8 minute read

Is forex banned in Nigeria? A Comprehensive Guide

from Exness Global

Forex trading has become a global phenomenon, attracting millions of individuals seeking financial independence through currency speculation. In Nigeria, a country with a rapidly growing population and an emerging economy, forex trading has gained significant traction over the past decade. However, a common question persists among aspiring traders: Is forex banned in Nigeria? The short answer is no, forex trading is not banned in Nigeria. However, the landscape is far more nuanced than a simple yes or no. This article delves deep into the regulatory framework, misconceptions, challenges, and opportunities surrounding forex trading in Nigeria.

Top 4 Best Forex Brokers in Nigeria

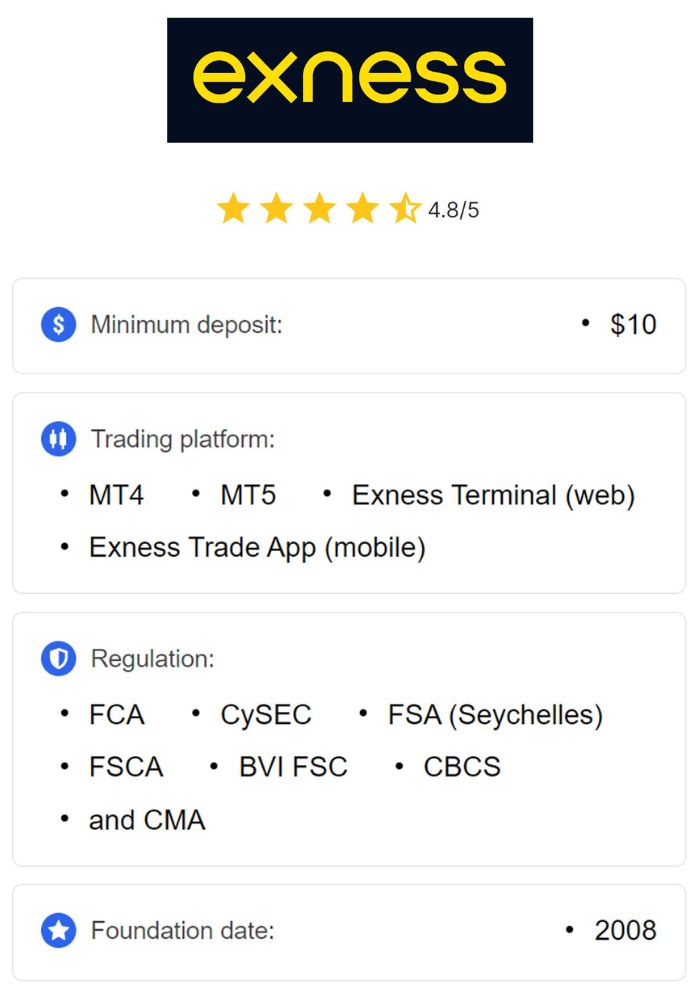

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

Understanding Forex Trading: A Brief Overview

Before addressing the legality of forex trading in Nigeria, let’s clarify what forex trading entails. The foreign exchange (forex) market is the largest and most liquid financial market globally, with a daily trading volume exceeding $7 trillion. It involves the buying and selling of currencies in pairs, such as USD/NGN (U.S. Dollar/Nigerian Naira) or EUR/USD (Euro/U.S. Dollar), with traders aiming to profit from fluctuations in exchange rates.

Forex trading is decentralized, meaning it operates over-the-counter (OTC) through electronic platforms rather than a centralized exchange like the stock market. This accessibility has made it a popular choice for retail traders worldwide, including in Nigeria. But with this accessibility comes the need for regulation, especially in a country like Nigeria, where economic stability and currency management are critical concerns.

The Legal Status of Forex Trading in Nigeria

So, is forex trading banned in Nigeria? To put it plainly, forex trading is legal in Nigeria, but it operates within a specific regulatory framework overseen by the Central Bank of Nigeria (CBN) and, to some extent, the Securities and Exchange Commission (SEC). Unlike some countries where forex trading is outright prohibited (e.g., North Korea or India under certain conditions), Nigeria permits individuals to engage in forex trading as long as they adhere to established guidelines.

The confusion around its legality often stems from the CBN’s strict foreign exchange policies and periodic interventions in the market. These measures are not designed to ban forex trading but to regulate access to foreign currency and stabilize the Naira, Nigeria’s national currency. Let’s break this down further.

The Role of the Central Bank of Nigeria (CBN)

The CBN is the primary authority responsible for managing Nigeria’s monetary policy and foreign exchange market. Established in 1958, the CBN has a mandate to ensure price stability, regulate financial institutions, and manage the country’s foreign reserves. In the context of forex trading, the CBN oversees:

Exchange Rate Management: The CBN sets official exchange rates and intervenes in the market to prevent excessive volatility in the Naira’s value.

Forex Access Restrictions: At times, the CBN restricts access to foreign exchange for certain transactions, such as non-essential imports, to preserve Nigeria’s foreign reserves.

Licensing of Forex Brokers: Only brokers and dealers licensed by the CBN or recognized international regulators can legally facilitate forex trading in Nigeria.

While these regulations may seem restrictive, they do not equate to a ban on forex trading. Instead, they create a controlled environment where traders must operate through legitimate channels.

The Securities and Exchange Commission (SEC) and Forex

The SEC plays a secondary role in Nigeria’s forex landscape. While it primarily regulates the capital markets (stocks, bonds, and derivatives), it also oversees certain financial activities related to forex trading, particularly when brokers offer contracts for difference (CFDs) or other investment products. However, forex trading as a retail activity is not heavily regulated by the SEC, leaving most oversight to the CBN.

Why the Misconception That Forex Is Banned Exists

Despite its legality, many Nigerians believe forex trading is banned or heavily restricted. Several factors contribute to this misconception:

1. CBN’s Forex Restrictions

In recent years, the CBN has implemented policies that limit access to foreign exchange for specific purposes. For example, in 2021, the CBN halted the sale of forex to Bureau de Change (BDC) operators, citing concerns over speculative trading and illegal forex activities. This move led some to mistakenly assume that forex trading itself was prohibited.

Additionally, the CBN has restricted forex access for importing certain goods (e.g., rice, cement, and poultry), a policy that was lifted for 43 items in October 2023. These restrictions are often misinterpreted as a blanket ban on forex-related activities.

2. Crackdowns on Illegal Forex Activities

The Nigerian government and agencies like the Economic and Financial Crimes Commission (EFCC) have cracked down on unregulated forex brokers and Ponzi schemes masquerading as forex trading platforms. High-profile arrests and warnings from authorities have fueled the perception that forex trading is illegal, when in reality, these actions target fraudulent operations, not legitimate trading.

3. Currency Volatility and Economic Challenges

Nigeria’s economy has faced significant challenges, including Naira depreciation, inflation, and foreign exchange scarcity. The Naira remains under pressure, with exchange rates fluctuating widely between the official and parallel (black) markets. This volatility has led to stricter controls on forex, further confusing the public about the legality of trading.

How Forex Trading Works in Nigeria

For Nigerians interested in forex trading, the process is straightforward but requires compliance with regulations. Here’s how it typically works:

1. Choosing a Forex Broker

Traders must select a reputable broker, ideally one regulated by the CBN or an internationally recognized authority like the Financial Conduct Authority (FCA) in the UK or the Cyprus Securities and Exchange Commission (CySEC). Many international brokers accept Nigerian clients, offering platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

💥 Trade with Exness now: Open An Account or Visit Brokers

2. Opening a Trading Account

After selecting a broker, traders open an account by providing identification and proof of address. Some brokers require a minimum deposit, which can range from $10 to $500, depending on the platform.

3. Funding the Account

Funding can be a challenge due to restrictions on international transactions imposed by local banks. However, options like bank cards, e-wallets (e.g., Skrill, Neteller), and cryptocurrency are often available for Nigerian traders.

4. Trading Currencies

Once funded, traders can speculate on currency pairs, leveraging market analysis and tools provided by the broker. Profits are earned by correctly predicting price movements, though losses are equally possible due to the high-risk nature of forex.

Challenges Nigerian Forex Traders Face

While forex trading is legal, Nigerian traders encounter unique hurdles that can make it seem restricted:

1. Limited Access to Forex

The CBN’s tight control over foreign exchange means that accessing USD or other currencies for trading can be difficult. Many traders resort to the parallel market, where rates are higher and unregulated, increasing costs and risks.

2. Payment Restrictions

Local banks often impose limits on international transfers, complicating deposits and withdrawals with forex brokers. This has driven the adoption of alternative payment methods, but it remains a barrier for beginners.

3. Economic Instability

Nigeria’s reliance on oil exports, coupled with political and economic instability, affects the Naira’s value. This unpredictability adds risk to forex trading, particularly for pairs involving the Naira (e.g., USD/NGN).

4. Scams and Unregulated Brokers

The lack of robust local regulation has allowed unregulated brokers and scammers to target Nigerian traders. Ponzi schemes promising unrealistic returns have tarnished the reputation of forex trading in the country.

Opportunities for Forex Trading in Nigeria

Despite these challenges, forex trading offers significant opportunities for Nigerians:

1. High Leverage

Unlike heavily regulated markets (e.g., the EU, where leverage is capped at 1:30), Nigerian traders can access higher leverage (up to 1:1000 with some brokers). This amplifies potential profits, though it also increases risk.

2. Growing Community

Nigeria boasts a vibrant forex trading community, with online forums, training programs, and social media groups providing education and support. This grassroots movement has empowered many to succeed in the market.

3. Global Market Access

Through international brokers, Nigerians can trade major currency pairs and exotic pairs, tapping into a global market unaffected by local restrictions.

Regulatory Changes and Recent Developments (2025)

The forex trading landscape in Nigeria continues to evolve. Recent developments include:

CBN Interventions: The CBN has pledged to boost liquidity in the official forex market, reducing reliance on the parallel market. This could ease access for traders.

Lifting of Restrictions: The 2023 decision to lift forex bans on 43 import items signals a shift toward market liberalization, potentially benefiting forex traders indirectly.

Crypto and Forex Intersection: While cryptocurrency trading faced scrutiny in 2021, some brokers now accept crypto deposits, offering a workaround for forex funding challenges.

Is Forex Trading Safe in Nigeria?

Safety depends on the trader’s approach. Forex trading is inherently risky due to leverage and market volatility, but it can be safe with the right precautions:

Choose Regulated Brokers: Opt for brokers with a strong reputation and regulatory oversight.

Educate Yourself: Understanding market dynamics and risk management is crucial.

Avoid Scams: Be wary of platforms promising guaranteed profits or requiring large upfront investments.

Conclusion: Forex Is Not Banned, But Proceed with Caution

To summarize, forex trading is not banned in Nigeria. It is a legal and viable activity, regulated primarily by the CBN, with opportunities for profit amid a challenging economic environment. Misconceptions arise from strict forex policies and crackdowns on illegal activities, but legitimate trading remains accessible through licensed brokers.

💥 Trade with Exness now: Open An Account or Visit Brokers

For Nigerians considering forex trading in 2025, the key is to stay informed, choose reputable platforms, and navigate the local economic landscape wisely. With proper knowledge and discipline, forex trading can be a rewarding venture in Nigeria’s evolving financial ecosystem.

Read more: