12 minute read

Exness Unlimited Leverage Rules: A Comprehensive Guide

In the fast-paced world of forex trading, leverage stands as one of the most powerful tools at a trader’s disposal. It allows individuals to control large market positions with a fraction of their own capital, amplifying both potential profits and losses. Among the brokers offering innovative leverage options, Exness has carved a unique niche with its unlimited leverage feature. This offering has sparked curiosity and debate among traders globally, making it a hot topic for both beginners and seasoned professionals. But what exactly are the Exness unlimited leverage rules? How can traders access this feature, and what are the risks and rewards involved?

💥 Trade with Exness now: Open An Account or Visit Brokers

In this in-depth guide, we’ll explore everything you need to know about Exness’s unlimited leverage rules. From eligibility criteria to practical applications, risk management strategies, and comparisons with other brokers, this article aims to equip you with the knowledge to navigate this high-stakes trading tool effectively. Whether you’re a scalper chasing small price movements or a long-term trader seeking maximum flexibility, understanding these rules is key to unlocking the full potential of Exness’s offering.

What Is Leverage in Forex Trading?

Before diving into the specifics of Exness’s unlimited leverage, let’s establish a foundational understanding of leverage itself. In forex trading, leverage is essentially borrowed capital provided by a broker to increase a trader’s market exposure. It’s expressed as a ratio, such as 1:100 or 1:500, indicating how much larger a position you can control compared to your account balance. For example, with a 1:100 leverage ratio and $1,000 in your account, you can control a position worth $100,000.

Leverage is a double-edged sword. It magnifies profits when trades go in your favor, but it also amplifies losses if the market moves against you. This inherent risk makes leverage a tool that requires careful handling, especially when it reaches the “unlimited” levels offered by Exness. Unlike traditional leverage caps imposed by many brokers (e.g., 1:30 or 1:100), unlimited leverage pushes the boundaries, offering traders unparalleled control over their positions—provided they meet certain conditions.

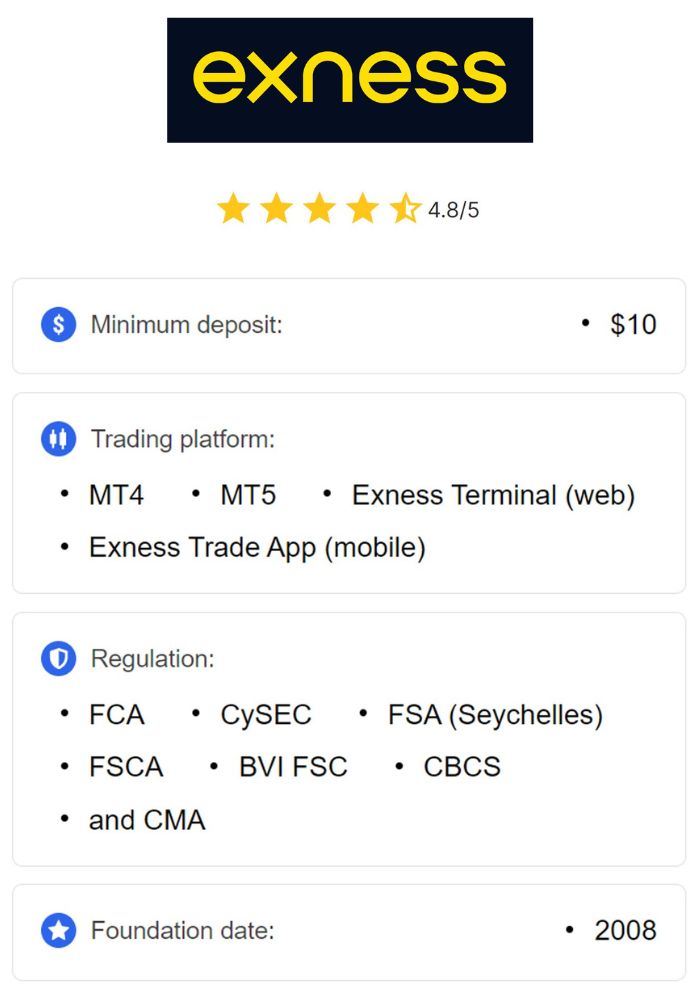

Exness: A Brief Overview of the Broker

Founded in 2008, Exness has grown into one of the most reputable forex and CFD brokers worldwide. Headquartered in Cyprus, the broker operates under stringent regulatory oversight from bodies like the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). This regulatory framework ensures a secure and transparent trading environment, a factor that has bolstered Exness’s credibility among traders.

Exness is known for its competitive spreads, lightning-fast execution, and a wide range of trading instruments, including forex pairs, metals, cryptocurrencies, indices, and stocks. However, its standout feature is the unlimited leverage option, which has positioned it as a pioneer in the industry. This feature caters primarily to experienced traders who understand the intricacies of risk management and seek to maximize their trading potential with minimal capital.

What Does “Unlimited Leverage” Mean at Exness?

At its core, unlimited leverage at Exness refers to the ability to trade with no predefined upper limit on the leverage ratio, theoretically allowing traders to control positions of virtually any size with a tiny margin. While most brokers cap leverage at levels like 1:1000 or 1:2000, Exness removes this ceiling under specific conditions, reducing the margin requirement to near-zero levels. For instance, with unlimited leverage, a trader with just $100 could theoretically control a position worth millions—though practical limitations and risk controls apply.

This feature is unique because it eliminates traditional restrictions, giving traders unprecedented flexibility. However, unlimited leverage isn’t available by default and comes with strict eligibility rules to ensure it’s used responsibly. Exness has designed these conditions to balance the benefits of high leverage with the need to protect traders from catastrophic losses.

Exness Unlimited Leverage Rules: Breaking Down the Requirements

To access unlimited leverage on Exness, traders must meet specific criteria. These rules are in place to limit risk exposure while ensuring that only those with sufficient trading experience can utilize this powerful tool. Below are the key requirements for real trading accounts:

1. Equity Limit

Your trading account’s equity (the total value of your account, including open positions) must be less than $1,000 USD. If your equity exceeds this threshold, the unlimited leverage option becomes unavailable, and the maximum leverage adjusts based on your account balance (e.g., 1:2000 for balances between $0 and $4,999).

2. Trading History

You must have closed at least 10 orders (excluding pending orders) across all real trading accounts linked to your Exness Personal Area. This ensures that only traders with a proven track record can access unlimited leverage.

3. Minimum Trading Volume

The cumulative trading volume of your closed orders must reach 5 standard lots (or 500 cent lots) across all real accounts in your Personal Area. This requirement further filters out inexperienced traders, as it demands a significant level of market activity.

4. Account Type Eligibility

Unlimited leverage is available on select account types, including Standard Cent, Standard, Pro, Raw Spread, and Zero accounts. However, it’s not offered on MT5 accounts by default, where the maximum leverage is capped at 1:2000.

5. Demo Account Access

For practice, unlimited leverage is available on demo accounts if the equity is set to $999.99 or lower. This allows traders to test strategies without financial risk.

Once these conditions are met, the option to select “Unlimited Leverage” appears in your account’s leverage settings within the Exness Personal Area. If any requirement isn’t fulfilled, the option remains grayed out, prompting you to adjust your trading activity accordingly.

How to Activate Unlimited Leverage on Exness

Activating unlimited leverage is a straightforward process once you meet the eligibility criteria. Here’s a step-by-step guide:

Log in to Your Exness Personal Area: Access your account via the Exness website or app.

Select Your Trading Account: Choose the real or demo account you want to apply unlimited leverage to.

Navigate to Leverage Settings: Click the three-dot menu next to your account and select “Change Max Leverage.”

Choose Unlimited Leverage: From the dropdown menu, select “1:Unlimited” and confirm your choice.

Verify Activation: Ensure the change takes effect (it may take a few moments) and check your account settings.

If you encounter issues, Exness’s 24/7 customer support can assist via live chat, email, or phone. For demo accounts, simply adjust your equity to below $1,000, and the option will unlock automatically.

Instruments Affected by Unlimited Leverage

While unlimited leverage is a game-changer, it doesn’t apply universally across all trading instruments. Exness restricts its use to specific asset classes to manage risk effectively. Here’s a breakdown:

Eligible Instruments: Unlimited leverage primarily applies to forex pairs (e.g., EUR/USD, GBP/USD) and select metals like gold (XAU/USD) and silver (XAG/USD).

Excluded Instruments: Assets like exotic currency pairs, cryptocurrencies, indices, stocks, and energies (e.g., crude oil) have fixed margin requirements and are unaffected by unlimited leverage. For these, leverage is capped based on the instrument and account type.

Traders should consult the Exness website or trading platform for a detailed list of margin requirements per instrument to avoid surprises when planning their trades.

Benefits of Exness Unlimited Leverage

Why opt for unlimited leverage? For the right trader, it offers several compelling advantages:

1. Maximized Trading Potential

With minimal margin requirements, you can control massive positions using a small account balance. This is ideal for traders aiming to capitalize on tiny price movements, such as scalpers or day traders.

2. Flexibility in Strategy

Unlimited leverage allows you to tailor your exposure to your risk tolerance and market conditions, offering unmatched freedom compared to fixed leverage ratios.

3. Low Capital Entry

Traders with limited funds can enter the market and compete with larger players, leveling the playing field in forex trading.

4. Enhanced Profit Opportunities

By amplifying your position size, even small market shifts can yield significant returns, making it attractive for those with precise strategies.

💥 Trade with Exness now: Open An Account or Visit Brokers

Risks of Unlimited Leverage

While the benefits are enticing, the risks are equally significant. Unlimited leverage isn’t for everyone, and misuse can lead to devastating losses. Here’s what to watch out for:

1. Amplified Losses

Just as profits are magnified, losses can quickly exceed your initial investment, potentially wiping out your account in a single unfavorable move.

2. Margin Calls and Stop-Outs

With near-zero margin requirements, even minor price fluctuations can trigger a margin call or stop-out, closing your positions automatically if your equity falls too low.

3. Lack of Stop-Out Protection

Accounts with unlimited leverage may not benefit from Exness’s Stop-Out Protection feature, increasing vulnerability during volatile market conditions.

4. High Volatility Risk

Forex markets are inherently volatile, and unlimited leverage heightens exposure to rapid price swings, especially during economic news releases or weekend gaps.

Risk Management Strategies for Unlimited Leverage

To harness unlimited leverage safely, robust risk management is non-negotiable. Here are proven strategies to protect your capital:

1. Use Stop-Loss Orders

Set stop-loss levels for every trade to cap potential losses automatically. This is critical when dealing with high leverage.

2. Limit Position Sizes

Even with unlimited leverage, avoid overexposing your account. Start with smaller positions and scale up as you gain confidence.

3. Monitor Margin Levels

Keep a close eye on your account’s margin level to prevent unexpected stop-outs. Exness provides real-time tools to track this metric.

4. Trade During Stable Conditions

Avoid using unlimited leverage during high-impact news events or market openings, when volatility spikes and slippage is common.

5. Develop a Trading Plan

Outline your entry/exit points, risk-reward ratio, and maximum loss tolerance before placing trades. Discipline is key to surviving the leverage game.

Exness Unlimited Leverage vs. Other Brokers

How does Exness stack up against competitors? Most brokers impose leverage caps based on regulatory requirements or internal policies. For example:

Retail Brokers (e.g., XM, IC Markets): Leverage is typically limited to 1:500 or 1:1000, with stricter caps (e.g., 1:30) in regions like the EU due to ESMA regulations.

High-Leverage Brokers (e.g., FBS): Some offer up to 1:3000, but this still falls short of Exness’s unlimited option.

Exness’s unlimited leverage stands out for its lack of a fixed ceiling, though it’s tempered by eligibility rules and asset restrictions. This makes it a top choice for experienced traders seeking maximum flexibility, while its regulatory oversight adds a layer of trust absent in some offshore brokers.

Practical Examples of Unlimited Leverage in Action

Let’s illustrate how unlimited leverage works with two hypothetical scenarios:

Scenario 1: Scalping EUR/USD

Account Balance: $100

Leverage: Unlimited

Position Size: 1 standard lot ($100,000)

Margin Required: Near-zero (e.g., $0.05)

Price Movement: 5 pips profit ($50)

Outcome: A 50% return on your $100 investment in minutes.

Scenario 2: Gold Trading Gone Wrong

Account Balance: $500

Leverage: Unlimited

Position Size: 10 lots ($1,000,000)

Margin Required: Minimal

Price Movement: 10-pip loss ($100)

Outcome: A 20% account loss in a single trade.

These examples highlight the potential for both rapid gains and steep losses, underscoring the need for precision and caution.

Who Should Use Unlimited Leverage?

Unlimited leverage isn’t for everyone. It’s best suited for:

Experienced Traders: Those with a deep understanding of market dynamics and risk management.

Scalpers and Day Traders: Individuals targeting small, frequent profits from short-term trades.

Low-Capital Traders: People with small accounts looking to maximize their market exposure.

Beginners, on the other hand, should start with lower leverage (e.g., 1:10 to 1:100) to build skills and confidence before venturing into unlimited territory.

How to Get Started with Exness Unlimited Leverage

Ready to explore this feature? Follow these steps:

Open an Exness Account: Register on the Exness website and choose an eligible account type (e.g., Standard or Pro).

Fund Your Account: Deposit up to $999.99 to stay within the equity limit.

Build Trading History: Close 10 orders with a total of 5 lots to unlock unlimited leverage.

Activate the Feature: Adjust your leverage settings as outlined earlier.

Practice First: Use a demo account to test strategies before going live.

Exness also offers educational resources, including webinars and tutorials, to help you master leverage and trading basics.

Common Misconceptions About Unlimited Leverage

Let’s debunk some myths:

“It’s Free Money”: Leverage is borrowed capital, not a gift. Losses can exceed your deposit.

“Anyone Can Use It”: Strict eligibility rules limit access to experienced traders.

“It Guarantees Profits”: High leverage increases potential returns but doesn’t ensure success—skill and timing are critical.

Understanding these realities prevents overconfidence and costly mistakes.

Exness Support and Tools for Leverage Users

Exness provides robust support to complement its leverage offerings:

24/7 Customer Support: Available via live chat, email, and phone.

Trading Calculators: Tools to compute margin, pip value, and profit/loss for any leverage level.

Personal Area Dashboard: A user-friendly interface to manage accounts and settings.

Educational Content: Guides and videos on leverage and risk management.

These resources empower traders to use unlimited leverage effectively while staying informed.

Conclusion: Is Exness Unlimited Leverage Right for You?

Exness’s unlimited leverage rules offer a rare opportunity to push the boundaries of forex trading. With the ability to control massive positions using minimal capital, it’s a dream tool for seasoned traders who thrive on precision and discipline. However, its high-risk nature demands respect—without proper risk management, it can turn profits into losses in the blink of an eye.

By adhering to Exness’s eligibility criteria, mastering risk strategies, and leveraging the broker’s tools, you can harness unlimited leverage to elevate your trading game. Whether you’re a scalper, a low-capital trader, or a market veteran, this feature could be the key to unlocking new possibilities—just tread carefully.

Ready to dive in? Sign up with Exness, meet the requirements, and explore the power of unlimited leverage today. Happy trading!

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: