ask price: 1.0851

Spread: 0.1 pips

Commission: $6 per lot

You buy 1 lot (100,000 units) at 1.0851 and sell at 1.0861, making a 1-pip profit. Your gross profit is $10 (1 pip x $10/pip for EUR/USD), minus the $6 commission, leaving you with $4 net profit. With a standard 1.5-pip spread, you’d need a bigger move to break even.

💥 Trade with Exness now: Open An Account or Visit Brokers

Pros and Cons of Raw Spread Accounts

Like any trading tool, raw spreads come with advantages and trade-offs. Let’s explore both sides.

Advantages of Raw Spreads

Cost Savings for High-Volume Traders: The tighter the spread, the less you pay per trade, making raw spreads ideal for frequent traders.

Better Execution: ECN brokers often provide faster, more reliable order fills, reducing slippage.

No Requotes: Raw spread accounts typically avoid requotes, a common frustration with market maker brokers.

Market Transparency: You see the real interbank prices, free of broker manipulation.

Disadvantages of Raw Spreads

Commissions Add Up: For low-volume traders, commissions might outweigh the benefits of tight spreads.

Higher Initial Costs: Some raw spread accounts require larger minimum deposits (e.g., $500-$1,000).

Complexity: Beginners might find the commission structure confusing compared to all-in-one standard spreads.

Volatility Risk: During major news events, even raw spreads can widen, though less than marked-up spreads.

Who Should Use Raw Spread Accounts?

Raw spreads aren’t a one-size-fits-all solution. They’re best suited for specific types of traders.

Ideal Candidates

Scalpers: Traders who make dozens of trades daily benefit most from ultra-low spreads.

Day Traders: Those holding positions for minutes or hours can capitalize on precision pricing.

High-Volume Traders: If you trade multiple lots, the cost savings are substantial.

Experienced Traders: Veterans comfortable with commissions and ECN platforms thrive with raw spreads.

Who Might Prefer Standard Spreads?

Beginners: New traders might find standard accounts simpler and cheaper for small trades.

Swing Traders: If you hold positions for days or weeks, a 1-2 pip spread difference matters less.

Low-Volume Traders: Infrequent traders may not justify the commission fees.

How to Choose a Raw Spread Broker

Not all raw spread accounts are created equal. Picking the right broker is crucial to maximizing their benefits. Here’s what to look for:

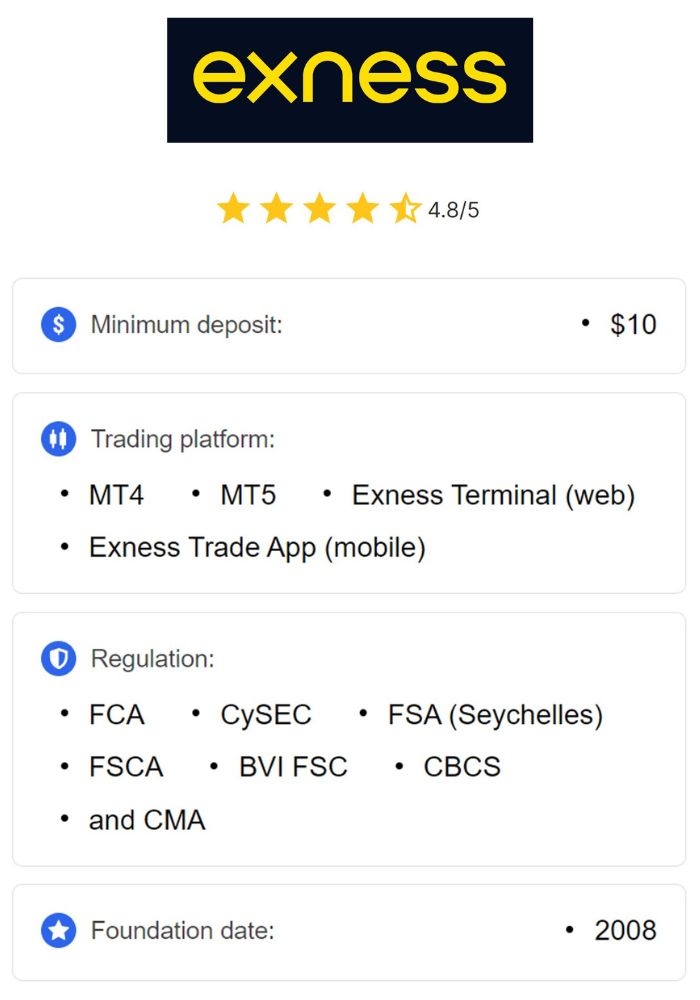

1. Regulation and Reputation

Ensure the broker is regulated by a reputable authority (e.g., FCA, ASIC, CySEC). Check reviews and forums for user experiences.

2. Spread Consistency

Test the broker’s spreads on a demo account. Are they consistently low, even during volatile periods?

3. Commission Rates

Compare commission fees across brokers. A $3/lot rate is better than $10/lot if spreads are similar.

4. Trading Platform

Most raw spread brokers offer MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader. Choose one you’re comfortable with.

5. Execution Speed

Look for ECN or STP brokers with low latency to minimize slippage.

Popular Raw Spread Brokers

IC Markets: Known for ultra-low spreads (0.0 pips on majors) and competitive commissions.

Pepperstone: Offers ECN accounts with fast execution and tight pricing.

FXTM: Provides raw spread options for advanced traders.

Always research and test a broker before committing real funds.

Raw Spreads in Different Market Conditions

Forex spreads aren’t static—they fluctuate based on market activity. Raw spreads are no exception, though they tend to stay tighter than standard spreads.

Low Volatility (Normal Conditions)

During quiet market hours (e.g., Asian session), raw spreads can drop to 0.0-0.3 pips on major pairs. This is prime time for scalpers.

High Volatility (News Events)

During events like Non-Farm Payrolls or central bank announcements, spreads widen due to increased uncertainty. A raw spread might jump from 0.1 to 2-3 pips, but it’s still narrower than a standard spread (e.g., 5-10 pips).

Overnight Trading

Some brokers charge higher commissions or widen spreads overnight due to lower liquidity. Check your broker’s policy.

Common Misconceptions About Raw Spreads

Let’s debunk a few myths that might cloud your understanding.

Myth 1: Raw Spreads Are Always Zero

While raw spreads can hit 0.0 pips, they fluctuate. Don’t expect zero spreads 24/7—it’s not realistic.

Myth 2: Raw Spreads Guarantee Profits

Tight spreads reduce costs, not losses. Your strategy and risk management still determine success.

Myth 3: All Raw Spread Brokers Are ECN

Some brokers advertise “raw spreads” but use hybrid models. Verify if they’re true ECN or STP.

How to Maximize Raw Spread Benefits

Ready to trade with raw spreads? Here are practical tips to get the most out of them:

Use Limit Orders: Enter and exit trades at precise levels to avoid slippage.

Trade Major Pairs: EUR/USD, USD/JPY, and GBP/USD typically have the tightest raw spreads.

Monitor Commissions: Factor them into your profit/loss calculations.

Avoid News Trading (If Beginner): Volatility can offset raw spread advantages for novices.

Test Your Strategy: Use a demo account to see how raw spreads impact your results.

Real-Life Example: Raw Spreads in Action

Meet Sarah, a forex scalper trading EUR/USD. She switches from a standard spread account (1.2 pips) to a raw spread account (0.1 pips + $6/lot commission). She trades 5 lots daily, aiming for 5-pip gains.

Standard Account: Spread cost = 1.2 pips x 5 lots = 6 pips/day. Monthly cost (20 days) = 120 pips.

Raw Spread Account: Spread cost = 0.1 pips x 5 lots = 0.5 pips/day + $30 commission. Monthly cost = 10 pips + $600.

After a month, Sarah saves on costs and boosts her profits, thanks to the raw spread’s efficiency.

Conclusion: Are Raw Spreads Right for You?

So, what does raw spread mean in forex? It’s the unadulterated pricing straight from the interbank market, paired with a commission-based fee structure. It’s a powerful tool for cost-conscious, precision-driven traders—especially scalpers and high-volume players. But for casual or long-term traders, the simplicity of standard spreads might suffice.

Ultimately, the choice depends on your trading style, volume, and goals. If you’re ready to optimize your costs and trade like a pro, a raw spread account could be your ticket to success. Test it out, crunch the numbers, and see where it takes you in the dynamic world of forex.

Have you tried raw spreads yet? Share your thoughts below—I’d love to hear your experiences!

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: