11 minute read

Is Exness Safe in Pakistan? Review Broker 2025

Forex trading has surged in popularity across Pakistan in recent years, driven by the promise of financial independence and the accessibility of online platforms. Among the many brokers vying for attention, Exness stands out as a globally recognized name. But for Pakistani traders, one question looms large: Is Exness safe in Pakistan? With the complexities of local regulations, security concerns, and the risks inherent in forex trading, this is a critical inquiry that deserves a thorough exploration. In this article, we’ll dive deep into Exness’s safety features, its regulatory standing, and how it aligns with the needs of traders in Pakistan. Whether you’re a beginner or a seasoned investor, this guide will equip you with the knowledge to make an informed decision.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? An Overview of the Platform

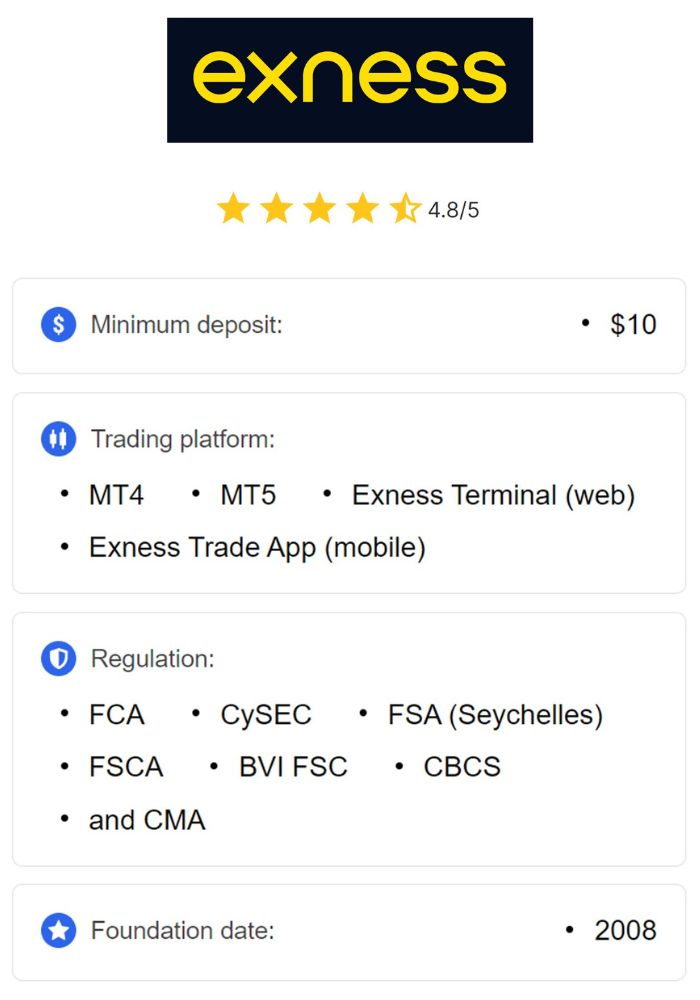

Exness, founded in 2008, is a leading online forex and CFD (Contracts for Difference) broker headquartered in Limassol, Cyprus. Over the past decade, it has earned a reputation for offering competitive trading conditions, including tight spreads, high leverage, and a variety of financial instruments such as forex pairs, commodities, cryptocurrencies, indices, and stocks. With millions of clients worldwide, Exness has positioned itself as a trusted name in the trading community, emphasizing transparency, innovation, and user satisfaction.

For Pakistani traders, Exness offers an appealing suite of features: low minimum deposits (starting at just $1 for standard accounts), access to popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), and instant withdrawal options. These perks make it an attractive choice, but safety goes beyond features—it hinges on regulation, security measures, and compliance with local laws. Let’s unpack these elements step by step to determine if Exness is a secure option for traders in Pakistan.

The Importance of Safety in Forex Trading

Before diving into Exness specifically, it’s worth understanding why safety matters in forex trading. The forex market is the largest financial market globally, with a daily trading volume exceeding $6 trillion. However, its decentralized nature and high volatility also make it a breeding ground for risks—ranging from market fluctuations to broker-related issues like fraud or mismanagement of funds.

For Pakistani traders, these risks are compounded by economic factors such as currency controls enforced by the State Bank of Pakistan (SBP) and the regulatory oversight of the Securities and Exchange Commission of Pakistan (SECP). Choosing a safe broker isn’t just about protecting your capital; it’s about ensuring your peace of mind in an industry where trust is paramount. So, how does Exness measure up?

Is Exness Regulated? A Look at Its Global Credentials

One of the first indicators of a broker’s safety is its regulatory status. Regulation ensures that a broker adheres to strict financial standards, maintains transparency, and protects client funds. Exness operates under multiple regulatory bodies worldwide, which bolsters its credibility on the global stage. Here’s a breakdown of its licenses:

Financial Conduct Authority (FCA) – United Kingdom: The FCA is one of the most stringent regulators in the world, enforcing high standards for financial conduct and client protection. While Exness’s FCA license applies primarily to its UK operations, it reflects the broker’s commitment to excellence.

Cyprus Securities and Exchange Commission (CySEC) – Cyprus: CySEC regulates Exness’s activities within the European Union, ensuring compliance with EU financial laws, including the Markets in Financial Instruments Directive (MiFID II).

Financial Services Authority (FSA) – Seychelles: This license governs Exness’s global entity (Exness SC Ltd), under which Pakistani traders typically register. While less rigorous than the FCA or CySEC, it still imposes standards for transparency and fund security.

Other Jurisdictions: Exness also holds licenses from the Financial Sector Conduct Authority (FSCA) in South Africa, the Capital Markets Authority (CMA) in Kenya, and several other tier-2 and tier-4 regulators.

These multi-layered regulations demonstrate that Exness operates under robust oversight. However, a key question remains: Is Exness regulated in Pakistan? The short answer is no—Exness is not directly licensed by the SECP, Pakistan’s primary financial regulator. This absence of local regulation doesn’t automatically deem it unsafe, but it does introduce nuances we’ll explore later.

Forex Trading Regulations in Pakistan

To assess Exness’s safety in Pakistan, we must first understand the local regulatory landscape. Forex trading is legal in Pakistan, but it operates within a framework overseen by two key institutions:

Securities and Exchange Commission of Pakistan (SECP): The SECP regulates financial markets, including forex brokers operating within Pakistan. It aims to ensure transparency, fairness, and investor protection. Brokers seeking to operate locally must obtain an SECP license, which involves rigorous vetting of their financial stability and operational practices.

State Bank of Pakistan (SBP): The SBP manages Pakistan’s monetary policy and foreign exchange reserves. It imposes capital controls to regulate the flow of foreign currency, which can affect how traders deposit and withdraw funds from international brokers.

While forex trading is permitted, the SECP has not formally approved most international brokers, including Exness, to operate directly in Pakistan. This creates a gray area: Pakistani traders can access Exness through its international entities (e.g., the Seychelles-based Exness SC Ltd), but the platform lacks a localized license. Does this make it unsafe? Not necessarily—many reputable global brokers operate in Pakistan without SECP oversight, relying instead on their international credentials.

How Exness Ensures Client Safety

Even without direct SECP regulation, Exness implements several measures to safeguard its clients, including those in Pakistan. These features are critical to answering the question, “Is Exness safe in Pakistan?” Let’s examine them closely:

1. Segregated Client Accounts

Exness keeps client funds in segregated accounts, separate from its operational funds. This means that even if the company faces financial difficulties, your money remains protected and cannot be used to cover corporate debts. Segregation is a standard practice among regulated brokers and a strong indicator of safety.

2. Negative Balance Protection

Forex trading involves leverage, which can amplify both profits and losses. In volatile markets, it’s possible for an account balance to drop below zero. Exness offers negative balance protection to retail clients in Pakistan, ensuring that you won’t owe more than your initial deposit. This feature is a safety net that mitigates the risk of catastrophic losses.

3. Advanced Security Protocols

Exness employs cutting-edge technology to protect client data and transactions. This includes SSL encryption for secure data transmission, two-factor authentication (2FA) for account access, and regular security audits. For Pakistani traders concerned about cyber threats, these measures provide reassurance that their personal and financial information is secure.

4. Transparent Operations

Transparency is a cornerstone of Exness’s brand. The broker publishes monthly financial reports detailing trading volumes, client withdrawals, and partner rewards. Additionally, it undergoes audits by Deloitte, one of the “Big Four” global accounting firms, every six months. This openness builds trust and accountability.

5. Instant Withdrawals

Unlike some brokers that delay withdrawals, Exness offers automated, instant withdrawal processing. For Pakistani traders, this means quick access to profits without unnecessary hurdles—an essential feature in a country where currency controls can complicate international transactions.

Is Exness Legal in Pakistan?

The legality of using Exness in Pakistan ties closely to its regulatory status. Since Exness isn’t banned by any Pakistani authority and forex trading itself is permissible, traders can legally use the platform by registering with its international branches. However, the lack of SECP oversight means that Pakistani traders assume some risk, as they may not have recourse to local authorities in case of disputes.

💥 Trade with Exness now: Open An Account or Visit Brokers

That said, Exness’s compliance with international regulations (e.g., FCA, CySEC) offers a layer of protection that exceeds what many unregulated brokers provide. For most traders, this global legitimacy outweighs the absence of a local license, especially given Exness’s track record of reliability.

Benefits of Trading with Exness in Pakistan

Beyond safety, Exness offers several advantages that appeal to Pakistani traders:

Low Entry Barrier: With a minimum deposit as low as $1 for standard accounts, Exness is accessible to beginners and those with limited capital.

High Leverage: Exness provides leverage up to 1:2000 (or unlimited under certain conditions), allowing traders to maximize their positions. However, high leverage also increases risk, so it should be used cautiously.

Islamic Accounts: As a Muslim-majority country, Pakistan has a demand for Sharia-compliant trading. Exness offers swap-free Islamic accounts, eliminating interest charges on overnight positions in line with Islamic finance principles.

Local Payment Options: Exness supports deposit and withdrawal methods convenient for Pakistanis, such as bank cards, e-wallets (e.g., Skrill, Neteller), and local bank transfers, despite SBP restrictions on foreign currency flows.

24/7 Customer Support: Exness provides multilingual support round-the-clock, ensuring Pakistani traders can resolve issues promptly, regardless of time zones.

Risks and Considerations for Pakistani Traders

While Exness appears safe on many fronts, there are risks and considerations to keep in mind:

1. Lack of Local Regulation

Without SECP oversight, Pakistani traders may face challenges in seeking legal recourse if disputes arise. Relying on international regulators like CySEC or the FCA can be less straightforward from Pakistan.

2. Currency Exchange Risks

The SBP’s capital controls can complicate deposits and withdrawals, potentially leading to delays or additional fees when converting Pakistani Rupees (PKR) to foreign currencies like USD.

3. Market Volatility

Forex trading is inherently risky, and Pakistan’s economic conditions—such as inflation or political instability—can amplify currency fluctuations, affecting trading outcomes.

4. Limited Investor Protection

Exness does not offer an investor compensation scheme under its FSA (Seychelles) jurisdiction, which applies to Pakistani clients. In contrast, FCA or CySEC-regulated accounts provide up to £85,000 or €20,000 in compensation, respectively, but these don’t extend to Pakistan-based traders.

Public Sentiment and Trader Feedback

What do Pakistani traders think of Exness? Online reviews and forums reveal a generally positive sentiment. Many praise its fast withdrawals, competitive spreads, and reliable platform. On platforms like Trustpilot, Exness holds a strong rating (around 4 stars from thousands of reviews globally), with users highlighting its transparency and customer service.

However, some Pakistani traders express caution about the lack of local regulation, urging others to research thoroughly before committing large sums. Anecdotal feedback suggests that verifying accounts properly (via KYC processes) resolves most withdrawal issues, countering occasional claims of delays or scams.

Comparing Exness to Alternatives in Pakistan

To gauge Exness’s safety, it’s helpful to compare it to other brokers available in Pakistan:

IC Markets: Regulated by ASIC (Australia) and offering similar trading conditions, IC Markets is another popular choice. However, it lacks the ultra-low minimum deposit of Exness.

Pepperstone: Also ASIC-regulated, Pepperstone provides excellent tools but has higher entry requirements than Exness’s $1 threshold.

Local Brokers: SECP-licensed brokers like those affiliated with the Pakistan Stock Exchange offer greater local compliance but often lack the global reach, leverage, or instrument variety of Exness.

For traders prioritizing affordability and flexibility, Exness stands out. However, those seeking maximum regulatory protection might prefer a locally licensed option.

Tips for Trading Safely with Exness in Pakistan

If you decide to trade with Exness, here are some practical tips to enhance your safety:

Start Small: Begin with a minimal deposit to test the platform before scaling up.

Use Risk Management Tools: Leverage stop-loss orders and take-profit levels to protect your capital.

Verify Your Account: Complete the KYC process fully to avoid withdrawal issues.

Monitor Local Laws: Stay updated on SECP and SBP regulations, as changes could impact international brokers.

Educate Yourself: Utilize Exness’s free educational resources (webinars, tutorials) to improve your trading skills.

Conclusion: Is Exness Safe in Pakistan?

So, is Exness safe in Pakistan? The answer is a qualified yes. Exness offers a secure trading environment backed by international regulations, segregated accounts, negative balance protection, and robust security measures. Its global reputation, transparent operations, and tailored features like Islamic accounts make it a compelling choice for Pakistani traders. However, the lack of SECP regulation introduces some risk, particularly regarding local dispute resolution and investor protection.

💥 Trade with Exness now: Open An Account or Visit Brokers

For most Pakistani traders, Exness strikes a balance between safety and accessibility, especially for those comfortable with its international oversight. If you value low costs, high leverage, and a trusted platform, Exness is worth considering—just proceed with caution, conduct due diligence, and trade responsibly. Ready to explore Exness for yourself? Open an account today and experience its offerings firsthand, but always prioritize your financial security above all else.

Read more: