8 minute read

Raw spread vs standard account which is better?

from Exness Global

When stepping into the world of forex trading, one of the most critical decisions you’ll face is choosing the right trading account type. Among the options available, two popular choices stand out: raw spread accounts vs standard accounts. Each comes with its own set of advantages, drawbacks, and ideal use cases, leaving traders wondering, "Which is better?" The answer isn’t one-size-fits-all—it depends on your trading style, experience level, capital, and goals. In this in-depth guide, we’ll break down the differences between raw spread and standard accounts, analyze their pros and cons, and help you decide which one aligns best with your needs.

What Are Raw Spread and Standard Accounts?

Before diving into the comparison, let’s define what these account types mean.

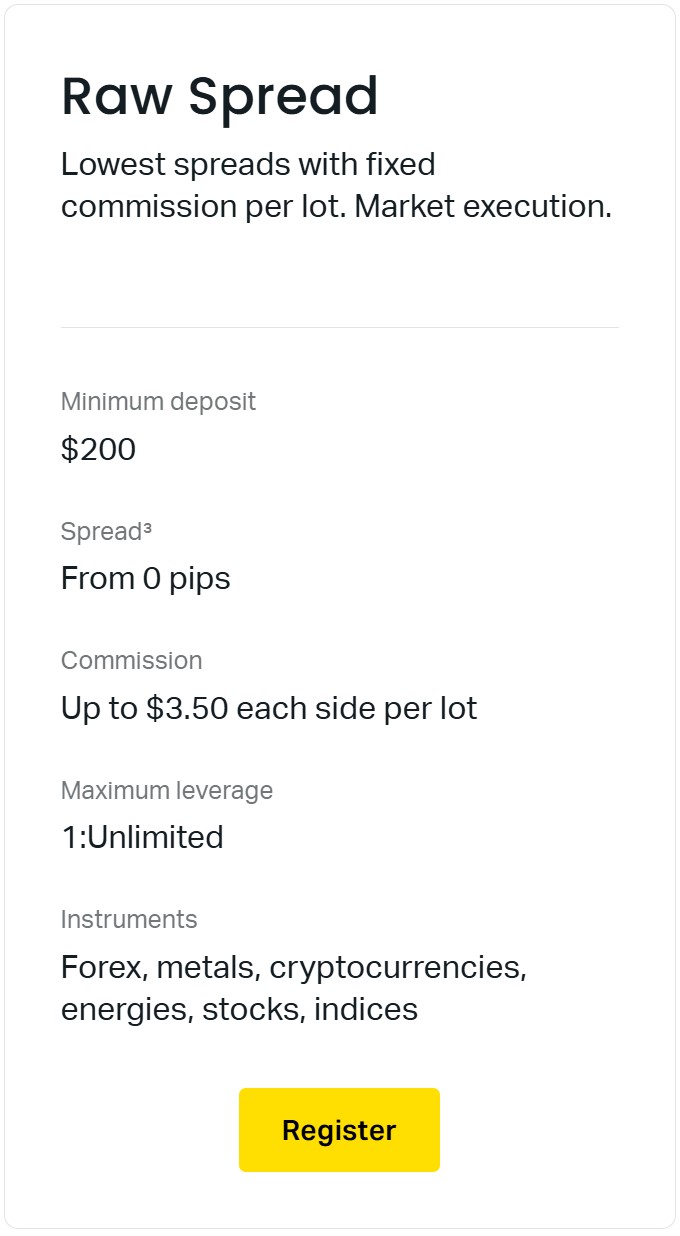

Raw Spread Accounts: The Basics

A raw spread account, sometimes called an ECN (Electronic Communication Network) account, offers traders direct access to the interbank market. In this setup, the broker connects you straight to liquidity providers—banks, financial institutions, and other traders. The defining feature? You get the "raw" market spread, which is the unfiltered difference between the bid and ask price.

Spreads: Typically start at 0 pips (or very close to it), but they fluctuate based on market conditions.

Commission: Brokers charge a fixed commission per trade (e.g., $3–$7 per lot) instead of widening the spread for profit.

Transparency: Pricing is highly transparent, reflecting real-time market conditions.

Raw spread accounts are often marketed to advanced traders, scalpers, and those who prioritize low costs on high-volume trades.

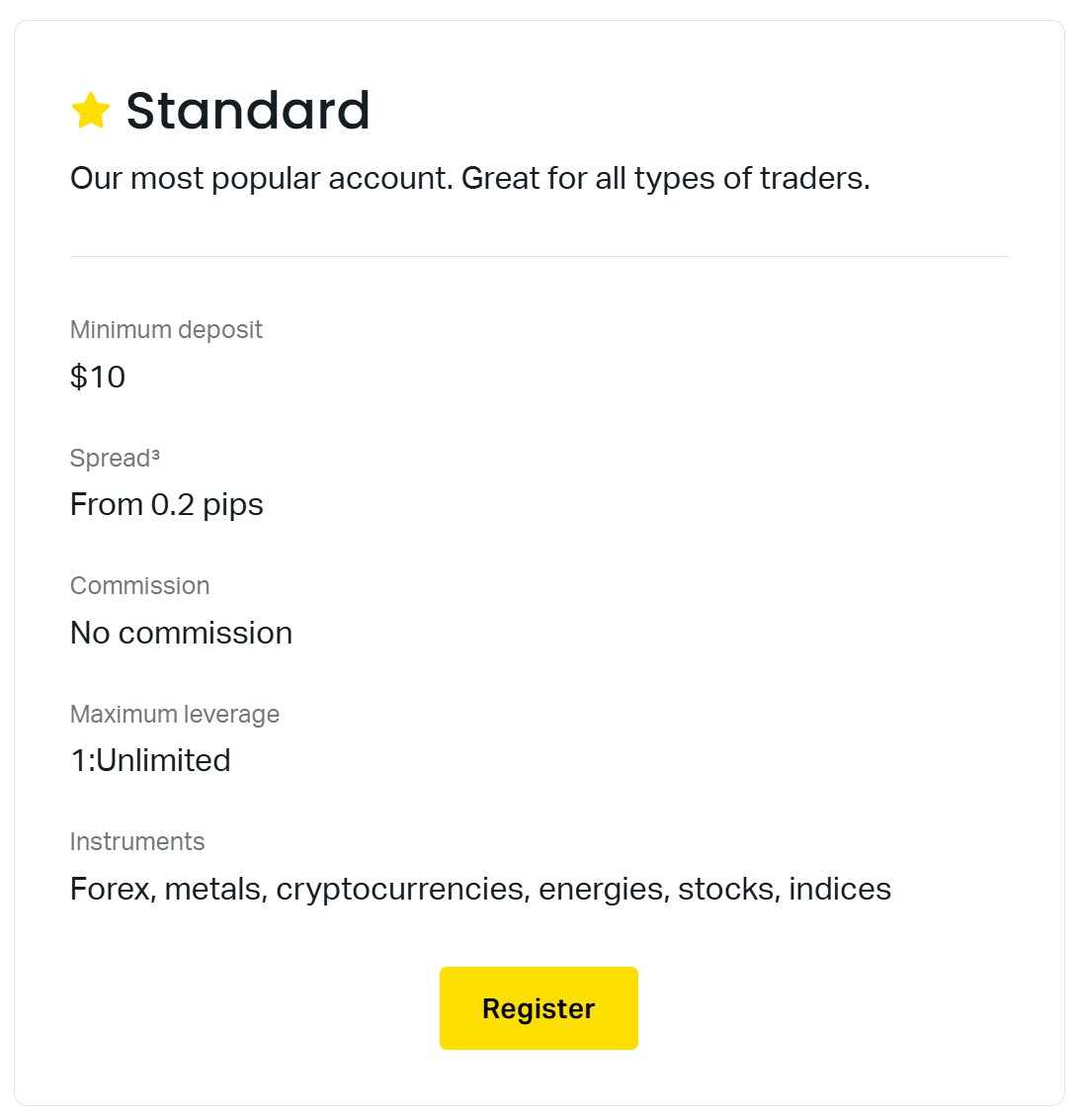

Standard Accounts: The Basics

A standard account, on the other hand, is the more traditional option offered by forex brokers. Here, the broker acts as a market maker, meaning they take the opposite side of your trade. The spread you see includes a markup, which is how the broker earns its revenue.

Spreads: Fixed or variable, starting at 1–2 pips or higher, depending on the broker and currency pair.

Commission: Usually no commission fees—costs are bundled into the spread.

Simplicity: Ideal for beginners due to its straightforward pricing structure.

Standard accounts are widely recommended for new traders or those who prefer a hassle-free experience without worrying about additional fees.

Key Differences Between Raw Spread and Standard Accounts

To determine which account type suits you, let’s explore the core differences in detail.

1. Spreads and Costs

Raw Spread: Offers ultra-low spreads (e.g., 0.0–0.5 pips on major pairs like EUR/USD during high liquidity). However, you pay a commission per trade, which can range from $2 to $10 per lot, depending on the broker.

Standard Account: Spreads are higher (e.g., 1.5–3 pips on EUR/USD), but there’s no commission. The broker’s profit is baked into the spread markup.

Which is cheaper? It depends on your trading frequency and volume. For high-volume traders, raw spread accounts often work out cheaper despite the commission. For occasional traders, standard accounts may be more cost-effective.

2. Execution Speed and Type

Raw Spread: Uses ECN or STP (Straight Through Processing) execution, connecting you directly to the market. This results in faster trade execution and less slippage—crucial for scalpers and day traders.

Standard Account: Typically relies on market maker execution, where the broker fills your order internally. While execution is still fast, there’s a higher chance of slippage or requotes during volatile markets.

1️⃣ Open Exness Raw Spread MT4 Account

2️⃣ Open Exness Raw Spread MT5 Account

3. Trading Conditions

Raw Spread: Offers a more volatile, market-driven environment. Spreads can widen significantly during news events or low liquidity periods.

Standard Account: Provides more predictable spreads, especially with fixed-spread options, making it easier to plan trades.

4. Minimum Deposit

Raw Spread: Often requires a higher minimum deposit (e.g., $200–$1,000), as it’s tailored to serious traders.

Standard Account: Usually has a lower entry barrier (e.g., $10–$100), appealing to beginners or those testing the waters.

Pros and Cons of Raw Spread Accounts

Advantages

Lower Trading Costs for High Volumes: If you trade large lot sizes or frequently scalp the market, the tight spreads can save you money over time.

Transparency: You see the real market spread without broker interference, fostering trust.

Ideal for Scalping and Day Trading: The combination of low spreads and fast execution suits short-term strategies.

No Conflict of Interest: With ECN brokers, there’s less risk of the broker trading against you.

Disadvantages

Commission Fees: These can add up, especially for small trades or low-volume traders.

Spread Volatility: Spreads can widen dramatically during volatile periods, negating the "low spread" benefit.

Complexity: Not beginner-friendly due to fluctuating costs and higher capital requirements.

Pros and Cons of Standard Accounts

Advantages

Simplicity: No need to calculate commissions—just focus on the spread.

Budget-Friendly for Beginners: Lower deposits and no extra fees make it accessible.

Stable Costs: Fixed spreads (where offered) provide predictability, especially during volatile markets.

Wide Availability: Most brokers offer standard accounts as their default option.

Disadvantages

Higher Spreads: Over time, the markup can erode profits, especially for frequent traders.

Potential Conflict of Interest: Market maker brokers may profit from your losses, raising ethical concerns.

Slower Execution: Slippage and requotes can occur, impacting trade outcomes.

Who Should Choose a Raw Spread Account?

Raw spread accounts shine in specific scenarios. Here’s who they’re best suited for:

Scalpers: Traders who open and close positions within seconds or minutes benefit from tight spreads and fast execution.

High-Volume Traders: If you trade multiple lots daily, the lower spread outweighs the commission cost.

Experienced Traders: Those comfortable with market volatility and cost calculations can maximize raw spread benefits.

News Traders: During high-impact events, ECN execution reduces the risk of requotes.

Example: A scalper trading 10 lots of EUR/USD daily with a 0.2-pip spread and $6 commission per lot saves significantly compared to a 1.8-pip spread on a standard account.

Who Should Choose a Standard Account?

Standard accounts cater to a different crowd. Consider this option if:

You’re a Beginner: The simplicity and lower entry cost make it a great starting point.

You Trade Infrequently: Casual traders won’t feel the pinch of higher spreads with fewer trades.

You Prefer Fixed Costs: Fixed-spread standard accounts offer predictability, ideal for long-term strategies like swing trading.

You Have Limited Capital: Low minimum deposits mean you can start trading without a big upfront investment.

Example: A beginner trading 0.1 lots once a week on GBP/USD won’t notice the spread difference as much and avoids commission fees.

1️⃣ Open Exness Standard MT4 Account

2️⃣ Open Exness Standard MT5 Account

Cost Comparison: Raw Spread vs Standard Account

Let’s crunch some numbers to see how costs stack up.

Scenario 1: Low-Volume Trader

Trade: 0.5 lots of EUR/USD, 5 trades per week.

Raw Spread: 0.2 pips + $6 commission = $3 spread cost + $30 commission = $33/week.

Standard Account: 1.8 pips = $9/week.

Winner: Standard account—cheaper for small, infrequent trades.

Scenario 2: High-Volume Scalper

Trade: 10 lots of EUR/USD, 20 trades per week.

Raw Spread: 0.2 pips + $6 commission = $20 spread cost + $120 commission = $140/week.

Standard Account: 1.8 pips = $180/week.

Winner: Raw spread account—saves money as volume increases.

This shows that trading volume is a key factor in determining cost-effectiveness.

Broker Considerations: What to Look For

Your choice of broker can make or break your experience with either account type. Here’s what to evaluate:

For Raw Spread Accounts

Commission Structure: Compare per-lot fees across brokers.

Liquidity Providers: More providers mean tighter spreads and better execution.

Regulation: Ensure the broker is reputable (e.g., ASIC, FCA, CySEC-regulated).

For Standard Accounts

Spread Consistency: Check if spreads remain reasonable during volatility.

No Hidden Fees: Confirm there are no sneaky charges beyond the spread.

Customer Support: Beginners need reliable assistance, so prioritize brokers with strong support.

Popular brokers like IC Markets and Pepperstone excel with raw spread accounts, while XM and Exness offer competitive standard accounts.

Trading Strategies and Account Types

Your trading strategy heavily influences which account is better.

Scalping/Day Trading: Raw spread accounts are superior due to low spreads and fast execution.

Swing Trading: Standard accounts work well, as wider spreads matter less over longer timeframes.

Automated Trading: Raw spread accounts are ideal for EAs (Expert Advisors) that rely on precision and speed.

Real-World Examples: Traders’ Experiences

John, the Scalper: John trades 15 lots daily using a raw spread account with a 0.1-pip average spread and $5 commission. His weekly cost is lower than a standard account’s 2-pip spread, boosting his profits.

Sarah, the Hobbyist: Sarah trades 0.2 lots monthly on a standard account with a 1.5-pip spread. The lack of commissions keeps her costs minimal, fitting her casual style.

These examples highlight how personal circumstances dictate the better choice.

Common Myths Debunked

Myth: "Raw spread accounts are always cheaper."

Truth: Not for low-volume traders—commissions can outweigh spread savings.

Myth: "Standard accounts are less professional."

Truth: They’re just different, not inferior—many pros use them for specific strategies.

Myth: "Raw spreads guarantee profits."

Truth: Tight spreads help, but success depends on skill and market conditions.

Final Verdict: Which Is Better?

So, raw spread vs standard account—which wins? There’s no universal answer. Here’s a quick decision guide:

Choose Raw Spread If: You’re an experienced, high-volume trader or scalper who values low spreads and transparency.

Choose Standard If: You’re a beginner, trade casually, or prefer simplicity and lower upfront costs.

Ultimately, test both account types with a demo account from your chosen broker. Analyze your trading habits, costs, and comfort level before committing real funds. The "better" option is the one that aligns with your goals and maximizes your edge in the market.

Conclusion

The debate between raw spread and standard accounts boils down to a trade-off between cost, complexity, and control. Raw spread accounts offer precision and savings for active traders, while standard accounts provide accessibility and ease for newcomers. By understanding their differences and matching them to your trading profile, you’ll set yourself up for success. Whether you’re chasing pips in a fast-paced scalp or holding positions for days, the right account type can make all the difference. So, which will you choose?

Read more: