9 minute read

Can we trade in Exness in India?

Forex trading has gained immense popularity in India over the past decade, with millions of aspiring traders seeking opportunities to profit from global currency markets. Among the many brokers available, Exness stands out as a globally recognized platform known for its competitive spreads, advanced trading tools, and user-friendly interface. However, one question frequently arises among Indian traders: Can we trade in Exness in India? This article dives deep into the legalities, practicalities, and nuances of trading with Exness in India, offering a complete guide for beginners and seasoned traders alike.

💥 Trade with Exness now: Open An Account or Visit Brokers

What is Exness? An Overview of the Platform

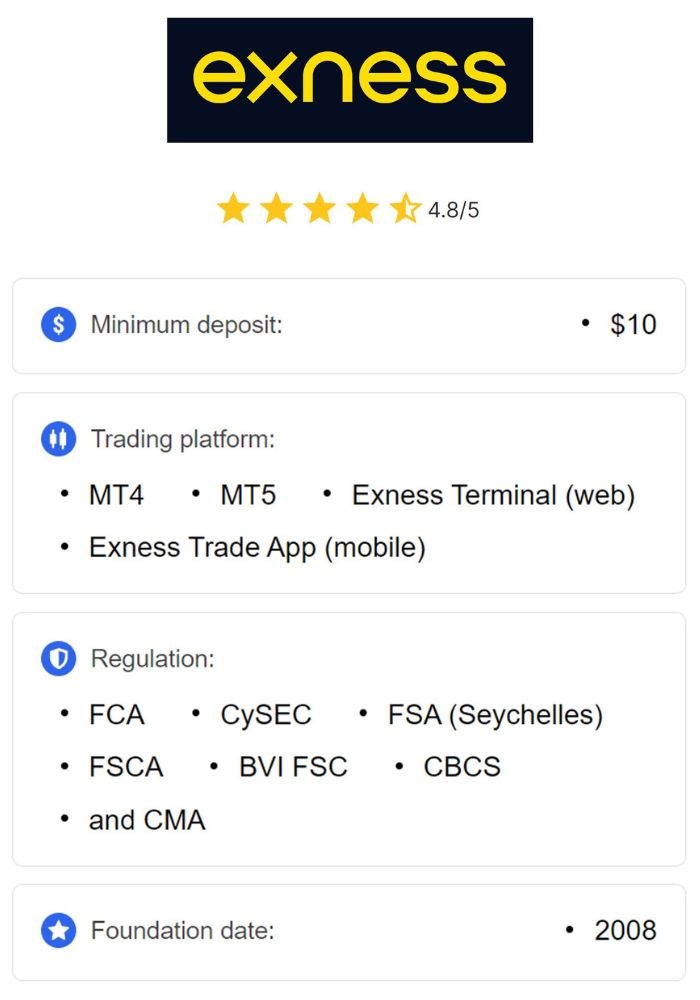

Before addressing the core question, let’s understand what Exness is and why it’s a popular choice among traders worldwide. Founded in 2008, Exness is an international forex and CFD (Contract for Difference) broker headquartered in Cyprus. It operates under multiple regulatory licenses, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority (FSA) in Seychelles. With a monthly trading volume exceeding $4 trillion, Exness has established itself as a titan in the forex industry.

Exness offers a wide range of trading instruments, including forex pairs, commodities, indices, cryptocurrencies, and stocks. Its platforms—MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the proprietary Exness Terminal—are equipped with advanced charting tools, fast execution speeds, and flexible leverage options (up to 1:2000). For Indian traders, Exness also supports local payment methods like UPI, Net Banking, and bank transfers, making it accessible and convenient.

But the real question is: Is it legal and safe to trade with Exness in India? Let’s explore the regulatory landscape and practical considerations.

Forex Trading Regulations in India: What You Need to Know

To determine whether trading with Exness in India is permissible, we must first examine the regulatory framework governing forex trading in the country. Forex trading in India is regulated by two primary authorities:

Reserve Bank of India (RBI): The RBI oversees all foreign exchange transactions in India under the Foreign Exchange Management Act (FEMA), 1999. Its primary goal is to maintain the stability of the Indian Rupee (INR) and prevent illegal capital outflows.

Securities and Exchange Board of India (SEBI): SEBI regulates financial markets, including forex trading, but its jurisdiction is limited to brokers and exchanges operating within India.

According to RBI guidelines, forex trading is legal in India, but with strict conditions:

Indian residents can only trade currency pairs that include the Indian Rupee (e.g., USD/INR, EUR/INR, GBP/INR).

Trading must occur through SEBI-registered brokers and recognized exchanges like the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), or Metropolitan Stock Exchange (MSE).

Trading non-INR pairs (e.g., EUR/USD, GBP/USD) through offshore brokers is not explicitly permitted and falls into a legal gray area.

Exness, as an offshore broker, is not regulated by SEBI or RBI. Instead, it operates under international licenses, serving traders globally, including in India. This raises the question: Does this make trading with Exness illegal in India?

Is Trading with Exness Legal in India?

The short answer is: Yes, you can trade with Exness in India, but it comes with legal and regulatory nuances that traders must understand.

The Legal Gray Area

Exness is not banned in India, nor has the RBI or SEBI explicitly prohibited Indian residents from using its services. However, because Exness is an offshore broker not registered with SEBI, trading with it does not fully align with Indian forex regulations. Specifically:

Trading INR-based pairs through SEBI-regulated platforms is compliant with FEMA.

Trading non-INR pairs (e.g., EUR/USD) through Exness technically violates RBI restrictions, as these transactions occur outside India’s regulated framework.

Despite this, thousands of Indian traders use Exness and similar offshore brokers without facing direct legal repercussions. Why? Because there’s no specific law that prohibits individuals from opening accounts with international brokers or trading forex online. The enforcement of FEMA typically targets brokers operating illegally within India or individuals involved in money laundering, not retail traders using offshore platforms for personal trading.

Exness’s Regulatory Status

Exness is regulated by reputable international bodies, including:

FCA (UK): Ensures high standards of transparency and client fund protection.

CySEC (Cyprus): Offers robust oversight within the European Union.

FSA (Seychelles): Governs Exness’s global operations, under which Indian traders are onboarded.

These licenses provide a layer of security and credibility, even though they don’t fall under Indian jurisdiction. Exness also adheres to strict financial standards, such as segregating client funds from company assets and offering negative balance protection, which prevents traders from losing more than their deposits.

Practical Implications for Indian Traders

While trading with Exness may not lead to immediate legal action, there are risks:

Regulatory Scrutiny: If the RBI tightens enforcement, traders using offshore brokers could face penalties or account freezes.

Fund Transfers: Transferring money to and from Exness must comply with FEMA rules, which limit overseas remittances for speculative purposes.

In summary, trading with Exness in India is possible and widely practiced, but it exists in a legal gray area. Traders should proceed with caution, ensuring compliance with FEMA and maintaining proper documentation for all transactions.

💥 Trade with Exness now: Open An Account or Visit Brokers

How to Trade with Exness in India: A Step-by-Step Guide

Assuming you’ve weighed the legal considerations and decided to trade with Exness, here’s how to get started:

Step 1: Account Registration

Visit the official Exness website:Open An Account or Visit Brokers

Click “Open Account” and provide your email, phone number, and country (India).

Choose an account type: Standard, Standard Cent, Raw Spread, Zero, or Pro. For beginners, the Standard account with a $10 minimum deposit is ideal.

Verify your identity by uploading documents like an Aadhaar card, PAN card, or passport.

Step 2: Depositing Funds

Exness supports multiple payment methods for Indian traders:

UPI: Instant deposits via apps like Google Pay or PhonePe.

Net Banking: Direct transfers from Indian bank accounts.

Bank Cards: Visa/Mastercard deposits (subject to bank restrictions).

E-Wallets: Options like Skrill or Neteller, though less common in India.

Cryptocurrencies: Bitcoin, USDT, and Ethereum for tech-savvy traders.

The minimum deposit is as low as $1 for some accounts, making it accessible for beginners.

Step 3: Choosing a Trading Platform

Exness offers:

MetaTrader 4 (MT4): Popular for its simplicity and automation tools.

MetaTrader 5 (MT5): Advanced features like additional timeframes and indicators.

Exness Terminal: A web-based platform for quick trading without downloads.

Mobile Apps: Exness Trader and MT4/MT5 apps for trading on the go.

Download your preferred platform, log in with your account credentials, and explore the interface.

Step 4: Start Trading

Select a trading instrument (e.g., forex pairs, gold, or crypto).

Analyze the market using charts and indicators.

Place a trade by setting your lot size, stop-loss, and take-profit levels.

Monitor your positions and adjust as needed.

Exness provides demo accounts with virtual funds, allowing you to practice risk-free before trading with real money.

Benefits of Trading with Exness in India

Why do Indian traders choose Exness despite the regulatory gray area? Here are the key advantages:

1. Low Spreads and Fees

Exness offers some of the tightest spreads in the industry:

Standard Accounts: Spreads from 0.3 pips with no commission.

Raw Spread Accounts: Spreads from 0.0 pips with a small commission.

Zero Accounts: Fixed 0-pip spreads on select pairs.

This cost efficiency is a major draw for active traders.

2. High Leverage

Exness provides leverage up to 1:2000, allowing traders to control large positions with minimal capital. However, high leverage increases risk, so use it wisely.

3. Fast Execution

With execution speeds under 25 milliseconds and no requotes, Exness ensures trades are processed instantly, even during volatile markets.

4. Local Payment Options

Support for UPI, Net Banking, and INR deposits eliminates currency conversion fees, making transactions seamless for Indian users.

5. Robust Security

Regulated by top-tier authorities, Exness uses 128-bit encryption and segregated accounts to protect client funds, offering peace of mind.

6. Educational Resources

Exness provides webinars, tutorials, and market analysis, helping beginners learn the ropes and veterans refine their strategies.

Risks and Challenges of Trading with Exness in India

While Exness offers numerous benefits, there are challenges to consider:

1. Legal Uncertainty

As an offshore broker, Exness operates outside SEBI’s oversight. Any future regulatory crackdown could impact traders’ ability to use the platform.

2. Bank Restrictions

Some Indian banks block transactions to forex brokers due to FEMA compliance concerns. Traders may need to rely on e-wallets or crypto for funding.

3. High Leverage Risks

Leverage of 1:2000 can amplify losses, especially for inexperienced traders without proper risk management.

4. Tax Implications

Forex profits in India are taxable as capital gains or business income. Traders must report earnings accurately to avoid penalties, which requires diligent record-keeping.

Alternatives to Exness for Indian Traders

If the legal gray area of Exness concerns you, consider these SEBI-regulated alternatives:

Zerodha: Offers forex trading via NSE’s currency derivatives segment.

Angel One: Provides INR-based forex trading with robust support.

ICICI Direct: A trusted platform for currency futures and options.

These brokers comply with Indian regulations but offer fewer currency pairs and lower leverage compared to Exness.

Tips for Safe and Successful Trading with Exness in India

To maximize your experience while minimizing risks, follow these tips:

Educate Yourself: Understand forex basics and Indian regulations before trading.

Start Small: Begin with a demo account or a low deposit to test the waters.

Use Risk Management Tools: Set stop-loss orders to limit potential losses.

Comply with FEMA: Use legal payment methods and document all transactions.

Consult a Tax Expert: Ensure proper reporting of profits for tax compliance.

Monitor News: Stay updated on RBI and SEBI announcements that could affect offshore trading.

Real User Experiences: What Indian Traders Say About Exness

Based on posts on X and online forums:

Many traders praise Exness for its low spreads, fast withdrawals, and reliable platforms.

Some report issues with bank deposits due to restrictions, resolved by using UPI or crypto.

A few express concerns about its offshore status, though no legal actions against individual traders have been widely reported.

Overall, Exness enjoys a positive reputation among Indian users, with its practical benefits often outweighing regulatory uncertainties.

Conclusion: Can You Trade with Exness in India?

Yes, you can trade with Exness in India. While it operates in a legal gray area due to its offshore status, Exness remains a viable option for Indian traders seeking access to global markets, competitive trading conditions, and local payment methods. Its international regulations, low fees, and high leverage make it attractive, but traders must navigate FEMA compliance and potential risks carefully.

💥 Trade with Exness now: Open An Account or Visit Brokers

If you prioritize full regulatory compliance, SEBI-registered brokers are a safer bet. However, for those willing to accept the gray area, Exness offers a powerful platform to explore forex trading. Start with a demo account, research thoroughly, and trade responsibly to make the most of what Exness has to offer.

Read more: