9 minute read

How to Verify Exness Account in Nigeria

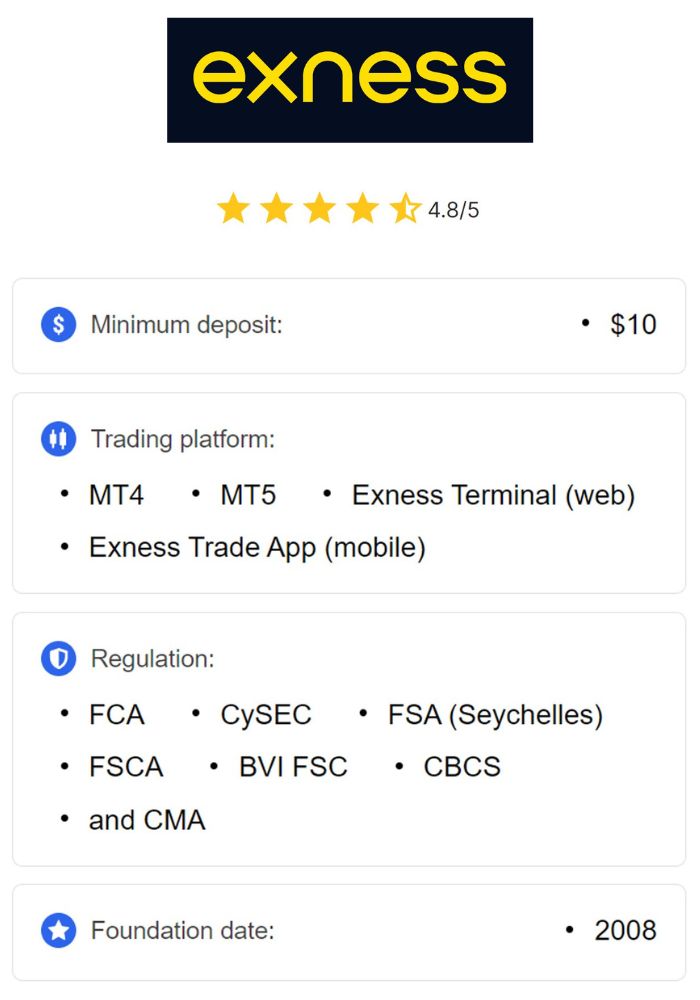

Online trading has become a popular way for Nigerians to explore financial opportunities, and Exness stands out as one of the leading platforms for forex and CFD trading. However, before you can fully unlock the potential of your Exness account, you must complete the verification process. Verifying your Exness account in Nigeria is a crucial step that ensures security, compliance with regulations, and access to all trading features. In this detailed guide, we’ll walk you through everything you need to know about how to verify your Exness account in Nigeria, from the importance of verification to troubleshooting tips and best practices.

💥 Trade with Exness now: Open An Account or Visit Brokers

Why Verifying Your Exness Account in Nigeria Matters

Before diving into the step-by-step process, let’s explore why account verification is essential for Nigerian traders using Exness.

1. Enhanced Security for Your Funds

Verification confirms that you are the rightful owner of your Exness account. By submitting identity and residency documents, you reduce the risk of unauthorized access, protecting your funds from fraud or theft. In a digital world where cyber threats are common, this added layer of security is invaluable.

2. Compliance with Financial Regulations

Exness operates under strict international regulations, including Know Your Customer (KYC) and Anti-Money Laundering (AML) policies. Verifying your account ensures that the platform complies with these laws, which are designed to prevent illegal activities like money laundering. For Nigerian traders, this compliance builds trust in the platform.

3. Access to Full Trading Features

An unverified Exness account comes with limitations, such as restricted deposit amounts and withdrawal options. Once verified, you gain access to higher transaction limits, advanced tools, and seamless withdrawals—key factors for a successful trading experience.

4. Faster Withdrawals

Nigerian traders often prioritize quick access to their profits. A fully verified account speeds up the withdrawal process, allowing you to transfer funds to your local bank account or e-wallet without unnecessary delays.

5. Building Trust in the Trading Community

Verification fosters accountability and trust between you and Exness. It also reassures other traders that the platform maintains a secure environment, encouraging responsible trading practices.

Now that you understand the importance, let’s move on to the practical steps for verifying your Exness account in Nigeria.

Prerequisites for Verifying Your Exness Account in Nigeria

Before starting the verification process, ensure you meet the basic requirements and have the necessary documents ready. Preparation is key to avoiding delays.

1. Be at Least 18 Years Old

Exness requires all traders to be at least 18 years old, in line with legal standards for financial contracts. You’ll need to provide proof of your age during verification.

2. Have an Active Exness Account

If you haven’t signed up yet, visit the Exness website, click “Open an Account,” and complete the registration form with your email, phone number, and personal details. This is your starting point.

3. Gather Required Documents

Exness requires two types of documents for verification:

Proof of Identity (POI): A government-issued ID such as a Nigerian passport, national ID card, or driver’s license. It must include your full name, photo, and date of birth.

Proof of Residence (POR): A document showing your current address, such as a utility bill (electricity, water, or internet), bank statement, or government-issued letter. It should be recent (within the last 3-6 months) and display your name and address clearly.

4. Ensure Document Quality

Your documents must be clear, legible, and unexpired. Blurry, cropped, or outdated submissions will be rejected, slowing down the process.

5. Stable Internet Connection and Device

You’ll need a smartphone, tablet, or computer with a reliable internet connection to upload documents via the Exness Personal Area.

With these in place, you’re ready to begin the verification process.

How to verify Exness account in Nigeria

Follow these detailed steps to verify your Exness account seamlessly. Each step is designed to guide Nigerian traders through the process with ease.

Step 1: Log In to Your Exness Personal Area

Visit the official Exness website (www.exness.com).

Click “Login” and enter your registered email and password to access your Personal Area (PA). This dashboard is where you’ll manage your account and verification.

Step 2: Start the Verification Process

Once logged in, look for a banner or notification at the top of your Personal Area that says “Complete Profile” or “Verify Account.” Click it to begin.

If you don’t see this, navigate to the “Verification” section manually.

Step 3: Verify Your Email Address

Exness will prompt you to confirm your email. Click “Send me a code,” and a 6-digit code will be sent to your inbox.

Enter the code in the provided field and click “Continue.” This step ensures your email is active and linked to your account.

Step 4: Verify Your Phone Number

Enter your Nigerian phone number (e.g., +234 followed by your number).

Choose to receive a verification code via SMS or a phone call. Click “Send me a code.”

Input the 6-digit code you receive and click “Continue.” This secures your account with two-factor authentication.

Step 5: Fill in Your Personal Details

Provide your full name, date of birth, and gender. Ensure these match the details on your verification documents exactly.

Click “Continue” to proceed. Any mismatch here could lead to rejection later.

Step 6: Complete Your Economic Profile

Answer a few questions about your financial background, such as your source of income, profession, and trading experience. This helps Exness assess your trading intentions and comply with regulations.

Once completed, click “Continue.”

Step 7: Upload Proof of Identity (POI)

Select the country of issue (Nigeria) and the document type (e.g., passport, national ID, or driver’s license).

Upload a clear, color image of your chosen document. Ensure all details—name, photo, and ID number—are visible.

Click “Submit” and wait for confirmation.

Step 8: Upload Proof of Residence (POR)

Choose a document like a utility bill or bank statement that shows your name and address.

Upload a high-quality image or PDF. It must be recent (within 3-6 months) and legible.

Click “Submit” to complete this step.

Step 9: Wait for Approval

Exness typically reviews documents within minutes, but it can take up to 24-48 hours if manual verification is required.

You’ll receive an email notification once your account is fully verified. Check your Personal Area for updates on your verification status.

Step 10: Start Trading Without Restrictions

Once approved, all limitations (e.g., deposit caps, withdrawal delays) are lifted. You can now fund your account, trade, and withdraw profits freely.

💥 Trade with Exness now: Open An Account or Visit Brokers

Common Documents Accepted for Verification in Nigeria

Exness accepts specific documents from Nigerian traders. Here’s a breakdown to help you choose the right ones:

Proof of Identity (POI)

Nigerian Passport: International or national version, showing your photo and personal details.

National ID Card: Issued by the National Identity Management Commission (NIMC).

Driver’s License: Must be valid and include your name and photo.

Proof of Residence (POR)

Utility Bill: Electricity, water, or internet bills with your name and address.

Bank Statement: A recent statement from a Nigerian bank like GTBank, Zenith, or First Bank.

Government Letter: Any official correspondence showing your address.

Ensure all documents are in English or accompanied by a certified translation if necessary.

Tips to Avoid Delays in Exness Account Verification

Verification is usually straightforward, but errors can slow things down. Here’s how Nigerian traders can ensure a smooth process:

1. Double-Check Document Quality

Use a scanner or high-resolution camera to capture clear images. Avoid shadows, blurriness, or cropped edges.

2. Match Account Details

Your name, address, and other details on your Exness profile must align with your documents. Even small discrepancies (e.g., a misspelled name) can lead to rejection.

3. Use Valid and Recent Documents

Expired IDs or old utility bills (over 6 months) won’t be accepted. Verify the validity before uploading.

4. Submit Both Sides of IDs

For documents like national ID cards or driver’s licenses, upload both the front and back if information is split across them.

5. Contact Support if Needed

If your documents are rejected, Exness will explain why via email. Resubmit corrected files or reach out to customer support for guidance.

Troubleshooting Verification Issues for Nigerian Traders

Even with preparation, issues can arise. Here’s how to handle common problems:

1. Documents Rejected

Cause: Poor image quality, expired documents, or mismatched details.

Solution: Review the rejection email, fix the issue (e.g., upload a clearer image), and resubmit.

2. Verification Taking Too Long

Cause: High submission volume or manual review.

Solution: Wait 24-48 hours. If it exceeds this, contact Exness support via live chat or email.

3. Unable to Upload Files

Cause: Internet issues or file format errors.

Solution: Check your connection and ensure files are in accepted formats (e.g., JPG, PNG, PDF).

4. Account Limitations Persist

Cause: Incomplete verification (e.g., missing POR).

Solution: Verify both POI and POR are approved in your Personal Area.

Benefits of a Fully Verified Exness Account in Nigeria

Once verified, Nigerian traders unlock a range of advantages:

1. Higher Deposit and Withdrawal Limits

Unverified accounts are capped at $2,000-$50,000 in deposits, depending on partial verification. Full verification removes these limits.

2. Local Payment Options

Access Nigerian-specific methods like bank transfers (e.g., GTBank, Zenith), Paystack, or Flutterwave for seamless transactions.

3. Enhanced Trading Tools

Trade forex, cryptocurrencies, and commodities with full leverage and advanced features on MetaTrader 4 or 5.

4. Priority Support

Verified users often receive faster responses from Exness’s 24/7 customer support team.

How Long Does Verification Take?

Exness typically processes documents within minutes using automated systems. However, if manual review is needed (e.g., for complex cases), it may take 24-48 hours. Nigerians should submit documents early to avoid delays, especially before making their first deposit, as a 30-day verification timer starts then.

Exness Verification vs. Other Brokers in Nigeria

How does Exness compare to competitors like XM or ForexTime (FXTM)? Here’s a quick look:

Speed: Exness’s automated system is faster than many brokers, which can take days.

Requirements: Similar POI and POR documents are needed across platforms, but Exness is stricter about matching details.

Flexibility: Exness accepts a wide range of Nigerian documents, making it more accessible.

Best Practices for Nigerian Traders After Verification

To maximize your Exness experience post-verification, consider these tips:

Secure Your Account: Enable two-factor authentication (2FA) for extra protection.

Fund Wisely: Start with a small deposit to test the platform before scaling up.

Stay Updated: Keep your documents current to avoid future verification issues.

Practice First: Use a demo account to hone your skills before trading live.

Conclusion: Start Trading with Confidence

Verifying your Exness account in Nigeria is a simple yet vital step to unlock the full potential of online trading. By following this guide, you can complete the process quickly, avoid common pitfalls, and enjoy a secure, unrestricted trading experience. Whether you’re a beginner or an experienced trader, a verified Exness account opens the door to forex, cryptocurrencies, and more—all tailored to the needs of Nigerians.

Ready to get started? Log in to your Exness Personal Area now, gather your documents, and take the first step toward financial freedom. Happy trading!

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: