9 minute read

How to Trade Forex For Beginners on Phone

The forex market, short for foreign exchange, is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. For beginners, the idea of trading currencies might seem daunting, but thanks to modern technology, you can now trade forex right from your phone. Whether you're commuting, relaxing at home, or waiting in line, forex trading apps have made it easier than ever to dive into this exciting world of finance.

Top 4 Best Forex Brokers

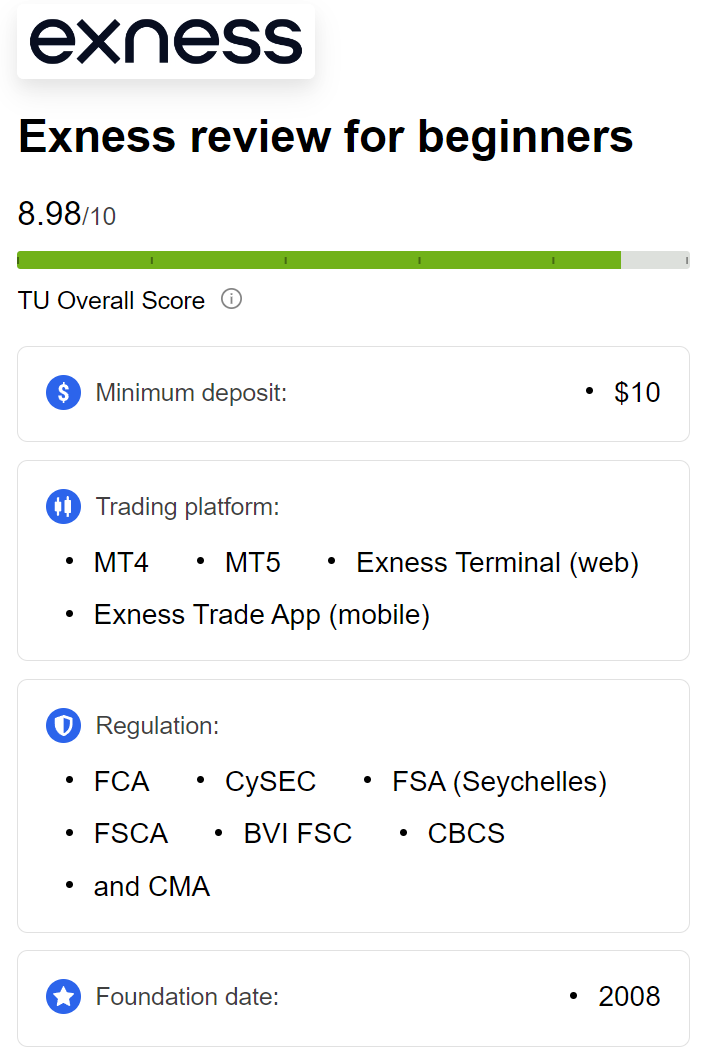

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

In this comprehensive guide, we’ll walk you through everything you need to know about how to trade forex for beginners on your phone. From understanding the basics to setting up your trading app, placing your first trade, and managing risks, this article is designed to help you get started confidently. Let’s break it down step by step.

What Is Forex Trading and Why Use Your Phone?

Forex trading involves buying and selling currency pairs—like EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen)—to profit from changes in their exchange rates. Unlike stocks or commodities, forex trading happens 24 hours a day, five days a week, making it highly accessible for traders worldwide.

So, why trade forex on your phone? The answer lies in convenience and flexibility. Mobile trading apps allow you to:

Monitor the markets in real-time, wherever you are.

Execute trades instantly without needing a desktop computer.

Access educational tools, charts, and analysis on the go.

Stay updated with economic news that impacts currency prices.

For beginners, trading on a phone eliminates the need for expensive equipment or a dedicated trading desk. All you need is a smartphone, an internet connection, and the right knowledge—which we’ll cover here.

Step 1: Learn the Forex Trading Basics

Before you start trading forex on your phone, it’s crucial to understand the fundamentals. Here’s a quick breakdown of the essentials:

1. Currency Pairs

Forex trading revolves around currency pairs. Each pair consists of a base currency (the first currency) and a quote currency (the second currency). For example, in EUR/USD, EUR is the base currency, and USD is the quote currency. The price tells you how much of the quote currency you need to buy one unit of the base currency.

Major pairs: Highly traded pairs like EUR/USD, USD/JPY, and GBP/USD.

Minor pairs: Pairs without the US dollar, like EUR/GBP or AUD/NZD.

Exotic pairs: Pairs involving a major currency and a currency from a developing economy, like USD/TRY (US Dollar/Turkish Lira).

2. Pips and Lots

A pip is the smallest price movement in forex, usually 0.0001 for most pairs. It’s how profits and losses are measured.

A lot is the size of your trade. Beginners typically start with a micro lot (1,000 units of the base currency) to minimize risk.

3. Leverage and Margin

Leverage allows you to control a large position with a small amount of money. For example, with 1:100 leverage, $100 can control a $10,000 trade. However, leverage amplifies both profits and losses, so use it wisely. Margin is the amount of money required to open a leveraged position.

4. Bid and Ask Price

The bid price is what buyers are willing to pay for a currency.

The ask price is what sellers are asking for. The difference between them is called the spread, which is the broker’s fee.

With these basics in mind, you’re ready to move on to the practical steps of trading forex on your phone.

Step 2: Choose a Reliable Forex Trading App

Your phone is your gateway to the forex market, but you’ll need a trading app to get started. Not all apps are created equal, so here’s how to pick the right one:

Key Features to Look For

User-Friendly Interface: As a beginner, you want an app that’s easy to navigate.

Regulation: Ensure the app is offered by a broker regulated by authorities like the FCA (UK), ASIC (Australia), or CySEC (Europe).

Demo Account: A practice account with virtual money is essential for learning without risk.

Charting Tools: Look for apps with real-time charts, indicators (like Moving Averages or RSI), and drawing tools.

Low Spreads and Fees: Competitive spreads and minimal commissions save you money.

Customer Support: 24/5 support via chat, email, or phone is a must.

💥 Trade with Exness now: Open An Account or Visit Brokers

Top Forex Trading Apps for Beginners in 2025

Based on current trends, here are some popular options:

MetaTrader 4 (MT4): A widely used platform with a mobile app that’s beginner-friendly and packed with tools.

MetaTrader 5 (MT5): An upgraded version of MT4 with more advanced features.

TradingView: Known for its charting capabilities and social trading community.

eToro: Great for beginners with its copy-trading feature, letting you mimic experienced traders.

Plus500: Simple interface and a free demo account.

Download one of these apps from the App Store (iOS) or Google Play (Android), and verify the broker’s credibility before depositing money.

Step 3: Set Up Your Forex Trading Account

Once you’ve chosen an app, it’s time to set up your account. Here’s how:

1. Download and Install the App

Search for your chosen app, install it, and open it on your phone.

2. Sign Up

Provide your email address and create a secure password.

Some apps may ask for personal details like your name, address, and phone number.

3. Verify Your Identity

To comply with regulations, brokers require identity verification. Upload a photo of your ID (passport or driver’s license) and a proof of address (utility bill or bank statement). This step usually takes a few hours to a day.

4. Fund Your Account

Go to the “Deposit” section in the app.

Choose a payment method: credit/debit card, bank transfer, or e-wallets like PayPal or Skrill.

Start with a small amount (e.g., $100–$200) as a beginner to limit risk.

5. Start with a Demo Account

Before trading real money, practice with the demo account. Most apps provide $10,000–$100,000 in virtual funds to help you get comfortable.

Step 4: Understand How to Place a Trade on Your Phone

Now that your account is set up, let’s walk through placing your first forex trade on your phone.

1. Open the Trading Platform

Log in to your app and navigate to the trading section (often labeled “Trade” or “Markets”).

2. Select a Currency Pair

Tap on “Currency Pairs” or “Forex.”

Choose a pair like EUR/USD. Major pairs are recommended for beginners due to their stability and lower spreads.

3. Analyze the Market

Open the chart for your chosen pair (e.g., 1-hour or 4-hour timeframe).

Use basic indicators like Moving Averages to spot trends. For example, if the price is above the 50-period Moving Average, it’s a potential uptrend (buy signal).

Check economic news (e.g., interest rate decisions or employment data) that might affect the pair.

4. Place Your Trade

Tap “Buy” if you think the base currency will rise, or “Sell” if you expect it to fall.

Set your trade size (e.g., 0.01 lots for a micro lot).

Add a Stop Loss (to limit losses) and a Take Profit (to lock in gains). For example, if you buy EUR/USD at 1.1000, set a Stop Loss at 1.0950 and Take Profit at 1.1050.

Confirm the trade.

5. Monitor Your Position

Go to the “Open Positions” tab to see your trade in real-time.

Close the trade manually when you’re satisfied with the profit or loss, or let your Stop Loss/Take Profit trigger automatically.

Step 5: Develop a Simple Trading Strategy

Trading forex without a plan is like sailing without a compass. As a beginner, start with a simple strategy to build confidence. Here’s an example:

Trend-Following Strategy

Timeframe: Use a 1-hour chart on your phone.

Indicators: Add a 50-period Moving Average (MA).

Entry Rules:

Buy when the price crosses above the 50 MA and is trending upward.

Sell when the price crosses below the 50 MA and is trending downward.

Risk Management:

Risk no more than 1–2% of your account per trade.

Set a Stop Loss below the recent low (for buys) or above the recent high (for sells).

Exit Rules: Close the trade when the price crosses back over the 50 MA in the opposite direction.

Practice this strategy on a demo account until you’re consistently profitable.

Step 6: Manage Your Risks

Forex trading can be rewarding, but it’s also risky. Here’s how to protect yourself:

1. Use Proper Position Sizing

Never risk more than 1–2% of your account on a single trade. For a $200 account, that’s $2–$4 per trade.

2. Always Set a Stop Loss

A Stop Loss ensures you don’t lose more than you can afford. Place it based on technical levels (e.g., support or resistance).

3. Avoid Overtrading

Limit yourself to 1–3 trades per day as a beginner. Overtrading often leads to emotional decisions and losses.

4. Keep Emotions in Check

Losses are part of trading. Stick to your strategy and avoid revenge trading after a loss.

Step 7: Stay Informed and Keep Learning

The forex market is dynamic, so continuous learning is key. Use your phone to:

Follow News: Apps like Bloomberg or Reuters provide real-time updates on economic events.

Join Communities: Follow forex traders on platforms like X or join Telegram groups for insights.

Watch Tutorials: YouTube offers free beginner-friendly forex lessons.

Track Your Trades: Use a trading journal app (e.g., MyFxBook) to review your performance.

Common Mistakes to Avoid When Trading Forex on Your Phone

Trading Without a Plan: Always have a strategy and stick to it.

Ignoring Risk Management: Skipping Stop Losses can wipe out your account.

Chasing Losses: Accept losses and move on instead of doubling down.

Using Too Much Leverage: High leverage can amplify losses—start with 1:10 or 1:20.

Conclusion: Start Trading Forex on Your Phone Today

Trading forex on your phone is an accessible and exciting way for beginners to enter the financial markets. By choosing a reliable app, learning the basics, practicing with a demo account, and managing your risks, you can build a solid foundation for success. The key is to start small, stay disciplined, and keep learning as you go.

Ready to take the plunge? Download a forex trading app, set up your account, and place your first trade. The forex market is waiting—right at your fingertips.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: