10 minute read

Exness vs Quotex Comparison: Which is better?

In the rapidly evolving world of online trading, choosing the right platform can make or break your financial journey. Two names that frequently come up in discussions among traders are Exness and Quotex. Both platforms cater to different types of traders with distinct offerings, but the question remains: which one is better? In this in-depth Exness vs Quotex comparison, we’ll explore their features, trading conditions, user experiences, and more to help you decide which platform suits your needs best. Whether you’re a beginner dipping your toes into trading or an experienced trader seeking advanced tools, this guide has you covered.

💥 Trade with Exness now: Open An Account or Visit Brokers

Introduction to Exness and Quotex

Before diving into the nitty-gritty, let’s get a clear picture of what Exness and Quotex bring to the table.

What is Exness?

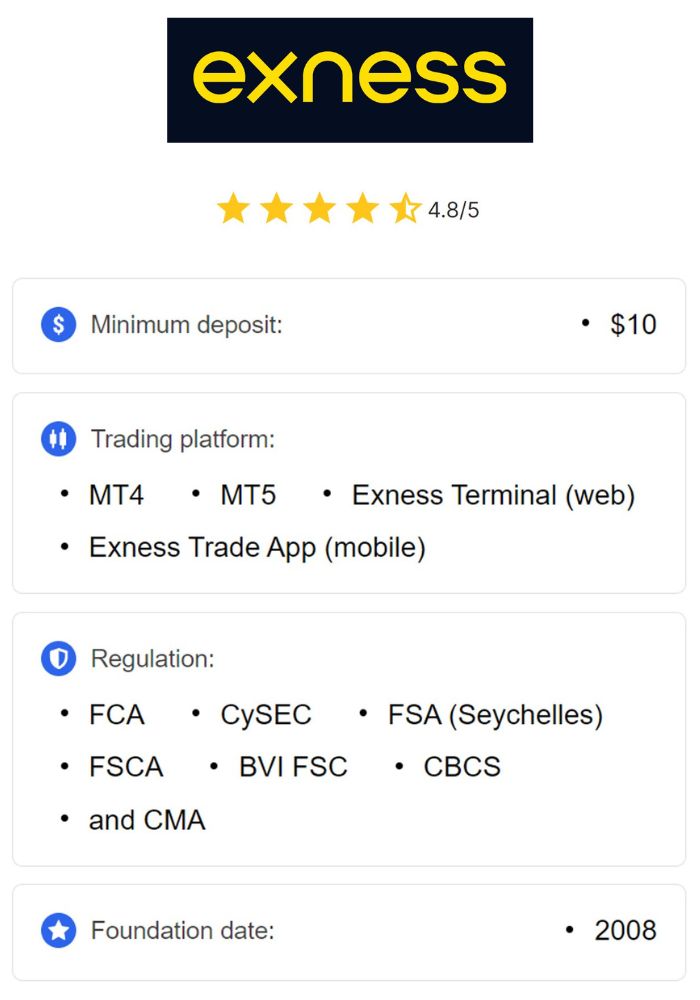

Exness, established in 2008, is a globally recognized forex and CFD broker headquartered in Cyprus. Over the years, it has built a solid reputation for offering low spreads, high leverage, and a wide range of trading instruments. Regulated by top-tier authorities like the FCA (UK), CySEC (Cyprus), and FSCA (South Africa), Exness appeals to traders who value security and transparency. With access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), it’s a favorite among forex enthusiasts and multi-asset traders.

What is Quotex?

Quotex, on the other hand, is a newer player, launched in 2020 by Awesomo Ltd., based in St. Vincent and the Grenadines. It specializes in binary options trading, a simpler and faster-paced trading style compared to traditional forex. Quotex offers a proprietary platform designed for ease of use, making it particularly attractive to beginners. While it lacks the extensive regulatory oversight of Exness, it has quickly gained popularity for its intuitive interface and high payout potential of up to 90% on trades.

Why Compare Exness and Quotex?

The Exness vs Quotex debate isn’t just about picking a winner—it’s about finding the platform that aligns with your trading goals. Exness caters to a broad audience with diverse instruments, while Quotex focuses on binary options with a streamlined experience. This comparison will break down their differences and similarities across key factors like regulation, trading platforms, fees, and customer support.

Regulation and Safety: Which Platform is More Secure?

When entrusting your money to a trading platform, safety is paramount. Let’s examine how Exness and Quotex stack up in terms of regulation and security.

Exness: A Regulated Powerhouse

Exness operates under strict regulatory frameworks, which is a huge plus for risk-averse traders. It’s licensed by:

Financial Conduct Authority (FCA) in the UK

Cyprus Securities and Exchange Commission (CySEC)

Financial Sector Conduct Authority (FSCA) in South Africa

These bodies enforce high standards for client fund protection, transparency, and operational integrity. Exness also offers negative balance protection, ensuring you never lose more than your deposit. For traders prioritizing safety, Exness is a clear leader in this category.

Quotex: Limited Oversight

Quotex, registered in St. Vincent and the Grenadines, operates with less stringent regulation. It’s overseen by the International Financial Market Relations Regulation Center (IFMRRC), but this organization isn’t as reputable as the FCA or CySEC. While Quotex claims to prioritize user security with features like two-factor authentication (2FA), its regulatory status may raise concerns for traders who value oversight from top-tier authorities.

Verdict: Safety Winner

Exness wins hands down in terms of regulation and safety. If peace of mind is a priority, Exness’s robust compliance makes it the better choice. However, Quotex’s security measures may suffice for traders comfortable with less-regulated platforms.

Trading Platforms: Tools and Usability

The trading platform is your gateway to the markets. Let’s compare what Exness and Quotex offer in terms of technology and user experience.

Exness: MetaTrader Excellence

Exness provides access to two industry-standard platforms:

MetaTrader 4 (MT4): Known for its reliability, extensive charting tools, and support for automated trading via Expert Advisors (EAs).

MetaTrader 5 (MT5): An upgraded version with more advanced features, including additional timeframes, indicators, and multi-asset trading capabilities.

Both platforms are available on desktop, web, and mobile, offering flexibility for traders on the go. With customizable interfaces and rapid execution speeds, Exness caters to both beginners and advanced users.

Quotex: Proprietary Simplicity

Quotex takes a different approach with its custom-built platform, designed specifically for binary options trading. Key features include:

A clean, user-friendly interface

Real-time market monitoring

Built-in trading signals

Basic charting tools with 29 technical indicators

Unlike Exness, Quotex doesn’t support third-party platforms like MT4 or MT5, which limits its appeal for traders seeking advanced functionality. However, its simplicity makes it ideal for newcomers who want a hassle-free experience.

Verdict: Platform Winner

Exness edges out Quotex for its versatility and advanced tools via MT4 and MT5. Quotex shines for beginners, but its proprietary platform lacks the depth that seasoned traders might crave.

Account Types and Minimum Deposits

Your trading journey starts with choosing an account. Here’s how Exness and Quotex differ in this area.

Exness Account Options

Exness offers a variety of account types to suit different trading styles:

Standard Account: No commission, low spreads, ideal for beginners (minimum deposit: $10).

Standard Cent Account: Micro-lot trading for novices (minimum deposit: $10).

Pro Account: Ultra-low spreads and instant execution for professionals (minimum deposit: $200).

Zero Account: Zero spreads on major pairs with a commission (minimum deposit: $200).

Raw Spread Account: Tight spreads with a small commission (minimum deposit: $200).

With a low entry point of $10, Exness is accessible to almost anyone.

Quotex Account Options

Quotex keeps it simple with a single account type:

Standard Account: Minimum deposit of $10, suitable for binary options trading.

There’s no tiered structure or advanced options, which aligns with Quotex’s focus on simplicity. Traders can start with as little as $1 per trade, making it beginner-friendly.

Verdict: Account Flexibility

Exness offers more variety, catering to a broader range of traders. Quotex’s single-account approach works for binary options enthusiasts but lacks the flexibility of Exness.

Trading Instruments: What Can You Trade?

Diversity in trading instruments allows you to explore multiple markets. Let’s see what each platform offers.

Exness: Multi-Asset Trading

Exness provides a wide range of instruments:

Forex: Over 100 currency pairs, including majors, minors, and exotics.

CFDs: Stocks, indices, commodities, and metals.

Cryptocurrencies: Bitcoin, Ethereum, and more.

This variety makes Exness a one-stop shop for traders looking to diversify their portfolios.

Quotex: Binary Options Focus

Quotex focuses exclusively on binary options, offering:

Forex: Major currency pairs.

Commodities: Gold, oil, etc.

Cryptocurrencies: Bitcoin, Litecoin, and others.

Stocks and Indices: Limited selection.

While Quotex covers multiple asset classes, its scope is narrower than Exness’s, reflecting its binary options specialization.

Verdict: Instrument Variety

Exness takes the lead with its extensive multi-asset offerings. Quotex is sufficient for binary options traders but falls short for those seeking broader market exposure.

💥 Trade with Exness now: Open An Account or Visit Brokers

Fees and Spreads: Cost of Trading

Trading costs can significantly impact your profits. Let’s break down the fees for Exness and Quotex.

Exness: Competitive Pricing

Exness is known for its low-cost trading environment:

Spreads: Start from 0.0 pips on premium accounts (e.g., Zero and Raw Spread).

Commissions: $3.5 per lot on Zero and Raw Spread accounts; no commission on Standard accounts.

Deposit/Withdrawal Fees: None, though third-party payment providers may charge.

Exness’s transparent pricing and tight spreads make it cost-effective, especially for high-volume traders.

Quotex: Flat Structure

Quotex operates differently due to its binary options model:

Spreads: Not applicable; profits depend on payout percentages (up to 90%).

Commissions: None.

Deposit/Withdrawal Fees: Free, with fast processing.

Quotex’s fee structure is straightforward, but payouts vary by asset and market conditions, which can affect profitability.

Verdict: Cost Efficiency

Exness offers better value for forex and CFD traders with its low spreads and flexible accounts. Quotex’s no-fee model suits binary options traders, but potential earnings depend on payout rates.

Leverage: Amplifying Your Trades

Leverage can boost your trading power, but it comes with risks. Here’s how the two platforms compare.

Exness: High Leverage

Exness offers some of the highest leverage in the industry:

Up to 1:2000 (or unlimited in some regions) on forex pairs.

Lower leverage on other assets like stocks and crypto.

This flexibility is a double-edged sword—great for maximizing gains but risky without proper risk management.

Quotex: Limited Leverage

Quotex doesn’t offer traditional leverage due to its binary options focus. Instead, your potential return is fixed based on the payout percentage, which can reach 90%. This eliminates the need for leverage but caps your exposure.

Verdict: Leverage Options

Exness is the winner for traders who want high leverage. Quotex’s model doesn’t rely on leverage, appealing to those who prefer fixed-risk trades.

Execution Speed and Reliability

In fast-moving markets, execution speed can determine your success. Let’s evaluate both platforms.

Exness: Lightning-Fast Execution

Exness boasts rapid order execution, often under 0.1 seconds, thanks to its advanced infrastructure. It supports various order types (market, limit, stop), giving traders control over their strategies. Downtime is rare, ensuring reliability.

Quotex: Mixed Performance

Quotex offers decent execution for binary options, but some users report delays during high volatility. Its simpler platform limits order types, which may frustrate advanced traders. Reliability is generally good, though not as robust as Exness.

Verdict: Execution Winner

Exness outperforms Quotex with faster, more reliable execution, making it ideal for active traders.

Customer Support: Who’s There When You Need Them?

Reliable support can save the day when issues arise. Here’s how Exness and Quotex compare.

Exness: 24/7 Assistance

Exness provides round-the-clock support via:

Live chat

Email

Phone

Available in multiple languages, their team is responsive and knowledgeable, earning high marks from users.

Quotex: Adequate Support

Quotex offers 24/7 support through:

Email

Live chat (response times vary)

While functional, Quotex’s support isn’t as polished as Exness’s, and some users note slower responses during peak times.

Verdict: Support Winner

Exness excels with its comprehensive, responsive support. Quotex is decent but falls short of Exness’s standard.

Educational Resources: Learning to Trade

For beginners, education is key. Let’s see what each platform offers.

Exness: Robust Learning Hub

Exness provides:

Webinars

Video tutorials

Market analysis

Trading guides

These resources cater to all skill levels, helping traders grow their knowledge.

Quotex: Basic Offerings

Quotex offers:

Tutorials

Trading signals

Demo account

While helpful for beginners, Quotex lacks the depth and variety of Exness’s educational tools.

Verdict: Education Winner

Exness leads with its extensive resources. Quotex is sufficient for basic learning but doesn’t match Exness’s offerings.

User Experience: What Traders Say

Real-world feedback sheds light on each platform’s strengths and weaknesses.

Exness Reviews

Exness users praise:

Low spreads and fast execution

Reliable withdrawals

Excellent support

Some note the complexity of MT4/MT5 as a learning curve for beginners.

Quotex Reviews

Quotex users appreciate:

Easy-to-use platform

Quick payouts

Demo account

Criticisms include occasional delays and limited asset variety.

Verdict: User Satisfaction

Exness enjoys broader acclaim for its reliability and features. Quotex satisfies binary options traders but has room for improvement.

Who Should Choose Exness?

Exness is ideal for:

Experienced Traders: Advanced tools, high leverage, and multi-asset trading.

Forex Enthusiasts: Tight spreads and extensive currency pairs.

Risk-Averse Traders: Strong regulation and fund protection.

Who Should Choose Quotex?

Quotex suits:

Beginners: Simple platform and low entry cost.

Binary Options Fans: High payouts and fast trades.

Casual Traders: No need for complex strategies or leverage.

Final Verdict: Exness vs Quotex—Which is Better?

After dissecting Exness and Quotex across multiple categories, the answer depends on your trading style:

Exness is the better overall choice for its regulatory security, versatile platforms, low costs, and extensive features. It’s perfect for serious traders who want a comprehensive, reliable experience.

Quotex shines for beginners and binary options traders seeking simplicity and quick returns. However, its limited scope and regulation may deter advanced users.

Ultimately, Exness offers more bang for your buck if you’re in it for the long haul. Quotex is a solid pick for a niche audience but can’t compete with Exness’s breadth and depth. Choose based on your priorities—security and variety with Exness, or ease and speed with Quotex.

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: