11 minute read

Exness broker charges? Exness Fees Explained

When it comes to online trading, one of the most critical factors influencing your success is understanding the costs involved. Broker fees can make or break your profitability, especially if you’re a frequent trader or managing a tight budget. Among the many brokers available, Exness stands out as a popular choice for traders worldwide, thanks to its competitive offerings and transparent approach. But what exactly are the Exness broker charges, and how do they impact your trading? In this in-depth guide, we’ll break down everything you need to know about Exness fees, from spreads and commissions to hidden costs and comparisons with other brokers. Whether you’re a beginner or a seasoned trader, this article will equip you with the knowledge to make informed decisions.

💥 Trade with Exness now: Open An Account or Visit Brokers

What is Exness? A Quick Overview

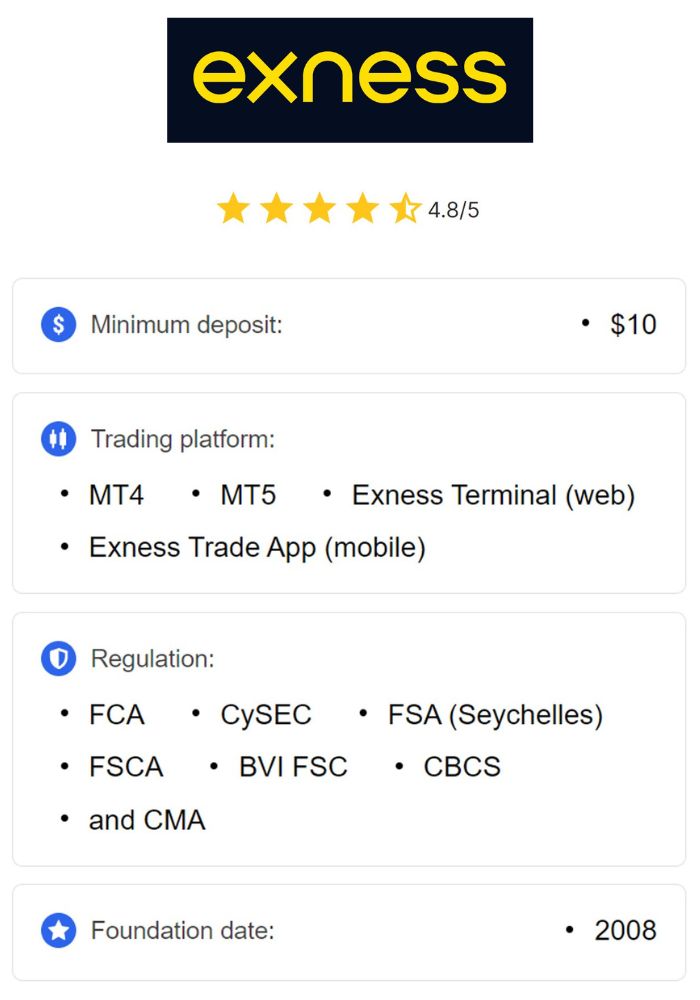

Before diving into the fees, let’s establish what Exness is and why it’s a go-to broker for over a million traders. Founded in 2008, Exness has grown into a globally recognized trading platform, offering access to forex, commodities, cryptocurrencies, stocks, and indices. Headquartered in Cyprus, it operates under strict regulations from authorities like the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), and others, ensuring a secure trading environment.

Exness is known for its user-friendly platforms (MetaTrader 4, MetaTrader 5, and its proprietary app), lightning-fast execution speeds, and a variety of account types tailored to different trading styles. But what truly sets it apart is its commitment to keeping costs low for traders. Unlike some brokers that pile on hidden fees, Exness emphasizes transparency, making it easier for users to calculate their expenses. So, let’s explore the Exness fee structure in detail.

Why Understanding Broker Charges Matters

Broker charges aren’t just numbers on a screen—they directly affect your bottom line. Whether you’re scalping for small profits or holding positions long-term, every pip, commission, or swap fee counts. Ignoring these costs can lead to unexpected losses, especially for high-volume traders. By understanding Exness broker charges, you can:

Maximize Profits: Lower fees mean more of your earnings stay in your pocket.

Choose the Right Account: Different account types come with varying costs, so knowing the fees helps you pick the best fit.

Plan Strategically: Awareness of spreads and overnight fees allows you to optimize your trading strategy.

With that in mind, let’s dissect the main types of fees you’ll encounter with Exness.

Types of Exness Broker Charges

Exness fees fall into two broad categories: trading fees and non-trading fees. Trading fees are costs tied directly to your trades, while non-trading fees cover account maintenance and fund transfers. Here’s a breakdown of each.

1. Trading Fees

Trading fees are the heart of any broker’s cost structure. At Exness, these include spreads, commissions, and swap fees. Let’s explore each one.

Spreads: The Primary Trading Cost

The spread is the difference between the bid (sell) and ask (buy) price of an asset. It’s essentially the broker’s fee for facilitating your trade. Exness offers both fixed and variable spreads, depending on the account type and market conditions.

Standard Accounts: These come with higher spreads (starting at 0.3 pips for major pairs like EUR/USD) but no commissions. They’re ideal for beginners or casual traders who prefer simplicity.

Pro Accounts: Designed for experienced traders, Pro accounts offer tighter spreads (from 0.1 pips) with no commissions, striking a balance between cost and flexibility.

Raw Spread Accounts: These provide ultra-low spreads (from 0.0 pips) but charge a commission per trade. Scalpers and high-frequency traders love this option.

Zero Accounts: As the name suggests, Zero accounts offer 0-pip spreads on select instruments for a fixed commission, perfect for precision trading.

Exness stands out by offering some of the tightest spreads in the industry. For example, EUR/USD spreads on Raw Spread accounts can drop to 0.0 pips during stable market conditions, making it a cost-effective choice compared to competitors like XM or IC Markets, where spreads often start higher.

Commissions: Account-Specific Charges

Not all Exness accounts charge commissions, which is a big plus for cost-conscious traders. Commissions only apply to Raw Spread and Zero accounts:

Raw Spread Accounts: A commission of $3.50 per lot per side ($7 round-turn) is charged. This scales proportionally for smaller lot sizes, making it affordable even for micro-traders.

Zero Accounts: Commissions vary by instrument, ranging from $0.05 to $3.50 per lot per side. For major forex pairs, it’s typically on the lower end.

Standard, Standard Cent, and Pro accounts are commission-free, relying solely on spreads. This flexibility lets you choose between paying a commission for tighter spreads or sticking to a commission-free model with slightly wider spreads.

Swap Fees: Overnight Holding Costs

Swap fees, also called overnight or rollover fees, apply when you hold a position past the trading day (typically 5 PM EST). They’re based on the interest rate differential between the two currencies in a forex pair or the cost of carrying a CFD position.

How It Works: If you’re long on a currency with a higher interest rate, you might earn a positive swap (a credit). If the reverse is true, you’ll pay a negative swap (a debit).

Exness Advantage: Exness offers swap-free accounts for traders in certain regions (often Islamic accounts), eliminating these fees entirely. For non-swap-free accounts, swap rates are competitive and transparent, with real-time updates available on their platform.

For example, holding a long EUR/USD position overnight might incur a small debit, while a USD/TRY position could yield a positive swap due to Turkey’s high interest rates. Traders can avoid swaps by closing positions daily or opting for swap-free accounts if eligible.

2. Non-Trading Fees

Non-trading fees cover everything outside of executing trades. Exness excels here by keeping these costs minimal or nonexistent.

Deposit Fees

Good news: Exness doesn’t charge deposit fees, regardless of the method you use. Whether you fund your account via bank transfer, credit/debit card, e-wallets (like Skrill or Neteller), or cryptocurrencies, Exness covers its side of the transaction costs. However, third-party providers (e.g., banks or payment processors) might apply their own fees, so it’s worth checking.

Withdrawal Fees

Exness also waives withdrawal fees for most methods, a rarity among brokers. You can withdraw to bank cards, e-wallets, or crypto wallets without Exness tacking on extra charges. Processing is often instant for e-wallets and crypto, while bank transfers may take 1-3 days. Again, third-party fees (like bank wire charges) could apply, but Exness itself keeps it free.

Inactivity Fees

Unlike many brokers that penalize dormant accounts, Exness doesn’t charge inactivity fees. Whether you trade daily or take a year-long break, your account balance remains untouched by administrative costs.

Currency Conversion Fees

If your account currency differs from the asset you’re trading or the payment method you’re using, Exness applies a market-based conversion rate. There’s no additional markup from Exness, but the exchange rate itself could impact your costs slightly. To minimize this, fund your account in the same currency as your trades (e.g., USD for forex majors).

💥 Trade with Exness now: Open An Account or Visit Brokers

Exness Account Types and Their Fees

Exness offers five main account types, each with a unique fee structure. Here’s how they stack up:

Standard Account

Spreads: From 0.3 pips

Commissions: None

Swap Fees: Applicable (swap-free option available)

Best For: Beginners and low-volume traders

Standard Cent Account

Spreads: From 0.3 pips

Commissions: None

Swap Fees: Applicable (swap-free option available)

Best For: Micro-trading and risk-averse beginners

Pro Account

Spreads: From 0.1 pips

Commissions: None

Swap Fees: Applicable (swap-free option available)

Best For: Experienced traders seeking low spreads without commissions

Raw Spread Account

Spreads: From 0.0 pips

Commissions: $3.50 per lot per side

Swap Fees: Applicable (swap-free option available)

Best For: Scalpers and high-frequency traders

Zero Account

Spreads: 0 pips on select instruments

Commissions: $0.05–$3.50 per lot per side

Swap Fees: Applicable (swap-free option available)

Best For: Precision traders targeting major pairs

Choosing the right account depends on your trading style. Day traders might prefer Raw Spread or Zero accounts for tight spreads, while swing traders could opt for Standard or Pro accounts to avoid commissions.

How Exness Fees Compare to Other Brokers

To see if Exness truly offers value, let’s compare its fees with competitors like IC Markets, XM, and Pepperstone.

Spreads: Exness Raw Spread (0.0 pips) and Zero (0 pips) accounts beat XM’s standard spreads (1.6 pips) and rival IC Markets’ raw spreads (0.0–0.1 pips). Pepperstone’s Razor account is close, with spreads from 0.0 pips, but its commissions are slightly higher.

Commissions: Exness’ $7 round-turn commission on Raw Spread accounts is competitive with IC Markets ($7) and Pepperstone ($7–$7.50). XM’s commission-free model comes with wider spreads, negating the savings.

Swap Fees: Exness’ swap-free option gives it an edge over XM and Pepperstone, which charge swaps unless you qualify for Islamic accounts. IC Markets also offers swap-free trading but with stricter eligibility.

Non-Trading Fees: Exness’ zero deposit, withdrawal, and inactivity fees outshine XM (withdrawal fees apply) and Pepperstone (inactivity fees after 12 months).

Overall, Exness holds its own as a low-cost broker, especially for traders prioritizing tight spreads and no hidden fees.

Hidden Fees: Are There Any with Exness?

One concern traders often have is hidden fees—costs not immediately obvious on a broker’s website. With Exness, transparency is a priority. There are no account management fees, no charges for opening an account, and no penalties for inactivity. The only potential “hidden” costs come from third-party providers (e.g., bank fees) or currency conversion, both of which Exness discloses upfront. Always review the terms for your specific payment method and account type to avoid surprises.

How to Minimize Exness Fees

Want to keep your trading costs as low as possible? Here are some practical tips:

Choose the Right Account: Match your account to your strategy—Raw Spread for scalping, Standard for casual trading.

Avoid Overnight Positions: Close trades daily to skip swap fees, or use a swap-free account if available.

Use Local Payment Methods: Fund your account in your base currency to avoid conversion fees.

Monitor Market Conditions: Spreads widen during volatility, so trade during stable hours for the best rates.

Leverage Tools: Use Exness’ fee calculator (available on their site) to estimate costs before trading.

Pros and Cons of Exness Fees

Pros

Ultra-low spreads (from 0.0 pips) on premium accounts

No deposit, withdrawal, or inactivity fees

Swap-free accounts for eligible traders

Transparent pricing with no hidden charges

Competitive commissions compared to industry standards

Cons

Commissions on Raw Spread and Zero accounts may deter low-volume traders

Swap fees apply unless you qualify for swap-free trading

Third-party payment fees are out of Exness’ control

Real-World Examples of Exness Fees

Let’s put theory into practice with two scenarios:

Scalping EUR/USD on a Raw Spread Account

Trade Size: 1 lot

Spread: 0.0 pips

Commission: $7 round-turn

Total Cost: $7

If the market moves 5 pips in your favor, your profit is $50 – $7 = $43.

Swing Trading GBP/USD on a Standard Account

Trade Size: 1 lot

Spread: 0.3 pips ($3)

Swap Fee (3 nights): $2

Total Cost: $5

A 20-pip gain yields $200 – $5 = $195 profit.

These examples show how fees vary by account and strategy, highlighting the importance of aligning your choice with your goals.

Exness Fees: What Traders Are Saying

User feedback on platforms like Trustpilot and Forex Peace Army praises Exness for its low costs and fast withdrawals. Many highlight the absence of inactivity fees and the swap-free option as game-changers. Some scalpers note that Raw Spread commissions are a fair trade-off for near-zero spreads, though a few swing traders wish swap rates were lower across the board. Overall, Exness earns high marks for affordability and transparency.

Final Thoughts: Are Exness Fees Worth It?

Exness broker charges are among the most competitive in the industry, offering a blend of low spreads, flexible account options, and minimal non-trading fees. Whether you’re a beginner testing the waters with a Standard account or a pro scalping with a Raw Spread account, Exness delivers value without compromising on quality. Its transparency, lack of hidden fees, and swap-free offerings make it a standout choice.

That said, no broker is perfect. Commissions on premium accounts and potential swap costs for overnight traders are worth considering. Ultimately, Exness is ideal if you value low costs, fast execution, and a broker that puts your profits first. Ready to explore Exness for yourself? Sign up today and see why it’s trusted by over a million traders worldwide.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: