10 minute read

Exness Zero Spread Account Commission Calculator

The forex trading world is brimming with opportunities, but it’s also a landscape where every penny counts. For traders aiming to maximize profits and minimize costs, tools like the Exness Zero Spread Account Commission Calculator have become indispensable. Whether you’re a scalper chasing quick gains or a long-term trader seeking predictability, understanding how this calculator works can transform your trading experience. In this in-depth guide, we’ll explore everything you need to know about the Exness Zero Spread Account, its commission structure, and how its commission calculator empowers traders to make informed decisions.

💥 Trade with Exness now: Open An Account or Visit Brokers

What is the Exness Zero Spread Account?

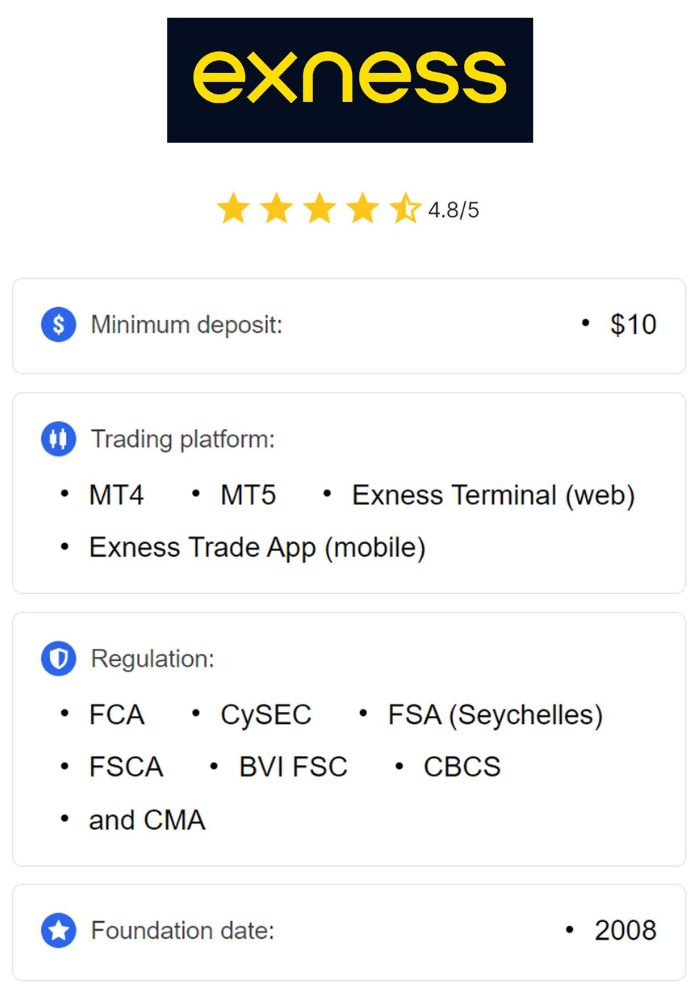

Before diving into the commission calculator, let’s first unpack what the Exness Zero Spread Account entails. Exness, a globally recognized forex and CFD broker established in 2008, is renowned for its competitive trading conditions and diverse account offerings. Among its professional account types, the Zero Spread Account stands out as a favorite for traders who prioritize low-cost trading.

Unlike traditional accounts where spreads (the difference between bid and ask prices) form a significant part of trading costs, the Zero Spread Account eliminates this variable. Instead, it offers zero spreads on the top 30 trading instruments for 95% of the trading day, replacing spreads with a fixed commission per lot traded. This structure appeals to high-frequency traders, scalpers, and anyone who values transparency and predictability in their trading expenses.

Key Features of the Exness Zero Spread Account

Zero Spreads: Trade major forex pairs, metals, and other instruments with no spread cost.

Fixed Commission: A transparent commission fee per lot, starting as low as $0.05 per side per lot (depending on the instrument and trading volume).

Market Execution: Ultra-fast execution speeds with no requotes, ideal for fast-paced strategies.

Minimum Deposit: Starts at $200 (varies by region and payment method).

Leverage: Up to 1:Unlimited (subject to regional restrictions).

Instruments: Access to forex pairs, metals, cryptocurrencies, energies, stocks, and indices.

This account type is designed for traders who want to eliminate the unpredictability of fluctuating spreads, especially during volatile market conditions. But how do you calculate the costs involved? That’s where the Exness Zero Spread Account Commission Calculator comes into play.

Understanding the Exness Zero Spread Account Commission Calculator

The Exness Zero Spread Account Commission Calculator is a powerful tool provided by Exness to help traders estimate their trading costs with precision. Forex trading involves multiple variables—spreads, commissions, swaps, and margins—and miscalculating any of these can erode profits. For Zero Spread Account users, where spreads are non-existent, the focus shifts to commissions, making this calculator a must-have.

What Does the Calculator Do?

The calculator allows traders to input specific trade details and instantly receive a breakdown of the commission fees they’ll incur. It’s integrated into the Exness ecosystem, ensuring real-time accuracy based on current market conditions and account settings. Here’s what it calculates:

Commission Fees: The total cost per lot traded, covering both opening and closing a position.

Swap Costs: Interest applied to positions held overnight (if applicable).

Pip Value: The monetary value of each pip movement based on the trade size and instrument.

Margin Requirements: The amount of capital needed to open a position based on leverage.

By providing these insights, the calculator eliminates guesswork, enabling traders to plan their strategies with full transparency.

Why Use the Exness Zero Spread Account Commission Calculator?

For traders, knowledge is power—and the commission calculator delivers it in spades. Here are some compelling reasons to incorporate this tool into your trading routine:

1. Cost Transparency

In forex trading, hidden costs can silently eat into your profits. The Zero Spread Account’s fixed commission structure already offers clarity, but the calculator takes it a step further by showing you the exact cost of each trade before you execute it. This transparency is invaluable for budgeting and risk management.

2. Optimized Trading Strategies

Scalpers and day traders thrive on small price movements, where even a slight miscalculation in costs can turn a profitable trade into a loss. The calculator helps you fine-tune your entries and exits by revealing the precise commission impact, ensuring your strategy remains viable.

3. Time Efficiency

Manually calculating commissions for every trade is time-consuming and prone to errors. The Exness calculator automates the process, delivering instant results so you can focus on analyzing the market instead of crunching numbers.

4. Adaptability Across Instruments

The Zero Spread Account supports a wide range of instruments, each with its own commission rate. Whether you’re trading EUR/USD, XAU/USD (gold), or cryptocurrencies, the calculator adjusts to provide accurate costs tailored to your chosen asset.

5. Enhanced Risk Management

By knowing your exact trading costs upfront, you can better manage your risk-reward ratio. This is especially critical for high-leverage traders, where small cost differences can amplify gains or losses.

How to Use the Exness Zero Spread Account Commission Calculator

Using the calculator is straightforward, even for beginners. Exness has designed it to be user-friendly while delivering robust functionality. Here’s a step-by-step guide:

Step 1: Access the Calculator

Log into your Exness Personal Area (PA) or visit the official Exness website.

Navigate to the “Tools” or “Calculators” section. The commission calculator is typically linked to the Zero Spread Account details.

💥 Trade with Exness now: Open An Account or Visit Brokers

Step 2: Input Trade Details

Account Type: Select “Zero Spread Account.”

Trading Instrument: Choose from the available options (e.g., EUR/USD, XAU/USD).

Lot Size: Enter the volume of your trade (e.g., 1 lot, 0.5 lots).

Account Currency: Specify your base currency (e.g., USD, EUR).

Leverage: Input your chosen leverage (e.g., 1:200, 1:1000).

Step 3: Review Results

The calculator instantly displays:

Commission: Total fee for opening and closing the position.

Pip Value: Value of each pip movement.

Swap Fees: If you plan to hold the trade overnight.

Margin: Capital required to open the position.

Step 4: Apply to Your Trading

Use the results to adjust your trade size, set stop-loss and take-profit levels, or refine your overall strategy.

Example Scenario

Let’s say you’re trading 2 lots of EUR/USD on the Zero Spread Account with a commission rate of $3.50 per lot per side. Here’s how the calculator works:

Commission: $3.50 x 2 lots x 2 (open + close) = $14.

Pip Value: Approximately $20 (for 2 lots in USD).

Margin: Depends on leverage—e.g., $200 at 1:1000.

With this data, you can decide if the trade aligns with your profit goals and risk tolerance.

Commission Structure of the Exness Zero Spread Account

To fully appreciate the calculator, it’s essential to understand the commission structure it’s based on. Unlike spread-based accounts, where costs fluctuate with market conditions, the Zero Spread Account uses a fixed commission model. However, the exact rate varies depending on several factors.

Factors Influencing Commission Rates

Trading Instrument: Major forex pairs like EUR/USD typically have lower commissions (e.g., $0.05–$3.50 per lot per side), while metals like XAU/USD might range from $4–$5 per lot.

Partner Level: Exness offers tiered commission rates based on your trading volume and partner status (Standard, Pro, Raw Spread). Higher volumes can unlock lower rates.

Trade Direction: Commissions apply to both opening and closing trades, doubling the per-lot fee for a round trip.

Sample Commission Rates

EUR/USD: $0.05–$3.50 per lot per side.

XAU/USD: $4–$5 per lot per side.

Cryptocurrencies: Varies widely based on volatility and liquidity.

The calculator pulls these rates directly from Exness’s real-time data, ensuring accuracy tailored to your account and trading activity.

Benefits of Trading with Zero Spreads

The Zero Spread Account’s appeal lies in its core feature: zero spreads. But what does this mean for your trading? Let’s break down the advantages:

1. Lower Transaction Costs

Spreads can widen unpredictably during news events or low liquidity, increasing trading costs. With zero spreads, you only pay the fixed commission, making your expenses predictable and often lower than spread-based accounts.

2. Precision in Scalping

Scalpers rely on tiny price movements—sometimes just a few pips. Zero spreads ensure that every pip gained goes straight to your profit, unhindered by spread costs.

3. Better Entry and Exit Points

Without spreads, you enter and exit trades at the exact market price, improving your timing and reducing slippage risks.

4. Ideal for High-Volume Trading

For traders executing dozens or hundreds of trades daily, the savings from zero spreads can add up significantly, even with commissions factored in.

5. Transparent Profitability

With spreads out of the equation, your profit calculations become simpler and more accurate, aligning perfectly with the commission calculator’s outputs.

Who Should Use the Exness Zero Spread Account?

This account isn’t for everyone—it’s tailored to specific trading styles and goals. Here’s who stands to benefit most:

1. Scalpers

Scalping involves rapid trades to capture small price shifts. The zero-spread, low-commission model minimizes costs, making it a scalper’s dream.

2. High-Frequency Traders

If you trade large volumes daily, the savings from zero spreads outweigh the modest commissions, boosting overall profitability.

3. Cost-Conscious Traders

Traders who meticulously track expenses will appreciate the predictability and transparency of fixed commissions over variable spreads.

4. Expert Advisor (EA) Users

Automated trading systems often execute numerous trades. The Zero Spread Account, paired with the commission calculator, ensures EAs operate cost-effectively.

5. Volatility Seekers

During high-volatility events (e.g., economic releases), spreads on standard accounts can skyrocket. The Zero Spread Account keeps costs stable, letting you capitalize on big moves.

Limitations and Considerations

While the Zero Spread Account and its commission calculator offer immense value, they’re not without drawbacks. Here’s what to keep in mind:

1. Higher Minimum Deposit

The $200 minimum deposit (or higher in some regions) may deter beginners with limited capital compared to Exness’s Standard Account ($10 minimum).

2. Commission Costs

Though lower than many competitors, commissions still apply. For low-volume traders, these fees might outweigh the benefits of zero spreads.

3. Not All Instruments Are Zero Spread

Only the top 30 instruments enjoy zero spreads consistently. Exotic pairs or less-traded assets may still incur spreads, affecting cost calculations.

4. Leverage Risks

With leverage up to 1:Unlimited, misjudging trade sizes or costs (even with the calculator) can amplify losses.

Comparing Exness Zero Spread Account with Competitors

To put the Zero Spread Account and its calculator in context, let’s compare it with similar offerings from other brokers:

Exness vs. IC Markets

IC Markets Raw Spread: Offers spreads from 0.0 pips with a $3.50 commission per lot per side. Exness’s commission can be lower (starting at $0.05), but IC Markets provides a broader instrument range.

Calculator: Both brokers offer trading calculators, but Exness’s integrates seamlessly with its account ecosystem.

Exness vs. Pepperstone

Pepperstone Razor Account: Zero spreads with commissions starting at $3.50 per lot. Exness edges out with potentially lower rates and unlimited leverage.

Tools: Pepperstone’s calculator is robust, but Exness’s focus on transparency gives it an edge for cost-conscious traders.

Exness vs. XM

XM Zero Account: Zero spreads with commissions from $3.50 per lot. Exness offers more competitive rates and faster execution.

User Experience: Exness’s calculator is more intuitive, catering to both novices and pros.

Exness stands out for its low commissions, high leverage, and user-friendly tools, making it a top choice for zero-spread trading.

Tips for Maximizing the Exness Zero Spread Account

To get the most out of this account and its commission calculator, consider these strategies:

Leverage the Calculator: Use it before every trade to optimize lot sizes and minimize costs.

Trade High-Volume Instruments: Focus on the top 30 zero-spread assets for maximum savings.

Monitor Partner Levels: Increase your trading volume to unlock lower commission rates.

Combine with Technical Analysis: Pair cost insights with market trends for smarter entries.

Test with a Demo: Exness offers demo accounts—practice using the calculator risk-free.

Conclusion: Empowering Your Trading Journey

The Exness Zero Spread Account Commission Calculator is more than just a tool—it’s a gateway to smarter, more profitable trading. By eliminating spreads and offering a transparent commission structure, Exness caters to traders who demand precision and efficiency. Whether you’re scalping EUR/USD or holding XAU/USD overnight, this calculator ensures you’re never in the dark about your costs.

Exness continues to innovate, providing traders with cutting-edge resources to navigate the forex market. If you’re ready to take control of your trading expenses, open a Zero Spread Account and start using the commission calculator today. Your profits—and peace of mind—will thank you.

Read more: