9 minute read

Is Exness Banned in Singapore? A Comprehensive Review for Traders

Forex trading has become increasingly popular worldwide, and Singapore stands out as a major financial hub in Asia, attracting traders and brokers alike. Among the many forex brokers available, Exness has gained significant attention for its competitive trading conditions, user-friendly platforms, and global presence. However, a question that often arises among Singaporean traders is: "Is Exness banned in Singapore?" This article dives deep into the legal status of Exness in Singapore, its regulatory framework, and what it means for traders in this vibrant city-state.

💥 Trade with Exness now: Open An Account or Visit Brokers

With Singapore’s strict financial regulations overseen by the Monetary Authority of Singapore (MAS), understanding whether a broker like Exness can legally operate is crucial for anyone looking to trade forex safely. Let’s explore the facts, dispel myths, and provide clarity on whether Exness is banned in Singapore or if it remains a viable option for local traders.

What is Exness? An Overview of the Broker

Before addressing the core question, it’s essential to understand what Exness is and why it matters to traders. Founded in 2008, Exness is a globally recognized forex and Contracts for Difference (CFD) broker headquartered in Cyprus. Over the years, it has built a reputation for offering low spreads, high leverage, and a variety of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Exness operates under multiple regulatory licenses from reputable financial authorities, such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority (FSA) in Seychelles. This multi-jurisdictional regulation enhances its credibility and allows it to serve clients in various regions. The broker provides access to popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside its proprietary Exness Trader app, making it appealing to both novice and experienced traders.

For Singaporean traders, Exness’s attractive features—like instant withdrawals, competitive spreads starting from 0.0 pips, and flexible leverage up to 1:2000—raise the question of its availability and legality in the country. However, the answer lies in Singapore’s unique regulatory landscape, which we’ll explore next.

Singapore’s Financial Regulatory Framework: The Role of MAS

Singapore is renowned for its robust and transparent financial system, which is overseen by the Monetary Authority of Singapore (MAS). As the country’s central bank and primary financial regulator, MAS is responsible for supervising all financial institutions, including banks, insurance companies, and forex brokers. Its mission is to ensure a stable, secure, and competitive financial ecosystem while protecting consumers from risks.

For forex brokers to operate legally in Singapore, they must obtain a license from MAS under the Securities and Futures Act (SFA). This licensing process is rigorous, requiring brokers to demonstrate financial stability, operational transparency, and adherence to strict guidelines, such as anti-money laundering (AML) and risk management protocols. MAS also imposes leverage limits (typically capped at 1:50 for retail traders) and mandates clear risk disclosures to safeguard investors.

Unlicensed brokers operating in Singapore or offering services to its residents without MAS approval face severe consequences, including fines, warnings, or outright bans. This strict oversight explains why many international brokers either seek MAS regulation or choose not to serve Singaporean clients. So, where does Exness stand in this context?

Is Exness Regulated by MAS?

The short answer is no—Exness is not directly regulated by the Monetary Authority of Singapore. While Exness holds licenses from several top-tier global regulators, such as the FCA, CySEC, and FSA, it does not appear on the MAS’s list of licensed financial institutions. This lack of MAS regulation is a critical factor in determining its legal status for Singaporean traders.

However, not being regulated by MAS doesn’t automatically mean Exness is banned. Many international brokers operate in a regulatory gray area, serving clients in countries where they don’t hold local licenses, provided they comply with international standards and don’t actively target residents without approval. To understand Exness’s status, we need to examine whether it accepts Singaporean clients and how it aligns with local laws.

Does Exness Accept Singaporean Traders?

One way to gauge Exness’s availability in Singapore is to check its official stance on accepting clients from the country. According to Exness’s website and terms of service, Singapore is listed among the countries where it does not offer its services. This restriction isn’t due to an explicit ban by MAS but rather a strategic decision by Exness to avoid potential regulatory conflicts.

When attempting to register an account with Exness from Singapore, users typically encounter a message indicating that the broker does not accept residents from this jurisdiction. This self-imposed restriction suggests that Exness has chosen not to pursue MAS licensing or adjust its offerings—such as leverage limits—to comply with Singapore’s strict regulations. Instead, it focuses on markets where its existing regulatory framework aligns more seamlessly.

Is Exness Banned in Singapore? The Definitive Answer

Based on the available evidence, Exness is not banned in Singapore. There are no official statements or actions from MAS indicating that Exness has been prohibited from operating or that it has faced penalties for non-compliance. Instead, Exness’s absence from the Singapore market stems from its own decision not to offer services to Singaporean residents, likely due to the complexity and cost of obtaining MAS approval.

This distinction is crucial: a ban implies regulatory action, whereas Exness’s unavailability reflects a voluntary withdrawal from the market. For Singaporean traders, this means that while Exness isn’t technically illegal, using its services could involve circumventing its geographic restrictions (e.g., through VPNs), which carries legal and ethical risks.

💥 Trade with Exness now: Open An Account or Visit Brokers

Why Isn’t Exness Available in Singapore?

Several factors likely contribute to Exness’s decision to exclude Singapore from its operational scope:

1. Strict MAS Regulations

MAS imposes stringent requirements that may not align with Exness’s business model. For example, the leverage cap of 1:50 contrasts sharply with Exness’s offering of up to 1:2000 in other regions. Adjusting its services to meet MAS standards could reduce its competitive edge.

2. Licensing Costs and Complexity

Obtaining an MAS license involves significant financial and operational commitments, including maintaining a local presence, adhering to capital adequacy rules, and submitting to regular audits. For a broker with a global focus, this investment may not be justifiable given Singapore’s relatively small retail trading market.

3. Focus on Other Markets

Exness may prioritize regions with less restrictive regulations or larger trader bases, such as Europe, Africa, or parts of Asia, where its high-leverage offerings and low-cost structure resonate more strongly.

4. Risk of Penalties

Operating without MAS approval, even indirectly, could expose Exness to fines or reputational damage. By proactively excluding Singapore, it avoids potential legal entanglements.

Implications for Singaporean Traders

For traders in Singapore, Exness’s unavailability means they must seek alternatives that comply with MAS regulations. While Exness offers appealing features, its absence underscores the importance of trading with a licensed broker to ensure safety and recourse in case of disputes. Using an unregulated or restricted broker like Exness (via workarounds) could jeopardize fund security and violate local laws.

Fortunately, Singapore offers a wealth of MAS-regulated brokers, such as IG Markets, CMC Markets, Saxo Bank, and OANDA. These platforms provide robust trading environments, competitive spreads, and the added assurance of regulatory oversight. While they may not match Exness’s ultra-high leverage or zero-pip spreads, they prioritize investor protection—a trade-off many Singaporean traders value.

Comparing Exness with MAS-Regulated Brokers

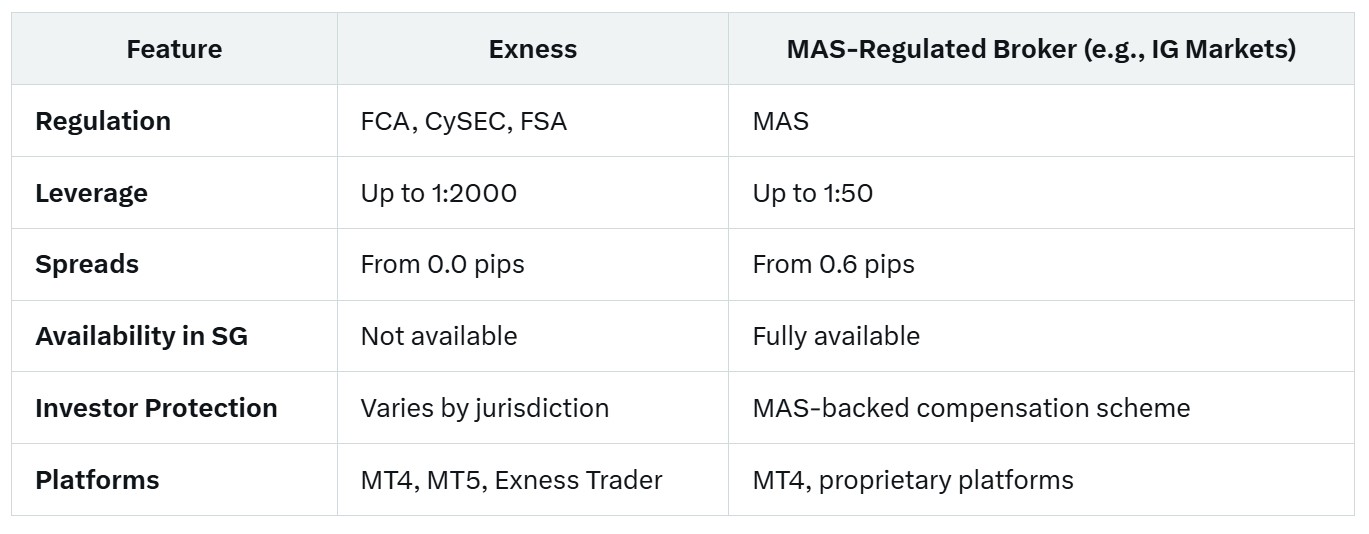

To highlight the differences, let’s compare Exness with a typical MAS-regulated broker:

While Exness excels in flexibility and cost, MAS-regulated brokers offer legal certainty and localized support, making them a safer choice for Singaporeans.

Can Singaporeans Still Use Exness?

Technically, some traders might bypass Exness’s restrictions using VPNs or by registering with an address outside Singapore. However, this approach is risky and not recommended:

Legal Risks: Trading with an unlicensed broker violates MAS regulations, potentially leading to penalties or frozen funds.

Security Concerns: Without MAS oversight, there’s no guarantee of fund safety or dispute resolution.

Ethical Considerations: Circumventing restrictions undermines the broker’s intent and could result in account closure.

For peace of mind, Singaporean traders are better off sticking to regulated alternatives.

The Future of Exness in Singapore

Could Exness enter the Singapore market in the future? It’s possible. If MAS relaxes its forex regulations or introduces a framework for international brokers to operate more easily, Exness might pursue a license. Alternatively, if demand from Singaporean traders grows, the broker could adapt its offerings to comply with local standards. However, there’s no indication of such a shift.

Traders interested in Exness should monitor regulatory updates and the broker’s official announcements for any changes. For now, its absence remains a business choice rather than a legal ban.

Alternatives to Exness for Singaporean Traders

If Exness isn’t an option, here are some top MAS-regulated brokers to consider:

1. IG Markets

Pros: Low spreads, extensive research tools, MAS-regulated.

Cons: Higher fees compared to Exness.

2. Saxo Bank

Pros: Wide range of instruments, advanced platforms, MAS oversight.

Cons: Higher minimum deposit.

3. OANDA

Pros: User-friendly interface, competitive spreads, MAS-licensed.

Cons: Limited leverage options.

These brokers offer a balance of security and functionality, making them ideal for Singaporean traders seeking reliable alternatives.

Conclusion: Is Exness Banned in Singapore?

To summarize, Exness is not banned in Singapore. Rather, it has chosen not to offer its services to Singaporean residents due to the country’s stringent regulatory requirements under MAS. While this limits its accessibility, it reflects a cautious approach to compliance rather than a prohibition by authorities. For Singaporean traders, this means Exness isn’t a viable option without risking legal and financial complications.

The best course of action for forex enthusiasts in Singapore is to opt for MAS-regulated brokers that provide a secure and compliant trading experience. While Exness remains a powerhouse in the global forex market, its absence from Singapore highlights the importance of aligning with local regulations for a safe and sustainable trading journey.

Have thoughts or experiences with Exness or forex trading in Singapore? Share them below—I’d love to hear from you!

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: