9 minute read

Is Exness Sebi Registered in India? Review Broker 2025

Forex trading has surged in popularity across India in recent years, attracting both novice and seasoned traders eager to tap into the global currency markets. With this growing interest, platforms like Exness have emerged as go-to options for many Indian traders due to their competitive offerings and global reputation. However, a critical question looms large for those considering this broker: Is Exness SEBI registered in India? Understanding the regulatory status of a forex broker is vital for ensuring the safety of your funds and compliance with local laws. In this in-depth guide, we’ll explore Exness’s registration status with the Securities and Exchange Board of India (SEBI), its implications for Indian traders, and what you need to know before trading with this platform.

💥 Trade with Exness now: Open An Account or Visit Brokers

What is Exness? An Overview of the Broker

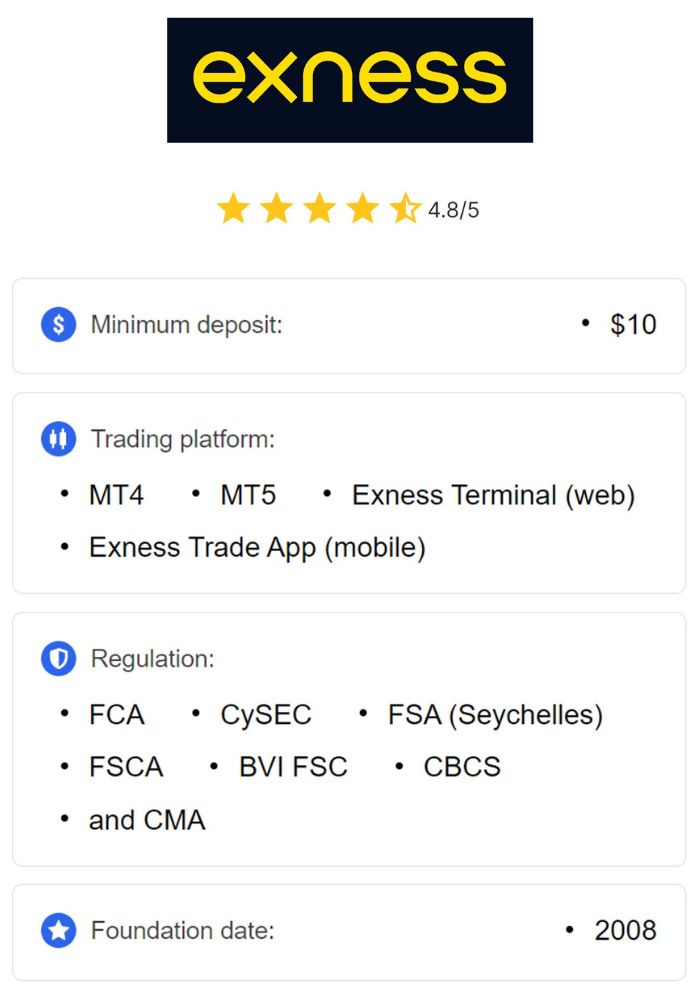

Before diving into the regulatory details, let’s first understand what Exness is and why it’s gained traction worldwide, including in India. Founded in 2008 and headquartered in Cyprus, Exness is a globally recognized forex and Contracts for Difference (CFD) broker. It serves over 700,000 active clients and processes a staggering monthly trading volume exceeding $4 trillion, making it one of the largest retail forex brokers in the world.

Exness offers a wide range of trading instruments, including over 100 currency pairs, commodities like gold and oil, indices, and cryptocurrencies such as Bitcoin and Ethereum. The broker is known for its tight spreads (starting from 0.0 pips on some accounts), instant withdrawals, and support for popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Additionally, Exness provides multiple account types—Standard, Pro, Raw Spread, and Zero—to cater to traders of all experience levels.

For Indian traders, Exness stands out with features like localized payment methods (e.g., UPI and Netbanking), 24/7 customer support in English and Hindi, and a user-friendly mobile app. But while these perks are enticing, the question remains: Is Exness SEBI registered in India? To answer this, we need to examine India’s regulatory framework for forex trading.

Understanding Forex Regulation in India

Forex trading in India operates under a tightly controlled regulatory environment, overseen by two primary authorities: the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). These bodies work together to ensure financial stability, protect investors, and regulate foreign exchange transactions.

The Role of the RBI

The RBI, India’s central bank, governs all foreign exchange activities under the Foreign Exchange Management Act (FEMA), 1999. According to FEMA guidelines, Indian residents are restricted to trading currency pairs that involve the Indian Rupee (INR), such as USD/INR, EUR/INR, or GBP/INR. Trading foreign-to-foreign currency pairs (e.g., EUR/USD or GBP/JPY) is prohibited unless conducted through recognized Indian exchanges like the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE). The RBI also monitors cross-border transactions to prevent illegal money flows and speculative trading that could destabilize the Indian economy.

The Role of SEBI

SEBI, established in 1988 and granted statutory powers in 1992, is the primary regulator of India’s securities and capital markets. While its core focus is on stocks, mutual funds, and derivatives, SEBI also oversees forex trading when it involves currency derivatives traded on recognized exchanges. For a broker to legally offer forex trading services in India, it must be registered with SEBI and comply with its stringent guidelines. SEBI-registered brokers are subject to regular audits, must segregate client funds, and provide transparent trading conditions, ensuring a high level of investor protection.

Forex Trading Restrictions in India

The combination of RBI and SEBI regulations creates a unique forex trading landscape in India. Key restrictions include:

INR-based pairs only: Trading is limited to currency pairs involving the INR.

Recognized exchanges: Forex trading must occur through SEBI-regulated exchanges like NSE, BSE, or Metropolitan Stock Exchange (MSE).

Offshore brokers: Using international brokers for non-INR pairs falls into a legal gray area, as it may violate FEMA rules.

With this context in mind, let’s address the core question: Is Exness SEBI registered in India?

Is Exness SEBI Registered in India?

The short answer is no, Exness is not SEBI registered in India. Exness operates as an offshore broker and does not hold a license from SEBI or the RBI to provide forex trading services under India’s regulatory framework. Instead, Exness is regulated by several reputable international authorities, including:

Cyprus Securities and Exchange Commission (CySEC): License number 178/12, ensuring compliance with EU financial standards.

Financial Conduct Authority (FCA): A UK-based Tier-1 regulator known for its strict oversight.

Financial Services Authority (FSA): In Seychelles, regulating Exness’s global operations.

Financial Sector Conduct Authority (FSCA): In South Africa, adding another layer of credibility.

💥 Trade with Exness now: Open An Account or Visit Brokers

These global licenses demonstrate that Exness adheres to high standards of transparency, security, and client fund protection. For instance, it segregates client funds from company assets, offers negative balance protection, and undergoes regular audits by independent firms. However, none of these regulations align with SEBI’s jurisdiction, meaning Exness is not directly accountable to Indian authorities.

Why Isn’t Exness Registered with SEBI?

Exness operates as a global broker, focusing on international markets rather than tailoring its services to specific local regulations like those in India. Registering with SEBI would require Exness to:

Limit its offerings to INR-based currency pairs.

Partner with Indian exchanges like NSE or BSE.

Comply with SEBI’s operational and reporting requirements, which may conflict with its global business model.

For a broker of Exness’s scale, which thrives on offering a vast array of trading instruments (including non-INR pairs), obtaining SEBI registration might not align with its strategy. Instead, it relies on its international licenses to serve traders worldwide, including those in India.

Is It Legal to Trade with Exness in India?

The lack of SEBI registration doesn’t automatically make trading with Exness illegal, but it does place Indian traders in a regulatory gray area. Let’s break this down:

Legal Implications

FEMA Compliance: Under FEMA, trading non-INR currency pairs through offshore brokers like Exness is technically prohibited. If Indian authorities detect such activity, it could lead to penalties, account freezes, or legal action.

No Explicit Ban: There’s no specific law outright banning Indian residents from using offshore brokers. Many traders use platforms like Exness without facing immediate repercussions, as enforcement has been inconsistent.

Tax and Remittance: Funds sent to or withdrawn from offshore brokers must comply with RBI’s Liberalised Remittance Scheme (LRS), which caps annual remittances at $250,000 per individual. Proper tax reporting is also required.

Practical Reality

Despite the legal ambiguity, thousands of Indian traders actively use Exness and similar offshore brokers. The platform’s global reputation, fast withdrawals, and competitive conditions outweigh the regulatory concerns for many. However, traders must be aware that:

They may lack recourse under Indian law in case of disputes.

Funds are not protected by SEBI’s investor protection mechanisms.

In summary, while trading with Exness isn’t explicitly illegal, it carries risks due to its lack of SEBI registration and potential non-compliance with FEMA.

Advantages of Trading with Exness for Indian Traders

Even without SEBI registration, Exness offers several benefits that appeal to Indian traders:

Global Regulation: Licenses from CySEC, FCA, and other authorities ensure a secure trading environment with robust safety measures.

Low Trading Costs: Tight spreads (e.g., 0.0 pips on Zero accounts) and no commission on Standard accounts make trading cost-effective.

Fast Withdrawals: Instant withdrawal options via UPI, Netbanking, and other local methods are a major draw.

Wide Instrument Range: Access to over 100 currency pairs, commodities, and cryptocurrencies offers diversification beyond INR pairs.

User-Friendly Platforms: MT4, MT5, and the Exness mobile app are intuitive and reliable.

Localized Support: 24/7 customer service in English and Hindi caters to Indian users.

These features make Exness an attractive choice, but they must be weighed against the regulatory risks.

Risks of Trading with an Unregistered Broker in India

Using a broker like Exness that isn’t SEBI registered comes with notable drawbacks:

Legal Uncertainty: Trading non-INR pairs could violate FEMA, risking penalties or fund confiscation.

No Local Oversight: Without SEBI regulation, Indian traders rely on international regulators for dispute resolution, which may be less accessible.

Fund Safety Concerns: While Exness segregates funds, there’s no SEBI-backed guarantee in case of broker insolvency.

Limited Recourse: Disputes with Exness can’t be escalated to SEBI or Indian courts, complicating resolution.

For risk-averse traders, these factors may outweigh Exness’s benefits, pushing them toward SEBI-registered alternatives.

Alternatives to Exness: SEBI-Registered Brokers in India

If you prioritize compliance and local protection, consider these SEBI-registered brokers offering forex trading:

Zerodha: India’s largest discount broker, offering currency derivatives on NSE and BSE.

ICICI Direct: A full-service broker with forex trading options via recognized exchanges.

HDFC Securities: Provides INR-based forex trading with robust customer support.

Angel One: A popular choice for currency derivatives and other financial products.

These brokers limit trading to INR pairs and operate under SEBI’s oversight, ensuring legal compliance and investor protection. However, they lack the global instrument variety and tight spreads offered by Exness.

How Indian Traders Can Use Exness Safely

If you choose to trade with Exness despite its lack of SEBI registration, here are some tips to minimize risks:

Stick to INR Pairs: Focus on USD/INR or EUR/INR to align with FEMA guidelines.

Use Legal Payment Methods: Fund your account via UPI or Netbanking and report transactions under LRS.

Monitor Regulations: Stay updated on RBI and SEBI policies to avoid unintentional violations.

Start Small: Test the platform with a small deposit to assess its reliability.

Keep Records: Maintain detailed records of trades and transactions for tax and compliance purposes.

By taking these precautions, you can mitigate some of the risks associated with trading on an unregistered platform.

Conclusion: Should Indian Traders Use Exness?

So, is Exness SEBI registered in India? No, it isn’t—and this fact shapes its suitability for Indian traders. Exness is a globally trusted broker with top-tier international regulation, competitive trading conditions, and features tailored to the Indian market. However, its lack of SEBI registration places it in a legal gray area, exposing traders to potential risks under FEMA and limiting local protections.

💥 Trade with Exness now: Open An Account or Visit Brokers

For traders prioritizing compliance and safety, SEBI-registered brokers like Zerodha or ICICI Direct are better options. But if you value low costs, a wide range of instruments, and fast withdrawals—and are willing to navigate the regulatory uncertainties—Exness remains a viable choice. Ultimately, your decision should align with your risk tolerance, trading strategy, and commitment to staying within India’s legal boundaries.

Read more: Exness App is Legal in India?