8 minute read

How to Trade in Forex from India: A Comprehensive Guide for Beginners

from Exness Global

The foreign exchange (Forex) market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $7 trillion. For Indians looking to diversify their investment portfolio or explore new income streams, Forex trading offers an exciting opportunity. However, trading Forex from India comes with its own set of rules, regulations, and challenges. In this detailed guide, we’ll walk you through everything you need to know about how to trade in Forex from India—legally, safely, and profitably.

Top 4 Best Forex Brokers in India

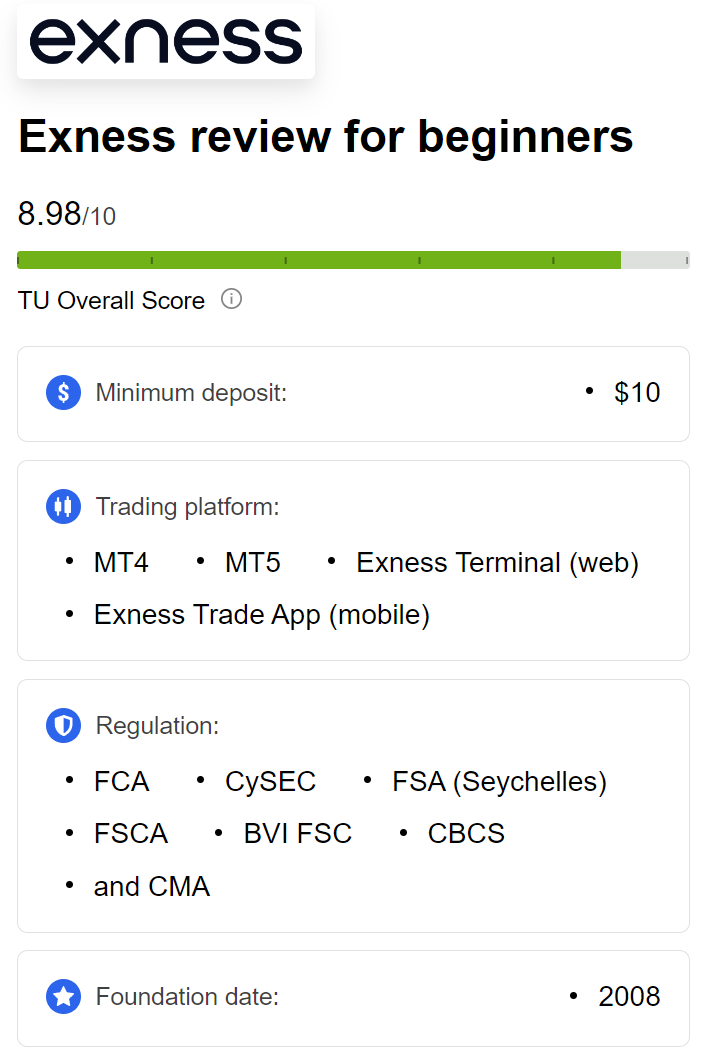

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

Whether you're a complete beginner or someone with some trading experience, this article will provide actionable insights, tips, and strategies tailored to the Indian context. Let’s dive into the world of Forex trading and uncover how you can get started today!

What Is Forex Trading?

Forex trading involves buying and selling currencies with the aim of profiting from fluctuations in their exchange rates. The Forex market operates 24 hours a day, five days a week, and is decentralized, meaning trades happen globally across various financial centers like London, New York, Tokyo, and Sydney.

For example, if you believe the US dollar (USD) will strengthen against the Indian rupee (INR), you might buy USD/INR. If the exchange rate rises, you can sell it back at a higher rate and pocket the difference. This speculative activity is the essence of Forex trading.

In India, Forex trading is regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Unlike stocks or commodities, Forex trading in India is limited to currency pairs involving the INR, and only authorized brokers can facilitate these trades.

Is Forex Trading Legal in India?

One of the most common questions among Indian traders is whether Forex trading is legal. The short answer is yes, but with strict conditions.

The RBI allows Forex trading only through recognized exchanges like the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), or Metropolitan Stock Exchange (MSE). You can trade currency derivatives—such as futures and options—on these platforms. However, retail Forex trading through international brokers (e.g., trading EUR/USD or GBP/JPY) is not permitted for Indian residents under the Foreign Exchange Management Act (FEMA), 1999.

Here’s what’s allowed:

Trading INR-based currency pairs (e.g., USD/INR, EUR/INR, GBP/INR, JPY/INR).

Using SEBI-regulated brokers or RBI-authorized dealers.

Trading on recognized Indian exchanges.

What’s not allowed:

Trading with unregulated offshore Forex brokers.

Trading exotic currency pairs (e.g., EUR/USD) that don’t involve INR.

Remitting money abroad for margin trading with international platforms.

Violating these rules can result in penalties under FEMA. To stay on the right side of the law, always choose a SEBI-registered broker and stick to INR-based pairs.

Why Trade Forex from India?

Forex trading offers several advantages that make it appealing for Indian investors:

High Liquidity: With trillions of dollars traded daily, you can enter and exit positions quickly.

24/5 Market Access: The Forex market operates round-the-clock, allowing flexibility for traders in different time zones, including India.

Low Entry Barrier: You can start with a small capital investment, unlike stock or real estate markets.

Hedging Opportunities: Businesses and individuals can use Forex to hedge against currency fluctuations.

Profit Potential: Leverage allows you to amplify your gains (though it also increases risk).

For Indians, Forex trading can also serve as a hedge against INR depreciation, which has been a recurring trend over the years.

Step-by-Step Guide to Start Forex Trading in India

Ready to begin your Forex trading journey? Follow these steps to trade legally and effectively from India.

Step 1: Understand the Basics of Forex Trading

Before jumping in, educate yourself about key concepts:

Currency Pairs: In India, you’ll trade pairs like USD/INR, EUR/INR, etc.

Pips: The smallest price movement in a currency pair (e.g., 0.01 INR).

Leverage: Borrowed funds from brokers to increase your trade size.

Margin: The amount you need to deposit to open a leveraged position.

Lot Size: Standardized trade sizes (e.g., 1 lot = 1,000 units of the base currency in India).

You can find free resources, tutorials, and courses online to build your knowledge.

Step 2: Choose a SEBI-Registered Broker

Since Forex trading in India must go through regulated channels, select a broker registered with SEBI and offering access to NSE, BSE, or MSE. Popular options include:

Exness: Known for low fees and a user-friendly platform.

Upstox: Offers currency derivatives trading with competitive pricing.

Angel One: A trusted name with robust trading tools.

Compare brokerage fees, trading platforms, and customer support before deciding.

💥 Trade with Exness now: Open An Account or Visit Brokers

Step 3: Open a Trading Account

To open an account:

Submit KYC documents (Aadhaar, PAN card, bank details).

Link your bank account for deposits and withdrawals.

Activate the currency trading segment on your account.

Most brokers offer a demo account—use it to practice without risking real money.

Step 4: Fund Your Account

Deposit funds into your trading account using NEFT, RTGS, or UPI. The minimum amount varies by broker but can be as low as ₹10,000. Note that FEMA restricts sending money abroad for Forex trading, so your funds will stay within India.

Step 5: Learn Technical and Fundamental Analysis

Successful Forex trading requires analyzing market trends. There are two main approaches:

Technical Analysis: Study charts, indicators (e.g., Moving Averages, RSI), and patterns to predict price movements.

Fundamental Analysis: Monitor economic factors like interest rates, inflation, and RBI policies that affect INR value.

For instance, if the US Federal Reserve raises interest rates, the USD might strengthen against the INR, creating a trading opportunity.

Step 6: Start Trading

Log into your broker’s platform, select a currency pair (e.g., USD/INR), and place your trade. You can trade futures or options contracts depending on your strategy:

Futures: Agreements to buy/sell a currency at a future date and price.

Options: Give you the right (but not the obligation) to buy/sell at a set price.

Start small, monitor your trades, and avoid over-leveraging.

Best Currency Pairs for Indian Traders

In India, you’re limited to INR-based pairs. Here are the most popular ones:

USD/INR: The most traded pair due to the US dollar’s global dominance.

EUR/INR: Reflects the Eurozone’s economic performance.

GBP/INR: Influenced by UK economic data and Brexit-related news.

JPY/INR: Affected by Japan’s monetary policies and safe-haven demand.

Each pair has unique volatility and trading hours, so study their behavior before investing.

Tools and Platforms for Forex Trading in India

To trade effectively, you’ll need the right tools:

Trading Platforms: Most Indian brokers offer platforms like Kite (Zerodha), Upstox Pro, or Angel One SpeedPro.

Charting Software: Use TradingView or MetaTrader (if supported) for advanced technical analysis.

Economic Calendar: Track events like RBI announcements or US non-farm payroll data.

Mobile Apps: Trade on the go with broker-provided apps.

These tools help you stay informed and execute trades efficiently.

Forex Trading Strategies for Beginners

Here are three beginner-friendly strategies to try:

1. Trend Following

Identify the direction of the market (uptrend or downtrend) using moving averages or trendlines. Enter a buy trade in an uptrend or a sell trade in a downtrend.

2. Range Trading

When a currency pair moves sideways between support and resistance levels, buy at support and sell at resistance.

3. News Trading

Capitalize on volatility caused by economic releases (e.g., RBI interest rate decisions). Be cautious, as this strategy carries higher risk.

Practice these strategies on a demo account before using real money.

Risks of Forex Trading in India

While Forex trading offers profit potential, it’s not without risks:

Leverage Risk: High leverage can magnify losses.

Market Volatility: Sudden price swings can wipe out your capital.

Regulatory Risk: Trading with unregulated brokers can lead to legal trouble.

Emotional Decisions: Fear or greed can cloud your judgment.

To mitigate risks, use stop-loss orders, trade with a clear plan, and never invest more than you can afford to lose.

Taxation on Forex Trading in India

Profits from Forex trading in India are taxable under the Income Tax Act:

Short-Term Gains: Treated as business income and taxed as per your income slab (e.g., 30% for high earners).

Long-Term Gains: Not applicable, as Forex trades are short-term by nature.

Maintain records of your trades and consult a chartered accountant to ensure compliance.

Common Mistakes to Avoid

Overtrading: Taking too many trades can lead to losses.

Ignoring Risk Management: Not setting stop-losses is a recipe for disaster.

Using Unregulated Brokers: Stick to SEBI-approved platforms.

Chasing Losses: Accept losses and move on instead of doubling down.

Learning from these pitfalls will make you a better trader over time.

How to Stay Updated on Forex Markets

To succeed, stay informed:

Follow RBI announcements on monetary policy.

Monitor global news (e.g., Bloomberg, Reuters) for events affecting major currencies.

Join Indian trading communities on Telegram or forums like TradingQ&A.

Knowledge is power in the Forex market.

Conclusion: Your Journey to Forex Success in India

Forex trading from India is a legitimate and exciting way to participate in the global financial market, provided you follow the rules set by the RBI and SEBI. By choosing a regulated broker, mastering the basics, and adopting a disciplined approach, you can turn Forex trading into a profitable venture.

Start small, practice consistently, and never stop learning. The Forex market rewards patience and strategy—so take your time to build your skills. Ready to take the plunge? Open a demo account today and explore the world of Forex trading from the comfort of your home in India!

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: