11 minute read

Is Exness Regulated in Pakistan? A Deep Dive into Forex Trading

Forex trading has surged in popularity across the globe, and Pakistan is no exception. With its promise of financial independence and the allure of global markets, many Pakistani traders are turning to platforms like Exness to explore trading opportunities. However, a critical question looms large for anyone venturing into this space: Is Exness regulated in Pakistan? This article aims to answer that question comprehensively, exploring Exness’s regulatory status, the forex trading landscape in Pakistan, and what it all means for local traders. By the end, you’ll have a clear understanding of whether Exness is a safe and legal option for you.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? An Overview of the Platform

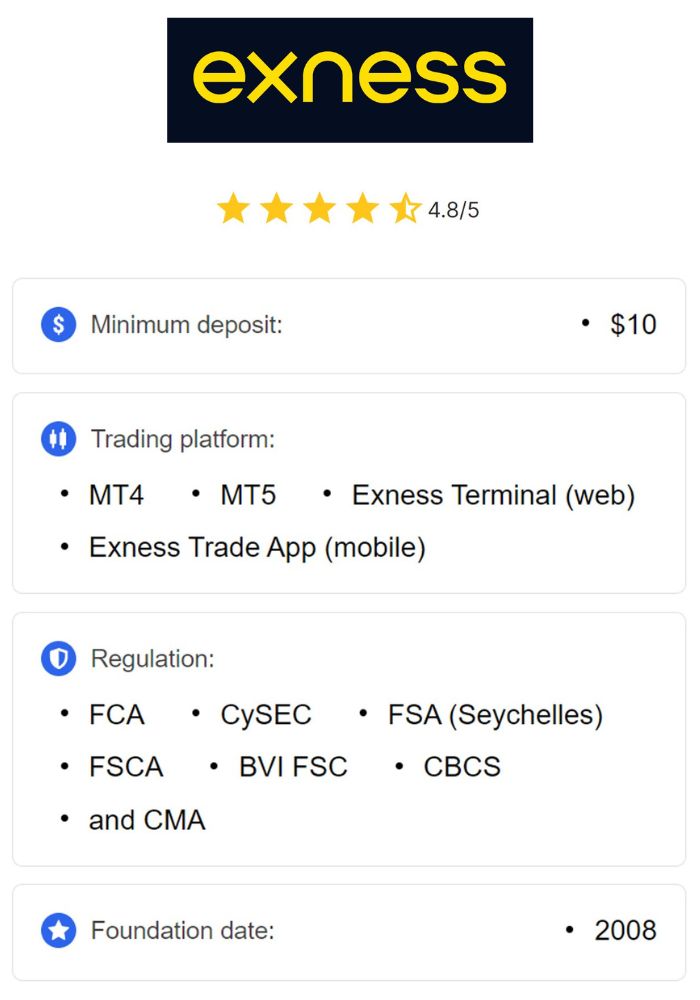

Before diving into the specifics of regulation, let’s first understand what Exness is. Founded in 2008, Exness is a globally recognized online broker specializing in forex and Contracts for Difference (CFDs). Headquartered in Cyprus, the company has grown into a powerhouse, serving millions of traders across more than 200 countries. Exness offers a wide range of trading instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies, making it a versatile platform for both beginners and seasoned traders.

Exness stands out for its competitive trading conditions, such as tight spreads, high leverage (up to 1:2000 or even unlimited in some cases), and fast execution speeds. The broker supports popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside its proprietary Exness Terminal and mobile apps. Additionally, Exness is known for its transparency, regularly publishing financial reports audited by reputable firms like Deloitte, one of the "Big Four" accounting organizations.

But while Exness enjoys a stellar reputation globally, its regulatory status varies by region. For Pakistani traders, understanding how this applies locally is crucial. Let’s explore the regulatory framework in Pakistan to set the stage.

Forex Trading in Pakistan: The Legal Landscape

Forex trading in Pakistan operates in a somewhat unique environment. Unlike countries with well-established forex regulatory bodies (e.g., the U.S. with the CFTC or the UK with the FCA), Pakistan lacks a dedicated authority solely focused on forex trading. Instead, oversight falls under two primary institutions: the Securities and Exchange Commission of Pakistan (SECP) and the State Bank of Pakistan (SBP).

The Role of the SECP

The SECP is Pakistan’s primary financial regulatory body, tasked with supervising securities markets, commodities, and other financial activities. Its mission is to ensure transparency, protect investors, and maintain the integrity of the financial system. For forex brokers to operate legally within Pakistan, they must register with the SECP and obtain a license. This process involves meeting strict financial and operational standards, such as maintaining segregated client accounts, adhering to anti-money laundering (AML) protocols, and complying with Know Your Customer (KYC) requirements.

However, the SECP’s jurisdiction primarily applies to brokers physically based in Pakistan or explicitly targeting Pakistani residents with localized services. International brokers like Exness, which operate online and cater to a global audience, often fall outside this direct oversight—creating a gray area for traders.

The State Bank of Pakistan’s Influence

The SBP, as the country’s central bank, plays a complementary role by regulating foreign exchange transactions under the Foreign Exchange Regulation Act of 1947. The SBP oversees currency exchange, capital flows, and remittances, ensuring that forex trading doesn’t destabilize Pakistan’s economy or lead to illegal outflows of foreign currency. While the SBP doesn’t directly regulate forex brokers, its policies impact how traders interact with international platforms, particularly regarding funding and withdrawals.

Forex trading itself is legal in Pakistan, provided it adheres to these regulations. Pakistani residents can trade currencies through licensed local brokers or international platforms, but the lack of a clear framework for offshore brokers raises questions about compliance and safety. With this in mind, let’s examine Exness’s regulatory status.

Is Exness Regulated Globally?

Exness operates under a multi-jurisdictional regulatory framework, which is a key factor in its global credibility. The broker is licensed and supervised by several reputable financial authorities worldwide. Here’s a breakdown of its primary regulators:

Cyprus Securities and Exchange Commission (CySEC): Exness Europe Limited is regulated by CySEC under license number 178/12. CySEC is a respected regulator within the European Union, enforcing strict rules aligned with the Markets in Financial Instruments Directive (MiFID II). This includes client fund segregation, regular audits, and participation in the Investor Compensation Fund (ICF), which offers up to €20,000 in protection per client in case of broker insolvency.

Financial Conduct Authority (FCA) – UK: Exness (UK) Ltd is authorized and regulated by the FCA, one of the world’s most stringent financial regulators. The FCA imposes rigorous standards for transparency, client protection, and financial stability, including the Financial Services Compensation Scheme (FSCS), which covers up to £85,000 per client.

Financial Services Authority (FSA) – Seychelles: Exness (SC) Ltd, the entity serving most international clients (including Pakistan), is regulated by the FSA Seychelles under license number SD025. While less stringent than CySEC or the FCA, this regulator still requires compliance with basic financial standards.

Other Jurisdictions: Exness also holds licenses from the Financial Sector Conduct Authority (FSCA) in South Africa, the Central Bank of Curaçao and Sint Maarten (CBCS), the Financial Services Commission (FSC) in Mauritius and the British Virgin Islands, and the Capital Markets Authority (CMA) in Kenya. This multi-tiered regulation enhances its trustworthiness on a global scale.

These licenses demonstrate Exness’s commitment to operating within established financial frameworks. But how does this translate to Pakistan?

Is Exness Regulated in Pakistan Specifically?

The short answer is no, Exness is not directly regulated by the SECP or any Pakistani authority. Exness does not hold a specific license to operate within Pakistan, nor does it have a physical presence or localized office in the country. Instead, Pakistani traders access Exness through its international entities, primarily Exness (SC) Ltd, regulated by the FSA Seychelles.

This lack of local regulation doesn’t mean Exness is banned or illegal in Pakistan—it simply operates as an offshore broker. Many international forex brokers follow a similar model, offering services to clients in regions where they aren’t locally licensed, relying instead on their global regulatory credentials. For Pakistani traders, this raises two key considerations: legality and safety.

💥 Trade with Exness now: Open An Account or Visit Brokers

Is It Legal to Trade with Exness in Pakistan?

Forex trading with offshore brokers like Exness falls into a legal gray area in Pakistan. The SBP and SECP have not explicitly banned Pakistani residents from using international platforms, and thousands of traders in the country actively use Exness without reported legal repercussions. However, the SECP has issued warnings about the risks of trading with unregulated or unlicensed brokers, emphasizing that such activities may not offer the same protections as dealing with a locally licensed entity.

From a practical standpoint, Pakistani traders can open accounts with Exness, deposit funds, and trade, provided they comply with SBP rules on foreign exchange transactions (e.g., using legitimate payment methods and declaring income for tax purposes). The absence of a local ban or restriction means Exness remains accessible, but traders must proceed with caution due to the lack of direct oversight by Pakistani authorities.

Is Exness Safe for Pakistani Traders?

While Exness isn’t regulated in Pakistan, its global licenses provide a layer of security. Here’s why it’s considered safe by many traders:

Fund Segregation: Exness keeps client funds in segregated accounts, separate from company funds, reducing the risk of loss in case of broker insolvency.

Regular Audits: Independent audits by Deloitte ensure transparency in financial operations.

Negative Balance Protection: Exness offers this feature to prevent traders from losing more than their deposited funds, a significant safeguard in volatile markets.

SSL Encryption: The platform uses advanced encryption to protect user data and transactions.

However, because Exness isn’t under SECP jurisdiction, Pakistani traders may face challenges in resolving disputes or seeking compensation if issues arise. The lack of local investor protection schemes (like those offered by CySEC or the FCA) is a notable drawback.

Benefits of Trading with Exness in Pakistan

Despite the regulatory ambiguity, Exness offers several advantages that make it appealing to Pakistani traders:

1. Low Minimum Deposit

Exness allows traders to start with as little as $1 for Standard accounts, making it accessible for beginners or those with limited capital—a significant plus in Pakistan’s developing forex market.

2. High Leverage Options

With leverage up to 1:2000 (or unlimited under certain conditions), Exness enables traders to maximize potential profits with small investments. However, this also amplifies risk, requiring careful management.

3. Wide Range of Instruments

From forex pairs to cryptocurrencies, Exness provides over 200 trading instruments, offering diversification opportunities for Pakistani traders looking to explore global markets.

4. Fast Withdrawals

Exness is renowned for its instant withdrawal processing, a critical feature for traders needing quick access to funds. Local payment methods like bank cards and e-wallets are supported, though availability may vary.

5. Islamic Accounts

For Pakistan’s predominantly Muslim population, Exness offers swap-free Islamic accounts compliant with Sharia law, eliminating interest charges on overnight positions.

6. User-Friendly Platforms

MT4, MT5, and the Exness mobile app provide robust tools for technical analysis, automated trading, and on-the-go access—ideal for Pakistan’s tech-savvy younger generation.

Risks of Trading with Exness in Pakistan

While the benefits are compelling, there are risks to consider:

1. Lack of Local Regulation

Without SECP oversight, traders lack a direct avenue for legal recourse in Pakistan, relying instead on Exness’s international regulators.

2. Currency Exchange Risks

Fluctuations in the Pakistani Rupee (PKR) can affect profits when converting funds to or from USD, the primary trading currency on Exness.

3. Leverage Risks

High leverage, while advantageous, can lead to significant losses, especially for inexperienced traders.

4. Limited Local Support

Although Exness offers 24/7 customer support in multiple languages, there’s no dedicated Pakistani office, which could delay resolution of region-specific issues.

How to Verify Exness’s Regulatory Status

For peace of mind, Pakistani traders can verify Exness’s licenses through the following steps:

Visit Regulator Websites: Check CySEC (www.cysec.gov.cy), FCA (www.fca.org.uk), or FSA Seychelles (www.fsaseychelles.sc) and search for Exness’s entities (e.g., Exness Europe Ltd, Exness UK Ltd, or Exness SC Ltd).

Confirm License Numbers: Cross-reference license numbers listed on Exness’s website (e.g., CySEC 178/12, FCA 730729, FSA SD025).

Contact Exness Support: Request clarification on which entity serves Pakistani clients and its regulatory status.

Alternatives to Exness in Pakistan

If the lack of local regulation is a dealbreaker, consider these SECP-regulated or globally reputable alternatives:

IG Group: Regulated by the FCA and ASIC, offering a wide range of instruments.

XM: Licensed by CySEC and ASIC, known for low spreads and educational resources.

Local Brokers: Firms like Arif Habib Limited or AKD Securities, though they may lack the forex focus of international platforms.

Tips for Safe Forex Trading in Pakistan with Exness

To mitigate risks while using Exness, follow these best practices:

Start Small: Use a demo account or low deposit to test the platform.

Understand Leverage: Limit exposure to avoid margin calls.

Use Secure Payment Methods: Opt for regulated channels like bank transfers or verified e-wallets.

Stay Informed: Monitor SBP and SECP announcements for regulatory updates.

Keep Records: Document trades and earnings for tax compliance.

The Future of Exness in Pakistan

As forex trading grows in Pakistan, regulatory clarity may emerge. The SECP could tighten rules on offshore brokers, potentially requiring Exness to seek local licensing or face restrictions. Alternatively, Exness might proactively establish a presence in Pakistan to tap into this expanding market. For now, its status remains unchanged: accessible, but unregulated locally.

Conclusion: Should You Trade with Exness in Pakistan?

So, is Exness regulated in Pakistan? Not directly by local authorities, but its robust global regulation offers a degree of reliability. For Pakistani traders, Exness presents a compelling option due to its low entry barriers, diverse offerings, and strong reputation. However, the absence of SECP oversight means you must weigh the benefits against the risks, particularly regarding legal recourse and fund protection.

If you prioritize accessibility and advanced trading tools over local regulation, Exness is worth considering. But if local compliance is non-negotiable, exploring SECP-licensed brokers might be safer. Ultimately, your decision should align with your risk tolerance, trading goals, and commitment to due diligence.

Ready to explore Exness? Start with a demo account to test the waters, and always trade responsibly. The forex market offers opportunities, but knowledge and caution are your best allies.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: