8 minute read

How to Trade XAUUSD in India: A Comprehensive Guide for Beginners

from Exness Global

Gold has always held a special place in the hearts of Indians. From jewelry to investment, it’s a symbol of wealth and security. But in today’s digital age, trading gold doesn’t just mean buying physical bars or coins—it means diving into the world of forex trading with XAUUSD, the trading pair that represents gold priced in U.S. dollars. If you’re in India and curious about how to trade XAUUSD, you’re in the right place. This guide will walk you through everything you need to know, from the basics to advanced strategies, ensuring you’re equipped to succeed in this exciting market.

Top 4 Best Forex Brokers

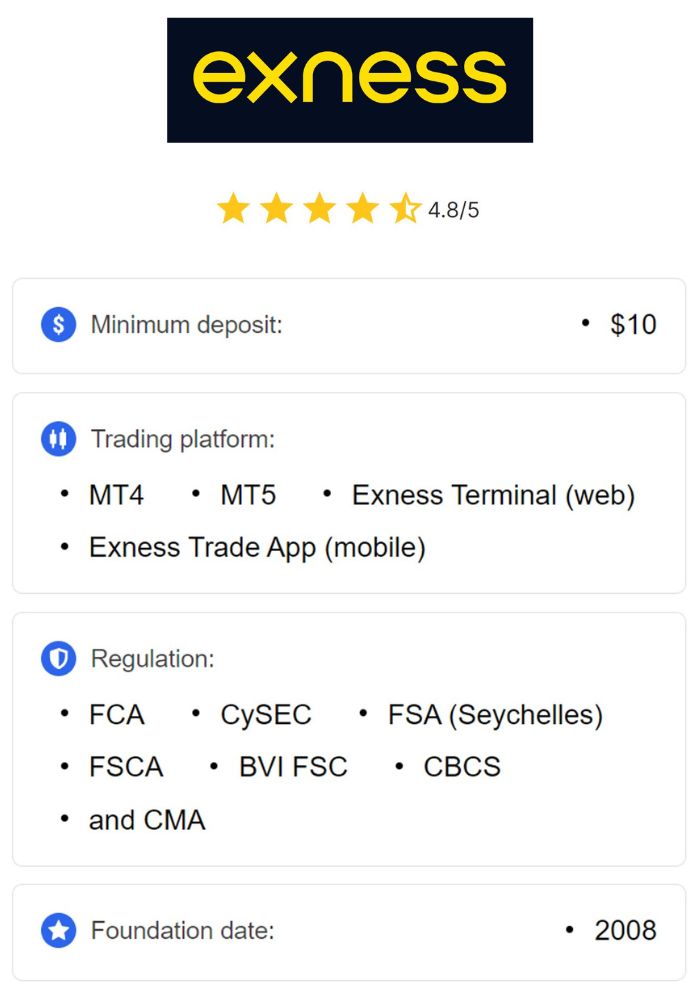

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

What Is XAUUSD?

XAUUSD is the ticker symbol used in forex trading to represent the price of one troy ounce of gold (XAU) in U.S. dollars (USD). Unlike stocks or traditional commodities, XAUUSD is traded on the forex market, which operates 24 hours a day, five days a week. For Indian traders, this means you can speculate on gold price movements without ever owning physical gold—a process known as Contracts for Difference (CFD) trading.

Gold’s value fluctuates based on global economic factors like inflation, interest rates, and geopolitical tensions, making XAUUSD a dynamic and potentially profitable trading instrument. But how do you get started in India, where forex trading regulations can seem complex? Let’s break it down step-by-step.

Why Trade XAUUSD in India?

Before diving into the "how," let’s explore the "why." Here are some compelling reasons to trade XAUUSD:

Hedge Against Inflation: Gold is often seen as a safe-haven asset. When the Indian rupee weakens or inflation rises, gold prices tend to increase, offering a hedge.

High Liquidity: The forex market, including XAUUSD, is one of the most liquid markets in the world, meaning you can enter and exit trades quickly.

Accessibility: You don’t need to buy physical gold or deal with storage costs—just a trading account and an internet connection.

24/5 Market: Unlike the Indian stock market, XAUUSD trading allows you to react to global events in real-time, even outside Indian business hours.

Cultural Affinity: Indians already understand gold’s value, making XAUUSD trading a natural extension of this knowledge.

Now that you’re sold on the idea, let’s get into the nitty-gritty of trading XAUUSD in India.

How to trade XAUUSD in India

Step 1: Understanding the Legal Landscape in India

Forex trading in India is regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Here’s what you need to know:

Currency Pairs Limitation: The RBI allows retail forex trading only in currency pairs involving the Indian Rupee (INR), such as USD/INR, EUR/INR, etc. Trading XAUUSD directly through Indian brokers isn’t permitted under RBI guidelines because it’s a commodity pair, not a currency pair involving INR.

Solution: To trade XAUUSD, Indian traders typically use international forex brokers that offer CFD trading. These brokers operate outside India but accept Indian clients.

FEMA Compliance: Under the Foreign Exchange Management Act (FEMA), you can remit up to $250,000 per year abroad for various purposes, including funding a trading account. Ensure your transactions comply with FEMA to avoid legal issues.

Choosing a Broker

Since you’ll likely use an international broker, prioritize these factors:

Regulation: Look for brokers regulated by reputable bodies like the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

Low Spreads: XAUUSD spreads can vary; choose a broker with competitive pricing.

Deposit Options: Ensure they accept Indian payment methods like bank cards or UPI.

Platform: Most brokers offer MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which are ideal for XAUUSD trading.

Popular brokers for Indian traders include Exness, XM and IC Markets. Always verify a broker’s legitimacy before depositing funds.

💥 Trade with Exness now: Open An Account or Visit Brokers

Step 2: Setting Up Your Trading Account

Once you’ve chosen a broker, follow these steps to get started:

Register: Sign up on the broker’s website with your email and personal details.

Verify Identity: Submit KYC documents (e.g., Aadhaar, PAN card, or passport) as required by international regulations.

Fund Your Account: Use a bank transfer, debit/credit card, or e-wallet to deposit funds. Be mindful of conversion rates from INR to USD.

Download a Platform: Install MT4/MT5 on your computer or phone. Most brokers also offer web-based platforms.

Locate XAUUSD: In the platform’s market watch, find XAUUSD (sometimes listed as GOLD or XAU/USD).

With your account ready, it’s time to understand the mechanics of trading gold.

Step 3: How XAUUSD Trading Works

XAUUSD trading involves speculating on whether gold’s price will rise (go long) or fall (go short). Here’s a breakdown:

Key Terms

Pip: The smallest price movement in XAUUSD. For gold, 1 pip is typically $0.01 per ounce.

Lot Size: Trading volume is measured in lots. A standard lot is 100 ounces, but retail traders often use mini (10 ounces) or micro (1 ounce) lots.

Spread: The difference between the buy (bid) and sell (ask) price. For XAUUSD, spreads might range from 20–50 cents per ounce, depending on the broker.

Leverage: Brokers offer leverage (e.g., 1:100), allowing you to control a large position with a small deposit. However, leverage amplifies both profits and losses.

Example Trade

Scenario: Gold is trading at $2,000 per ounce. You predict it will rise to $2,020.

Action: You buy 1 mini lot (10 ounces) with 1:100 leverage, risking $20 of your own money.

Outcome: If gold hits $2,020, you earn $20 (10 ounces x $2). After accounting for the spread (say $0.30), your net profit is $19.70.

This simplified example shows how small price movements can yield profits—or losses if the market moves against you.

Step 4: Developing a Trading Strategy

Success in XAUUSD trading requires a plan. Here are three proven strategies tailored for Indian traders:

1. Trend Following

Concept: Gold prices often trend during economic uncertainty. Use technical indicators like Moving Averages (MA) to identify trends.

How: If the 50-day MA crosses above the 200-day MA, it’s a buy signal (bullish trend). Reverse for a sell signal.

Best For: Long-term traders.

2. News-Based Trading

Concept: Gold reacts to U.S. economic data (e.g., Non-Farm Payrolls, Federal Reserve rate decisions) and geopolitical events.

How: Monitor an economic calendar and trade during high-impact news releases. For example, a U.S. interest rate hike might push XAUUSD down.

Best For: Short-term, aggressive traders.

3. Support and Resistance

Concept: Gold prices often bounce or break at key levels.

How: Use historical price charts to identify support (where prices stop falling) and resistance (where prices stop rising). Place buy orders near support and sell near resistance.

Best For: Beginners.

Tools to Use

Charts: Candlestick charts on MT4/MT5 for price analysis.

Indicators: RSI, MACD, and Bollinger Bands to gauge momentum and volatility.

Economic Calendar: Websites like Investing.com or Forex Factory for news schedules.

Step 5: Managing Risks

XAUUSD trading can be volatile, so risk management is critical. Here’s how to protect your capital:

Set Stop-Loss Orders: Automatically close a trade if losses hit a predefined level (e.g., $10 below your entry).

Use Proper Position Sizing: Risk only 1–2% of your account per trade. For a $1,000 account, that’s $10–20.

Avoid Over-Leveraging: High leverage (e.g., 1:500) can wipe out your account in a single bad trade. Stick to 1:50 or lower.

Diversify: Don’t put all your funds into XAUUSD—consider other pairs like USD/INR if permitted.

Step 6: Timing Your Trades in India

The forex market operates in GMT, so align your trading with India Standard Time (IST, GMT+5:30):

London Session (12:30 PM–8:30 PM IST): High volatility as European markets overlap with India.

New York Session (5:30 PM–2:30 AM IST): Peak activity when U.S. markets join, often driving XAUUSD movements.

Asian Session (4:30 AM–12:30 PM IST): Quieter, but still tradable.

Gold tends to move most during U.S. hours, so night owls in India might have an edge.

Step 7: Taxation and Withdrawals

Profits from XAUUSD trading are considered income in India and taxed accordingly:

Short-Term Capital Gains: If you hold trades for less than a year (common in forex), profits are taxed as per your income slab (e.g., 30% for high earners).

Documentation: Maintain records of trades and bank statements for tax filing.

Withdrawals: Repatriate profits to your Indian bank account via wire transfer, ensuring FEMA compliance.

Consult a tax professional to optimize your filings.

Common Mistakes to Avoid

Trading Without a Plan: Emotional decisions lead to losses.

Ignoring Spreads: High spreads can eat into small profits.

Overtrading: Stick to a few high-quality setups rather than chasing every price move.

Neglecting News: Gold is sensitive to global events—stay informed.

Advanced Tips for XAUUSD Trading

Once you’re comfortable with the basics, try these:

Correlate with USD: Since XAUUSD is gold in dollars, a strong USD often weakens gold prices, and vice versa.

Seasonal Trends: Gold often rises during Indian festive seasons (e.g., Diwali) due to physical demand.

Scalping: Use 1-minute or 5-minute charts for quick profits during volatile sessions.

Conclusion: Start Trading XAUUSD Today

Trading XAUUSD in India combines the country’s love for gold with the global reach of forex markets. While it requires navigating regulatory hurdles and choosing the right broker, the potential rewards make it worth the effort. Start small, practice on a demo account, and gradually build your skills. With discipline and strategy, XAUUSD trading can become a lucrative venture from the comfort of your home in India.

Ready to take the plunge? Open an account with a trusted broker, download MT4, and begin your journey into the golden world of XAUUSD trading. Happy trading!

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: