11 minute read

Is Exness Good for Beginners? A Comprehensive Guide for New Traders

When stepping into the world of online trading, beginners often face a daunting question: which broker should I choose? With countless options available, finding a platform that’s reliable, user-friendly, and beginner-focused can feel overwhelming. One name that frequently pops up in discussions is Exness. But is Exness good for beginners? In this in-depth guide, we’ll explore everything you need to know about Exness, from its features and account types to its tools, support, and overall suitability for those just starting their trading journey.

💥 Trade with Exness now: Open An Account or Visit Brokers

By the end of this article, you’ll have a clear understanding of whether Exness is the right fit for you as a novice trader. Let’s dive in!

What Is Exness? A Quick Overview

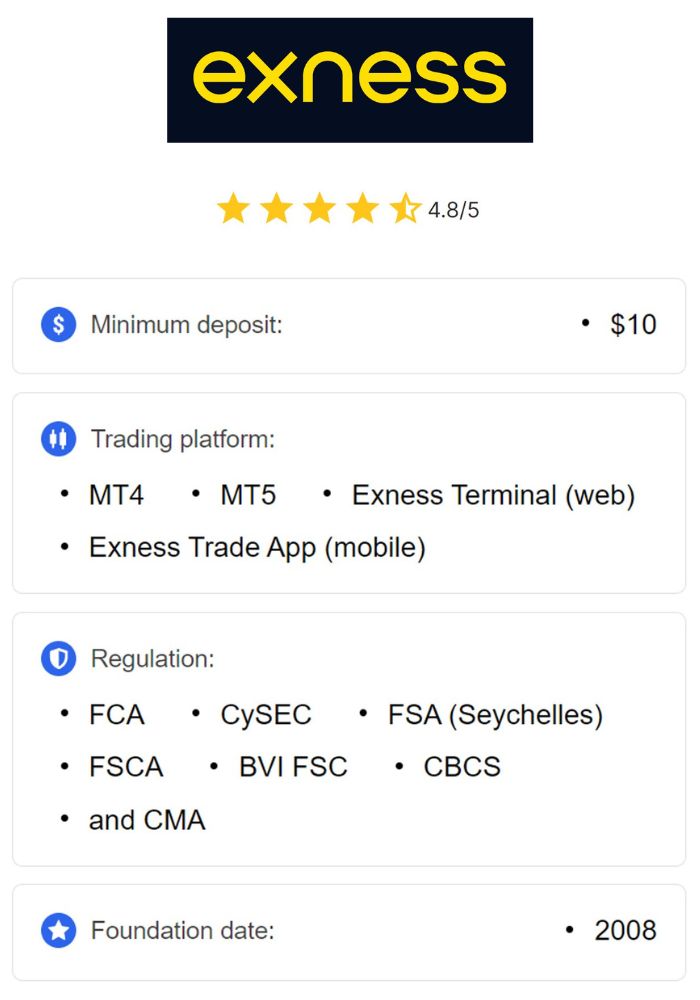

Before we assess whether Exness is beginner-friendly, let’s get to know the broker. Founded in 2008, Exness has grown into one of the world’s leading online trading platforms, serving over a million active clients globally. Headquartered in Cyprus, the company is regulated by multiple reputable authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). This strong regulatory framework ensures a level of trust and security—key factors for beginners who need a safe environment to learn and trade.

Exness offers a wide range of trading instruments, including forex, cryptocurrencies, commodities, indices, and stocks, all available as Contracts for Difference (CFDs). With competitive spreads, high leverage options, and a variety of trading platforms, Exness caters to traders of all levels. But how does it stack up specifically for those new to the game? Let’s break it down step by step.

Why Choosing the Right Broker Matters for Beginners

As a beginner, your choice of broker can make or break your trading experience. A good broker provides more than just a platform to place trades—it offers education, tools, and support to help you grow. For new traders, key considerations include:

Ease of Use: A simple, intuitive interface reduces the learning curve.

Low Costs: Tight spreads and minimal fees keep trading affordable.

Risk Management Tools: Features like demo accounts and stop-loss orders protect your capital.

Educational Resources: Guides, tutorials, and market analysis help you learn the ropes.

Customer Support: Responsive assistance is crucial when you’re stuck.

With these factors in mind, let’s evaluate how Exness performs in each area and whether it meets the needs of beginners.

Exness Features That Benefit Beginners

Exness offers several features that make it an attractive option for new traders. Here’s a closer look at what sets it apart:

1. User-Friendly Trading Platforms

One of the first hurdles for beginners is navigating a trading platform. Exness provides access to popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are widely regarded as industry standards. While MT4 is known for its simplicity and reliability—perfect for beginners—MT5 offers advanced features that can grow with you as your skills develop.

Additionally, Exness has its own proprietary platform, the Exness Terminal, powered by TradingView. This web-based option is sleek, intuitive, and ideal for those who prefer a modern interface without the need to download software. For mobile traders, the Exness Trade app (available on iOS and Android) allows you to manage trades on the go, complete with real-time charts and easy order placement.

Why It’s Good for Beginners: The variety of platforms means you can start with something simple like MT4 or the Exness Terminal and transition to more advanced tools later, all within the same broker ecosystem.

2. Demo Accounts for Risk-Free Practice

Trading with real money right away can be intimidating—and risky—for beginners. Exness addresses this by offering unlimited demo accounts on MT4 and MT5. These accounts come preloaded with virtual funds, allowing you to practice strategies, test the platform, and build confidence without financial risk.

Unlike some brokers whose demo accounts expire after 30 days, Exness demo accounts remain active as long as you use them. This flexibility is a huge plus for beginners who need time to experiment and learn.

Why It’s Good for Beginners: A demo account is like a sandbox—it lets you play, make mistakes, and learn without losing a dime.

3. Low Minimum Deposit

Cost is a major concern for new traders, many of whom aren’t ready to commit large sums of money. Exness stands out with a low minimum deposit of just $10 for its Standard account (though this can vary slightly depending on your payment method and region). This accessibility makes it easy for beginners to dip their toes into trading without breaking the bank.

Why It’s Good for Beginners: A low entry point reduces financial pressure, letting you start small and scale up as you gain experience.

4. Competitive Spreads and No Hidden Fees

Trading costs can eat into profits, especially for beginners working with small accounts. Exness offers competitive spreads starting at 0.3 pips on its Standard account, with no commission fees. For those who progress to professional accounts like the Raw Spread or Zero account, spreads can drop even lower (though commissions apply).

Exness also prides itself on transparency—no hidden fees for deposits or withdrawals (though third-party payment providers may charge their own fees). This predictability helps beginners budget their trading activities effectively.

Why It’s Good for Beginners: Affordable trading costs mean more of your money stays in your account, giving you room to learn and grow.

5. Flexible Leverage Options

Leverage allows traders to control larger positions with a smaller amount of capital—a double-edged sword that can amplify both profits and losses. Exness offers leverage ranging from 1:2 to 1:Unlimited, depending on your account type and experience level. For beginners, this flexibility is a boon, as you can start with conservative leverage (e.g., 1:50) and adjust as you become more comfortable.

Why It’s Good for Beginners: Controlled leverage lets you experiment with bigger trades while managing risk, though caution is advised to avoid overexposure.

6. Cent Account for Micro-Trading

One of Exness’s standout offerings for beginners is the Standard Cent account. Unlike the Standard account, which uses dollars as the base currency, the Cent account operates in cents. For example, a $10 deposit becomes 1,000 cents, and trades are executed in micro-lots (1/100th of a standard lot). This reduces the financial stakes significantly, making it ideal for testing real-market conditions with minimal risk.

Why It’s Good for Beginners: The Cent account bridges the gap between demo and live trading, offering a low-risk way to experience real market dynamics.

💥 Trade with Exness now: Open An Account or Visit Brokers

Educational Resources: Does Exness Help Beginners Learn?

Learning to trade is a journey, and a good broker should support that process. Exness provides a decent range of educational resources, though it’s not as extensive as some competitors. Here’s what’s available:

Exness Academy: A dedicated section on the website with articles and videos covering trading basics, technical analysis, and market insights.

YouTube Channel: Regular updates with tutorials and market analysis from experts.

Blog: Insights into trading strategies and platform features.

While these resources are helpful for beginners, they lack advanced courses or live webinars, which some brokers like IG or Forex.com offer. That said, the content is clear, concise, and beginner-friendly, making it a solid starting point.

Why It’s Good for Beginners: The Exness Academy provides foundational knowledge, though you may need to supplement it with external resources as you progress.

Risk Management Tools for New Traders

Trading is inherently risky, especially for beginners who may not yet grasp market volatility. Exness equips new traders with tools to manage risk effectively:

Stop-Loss Orders: Set automatic exit points to limit losses.

Negative Balance Protection: Ensures your account balance never goes below zero, protecting you from debt.

Margin Alerts: Notifications to help you monitor your account and avoid margin calls.

These features create a safety net, allowing beginners to trade with greater peace of mind.

Why It’s Good for Beginners: Risk management tools reduce the chances of catastrophic losses, giving you time to learn without wiping out your account.

Customer Support: Help When You Need It

For beginners, reliable customer support is non-negotiable. Exness offers 24/7 assistance via live chat, email, and phone, with support available in multiple languages. Response times are typically fast, and the team is known for being knowledgeable and patient—crucial for new traders with lots of questions.

Why It’s Good for Beginners: Round-the-clock support means you’re never left in the dark, no matter your time zone or issue.

Account Types: Which One Suits Beginners?

Exness offers several account types, but not all are beginner-friendly. Here’s a breakdown:

Standard Account: The go-to choice for beginners, with a $10 minimum deposit, spreads from 0.3 pips, and no commissions.

Standard Cent Account: Perfect for absolute novices, with micro-lot trading and a low-risk environment.

Professional Accounts (Raw Spread, Zero, Pro): Better suited for experienced traders due to higher minimum deposits ($200-$500) and more complex fee structures.

For most beginners, the Standard or Standard Cent account is the best starting point. They offer simplicity, affordability, and flexibility—everything a new trader needs.

Why It’s Good for Beginners: The Standard and Cent accounts cater specifically to those new to trading, balancing cost and functionality.

Deposits and Withdrawals: Easy for Beginners?

Funding your account and withdrawing profits should be straightforward, especially for beginners. Exness excels here with a wide range of payment methods, including bank cards, e-wallets (Skrill, Neteller), and cryptocurrencies (Bitcoin, USDT). Deposits are instant, and withdrawals are processed quickly—often within hours—thanks to Exness’s automated system.

There are no broker-side fees for deposits or withdrawals, though payment providers may charge small fees. The low minimum withdrawal amount ($10) also makes it easy for beginners to access their funds.

Why It’s Good for Beginners: Fast, fee-free transactions remove financial friction, letting you focus on trading rather than logistics.

Pros and Cons of Exness for Beginners

Let’s summarize the key advantages and potential drawbacks:

Pros

Low minimum deposit ($10) and affordable spreads.

User-friendly platforms (MT4, MT5, Exness Terminal).

Unlimited demo accounts for practice.

Standard Cent account for micro-trading.

24/7 multilingual customer support.

Strong regulation for safety.

Cons

Limited advanced educational content (no webinars or courses).

High leverage (up to 1:Unlimited) can be risky if misused.

Fewer trading instruments compared to some competitors (e.g., no ETFs).

For beginners, the pros far outweigh the cons, though caution with leverage and a willingness to seek external education are recommended.

How Exness Compares to Other Beginner-Friendly Brokers

To put Exness in context, let’s compare it to two other popular brokers for beginners: eToro and XM.

Exness vs. eToro: eToro is known for social trading, letting beginners copy experienced traders. It has a higher minimum deposit ($50-$200) and fewer forex pairs than Exness. Exness, however, offers lower spreads and more platform options.

Exness vs. XM: XM also caters to beginners with a $5 minimum deposit and extensive education. Its spreads are slightly higher than Exness’s, but it offers more advanced learning resources.

Exness shines with its low costs and platform variety, though it lags in educational depth compared to XM and social trading features compared to eToro.

Tips for Beginners Using Exness

If you decide to start with Exness, here are some tips to maximize your experience:

Start with a Demo Account: Practice until you’re comfortable with the platform and your strategy.

Use the Cent Account: Transition to live trading with minimal risk.

Keep Leverage Low: Stick to 1:50 or less to avoid big losses.

Learn the Basics: Use Exness Academy and supplement with free online resources.

Set a Budget: Only trade what you can afford to lose.

These steps will help you build a strong foundation as a beginner trader.

Is Exness Good for Beginners? The Verdict

So, is Exness good for beginners? The answer is a resounding yes, with a few caveats. Exness offers a beginner-friendly experience through its low entry costs, intuitive platforms, demo and cent accounts, and robust support. It’s a safe, regulated broker that prioritizes transparency and affordability—qualities that new traders need to thrive.

However, it’s not perfect. The educational resources could be more comprehensive, and the high leverage options require careful handling. If you’re willing to supplement your learning elsewhere and approach trading with discipline, Exness is an excellent choice to kickstart your journey.

For beginners seeking a reliable, cost-effective, and flexible broker, Exness ticks most of the boxes. Why not give it a try with a demo account and see for yourself?

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: