9 minute read

How long does it take to withdraw from Exness?

When it comes to online trading, one of the most pressing questions for traders is: How long does it take to withdraw funds from a broker? For those using Exness, a globally recognized forex and CFD broker, this question is especially relevant. Whether you're a beginner or an experienced trader, understanding the withdrawal process—including timelines, methods, and potential delays—is crucial for managing your finances effectively. In this in-depth guide, we’ll explore everything you need to know about withdrawing money from Exness, including processing times, factors that influence delays, and tips to ensure a smooth experience.

💥 Trade with Exness now: Open An Account or Visit Brokers

Exness is known for its user-friendly platform, competitive spreads, and efficient financial transactions. But how does it perform when it’s time to cash out your profits? Let’s dive into the details.

What Is Exness? A Quick Overview

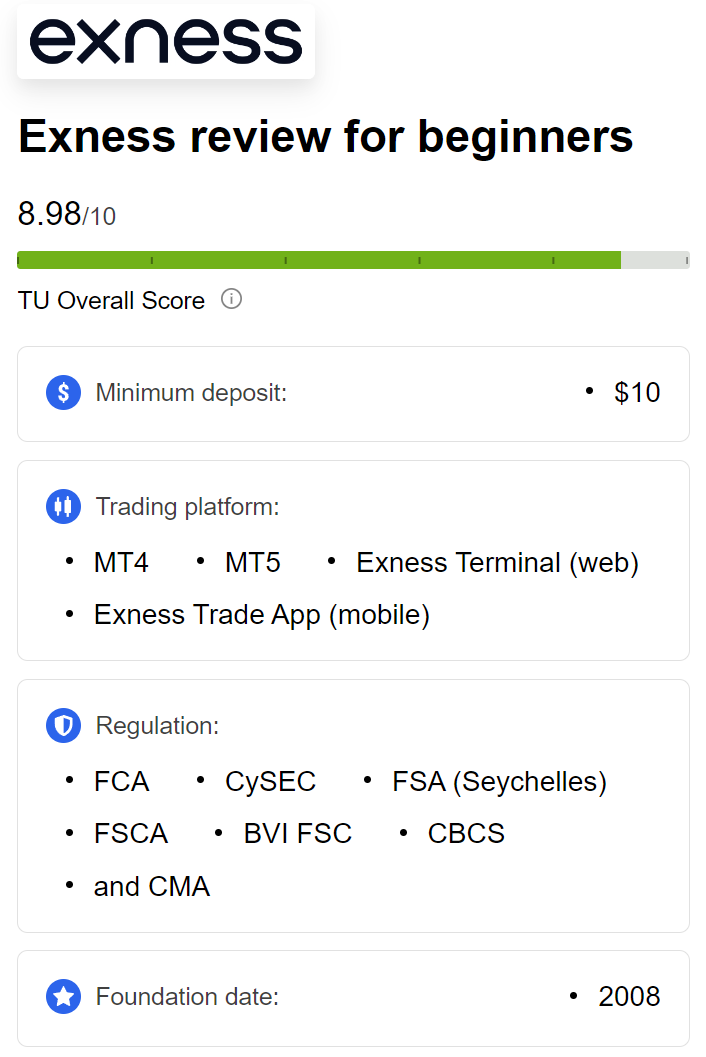

Before we get into the nitty-gritty of withdrawal times, let’s briefly introduce Exness for those unfamiliar with the platform. Founded in 2008, Exness has grown into one of the leading online brokers, serving millions of traders worldwide. Regulated by top-tier authorities like the FCA (UK), CySEC (Cyprus), and FSCA (South Africa), Exness offers a secure and transparent trading environment. Traders can access a wide range of instruments, including forex pairs, cryptocurrencies, metals, and indices, all while enjoying low fees and fast execution.

One of Exness’s standout features is its commitment to seamless deposits and withdrawals. The broker claims that 95% of withdrawals are processed instantly, but what does that mean in practice? Let’s break it down.

How Long Does It Take to Withdraw from Exness?

The time it takes to withdraw funds from Exness depends on several factors, including the payment method you choose, your account verification status, and external processing times beyond Exness’s control. Here’s a general overview:

Instant Withdrawals (Under 1 Minute): Exness processes 95% of withdrawal requests instantly on their end, meaning the transaction is executed within seconds without manual intervention from their financial team.

Payment Provider Processing Time: While Exness may process your request instantly, the time it takes for funds to reach your account depends on the payment provider. This can range from a few minutes to several business days.

Average Range: Most traders receive their funds within a few hours to 24 hours, though some methods (like bank transfers) can take up to 5–7 business days.

To give you a clearer picture, let’s explore the withdrawal times for the most popular payment methods offered by Exness.

Withdrawal Times by Payment Method

Exness supports a variety of withdrawal options to cater to its global user base. Each method has its own processing timeline, influenced by both Exness’s internal systems and the external payment provider. Here’s a breakdown:

1. E-Wallets (Skrill, Neteller, Perfect Money, WebMoney)

Exness Processing Time: Instant (under 1 minute)

Total Time to Receive Funds: Typically within 1–24 hours

Why It’s Fast: E-wallets are digital payment systems designed for speed. Once Exness approves the withdrawal, the funds are credited to your e-wallet account almost immediately. Popular options like Skrill and Neteller are favored by traders who prioritize quick access to their money.

2. Cryptocurrency (Bitcoin, USDT, USDC)

Exness Processing Time: Instant

Total Time to Receive Funds: 15 minutes to 3 hours (depending on blockchain network congestion)

Why It Varies: Crypto withdrawals are fast but depend on the specific cryptocurrency’s network. For example, USDT and USDC transactions on efficient blockchains like TRON or Ethereum can be completed in under 15 minutes, while Bitcoin might take longer during peak network activity.

3. Bank Cards (Visa, Mastercard)

Exness Processing Time: Instant

Total Time to Receive Funds: 1–5 business days

Why It Takes Longer: While Exness processes the request instantly, banks and card issuers often take additional time to finalize the transaction. Factors like international transfers, weekends, or holidays can extend this timeline.

4. Bank Transfers (Wire Transfers)

Exness Processing Time: Instant to 24 hours

Total Time to Receive Funds: 3–7 business days

Why It’s Slower: Bank transfers involve multiple intermediaries, including your bank and Exness’s payment processors. Processing times vary based on your location, banking regulations, and whether it’s a domestic or international transfer.

5. Mobile Money (e.g., M-Pesa in Kenya and Tanzania)

Exness Processing Time: Instant

Total Time to Receive Funds: Within 1 hour

Why It’s Convenient: Mobile money is a fast and accessible option in regions like East Africa. Once Exness approves the withdrawal, funds are credited to your mobile money account quickly, making it ideal for traders in supported countries.

Factors That Affect Withdrawal Times

While Exness strives to process withdrawals instantly, several variables can influence how long it takes for funds to reach your account. Understanding these factors can help you plan your withdrawals more effectively.

1. Account Verification Status

Impact: Unverified accounts may face delays or restrictions on withdrawals.

Solution: Complete the Know Your Customer (KYC) process by submitting a government-issued ID and proof of address (e.g., a utility bill). Verified accounts are prioritized for faster processing.

2. Payment Method Priority Rules

Impact: Exness follows a payment system priority policy to comply with anti-money laundering (AML) regulations. You must withdraw funds using the same method used for deposits, in proportion to the deposited amounts.

Solution: Ensure your preferred withdrawal method matches your deposit method to avoid complications.

3. Currency Conversion

Impact: If your withdrawal currency differs from your account’s base currency, conversion delays or fees may apply.

Solution: Use a multi-currency account or withdraw in the same currency as your trading account to minimize delays.

4. Bank or Payment Provider Delays

Impact: Once Exness processes the withdrawal, delays can occur due to your bank’s policies, holidays, or weekends.

Solution: Opt for e-wallets or cryptocurrencies for faster processing, especially if timing is critical.

5. Technical Issues

Impact: Rare technical glitches on Exness’s platform or the payment provider’s side can cause delays.

Solution: Contact Exness customer support if your withdrawal takes longer than expected.

💥 Trade with Exness now: Open An Account or Visit Brokers

Step-by-Step Guide to Withdrawing from Exness

Ready to withdraw your funds? Here’s a simple guide to navigate the process:

Log In to Your Personal Area

Visit the Exness website or app and log in to your Personal Area using your credentials.

Navigate to the Withdrawal Section

On the left-hand menu, click “Withdrawal” to view available options.

Choose Your Payment Method

Select a method from the list (e.g., bank card, e-wallet, or crypto). Ensure it aligns with your deposit method per Exness’s priority rules.

Enter Withdrawal Details

Input the amount you wish to withdraw and provide necessary account details (e.g., bank account number or wallet address).

Verify the Transaction

Exness will send a confirmation code to your email or phone. Enter this code to authorize the withdrawal.

Confirm and Wait

Double-check the details, confirm the request, and wait for processing. You’ll receive a notification once it’s complete.

How Does Exness Compare to Other Brokers?

To put Exness’s withdrawal times in context, let’s compare it to other popular forex brokers:

XM: Offers instant withdrawals for e-wallets (1–24 hours) but bank transfers can take 2–5 days.

FXTM: Processes withdrawals within 24 hours, with e-wallets being the fastest (under 12 hours).

Pepperstone: Instant processing for e-wallets and cards, though bank transfers may take 3–5 days.

Exness stands out with its claim of 95% instant withdrawals, a feature not all brokers can match. Its lack of internal withdrawal fees and coverage of third-party fees also give it an edge.

Tips to Speed Up Your Exness Withdrawals

Want to get your funds faster? Follow these practical tips:

Verify Your Account Early: Complete KYC verification as soon as you open your account to avoid delays later.

Use E-Wallets or Crypto: These methods are consistently faster than bank cards or wire transfers.

Withdraw During Business Hours: Submitting requests during weekdays (Monday–Friday) can reduce delays caused by weekends or holidays.

Check Payment Method Limits: Ensure your chosen method supports your withdrawal amount to avoid rejections.

Contact Support for Issues: If your withdrawal is delayed, Exness’s 24/7 support team can assist promptly.

Common Withdrawal Problems and Solutions

Even with a reliable broker like Exness, issues can arise. Here are some common problems and how to address them:

Problem: Withdrawal request rejected.

Solution: Check if your account is verified and if the payment method matches your deposit method.

Problem: Funds not received after processing.

Solution: Confirm with your payment provider and provide Exness support with transaction details.

Problem: Unexpected fees deducted.

Solution: Review third-party fees (Exness covers these, but currency conversion fees may apply).

Why Choose Exness for Withdrawals?

Exness has built a reputation for efficient and cost-effective withdrawals. Here’s why traders trust it:

No Internal Fees: Exness doesn’t charge withdrawal fees, and it even covers third-party transaction costs.

Instant Processing: The majority of withdrawals are processed in under a minute on Exness’s side.

Wide Range of Methods: From e-wallets to crypto, Exness offers flexibility for global traders.

Regulatory Compliance: Strict adherence to AML and KYC rules ensures your funds are secure.

Final Thoughts: How Long Does It Really Take?

So, how long does it take to withdraw from Exness? For most traders, the answer is anywhere from a few minutes to 24 hours, depending on the payment method. E-wallets and cryptocurrencies offer the fastest turnaround, while bank transfers take the longest due to external processing. By verifying your account, choosing the right method, and timing your request wisely, you can minimize delays and enjoy quick access to your profits.

Exness’s commitment to speed, transparency, and zero internal fees makes it a top choice for traders who value efficiency. Whether you’re cashing out a small profit or a large sum, Exness ensures the process is as smooth as possible.

Have you withdrawn from Exness recently? Share your experience in the comments below—I’d love to hear how long it took for you!

FAQs About Exness Withdrawals

Q: Can I withdraw funds to a different account than the one I deposited from?A: No, Exness requires withdrawals to match the deposit method and account for security and regulatory reasons.

Q: Is there a minimum withdrawal amount?A: Exness doesn’t set a universal minimum, but payment providers may have their own limits, visible in your Personal Area.

Q: What happens if my withdrawal is delayed?A: Contact Exness support with your transaction details for assistance—they’re available 24/7.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: