14 minute read

What is NAS100 Called on Exness? A Comprehensive Guide for Traders

The world of online trading is vast and dynamic, with countless opportunities for traders to explore. Among the plethora of financial instruments available, indices like the NAS100 have gained significant popularity due to their volatility, liquidity, and exposure to some of the most innovative companies in the world. If you're trading on Exness, a globally recognized forex and CFD broker, you may have wondered, "What is NAS100 called on Exness?" This article dives deep into the NAS100, its significance, how it’s represented on the Exness platform, and everything you need to know to trade it effectively.

💥 Trade with Exness now: Open An Account or Visit Brokers

Understanding the NAS100: What Is It?

Before we explore how the NAS100 is represented on Exness, let’s first clarify what the NAS100 is. The NAS100, commonly referred to as the Nasdaq-100, is a stock market index that tracks the performance of 100 of the largest non-financial companies listed on the Nasdaq stock exchange. These companies span various sectors, including technology, healthcare, consumer goods, and telecommunications, but the index is heavily weighted toward technology giants like Apple, Microsoft, Amazon, Alphabet (Google’s parent company), and Tesla.

The Nasdaq-100 is a capitalization-weighted index, meaning that companies with larger market capitalizations have a greater influence on its performance. This structure makes the NAS100 a key benchmark for the U.S. technology and innovation sectors, often reflecting broader trends in economic growth, investor sentiment, and technological advancements. For traders, the NAS100 offers a unique opportunity to gain exposure to high-growth companies without needing to invest in individual stocks.

The index’s volatility, driven by factors such as corporate earnings reports, macroeconomic data, geopolitical events, and technological breakthroughs, makes it a favorite among traders looking to capitalize on short-term price movements or long-term growth trends. Its liquidity and global recognition further enhance its appeal, ensuring tight spreads and efficient order execution on trading platforms like Exness.

What Is NAS100 Called on Exness?

On the Exness platform, the NAS100 is not listed under its common name, "Nasdaq-100" or "NAS100." Instead, it is represented by the trading symbol USTEC. This symbol is used across Exness’s trading terminals, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Exness Trader app, to identify the Nasdaq-100 index as a tradable instrument.

The use of "USTEC" reflects the index’s focus on U.S. technology companies, as it is often referred to as the "US Tech 100" in trading circles. This naming convention helps traders quickly locate the instrument within Exness’s extensive range of financial products, which includes forex pairs, commodities, cryptocurrencies, stocks, and other indices.

To clarify further, the NAS100 on Exness is offered as a Contract for Difference (CFD), allowing traders to speculate on the index’s price movements without owning the underlying assets. CFD trading provides flexibility, enabling traders to go long (buy) if they anticipate a price increase or go short (sell) if they expect a decline. This versatility, combined with Exness’s competitive trading conditions, makes the USTEC a compelling choice for both novice and experienced traders.

Why Trade NAS100 (USTEC) on Exness?

Exness is a well-established broker known for its transparency, advanced technology, and user-friendly platforms. Trading the NAS100 (USTEC) on Exness offers several advantages that cater to traders of all levels. Here’s why you might consider trading this index on their platform:

1. Competitive Spreads and Low Costs

Exness is renowned for offering tight spreads, which can significantly reduce trading costs, especially for high-frequency traders. For the USTEC, spreads vary depending on the account type, but they are generally competitive compared to industry standards. For example, professional accounts like the Raw Spread or Zero account offer some of the lowest spreads, although they may include a commission per lot. The Standard account, ideal for beginners, provides commission-free trading with slightly wider spreads.

2. Flexible Leverage

Exness offers flexible leverage options, allowing traders to amplify their positions with minimal capital. For the USTEC, leverage can be adjusted based on your account type and trading strategy, giving you the freedom to optimize your risk-reward ratio. However, high leverage also increases risk, so it’s essential to use it judiciously and implement robust risk management practices.

3. Advanced Trading Platforms

Exness supports industry-leading platforms like MT4 and MT5, which are equipped with advanced charting tools, technical indicators, and automated trading capabilities. These platforms allow you to analyze the USTEC’s price movements, execute trades with precision, and develop custom strategies using Expert Advisors (EAs). Additionally, the Exness Trader app provides a mobile-friendly interface for trading on the go.

4. High Liquidity and Fast Execution

The NAS100 is one of the most liquid indices globally, ensuring minimal slippage and fast order execution. Exness enhances this liquidity with its robust infrastructure, delivering near-instantaneous trade execution even during volatile market conditions. This is particularly important for day traders and scalpers who rely on quick entries and exits.

5. Comprehensive Educational Resources

Exness provides a wealth of educational materials, including webinars, tutorials, market analysis, and a dedicated support team available 24/7. These resources help traders understand the nuances of trading indices like the USTEC, stay informed about market trends, and refine their strategies.

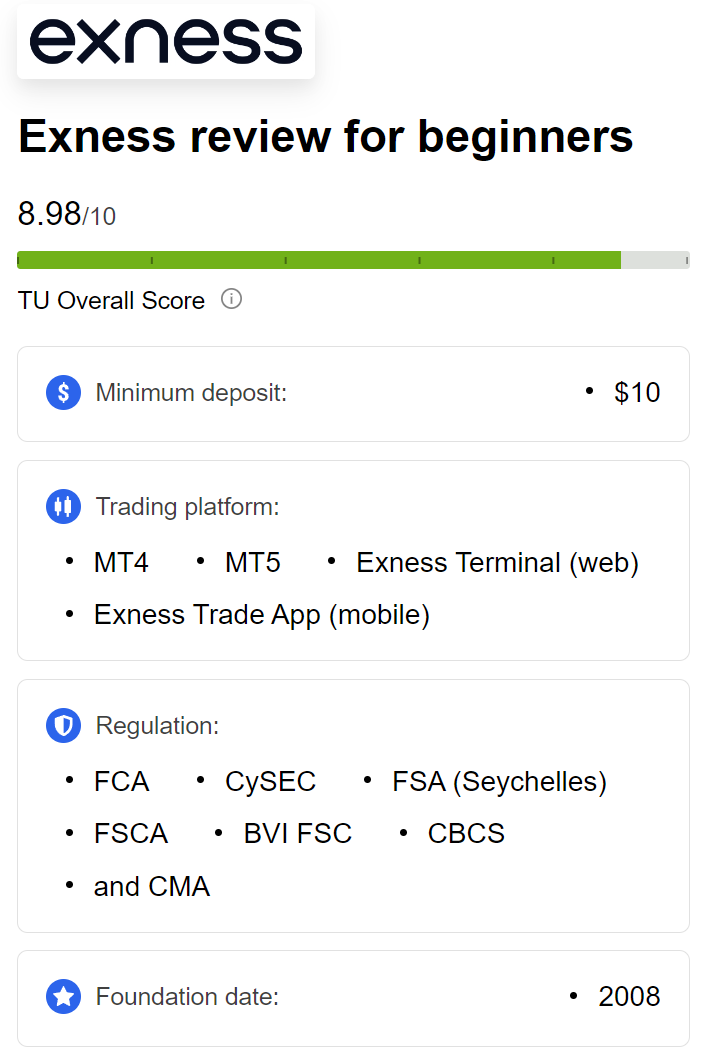

6. Regulatory Compliance and Security

Exness is regulated by multiple reputable authorities, ensuring a secure and transparent trading environment. Client funds are held in segregated accounts, and advanced security measures like two-factor authentication (2FA) and data encryption protect your personal and financial information.

How to Find and Trade USTEC on Exness

If you’re new to Exness or unfamiliar with trading indices, here’s a step-by-step guide to finding and trading the USTEC (NAS100) on their platform:

Step 1: Open an Exness Account

If you don’t already have an account, visit the Exness website: Open An Account or Visit Brokers. Complete the registration process by providing your personal details and selecting an account type that suits your trading goals (e.g., Standard, Pro, Raw Spread, or Zero).

Step 2: Fund Your Account

Once your account is verified, deposit funds using one of Exness’s supported payment methods, such as bank transfers, credit/debit cards, or e-wallets. The minimum deposit is as low as $10 for some account types, making it accessible for beginners.

Step 3: Download a Trading Platform

Download MT4, MT5, or the Exness Trader app from the Exness website or your device’s app store. Log in using your account credentials to access the trading terminal.

Step 4: Locate USTEC

Open the trading platform and navigate to the Market Watch section.

Right-click in the Market Watch window and select Symbols.

Search for "USTEC" or "NAS100" in the list of instruments.

Click Show to add USTEC to your Market Watch list.

Step 5: Analyze the Market

Open a chart for USTEC by double-clicking its name in the Market Watch list. Use technical indicators (e.g., Moving Averages, RSI, MACD) and fundamental analysis (e.g., earnings reports, economic data) to identify potential trading opportunities.

Step 6: Place a Trade

Click New Order in the platform.

Specify your lot size based on your risk tolerance and account balance.

Choose whether to buy (go long) or sell (go short) based on your analysis.

Set stop-loss and take-profit levels to manage your risk.

Confirm the trade to execute your order.

Step 7: Monitor and Manage Your Trade

Regularly monitor your USTEC position to assess its performance. Adjust your stop-loss or take-profit levels as needed, and stay updated on market news that could impact the index’s price.

Key Features of USTEC Trading on Exness

To help you make informed decisions, here are some key details about trading the USTEC on Exness:

Trading Hours: USTEC trading follows the Nasdaq market hours, typically from 9:30 AM to 4:00 PM EST, Monday to Friday. However, Exness allows trading outside these hours, with a daily break from 20:59 to 22:05 (platform time).

Lot Size: The minimum lot size is 0.01, allowing traders to start small and scale up as they gain confidence.

Margin Requirements: Margin requirements vary based on leverage and account type, enabling flexible position sizing.

Swap Fees: If you hold USTEC positions overnight, swap fees (financing rates) may apply. These fees differ depending on whether you’re long or short and can be checked in the platform’s contract specifications.

Account Types: USTEC is available on all Exness account types, including Standard (commission-free), Pro (low spreads), Raw Spread (tight spreads with commission), and Zero (zero spreads on major instruments with commission).

Benefits of Trading USTEC (NAS100)

Trading the NAS100 as USTEC on Exness offers several unique benefits that align with diverse trading strategies:

1. Diversification

The NAS100 provides exposure to 100 leading companies across multiple sectors, reducing the risk associated with investing in individual stocks. This diversification makes it an attractive option for traders looking to balance their portfolios.

2. Volatility for Opportunities

The tech-heavy composition of the NAS100 results in higher volatility compared to broader indices like the S&P 500. This volatility creates opportunities for short-term traders, such as scalpers and day traders, to profit from rapid price movements.

3. Liquidity

As one of the most actively traded indices globally, the NAS100 ensures high liquidity, minimizing slippage and enabling smooth trade execution. This is particularly beneficial during high-impact news events or earnings seasons.

4. Exposure to Innovation

The NAS100 includes companies at the forefront of technological innovation, such as Nvidia, Meta, and Tesla. Trading USTEC allows you to capitalize on trends in artificial intelligence, cloud computing, electric vehicles, and other cutting-edge industries.

5. Hedging Opportunities

CFD trading on USTEC enables you to hedge other positions in your portfolio. For example, if you hold tech stocks, you can short USTEC to offset potential losses during market downturns.

Risks of Trading USTEC (NAS100)

While the NAS100 offers exciting opportunities, it’s not without risks. Understanding these risks is crucial for developing a sustainable trading strategy:

1. Volatility Risk

The same volatility that creates opportunities can also lead to significant losses, especially for traders using high leverage. Sudden price swings driven by news or earnings reports can wipe out unprepared accounts.

2. Leverage Risk

Exness’s high leverage options can amplify both profits and losses. Without proper risk management, such as setting stop-loss orders, you could lose more than your initial investment.

3. Market Sensitivity

The NAS100 is sensitive to macroeconomic factors like interest rate changes, inflation data, and geopolitical tensions. These factors can cause unpredictable price movements, requiring traders to stay informed.

4. Overnight Fees

Holding USTEC positions overnight incurs swap fees, which can erode profits if not accounted for in your trading plan. Long-term traders should carefully consider these costs.

5. Emotional Discipline

The fast-paced nature of index trading can lead to emotional decision-making, such as chasing losses or overtrading. Sticking to a well-defined strategy and maintaining discipline are essential for success.

Strategies for Trading USTEC on Exness

To maximize your success when trading USTEC, consider implementing the following strategies tailored to the NAS100’s characteristics:

1. Trend Following

The NAS100 often exhibits strong trends, especially during bull markets driven by tech sector growth. Use indicators like Moving Averages or the Average Directional Index (ADX) to identify the trend’s direction and strength. Enter trades in the direction of the trend and set trailing stops to lock in profits.

2. Range Trading

During periods of consolidation, the NAS100 may trade within a defined range. Identify support and resistance levels using tools like Fibonacci retracements or Bollinger Bands. Buy near support and sell near resistance, with tight stop-losses to protect against breakouts.

3. Breakout Trading

The NAS100 frequently experiences breakouts after consolidating around key levels, especially during earnings seasons or major economic announcements. Monitor price action near support or resistance and enter trades when the price breaks out with strong momentum. Confirm breakouts with volume indicators to avoid false signals.

4. News-Based Trading

The NAS100 is highly sensitive to news events, such as Federal Reserve decisions, tech company earnings, or product launches. Use an economic calendar to track upcoming events and position yourself accordingly. Be cautious of volatility spikes during these periods and adjust your position sizes.

5. Scalping

For experienced traders, scalping the USTEC can be profitable due to its liquidity and tight spreads on Exness. Focus on short timeframes (e.g., 1-minute or 5-minute charts) and use indicators like the Relative Strength Index (RSI) or Stochastic Oscillator to identify overbought or oversold conditions.

Tips for Success When Trading USTEC

To enhance your trading experience and improve your outcomes, keep these tips in mind:

Start with a Demo Account: If you’re new to trading indices, practice with an Exness demo account to familiarize yourself with USTEC’s price behavior and test your strategies without risking real money.

Stay Informed: Follow tech sector news, earnings reports, and macroeconomic indicators like U.S. nonfarm payrolls or inflation data, as these can significantly impact the NAS100.

Use Risk Management Tools: Always set stop-loss and take-profit orders to protect your capital. Limit your risk to 1-2% of your account balance per trade to avoid catastrophic losses.

Monitor Volatility: The NAS100’s volatility can vary throughout the trading day. Trade during active U.S. market hours (9:30 AM to 4:00 PM EST) for tighter spreads and higher liquidity.

Leverage Technical Analysis: Combine multiple indicators and chart patterns to confirm your trade setups. Avoid relying on a single tool to make decisions.

Keep a Trading Journal: Record your USTEC trades, including entry/exit points, rationale, and outcomes. Reviewing your journal can help you identify patterns and refine your approach.

Comparing USTEC to Other Indices on Exness

Exness offers a variety of indices alongside USTEC, such as the US30 (Dow Jones Industrial Average), UK100 (FTSE 100), and DE40 (DAX). Here’s how USTEC compares:

USTEC vs. US30: The US30 represents 30 large-cap U.S. companies across various sectors, making it less tech-focused and generally less volatile than USTEC. Traders seeking broader market exposure may prefer US30, while those targeting tech growth opt for USTEC.

USTEC vs. UK100: The UK100 tracks 100 major UK companies, with a heavier weighting toward financials and energy. It’s less volatile than USTEC and influenced by different economic factors, such as Brexit or European Central Bank policies.

USTEC vs. DE40: The DE40 includes 40 leading German companies, with a focus on manufacturing and automotive sectors. It’s sensitive to Eurozone economic data, unlike USTEC, which is driven by U.S. tech trends.

Each index has unique characteristics, so your choice depends on your trading style, risk tolerance, and market outlook.

Common Mistakes to Avoid When Trading USTEC

To trade USTEC effectively, steer clear of these common pitfalls:

Overleveraging: Using excessive leverage can lead to margin calls or account wipeouts during volatile periods. Stick to conservative leverage ratios.

Ignoring News Events: Failing to account for earnings reports or economic data releases can result in unexpected losses. Always check the economic calendar.

Lack of a Plan: Trading without a clear strategy or risk management plan is a recipe for failure. Define your entry/exit criteria and stick to them.

Emotional Trading: Letting fear or greed drive your decisions can lead to impulsive trades. Maintain discipline and follow your analysis.

Neglecting Swap Fees: Holding USTEC positions for extended periods can accumulate significant swap fees. Factor these into your cost calculations.

Why Exness Stands Out for USTEC Trading

Exness’s combination of competitive spreads, flexible leverage, advanced platforms, and robust security makes it an excellent choice for trading USTEC. The broker’s commitment to transparency and client satisfaction ensures a seamless trading experience, whether you’re scalping during U.S. market hours or holding swing trades over several days. Additionally, Exness’s low minimum deposit and diverse account types cater to traders with varying budgets and expertise levels.

The availability of USTEC across all account types, coupled with Exness’s fast execution and high liquidity, allows traders to capitalize on the NAS100’s volatility with confidence. Whether you’re drawn to the index’s tech-driven growth or its potential for short-term profits, Exness provides the tools and conditions to succeed.

Conclusion

The NAS100, known as USTEC on Exness, is a powerful instrument for traders seeking exposure to the world’s leading technology and innovation companies. Its volatility, liquidity, and diversification make it an attractive choice for both short-term and long-term strategies. By trading USTEC on Exness, you gain access to competitive spreads, flexible leverage, advanced platforms, and a secure environment backed by a trusted broker.

To succeed, take the time to understand the NAS100’s behavior, develop a disciplined trading plan, and leverage Exness’s resources to stay informed and prepared. Whether you’re a beginner exploring indices for the first time or an experienced trader refining your approach, USTEC on Exness offers endless possibilities to grow your portfolio.

Ready to trade the NAS100? Open an Exness account today, locate USTEC in your trading platform, and start capitalizing on the dynamic world of tech-driven markets. Happy trading!

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: