10 minute read

Does Exness Work in India? A Detailed Guide for Indian Traders

Forex trading has taken the world by storm, and India is no exception. With millions of retail traders exploring opportunities in the global financial markets, platforms like Exness have gained significant attention. But one question lingers in the minds of Indian traders: Does Exness work in India? This article dives deep into Exness’s operations, its legal standing, regulatory compliance, user experience, and practical considerations for Indian traders in 2025. Whether you're a beginner or a seasoned trader, this guide will equip you with everything you need to know.

💥 Trade with Exness now: Open An Account or Visit Brokers

What is Exness? A Global Trading Powerhouse

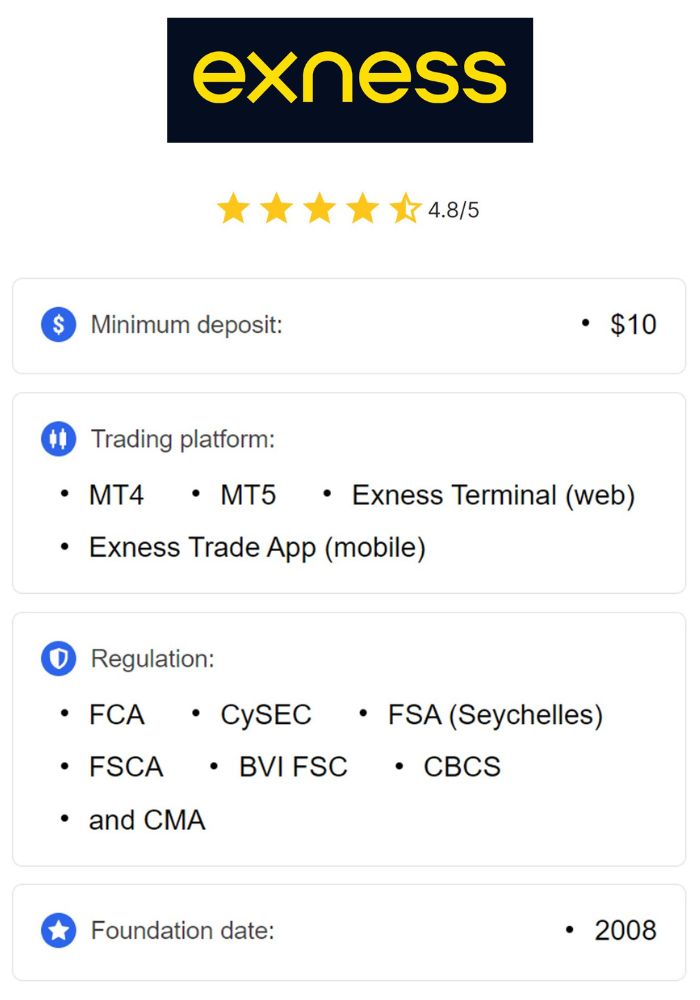

Founded in 2008, Exness has grown into one of the world’s leading online brokers, specializing in forex and Contracts for Difference (CFDs). Headquartered in Cyprus, the company serves over 700,000 active clients globally and processes a staggering monthly trading volume exceeding $4 trillion. Exness is renowned for its competitive spreads, low fees, and a wide range of financial instruments, including currency pairs, commodities, stocks, indices, and cryptocurrencies.

For Indian traders, Exness offers an appealing mix of accessibility and advanced trading tools. The broker supports popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside its proprietary Exness Terminal, making it versatile for traders of all levels. But the real question is whether this global giant aligns with India’s unique regulatory and operational landscape.

The Forex Trading Landscape in India

Before exploring Exness’s functionality in India, it’s crucial to understand the country’s forex trading environment. Forex trading in India is governed by strict regulations under the Foreign Exchange Management Act (FEMA), 1999, enforced by the Reserve Bank of India (RBI). Additionally, the Securities and Exchange Board of India (SEBI) oversees financial markets, including forex brokers operating within the country.

In India, retail forex trading is limited to specific currency pairs involving the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. These trades must occur through SEBI-regulated brokers or recognized exchanges like the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE). Trading foreign-to-foreign currency pairs (e.g., EUR/USD) or using offshore brokers falls into a legal gray area, as it’s not explicitly permitted under FEMA guidelines.

This regulatory framework creates a complex scenario for international brokers like Exness. While Indian traders are drawn to the flexibility and opportunities of global platforms, they must navigate potential legal risks. So, does Exness fit into this picture?

Does Exness work in India?

The short answer is yes, Exness does work in India from a technical and practical standpoint. Indian traders can access the platform, open accounts, deposit funds, and trade a wide range of instruments. Exness does not impose geographic restrictions on Indian users, and its website and services are fully functional for residents of India.

However, the deeper question is whether Exness operates legally and effectively within India’s regulatory boundaries. To answer this, we need to examine its regulatory status, compliance measures, and how it caters to Indian traders.

💥 Trade with Exness now: Open An Account or Visit Brokers

Exness’s Regulatory Status

Exness is not directly regulated by SEBI or the RBI, the two primary authorities overseeing forex trading in India. Instead, it operates under international licenses from reputable regulatory bodies, including:

Cyprus Securities and Exchange Commission (CySEC): License number 178/12, allowing Exness to operate within the European Union and beyond.

Financial Conduct Authority (FCA): A stringent UK regulator ensuring high standards of financial conduct.

Financial Services Authority (FSA): Based in Seychelles, regulating one of Exness’s entities.

Financial Services Commission (FSC): Mauritius-based oversight for Exness (MU) Ltd, which serves many Asian clients, including those in India.

These licenses demonstrate Exness’s commitment to global standards of transparency, security, and client protection. However, since it lacks SEBI registration, Exness is considered an offshore broker in India. This status doesn’t make it illegal for Indian traders to use, but it raises questions about compliance with local laws.

Legal Implications for Indian Traders

Under FEMA, Indian residents can trade forex with offshore brokers, but there are restrictions. The RBI allows individuals to remit up to $250,000 per year under the Liberalised Remittance Scheme (LRS) for various purposes, including investments. Many traders use this allowance to fund offshore trading accounts like Exness. However, the RBI has occasionally warned against unauthorized platforms, stating that forex trading outside regulated exchanges could violate FEMA provisions.

In practice, thousands of Indian traders use Exness without facing legal repercussions, as enforcement tends to focus on brokers rather than individual users. That said, the lack of SEBI oversight means traders assume some risk, particularly if disputes arise. For instance, SEBI-regulated brokers offer recourse through Indian authorities, whereas with Exness, traders must rely on international regulators or the broker’s internal resolution process.

How Exness Works for Indian Traders

Despite the regulatory ambiguity, Exness remains a popular choice among Indian traders due to its practical features and user-friendly approach. Here’s how it functions in the Indian context:

1. Account Opening and Accessibility

Opening an account with Exness is straightforward for Indian residents. The process involves:

Visiting the official Exness website.

Providing basic personal information (name, email, phone number).

Completing Know Your Customer (KYC) verification with identity and address proof (e.g., Aadhaar, passport, utility bill).

Once verified, traders gain access to a personal trading dashboard. Exness offers a demo account option, allowing beginners to practice without risking real money—a feature highly valued in India’s growing trading community.

2. Deposit and Withdrawal Options

Exness supports a variety of payment methods tailored to Indian users, including:

Bank Cards: Visa and Mastercard deposits are processed instantly, though withdrawals may take 3-5 days.

E-Wallets: Options like Skrill and Neteller offer fast transactions.

Bank Transfers: Local bank wires are available, though slower than e-wallets.

Cryptocurrencies: Bitcoin and USDT provide a modern alternative for tech-savvy traders.

The minimum deposit is as low as $1 for Standard accounts, making Exness accessible to beginners. Withdrawals are typically instant for e-wallets, a standout feature that enhances trust among Indian users. Importantly, Exness complies with India’s taxation and remittance rules by requiring KYC, ensuring funds are traceable.

3. Trading Instruments and Conditions

Exness offers over 100 currency pairs, including INR-based pairs like USD/INR, alongside global pairs like EUR/USD. Indian traders can also trade CFDs on commodities (gold, oil), indices, stocks, and cryptocurrencies. Key trading conditions include:

Spreads: Starting at 0.1 pips for major pairs, among the lowest in the industry.

Leverage: Up to 1:2000, though restricted to 1:100 for INR pairs to align with global norms.

Execution: Market execution with no requotes, ideal for fast-moving markets.

These features make Exness attractive for scalpers, day traders, and long-term investors alike.

4. Platforms and Tools

Exness supports MT4, MT5, and its proprietary Exness Terminal, all available on desktop, web, and mobile devices. The mobile app, compatible with Android and iOS, allows Indian traders to monitor markets and execute trades on the go. Additional tools like real-time charts, economic calendars, and technical indicators enhance decision-making.

5. Customer Support

Exness provides 24/7 multilingual support, including English and Hindi, catering to India’s diverse linguistic needs. Traders can reach out via live chat, email, or phone, with response times generally quick and efficient.

Advantages of Using Exness in India

Exness stands out for Indian traders due to several compelling benefits:

Low Costs: Tight spreads and no withdrawal fees reduce trading expenses.

High Leverage: Flexible leverage options amplify potential returns (with added risk).

Instant Withdrawals: Rare among brokers, this feature builds trust.

Global Reputation: Regulated by top-tier authorities, Exness offers security and transparency.

Educational Resources: Webinars, tutorials, and a social trading app help beginners grow.

These advantages explain why Exness has cultivated a loyal user base in India, despite not being SEBI-registered.

Challenges and Risks

While Exness works well operationally, there are challenges Indian traders should consider:

1. Regulatory Uncertainty

The lack of SEBI regulation means Exness operates in a legal gray area. Although no widespread crackdown on individual traders has occurred, future regulatory changes could impact its accessibility.

2. Tax Implications

Forex profits from offshore brokers must be reported to the Income Tax Department in India. Failure to declare earnings could lead to penalties. Traders should maintain meticulous records of transactions for compliance.

3. Technical Risks

Like any online platform, Exness is susceptible to server issues or connectivity problems, though rare. Traders in rural areas with unreliable internet may face additional hurdles.

4. Limited Local Presence

Exness lacks a physical office in India, meaning support and dispute resolution occur remotely. This can feel less reassuring compared to SEBI-regulated brokers with local teams.

Is Exness Safe for Indian Traders?

Safety is a top concern for any trader. Exness implements robust measures to protect clients:

Segregated Accounts: Client funds are kept separate from company funds, reducing misuse risks.

Negative Balance Protection: Traders cannot lose more than their account balance.

SSL Encryption: Data transmission is secure, safeguarding personal and financial information.

Regular Audits: Third-party audits by firms like Deloitte ensure transparency.

While not SEBI-regulated, Exness’s adherence to international standards provides a strong safety net. Its 15-year track record and massive client base further bolster its credibility.

How to Start Trading with Exness in India

Ready to give Exness a try? Follow these steps:

Register: Visit the Exness website, sign up, and complete KYC verification.

Choose an Account: Options include Standard (no minimum deposit), Pro (from $200), or Zero (tight spreads, $200 minimum).

Fund Your Account: Use a preferred payment method like a bank card or e-wallet.

Download a Platform: Install MT4, MT5, or the Exness app.

Start Trading: Begin with a demo account to practice, then switch to live trading.

Tip: Start small and use risk management tools like stop-loss orders to protect your capital.

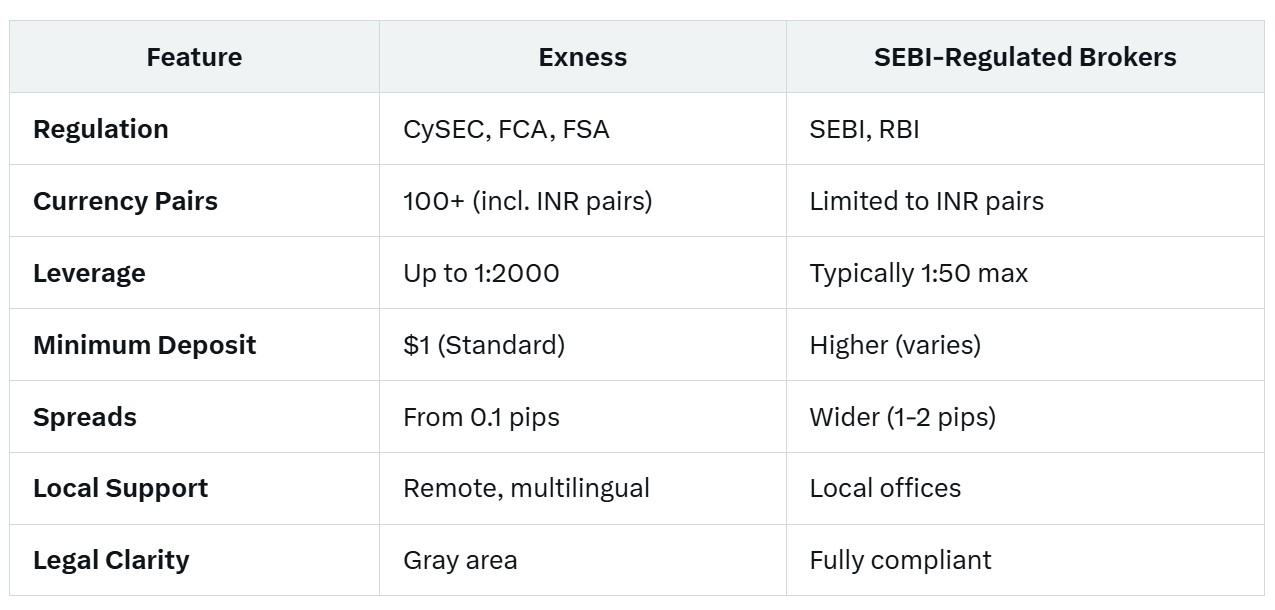

Exness vs. SEBI-Regulated Brokers: A Comparison

To fully assess whether Exness works for you, compare it with SEBI-regulated alternatives:

Exness excels in flexibility and cost-efficiency, while SEBI brokers offer legal certainty and local recourse.

User Experiences: What Indian Traders Say

Feedback from Indian traders highlights Exness’s strengths and weaknesses:

Positive: “Fast withdrawals and low spreads make it my go-to platform.” – Ravi, Mumbai.

Negative: “I worry about the legal side, but no issues so far.” – Priya, Delhi.

Mixed: “Great for global pairs, but I’d prefer SEBI regulation for peace of mind.” – Arjun, Bangalore.

These sentiments reflect Exness’s operational success tempered by regulatory concerns.

The Future of Exness in India

Exness shows no signs of retreating from the Indian market. Its adaptability—offering local payment methods, Hindi support, and INR pairs—suggests a long-term commitment. However, potential RBI or SEBI crackdowns on offshore brokers could shift the landscape. Traders should stay informed about regulatory updates to ensure uninterrupted access.

Conclusion: Does Exness Work in India?

Yes, Exness works in India both technically and practically. It provides a robust, cost-effective platform for forex and CFD trading, appealing to Indian traders with its low barriers to entry, instant withdrawals, and global reach. However, its offshore status introduces legal uncertainties that cautious traders must weigh.

💥 Trade with Exness now: Open An Account or Visit Brokers

For those prioritizing flexibility and advanced features, Exness is a compelling choice. If legal compliance is paramount, SEBI-regulated brokers may be safer. Ultimately, the decision hinges on your risk tolerance, trading goals, and willingness to navigate India’s regulatory nuances.

Ready to explore Exness? Start with a demo account to test the waters, and always trade responsibly. Have questions or experiences to share? Drop them in the comments below—let’s keep the conversation going!

Read more: