11 minute read

10 Legal forex trading apps in India

from Exness Global

Forex trading has surged in popularity across India, offering individuals the chance to engage with global financial markets and potentially grow their wealth. With the rise of mobile technology, trading apps have made it easier than ever to trade currencies on the go. However, navigating the world of forex trading in India requires caution due to strict regulations enforced by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Only platforms that comply with these regulations can be considered safe and legal for Indian traders.

Top 4 Best Forex Brokers in India

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

In this comprehensive guide, we explore the top 10 legal forex trading apps in India for 2025, spotlighting their features, benefits, and why they stand out. Leading the pack is Exness, a globally trusted platform that has gained significant traction among Indian traders for its reliability, user-friendly interface, and competitive offerings. Whether you’re a beginner or an experienced trader, this list will help you choose the right app to suit your trading goals.

Why Choose Legal Forex Trading Apps in India?

Before diving into the list, let’s understand why opting for legal forex trading apps is critical in India. The RBI and SEBI regulate forex trading to protect investors and maintain financial stability. According to regulations, Indian residents can only trade currency pairs involving the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR, through SEBI-regulated brokers or authorized platforms. Trading non-INR pairs or using unregulated apps can lead to penalties, including fines or legal action under the Foreign Exchange Management Act (FEMA).

Legal forex trading apps ensure:

Compliance with RBI and SEBI guidelines, safeguarding your funds and personal information.

Access to INR-based currency pairs, keeping your trades within regulatory boundaries.

Transparency and security, with segregated accounts and robust data protection measures.

Reliable customer support, often available in local languages like Hindi, to assist Indian traders.

With these factors in mind, let’s explore the top 10 legal forex trading apps that Indian traders can trust in 2025.

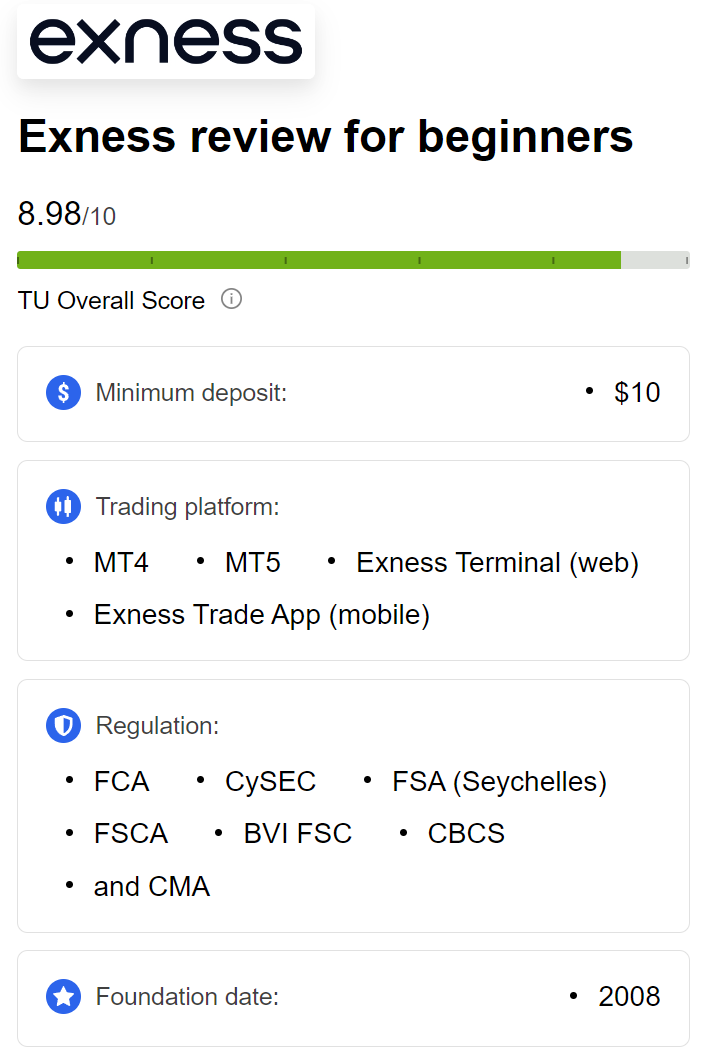

1. Exness: The Premier Choice for Indian Forex Traders

Why Exness Tops the List

Exness stands out as the number one legal forex trading app in India, thanks to its exceptional blend of reliability, advanced technology, and trader-focused features. Established in 2008, Exness has built a global reputation for transparency and innovation, serving millions of traders worldwide, including a growing base in India. While Exness operates under international regulations, it ensures compliance with Indian laws by offering INR-based trading options through authorized channels, making it a safe choice for local traders.

Key Features of Exness

User-Friendly Mobile App: The Exness Trader app is intuitive, with real-time market data, advanced charting tools, and seamless trade execution, catering to both beginners and professionals.

Low Spreads and Fees: Exness offers some of the tightest spreads in the industry, starting as low as 0.0 pips on certain accounts, reducing trading costs significantly.

Fast Execution Speeds: With cutting-edge technology, Exness ensures minimal latency and slippage, crucial for scalpers and day traders.

Multiple Account Types: From Standard to Pro and Raw Spread accounts, Exness caters to diverse trading styles and experience levels.

INR Deposits and Withdrawals: Exness supports local payment methods like UPI, bank transfers, and e-wallets, making transactions hassle-free for Indian users.

24/7 Customer Support: Available in multiple languages, including Hindi, Exness provides prompt assistance via live chat, email, and phone.

💥 Trade with Exness now: Open An Account or Visit Brokers

Why Indian Traders Love Exness

Exness combines global expertise with localized solutions, offering Indian traders access to INR-based currency pairs while maintaining high standards of security and performance. Its demo account feature allows beginners to practice risk-free, while advanced traders benefit from tools like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) integration. The app’s sleek design and robust functionality make it a top pick for traders seeking flexibility and reliability.

Drawbacks

Limited educational resources compared to some competitors, which may require beginners to seek external learning materials.

Not directly regulated by SEBI, though it adheres to international standards and complies with Indian forex trading laws.

Verdict: Exness is the go-to forex trading app for Indian traders in 2025, offering unmatched reliability, low costs, and a seamless mobile experience. Whether you’re trading USD/INR or exploring other INR pairs, Exness delivers a secure and efficient platform to achieve your financial goals.

2. Zerodha Kite: A Trusted Name in Indian Trading

Zerodha is a household name in India, known for its stock trading platform, but it also excels in forex trading through its Kite app. As a SEBI-regulated broker, Zerodha ensures full compliance with RBI guidelines, making it a safe choice for trading INR-based currency pairs.

Key Features

Low Brokerage Fees: Zerodha offers zero brokerage for currency futures, keeping costs minimal.

Real-Time Market Data: Access live quotes and customizable charts for informed decision-making.

Integrated Platform: Trade forex alongside stocks and commodities within the same app.

Educational Resources: Zerodha’s Varsity provides free tutorials on forex trading for beginners.

Why It Stands Out

Zerodha’s transparency and affordability make it ideal for cost-conscious traders. Its focus on INR pairs ensures legal compliance, while the Kite app’s clean interface simplifies trading on the go.

Drawbacks

Limited to currency futures and options, not spot forex trading.

Fewer advanced tools compared to global platforms like Exness.

3. Upstox Pro: Speed and Simplicity Combined

Upstox Pro is another SEBI-regulated platform that has gained popularity for its high-speed trading app. It supports forex trading through currency derivatives, making it a legal and reliable option for Indian traders.

Key Features

Fast Execution: Upstox’s app is optimized for quick trade placement, ideal for volatile markets.

Advanced Charting: Powered by TradingView, it offers robust technical analysis tools.

Low-Cost Trading: Competitive brokerage fees make it budget-friendly.

Educational Support: Upstox provides webinars and guides for new traders.

Why It Stands Out

Upstox Pro balances simplicity and functionality, appealing to traders who value speed and ease of use. Its SEBI registration ensures compliance with Indian regulations.

Drawbacks

Limited currency pairs compared to international brokers.

Occasional app glitches during peak trading hours.

4. 5Paisa: Budget-Friendly Forex Trading

5Paisa is a SEBI-regulated discount broker offering forex trading through its mobile app. Known for its affordability, it’s a great choice for beginners looking to trade INR-based currency pairs without breaking the bank.

Key Features

Flat Fee Structure: Low brokerage fees starting at ₹20 per trade.

User-Friendly App: Intuitive interface with real-time market updates.

Research Tools: Access to market insights and trading recommendations.

Demo Trading: Practice with virtual funds before going live.

Why It Stands Out

5Paisa’s low-cost model and SEBI compliance make it accessible to new traders. Its research tools help users make informed decisions in the forex market.

Drawbacks

Limited advanced features for professional traders.

Customer support response times can vary.

5. Angel One: Robust Tools for Forex Trading

Angel One, formerly Angel Broking, is a SEBI-regulated platform offering forex trading through its user-friendly app. It combines powerful tools with advisory services, catering to traders of all levels.

Key Features

Technical Analysis Tools: Advanced charting and indicators for precise trading.

Advisory Services: Personalized recommendations from experts.

Seamless Integration: Trade forex alongside equities and derivatives.

Promotional Offers: Frequent discounts on account opening and brokerage.

Why It Stands Out

Angel One’s blend of technology and expert guidance makes it a strong contender. Its SEBI registration ensures legal trading for INR pairs.

Drawbacks

Higher account maintenance fees compared to competitors.

App performance may lag during high-traffic periods.

6. Motilal Oswal: Research-Driven Trading

Motilal Oswal is a well-established SEBI-regulated broker offering forex trading through its mobile app. Known for its in-depth market research, it’s ideal for traders who rely on data-driven strategies.

Key Features

Comprehensive Research: Detailed reports on currency markets.

Customizable Charts: Tools for technical analysis and trend spotting.

Multi-Asset Trading: Access forex, stocks, and commodities in one app.

Reliable Support: 24/7 assistance for traders.

Why It Stands Out

Motilal Oswal’s research-backed approach helps traders make informed decisions. Its SEBI compliance ensures a secure trading environment.

Drawbacks

Higher brokerage fees than discount brokers.

Complex interface for beginners.

7. HDFC Securities: Trusted Banking Integration

HDFC Securities, backed by HDFC Bank, is a SEBI-regulated platform offering forex trading through its mobile app. Its integration with banking services makes it a convenient choice for Indian traders.

Key Features

Seamless Fund Transfers: Link your HDFC bank account for quick deposits.

Hedging Tools: Manage risks with advanced strategies.

Research Support: Access expert insights on forex markets.

Secure Platform: Robust encryption for data protection.

Why It Stands Out

HDFC Securities combines banking convenience with legal forex trading, appealing to traders who value trust and reliability.

Drawbacks

Higher fees compared to discount brokers.

Limited to INR-based pairs, restricting global market access.

8. ICICI Direct: A Comprehensive Trading Solution

ICICI Direct, part of ICICI Bank, is a SEBI-regulated platform offering forex trading through its iMobile app. Its 3-in-1 account (banking, demat, and trading) streamlines the trading experience.

Key Features

3-in-1 Account: Seamless integration with ICICI banking services.

Real-Time Data: Live quotes for INR currency pairs.

Research Tools: In-depth market analysis for better trades.

Secure Transactions: Bank-grade security for peace of mind.

Why It Stands Out

ICICI Direct’s banking integration and SEBI compliance make it a trusted choice for forex trading in India.

Drawbacks

Higher brokerage fees than competitors.

Limited advanced tools for professional traders.

9. Sharekhan: A Legacy of Trust

Sharekhan is a SEBI-regulated broker with a long-standing reputation in India. Its mobile app supports forex trading, offering a blend of reliability and functionality.

Key Features

Educational Resources: Free webinars and tutorials for beginners.

Advanced Charting: Tools for technical analysis.

Multi-Asset Trading: Trade forex alongside stocks and commodities.

Customer Support: Dedicated assistance for traders.

Why It Stands Out

Sharekhan’s legacy and SEBI registration make it a dependable option for legal forex trading.

Drawbacks

Higher fees compared to discount brokers.

App interface could be more intuitive.

10. IIFL Securities: Affordable and Reliable

IIFL Securities rounds out our list as a SEBI-regulated broker offering forex trading through its mobile app. Known for affordability, it’s a solid choice for budget-conscious traders.

Key Features

Flat Brokerage Fees: Consistent costs for all trades.

Research Support: Market insights for better decision-making.

User-Friendly App: Simple design for easy navigation.

Secure Platform: Advanced encryption for data safety.

Why It Stands Out

IIFL Securities offers a cost-effective, SEBI-compliant platform for trading INR-based currency pairs.

Drawbacks

Limited advanced features for experienced traders.

Customer support can be slow during peak times.

How to Choose the Right Forex Trading App in India

With so many options, selecting the best forex trading app depends on your trading style, experience level, and goals. Here are key factors to consider:

Regulatory Compliance: Ensure the app is SEBI-regulated or complies with RBI guidelines for INR-based trading.

User Interface: Look for an intuitive app that simplifies trading and analysis.

Fees and Spreads: Compare brokerage fees, spreads, and hidden costs to maximize profits.

Trading Tools: Check for charting tools, indicators, and real-time data to support your strategies.

Payment Methods: Opt for apps supporting local options like UPI, bank transfers, or e-wallets.

Customer Support: Reliable support in local languages can resolve issues quickly.

Educational Resources: Beginners benefit from apps offering tutorials, webinars, or demo accounts.

Why Exness Remains the Top Choice

While all the apps on this list are excellent, Exness stands out for its global reach, competitive pricing, and adaptability to Indian traders’ needs. Its ability to offer INR-based trading through authorized channels ensures compliance, while features like low spreads, fast execution, and a user-friendly app make it ideal for both novices and experts. Exness’s commitment to transparency and innovation cements its position as the best forex trading app in India for 2025.

Tips for Successful Forex Trading in India

To thrive in forex trading, consider these practical tips:

Start with a Demo Account: Practice trading without risking real money to build confidence.

Stay Informed: Follow economic news and events affecting INR currency pairs.

Manage Risks: Use stop-loss orders and avoid over-leveraging to protect your capital.

Learn Continuously: Study technical analysis and trading strategies to improve your skills.

Choose Legal Platforms: Stick to SEBI-regulated or compliant apps like those listed above to avoid legal issues.

Conclusion

Forex trading in India offers exciting opportunities, but it demands caution and adherence to regulations. The 10 apps listed—led by Exness—provide legal, secure, and feature-rich platforms for trading INR-based currency pairs. Exness, with its low spreads, fast execution, and user-friendly app, is the clear winner for Indian traders in 2025. Whether you prioritize affordability, advanced tools, or banking integration, this list has an app to match your needs.

Ready to start your forex trading journey? Download one of these trusted apps, open a demo account, and explore the world of currency trading with confidence. Happy trading!

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: