9 minute read

Is Exness Regulated in UAE? Review Broker 2025

The United Arab Emirates (UAE) has emerged as a global hub for finance and innovation, attracting traders from around the world to its bustling cities like Dubai and Abu Dhabi. With a tax-free environment, a thriving expat community, and a strategic location, it’s no wonder forex trading has taken root here. Among the brokers capturing attention in the UAE is Exness, a globally recognized name in forex and CFD trading. But one question stands out for UAE residents considering this platform: Is Exness regulated in the UAE?

💥 Trade with Exness now: Open An Account or Visit Brokers

This article dives deep into Exness’s regulatory status in the UAE, its legality for local traders, and what it means for your trading journey. Whether you’re a novice exploring forex or a seasoned trader seeking a reliable broker, understanding Exness’s standing in the UAE is crucial. Let’s break it down step by step.

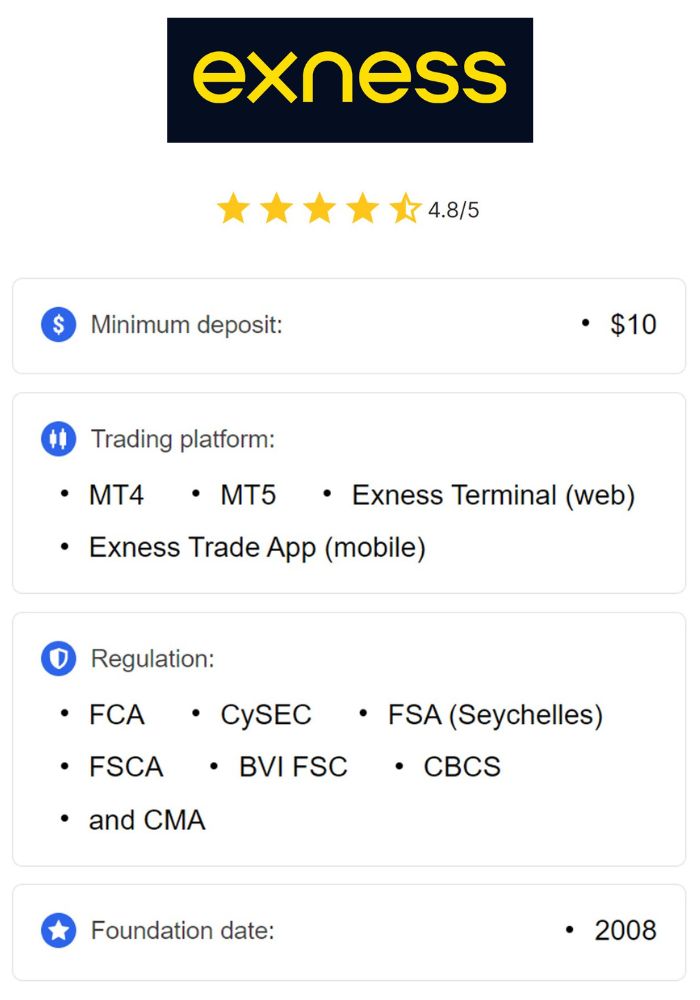

What is Exness? A Snapshot of the Broker

Before tackling the regulatory question, let’s get to know Exness. Established in 2008, Exness is a Cyprus-based forex and CFD broker that has grown into a global giant, serving millions of clients across 150+ countries. Known for its competitive trading conditions, Exness offers tight spreads (starting at 0.0 pips), leverage up to 1:Unlimited, and a variety of trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its own mobile app.

Exness provides access to a wide range of instruments—forex pairs, commodities, indices, stocks, and cryptocurrencies—making it versatile for traders with diverse strategies. Its appeal lies in its transparency, fast execution, and client-centric features like instant withdrawals. For UAE traders, these perks are enticing, but they come with a need for clarity: Does Exness comply with local regulations?

Why Regulation Matters in Forex Trading

Forex trading is inherently risky. Market fluctuations, high leverage, and broker reliability all play a role in your success—or potential losses. Regulation serves as a safeguard, ensuring brokers operate ethically and protect clients. A regulated broker must follow rules set by a financial authority, such as:

Segregating client funds: Keeping your money separate from the broker’s own funds.

Maintaining transparency: Disclosing fees, risks, and trading conditions upfront.

Adhering to standards: Complying with anti-money laundering (AML) and know-your-customer (KYC) requirements.

Without regulation, traders risk fraud, fund mismanagement, or lack of recourse in disputes. In the UAE, where financial markets are tightly monitored, regulation is a cornerstone of trust. So, how does the UAE regulate forex trading, and where does Exness fit in?

Forex Trading in the UAE: The Regulatory Framework

The UAE’s financial system is sophisticated, balancing innovation with strict oversight. Forex trading is legal, but it’s governed by a dual regulatory structure based on geography and jurisdiction:

1. Dubai International Financial Centre (DIFC)

The DIFC is a financial free zone in Dubai with its own legal and regulatory ecosystem. The Dubai Financial Services Authority (DFSA) oversees all financial activities here, including forex and CFD trading. Brokers operating in the DIFC must secure a DFSA license, which involves rigorous checks on capital adequacy, client protection, and compliance.

2. UAE Mainland (Outside Free Zones)

Beyond the DIFC, the UAE mainland falls under the jurisdiction of two key bodies:

Securities and Commodities Authority (SCA): Regulates financial markets, including forex brokers operating outside free zones.

Central Bank of the UAE (CBUAE): Oversees banking, foreign exchange transactions, and broader financial stability.

Both the SCA and CBUAE enforce strict rules to protect investors and maintain market integrity. However, a critical point for UAE traders: the country’s laws don’t explicitly ban residents from using offshore brokers—those regulated outside the UAE—as long as they meet international standards and comply with local financial regulations (e.g., AML/KYC).

This dual system creates a unique landscape for brokers like Exness. Let’s explore its specific status.

Is Exness Regulated in the UAE?

Here’s the straightforward answer: No, Exness is not directly regulated in the UAE. It doesn’t hold a license from the DFSA (for the DIFC) or the SCA (for the mainland). But this isn’t the full story—regulation in forex is rarely black-and-white, especially for global brokers.

💥 Trade with Exness now: Open An Account or Visit Brokers

Exness operates under a multi-jurisdictional regulatory framework, holding licenses from several respected international authorities:

Cyprus Securities and Exchange Commission (CySEC): Regulates Exness (Cy) Ltd under EU financial laws, ensuring high standards for transparency and client safety.

Financial Conduct Authority (FCA): Oversees Exness (UK) Ltd in the UK, a top-tier regulator known for its rigorous oversight.

Financial Services Authority (FSA): Licenses Exness (SC) Ltd in Seychelles, catering to non-EU markets like the UAE.

Additional Licenses: Exness is also regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, the Capital Markets Authority (CMA) in Kenya, and others.

For UAE traders, Exness typically operates through its Seychelles entity (Exness SC Ltd). The FSA in Seychelles is a Tier-3 regulator—less stringent than CySEC or FCA—but it still enforces standards like fund segregation and fair trading practices.

So, while Exness lacks a UAE-specific license, its global regulatory portfolio lends it credibility. The real question is whether this makes it legal and safe for UAE traders.

Is Exness Legal in the UAE?

Legality depends on how UAE laws treat offshore brokers. Here’s the analysis:

Offshore Brokers and UAE Law

UAE regulations permit residents to trade with internationally licensed brokers, even without local oversight, under these conditions:

The broker holds valid licenses from recognized global regulators.

Traders comply with UAE financial laws (e.g., reporting income if applicable, though individual forex profits are tax-free in the UAE).

The broker doesn’t falsely claim local regulation or target DIFC clients without a DFSA license.

Exness ticks these boxes. Its CySEC, FCA, and FSA licenses are from reputable jurisdictions, and it doesn’t misrepresent its status in the UAE. For mainland traders (outside the DIFC), using Exness as an offshore broker is within legal bounds. The UAE doesn’t block access to such platforms, and Exness’s adherence to AML/KYC aligns with CBUAE and SCA expectations.

DIFC Exception

If you’re based in the DIFC, the situation changes. The DFSA’s jurisdiction applies strictly, and using an unregulated (in DIFC terms) broker like Exness could violate local rules. However, most retail traders in the UAE operate outside the DIFC, making Exness a practical option.

Conclusion

Yes, Exness is legal for UAE traders outside the DIFC to use as an offshore broker. Its international licenses provide a foundation of legitimacy, even without SCA or DFSA oversight.

How Safe is Exness for UAE Traders?

Legality is one thing; safety is another. Here’s how Exness measures up:

1. Client Fund Protection

Exness segregates client funds in top-tier banks, separate from its own capital. This practice, required by its regulators, ensures your money is secure if the broker faces financial trouble.

2. Negative Balance Protection

With leverage up to 1:Unlimited, losses can escalate quickly. Exness offers negative balance protection, resetting your account to zero if it goes negative—a vital feature for high-leverage traders.

3. Multi-Regulatory Oversight

The FCA and CySEC are Tier-1 regulators with strict standards, while the FSA in Seychelles provides credible, if lighter, supervision. This layered regulation reduces risks of misconduct.

4. Financial Commission Backing

Exness is a member of the Financial Commission, an independent dispute resolution body offering up to €20,000 in compensation per client—a safety net beyond regulatory requirements.

5. Transparency and Reliability

Exness publishes real-time spread data, audited financials, and clear terms on its website, building trust through openness.

For UAE traders, these features offer significant protection, even without local regulation. Still, it’s worth comparing Exness to UAE-regulated alternatives.

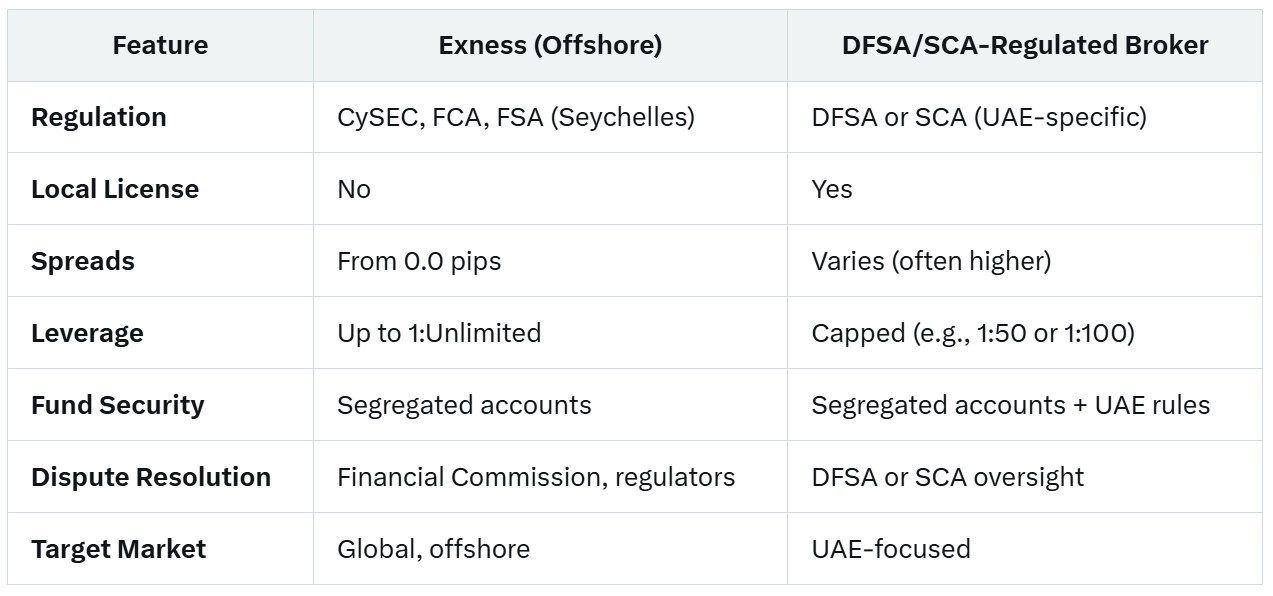

Exness vs. UAE-Regulated Brokers: A Side-by-Side Look

How does Exness stack up against brokers licensed by the DFSA or SCA? Here’s a comparison:

Cost Efficiency: Exness offers tighter spreads and higher leverage, ideal for cost-sensitive traders.

Local Assurance: DFSA/SCA brokers provide UAE-specific protections and easier dispute resolution.

Flexibility: Exness suits traders comfortable with offshore platforms; local brokers appeal to those prioritizing UAE oversight.

Your preference hinges on whether you value trading flexibility or local regulatory comfort.

Getting Started with Exness in the UAE

Ready to trade with Exness from the UAE? Here’s how:

Step 1: Confirm Your Jurisdiction

Ensure you’re outside the DIFC or not subject to its rules. Most UAE traders fall under mainland laws, where offshore brokers are allowed.

Step 2: Sign Up

Go to the Exness website.

Register with your email and phone number.

Complete KYC (upload ID and proof of address).

Step 3: Fund Your Account

Exness supports UAE-friendly payment options:

Bank Cards: Visa, Mastercard.

Cryptocurrencies: Bitcoin, USDT, Ethereum—popular given the UAE’s crypto-friendly stance.

E-Wallets: Skrill, Neteller (check availability).

Local bank transfers may face restrictions due to forex regulations, but crypto and e-wallets are seamless alternatives.

Step 4: Trade

Choose your platform (MT4, MT5, or Exness app), select an account type (Standard, Raw Spread, Pro), and start trading.

Pros and Cons of Exness for UAE Traders

Pros

Low Costs: Spreads from 0.0 pips and no hidden fees.

High Leverage: Up to 1:Unlimited for experienced traders.

Global Trust: Regulated by CySEC, FCA, and FSA.

Fast Withdrawals: Funds available in minutes.

Cons

No UAE License: Lacks DFSA or SCA regulation.

Leverage Risks: High leverage can lead to significant losses.

Limited Local Support: Offshore status may complicate disputes.

What UAE Traders Think of Exness

UAE-based traders often share positive experiences with Exness:

Strengths: Low spreads, quick withdrawals, and reliable platforms stand out.

Reservations: Some express caution about the lack of local regulation, though they trust Exness’s global reputation.

Exness enjoys popularity in the UAE’s trading circles, particularly among those prioritizing cost and performance.

Alternatives to Exness in the UAE

If you prefer a locally regulated broker, consider these options:

IG Group: DFSA-regulated with a broad asset range.

Saxo Bank: Offers premium tools and SCA/DFSA oversight.

Pepperstone: Known for competitive spreads and local licensing.

These brokers trade higher costs or lower leverage for UAE-specific regulation.

Final Thoughts: Should You Use Exness in the UAE?

Is Exness regulated in the UAE? No, it doesn’t hold a DFSA or SCA license. Is it legal? Yes, for traders outside the DIFC, it’s a lawful offshore option backed by international regulators.

Exness shines if you seek:

Affordable trading with low spreads.

High leverage for aggressive strategies.

A globally trusted platform with robust safety features.

If local regulation is non-negotiable, a DFSA- or SCA-licensed broker might be a better fit. Weigh your goals—cost, flexibility, or local oversight—and choose accordingly.

Ready to dive in? Explore Exness today and tap into the UAE’s vibrant forex market with confidence.

Read more: