11 minute read

Is Exness Regulated in India? A Comprehensive Guide for Indian Traders

Forex trading has surged in popularity across India in recent years, with platforms like Exness catching the attention of both novice and experienced traders. However, one question looms large in the minds of many: Is Exness regulated in India? This article aims to provide a definitive answer, diving deep into Exness’s regulatory status, the Indian forex trading landscape, and what it all means for traders in 2025. Whether you’re considering opening an account or simply curious about the legalities, this guide will equip you with everything you need to know.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? An Overview of the Platform

Before we tackle the regulatory question, let’s start with the basics. Exness is a globally recognized online forex and CFD (Contract for Difference) broker founded in 2008. Headquartered in Cyprus, it has grown into one of the most prominent names in the trading industry, serving millions of clients across over 190 countries. The platform offers a wide range of financial instruments, including forex pairs, commodities (like gold and oil), indices, stocks, and cryptocurrencies.

Exness stands out for its competitive spreads, high leverage options (up to 1:2000 in some regions), and fast execution speeds. Traders can access its services through popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Exness Web Terminal. Additionally, Exness emphasizes transparency, providing real-time data on spreads and trading volumes—an appealing feature for traders seeking reliability.

But while Exness enjoys a stellar reputation worldwide, its regulatory status in specific countries, including India, is a critical factor for local users. Let’s explore how forex trading is governed in India to set the stage.

The Regulatory Framework for Forex Trading in India

Forex trading in India operates under a strict and unique regulatory framework, primarily overseen by two key authorities: the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Understanding their roles is essential to determining whether Exness fits into India’s legal landscape.

The Role of the Reserve Bank of India (RBI)

The RBI is India’s central bank, responsible for managing the country’s monetary policy and regulating foreign exchange transactions. Under the Foreign Exchange Management Act (FEMA) of 1999, the RBI sets strict guidelines for forex trading. One of the most significant rules is that Indian residents can only trade currency pairs involving the Indian Rupee (INR). Examples include USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading non-INR pairs (e.g., EUR/USD or GBP/JPY) is prohibited for retail traders unless conducted through RBI-authorized entities.

The RBI’s restrictions aim to prevent capital outflows, maintain financial stability, and curb speculative trading in foreign currencies. Forex brokers operating in India must either be registered with the RBI or partner with authorized dealers (typically banks) to offer compliant services.

The Role of the Securities and Exchange Board of India (SEBI)

SEBI is the primary regulator of India’s securities and financial markets. While its main focus is on stock exchanges, mutual funds, and commodities, it also plays a role in overseeing forex brokers operating within India. SEBI ensures that brokers adhere to strict licensing requirements, maintain transparency, and protect investors from fraud.

For a forex broker to be fully regulated in India, it must obtain SEBI registration and comply with RBI guidelines. This dual oversight creates a robust but restrictive environment for forex trading, particularly for international brokers like Exness.

FEMA Guidelines and Their Impact

The Foreign Exchange Management Act (FEMA) is the cornerstone of forex regulation in India. Beyond limiting tradable currency pairs, FEMA allows Indian residents to invest up to $250,000 per year in overseas markets, including forex trading, under the Liberalised Remittance Scheme (LRS). However, this comes with a catch: any broker facilitating such trades must align with Indian laws, and traders must use approved payment methods (e.g., bank transfers) for deposits and withdrawals.

This regulatory framework raises a key question: Does Exness, an international broker, meet these standards? Let’s examine its global and local regulatory status.

Is Exness Regulated Globally?

Exness operates as a multi-jurisdictional broker, holding licenses from several reputable financial authorities worldwide. These regulations ensure that Exness adheres to international standards for transparency, client fund protection, and operational integrity. Here’s a breakdown of its global regulatory credentials:

Cyprus Securities and Exchange Commission (CySEC)

Exness (Cy) Ltd is regulated by CySEC under license number 178/12. CySEC is a Tier-1 regulator within the European Union, enforcing strict rules on financial services providers. This includes segregating client funds from company funds, offering negative balance protection, and adhering to the EU’s Markets in Financial Instruments Directive (MiFID II).

Financial Conduct Authority (FCA) – United Kingdom

Exness (UK) Ltd holds a license from the FCA (Financial Services Register number 730729), one of the world’s most respected regulatory bodies. The FCA imposes rigorous standards for financial conduct, ensuring client safety and market fairness. However, Exness (UK) Ltd primarily serves institutional clients, not retail traders.

Other Regulatory Licenses

Seychelles Financial Services Authority (FSA): Exness (SC) Ltd is licensed under number SD025, catering to clients outside the European Economic Area (EEA).

South Africa Financial Sector Conduct Authority (FSCA): Exness ZA (PTY) Ltd holds license number 51024, ensuring compliance in South Africa.

Financial Services Commission (FSC) – Mauritius: Exness (MU) Ltd operates under license GB20025294.

Capital Markets Authority (CMA) – Kenya: Exness (KE) Ltd is licensed as a non-dealing forex broker (license number 162).

These licenses demonstrate Exness’s commitment to operating legally and securely on a global scale. But how does this translate to India, where local regulation is paramount?

Is Exness Regulated in India by SEBI or RBI?

Here’s the crux of the matter: Exness is not directly regulated by SEBI or the RBI. It does not hold a specific license to operate as a forex broker within India under these authorities. This lack of local regulation stems from Exness’s status as an offshore broker, meaning its primary operations and licensing are based outside India.

Why Isn’t Exness Regulated in India?

There are several reasons why Exness lacks SEBI or RBI oversight:

Focus on Global Markets: Exness targets a worldwide audience, offering a broad range of currency pairs and instruments that go beyond India’s INR-only restriction. Registering with SEBI would limit its offerings to INR-based pairs, which may not align with its business model.

Complex Registration Process: Obtaining SEBI and RBI approval involves navigating a lengthy and stringent process, including setting up a local entity and adhering to India-specific compliance requirements.

Offshore Operations: Many international brokers, including Exness, serve Indian clients under their offshore licenses (e.g., CySEC or FSA), relying on global standards rather than local ones.

Does This Mean Exness Is Illegal in India?

Not necessarily. While Exness isn’t regulated by Indian authorities, using it isn’t explicitly illegal for Indian traders—provided certain conditions are met. The legality hinges on how traders use the platform and whether they comply with FEMA guidelines. Let’s break this down further.

Is Trading with Exness Legal for Indian Traders?

The legality of trading with Exness in India depends on two factors: compliance with FEMA regulations and the trader’s actions. Here’s what you need to know:

Permitted Trading Activities

Under FEMA, Indian residents can legally trade forex through:

INR-Based Pairs Only: Trading pairs like USD/INR or EUR/INR is allowed, as these involve the Indian Rupee and align with RBI rules.

Authorized Channels: Transactions must occur through RBI-approved banks or brokers, with funds transferred via legal payment methods (e.g., bank accounts, UPI, or Netbanking).

Exness offers INR-based currency pairs, meaning Indian traders can use the platform legally if they stick to these pairs. However, the platform also provides access to non-INR pairs (e.g., EUR/USD), which are prohibited for Indian retail traders. Trading these pairs could violate FEMA, exposing traders to legal risks.

Offshore Broker Considerations

Since Exness operates offshore, it isn’t subject to SEBI or RBI jurisdiction. Indian law doesn’t outright ban residents from using international brokers, but it places the onus on traders to ensure compliance. This creates a gray area:

Legal to Use: Indian traders can open accounts with Exness and trade INR pairs without breaking the law.

Risk of Non-Compliance: Trading non-INR pairs or failing to report overseas investments under the LRS could lead to penalties or scrutiny from authorities.

Taxation and Reporting

Forex profits in India are taxable as “income from other sources” under the Income Tax Act. Traders using Exness must declare their earnings and comply with tax obligations. Additionally, overseas remittances (e.g., deposits to Exness) must be reported under the LRS, with proper documentation submitted to the RBI or authorized banks.

In summary, Exness itself isn’t illegal in India, but its lack of SEBI/RBI regulation means traders must exercise caution and adhere strictly to local laws.

Safety and Security: Is Exness Trustworthy?

Regulation aside, safety is a top concern for traders. Exness’s global licenses provide a strong foundation for trust, but let’s explore its security measures in detail.

Client Fund Protection

Segregated Accounts: Exness keeps client funds separate from company funds, reducing the risk of misuse.

Negative Balance Protection: Traders cannot lose more than their account balance, a safeguard against market volatility.

Audits by Deloitte: Exness’s financial performance is independently verified by Deloitte, a leading auditing firm.

Technological Security

Encryption: Advanced SSL encryption protects personal and financial data.

Two-Factor Authentication (2FA): An extra layer of security for account logins and transactions.

Global Reputation

Exness has earned accolades for its reliability, including awards like “Best Global Broker” and “Most Transparent Broker.” With over 15 years in the industry and a client base exceeding 300,000 active traders monthly (as of 2025), it’s a trusted name worldwide.

For Indian traders, these features offer reassurance, even without local regulation. However, the absence of SEBI oversight means disputes may need resolution through international channels (e.g., CySEC or the Financial Commission), which could be less convenient.

Advantages of Trading with Exness in India

Despite its regulatory status, Exness offers several benefits that appeal to Indian traders:

1. Competitive Trading Conditions

Low Spreads: Starting from 0.0 pips on some accounts, making it cost-effective.

High Leverage: Up to 1:2000 (though capped for certain regions), amplifying potential profits.

2. User-Friendly Platforms

Seamless integration with MT4 and MT5, plus a proprietary mobile app for trading on the go.

3. Fast Deposits and Withdrawals

Multiple payment options, including bank cards, e-wallets, and local methods like UPI, with instant processing for most withdrawals.

4. Multilingual Support

24/7 customer service in Hindi and English, catering to India’s diverse trader base.

5. Educational Resources

Tutorials, webinars, and market analysis to help beginners and pros alike.

These advantages make Exness an attractive option, provided traders stay within legal boundaries.

Risks of Trading with Exness in India

While Exness has much to offer, there are risks to consider:

1. Lack of Local Regulation

Without SEBI or RBI oversight, traders lack direct recourse through Indian authorities in case of disputes.

2. Potential Legal Issues

Trading non-INR pairs could violate FEMA, leading to fines or account freezes.

3. High Leverage Risks

While high leverage boosts profits, it also magnifies losses—especially for inexperienced traders.

4. Market Volatility

Forex markets are inherently volatile, and offshore brokers may not offer tailored risk management for Indian conditions.

How Indian Traders Can Use Exness Safely

To trade with Exness legally and securely, follow these best practices:

1. Stick to INR-Based Pairs

Focus on USD/INR, EUR/INR, etc., to comply with FEMA.

2. Use Approved Payment Methods

Deposit and withdraw funds through RBI-authorized channels like bank transfers or UPI.

3. Start with a Demo Account

Test the platform risk-free before committing real money.

4. Manage Risk

Use stop-loss orders and limit leverage to protect your capital.

5. Consult Experts

Speak with a financial advisor or tax professional to ensure compliance with Indian laws.

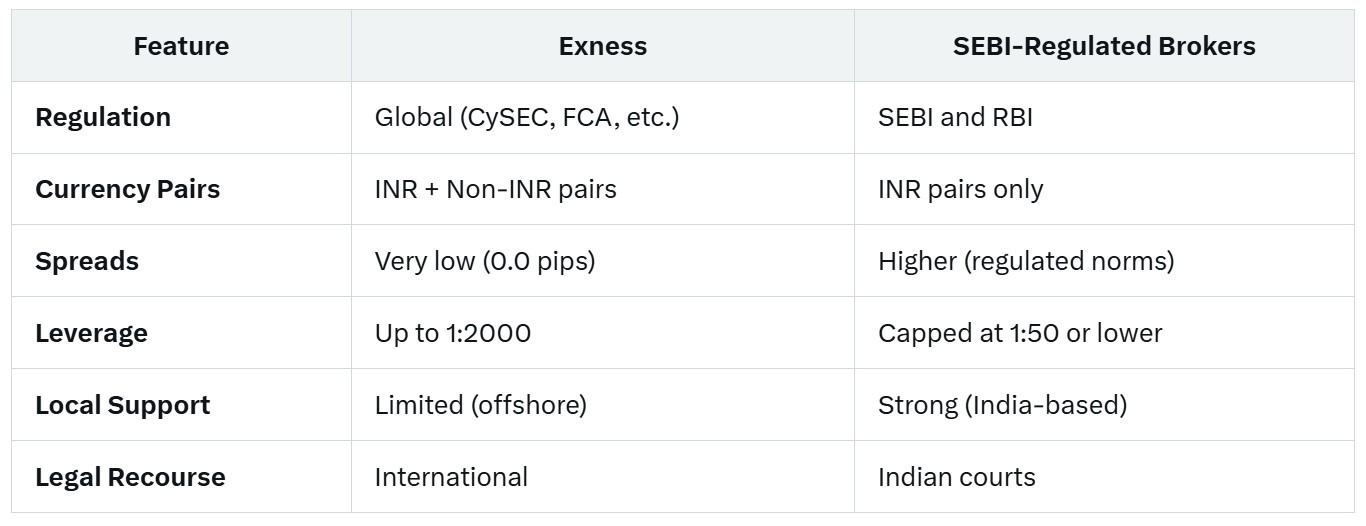

Exness vs. SEBI-Regulated Brokers: A Comparison

How does Exness stack up against SEBI-regulated brokers like Zerodha or Upstox? Here’s a quick comparison:

SEBI-regulated brokers offer greater legal protection but lack the flexibility and low costs of Exness. Your choice depends on your priorities—compliance or global access.

The Future of Exness in India

As forex trading grows in India, international brokers like Exness may seek SEBI/RBI registration to tap into this market fully. Regulatory landscapes evolve, and India’s authorities could adapt rules to accommodate offshore platforms while protecting traders. For now, Exness remains a viable option for those willing to navigate the legal nuances.

Conclusion: Is Exness Regulated in India?

To sum up, Exness is not regulated by SEBI or the RBI, but it operates legally under international licenses from CySEC, FCA, and other authorities. Indian traders can use Exness without breaking the law, provided they trade INR-based pairs and comply with FEMA guidelines. Its global reputation, competitive features, and robust security make it a compelling choice—though the lack of local oversight requires extra diligence.

If you’re an Indian trader considering Exness, weigh the pros and cons carefully. Stick to legal practices, leverage its demo account, and stay informed about regulatory updates. With the right approach, Exness can be a valuable tool in your trading journey in 2025 and beyond.

Ready to explore Exness? Start with a demo account today and see if it’s the right fit for you!

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: