11 minute read

Is Exness Available in Nigeria? A Comprehensive Guide for Traders

Forex trading has surged in popularity across Nigeria in recent years, fueled by growing internet access, a youthful population eager to explore financial opportunities, and the promise of generating income in a dynamic global market. Among the many forex brokers vying for attention, Exness stands out as a globally recognized name. But the burning question for many Nigerian traders is: Is Exness available in Nigeria? In this in-depth guide, we’ll explore everything you need to know about Exness’s availability in Nigeria, its services, regulatory status, payment options, and whether it’s the right choice for you. Whether you're a beginner or an experienced trader, this article will provide clarity and actionable insights.

What Is Exness? A Quick Overview

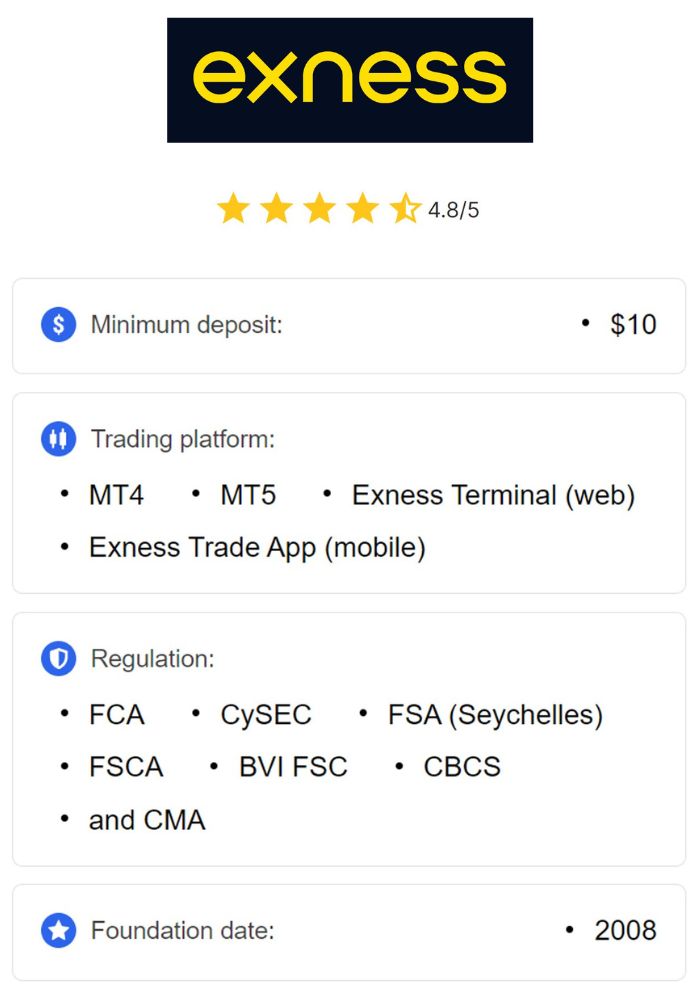

Before diving into its availability in Nigeria, let’s first understand what Exness is. Founded in 2008, Exness is a global forex and CFD (Contracts for Difference) broker headquartered in Cyprus. Over the years, it has built a reputation for offering competitive trading conditions, cutting-edge technology, and a user-friendly platform. Exness provides access to a wide range of financial instruments, including forex pairs, commodities (like gold and oil), indices, stocks, and cryptocurrencies. Its platforms, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), are popular among traders worldwide for their reliability and advanced features.

Exness has grown into one of the largest retail forex brokers globally, boasting millions of clients across more than 200 countries. The broker emphasizes transparency, low spreads, high leverage options, and fast execution speeds—qualities that appeal to traders of all levels. But does this global reach extend to Nigeria? Let’s find out.

Is Exness Available in Nigeria? The Short Answer

Yes, Exness is available in Nigeria. Nigerian traders can register accounts, deposit funds, trade, and withdraw profits using the Exness platform. The broker actively serves clients in Nigeria, offering localized support and payment methods to cater to the needs of the Nigerian market. However, while the answer is straightforward, there are nuances worth exploring, such as regulatory considerations, account setup processes, and practical usability for Nigerian traders. This article will break it all down for you.

💥 Trade with Exness now: Open An Account or Visit Brokers

Why Forex Trading Is Booming in Nigeria

To understand Exness’s availability and appeal in Nigeria, it’s worth looking at why forex trading has taken off in the country. Nigeria, with a population exceeding 200 million, is Africa’s largest economy. Despite economic challenges like inflation and currency volatility, many Nigerians are turning to forex trading as a way to diversify income streams. The rise of mobile internet, affordable smartphones, and financial education has made trading more accessible than ever.

Additionally, the Nigerian naira (NGN) has faced depreciation in recent years, prompting individuals to seek opportunities in foreign exchange markets where they can trade stronger currencies like the US dollar (USD), euro (EUR), or British pound (GBP). Exness, with its robust platform and global presence, fits perfectly into this growing trend. But how exactly does it cater to Nigerian traders?

How to Access Exness in Nigeria

Getting started with Exness in Nigeria is simple and mirrors the process for traders in other countries. Here’s a step-by-step guide:

1. Visit the Official Exness Website

Head to the official Exness website: Open An Account or Visit Brokers. The site is accessible from Nigeria without restrictions, and you’ll find it available in English, which is widely spoken across the country.

2. Register an Account

Fill out the registration form. You’ll need to provide basic details like your email address, phone number, and country of residence (select Nigeria). The process takes just a few minutes.

3. Verify Your Identity

To comply with international Know Your Customer (KYC) regulations, Exness requires account verification. You’ll need to upload a government-issued ID (e.g., a passport or national ID card) and proof of address (e.g., a utility bill or bank statement). Verification is typically quick, often completed within hours.

4. Choose Your Account Type

Exness offers various account types to suit different trading styles, including:

Standard Account: Ideal for beginners with a low minimum deposit (as little as $1 in some cases).

Standard Cent Account: Perfect for practicing with smaller trade sizes.

Pro Account: Designed for experienced traders with tighter spreads.

Zero Account: Offers zero spreads on select instruments.

Raw Spread Account: Provides raw market spreads with a small commission.

Nigerian traders can select an account with NGN as the base currency, avoiding unnecessary conversion fees.

5. Fund Your Account

Once verified, you can deposit funds using methods tailored for Nigeria (more on this later). Exness supports local bank transfers, e-wallets, and even cryptocurrencies, making it convenient for Nigerians.

6. Start Trading

Download the MT4 or MT5 platform (available for desktop, mobile, or web) or use the Exness WebTrader. From there, you can start trading forex, commodities, or other assets.

The process is seamless, and Exness’s platform is fully operational for Nigerian users. There are no geographic restrictions preventing Nigerians from signing up or trading.

Regulatory Status: Is Exness Regulated in Nigeria?

One of the most critical factors for any trader is the regulatory status of a broker. Regulation ensures that your funds are protected and that the broker operates ethically. So, is Exness regulated in Nigeria?

Global Regulation

Exness is not directly regulated by a Nigerian authority because Nigeria lacks a specific regulatory body dedicated to forex brokers. Instead, Exness operates under licenses from several reputable international regulators:

Cyprus Securities and Exchange Commission (CySEC): A top-tier regulator in the European Union.

Financial Conduct Authority (FCA): Oversees operations in the United Kingdom.

Financial Services Authority (FSA): Regulates Exness in Seychelles, where Nigerian clients are typically onboarded.

Other Jurisdictions: Exness also holds licenses in South Africa (FSCA), Kenya (CMA), and elsewhere.

For Nigerian traders, accounts are usually registered under the FSA in Seychelles. While this is considered an offshore regulator with less stringent oversight compared to the FCA or CySEC, Exness bolsters its credibility with additional safety measures:

Segregated Accounts: Client funds are kept separate from company funds.

Negative Balance Protection: Traders cannot lose more than their deposited amount.

Audits by Deloitte: Exness undergoes regular audits by Deloitte, a globally respected firm, ensuring transparency.

Nigeria’s Regulatory Landscape

In Nigeria, the Central Bank of Nigeria (CBN) oversees monetary policy and currency transactions, while the Securities and Exchange Commission (SEC) regulates financial markets. However, forex trading falls into a gray area. The CBN does not directly license forex brokers, and the SEC focuses more on securities than retail forex. As a result, many international brokers like Exness operate in Nigeria under their global licenses without local registration.

This lack of local regulation doesn’t mean Exness is unsafe for Nigerians. Its international oversight and track record of reliability make it a trusted option. However, traders should be aware that any disputes would be handled under the laws of the jurisdiction where their account is registered (e.g., Seychelles), not Nigeria.

💥 Trade with Exness now: Open An Account or Visit Brokers

Payment Methods for Nigerian Traders

A key concern for Nigerian traders is how to fund and withdraw from their Exness accounts. Fortunately, Exness offers a variety of payment options tailored to the Nigerian market:

1. Local Bank Transfers

Nigerian traders can deposit and withdraw funds directly to their local bank accounts. Exness partners with Nigerian banks like Wema Bank to facilitate these transactions. Deposits are usually processed instantly, while withdrawals may take 1-3 business days.

2. E-Wallets

Popular e-wallets like Skrill, Neteller, and Perfect Money are supported. These options are fast, secure, and ideal for traders who prefer digital payments over traditional banking.

3. Cryptocurrencies

Exness accepts deposits and withdrawals in Bitcoin (BTC) and Tether (USDT). This is a great option for tech-savvy Nigerians looking to bypass currency restrictions or bank delays.

4. Local Payment Solutions

Exness integrates with local payment gateways like Flutterwave and Paystack, which are widely used in Nigeria. These methods allow traders to fund accounts using NGN with minimal fees and instant processing.

Fees and Processing Times

Exness is known for its low-cost structure. Most deposit methods are free, though withdrawals may incur small fees depending on the payment provider (e.g., bank transfer fees). Processing times are competitive, with deposits often instant and withdrawals typically completed within 24 hours.

Trading Conditions: What Exness Offers Nigerians

Exness provides Nigerian traders with some of the best trading conditions in the industry. Here’s what you can expect:

1. Low Spreads

Spreads start as low as 0.0 pips on certain accounts (e.g., Zero and Raw Spread accounts), making Exness cost-effective for high-volume traders. Even the Standard Account offers competitive spreads from 0.3 pips.

2. High Leverage

Exness offers leverage up to 1:2000 (or unlimited in some cases for eligible accounts). This allows Nigerian traders to maximize their capital, though it comes with increased risk.

3. Fast Execution

With instant order execution, Exness ensures minimal slippage, which is crucial during volatile market conditions—like those often seen in forex pairs involving the naira.

4. Diverse Instruments

Nigerian traders can access over 100 forex pairs, commodities like oil (relevant given Nigeria’s oil-based economy), global indices, stocks, and cryptocurrencies.

5. Naira-Based Accounts

Exness allows traders to open accounts with NGN as the base currency, eliminating the need for costly conversions to USD or EUR.

Benefits of Using Exness in Nigeria

Why should Nigerian traders consider Exness? Here are some standout advantages:

Accessibility: No geographic barriers, easy registration, and localized payment options.

Low Entry Barrier: A minimum deposit as low as $1 makes it beginner-friendly.

Customer Support: 24/7 multilingual support via live chat, email, and phone, with English widely supported.

Educational Resources: Webinars, tutorials, and articles help new traders learn the ropes.

Transparency: Regular financial reports and audits build trust.

Challenges and Considerations

While Exness is available and functional in Nigeria, there are a few challenges to keep in mind:

1. Regulatory Uncertainty

The lack of direct regulation by Nigerian authorities means traders rely on Exness’s international licenses. This could complicate dispute resolution.

2. Withdrawal Delays

Some users report occasional delays in withdrawals, especially during peak times or with bank transfers.

3. Currency Volatility

The naira’s fluctuations can affect trading profitability, though this is a broader economic issue, not specific to Exness.

4. Internet Connectivity

Nigeria’s inconsistent internet infrastructure may impact trading, though Exness’s mobile app helps mitigate this with offline capabilities.

Is Exness Safe for Nigerian Traders?

Safety is paramount when choosing a forex broker. Exness’s global regulation, segregated funds, and negative balance protection make it a low-risk option. Its 17-year track record and millions of satisfied clients further bolster its reputation. While it’s not regulated locally in Nigeria, its international oversight provides a solid layer of security.

Alternatives to Exness in Nigeria

If you’re still unsure about Exness, here are some alternatives popular among Nigerian traders:

FXTM (ForexTime): Known for low spreads and strong regulation (FCA, CySEC).

HotForex (HFM): Offers competitive conditions and local support.

IC Markets: Ideal for advanced traders with raw spreads and fast execution.

Each broker has its strengths, but Exness’s combination of low costs, high leverage, and accessibility often makes it a top choice.

User Experiences: What Nigerian Traders Say

Feedback from Nigerian traders highlights Exness’s strengths and weaknesses:

Positive: Many praise the low spreads, fast withdrawals (especially via e-wallets), and ease of use.

Negative: Some mention occasional verification delays or customer support response times.

Overall, sentiment is largely positive, with Exness enjoying a strong reputation in Nigeria’s trading community.

How to Maximize Your Exness Experience in Nigeria

To get the most out of Exness, consider these tips:

Start with a Demo Account: Practice trading without risking real money.

Use Low Leverage Initially: High leverage can amplify losses, so start small.

Leverage Local Payments: Opt for NGN-based methods like Flutterwave to save on fees.

Stay Informed: Follow market news and Exness’s educational content to sharpen your skills.

Conclusion: Should You Trade with Exness in Nigeria?

So, is Exness available in Nigeria? Absolutely. Not only is it accessible, but it’s also well-suited to the needs of Nigerian traders with its low-cost structure, diverse payment options, and robust platform. While the lack of local regulation is a minor drawback, Exness’s global licenses and safety features provide ample reassurance.

Whether you’re a novice looking to dip your toes into forex or a seasoned trader seeking competitive conditions, Exness is a viable option in Nigeria. Its availability, combined with tailored services, makes it a standout choice in the country’s burgeoning trading scene. Ready to get started? Visit the Exness website, sign up, and explore the world of trading today.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: