9 minute read

How to Open a Forex Account in Nigeria: A Step-by-Step Guide

Forex trading has become a popular way for Nigerians to diversify their income streams, hedge against inflation, and tap into the global financial markets. With the rise of internet access and mobile technology, opening a forex account in Nigeria is now more accessible than ever. Whether you're a complete beginner or someone looking to refine your approach, this comprehensive guide will walk you through everything you need to know about starting your forex trading journey in Nigeria.

Top 4 Best Forex Brokers in Nigeria

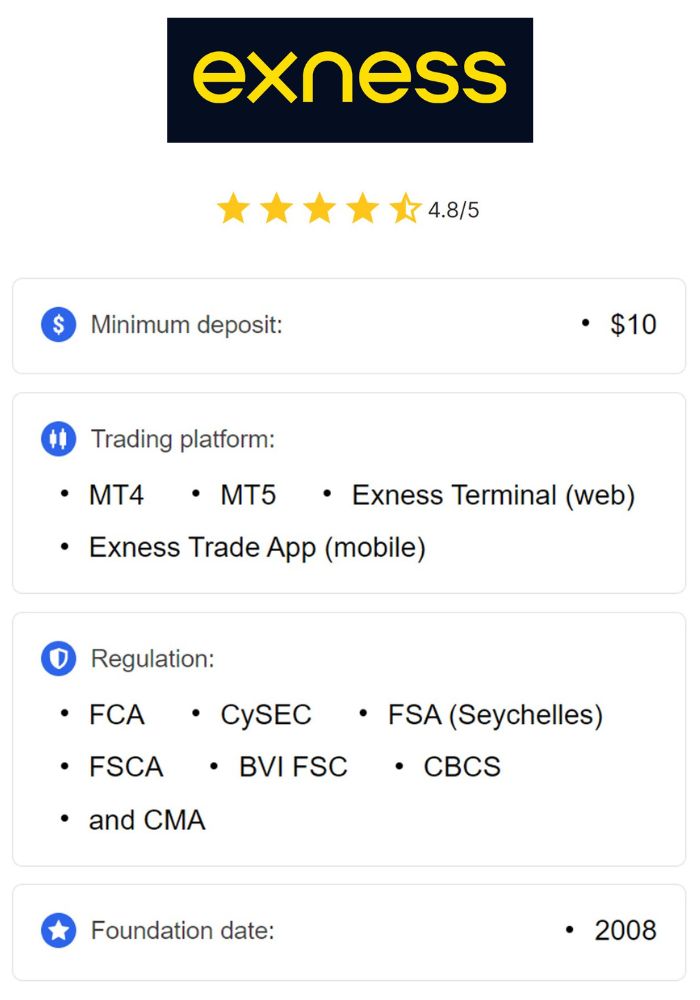

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

In this article, we’ll cover the basics of forex trading, why it’s gaining traction in Nigeria, how to choose the right broker, the step-by-step process of opening an account, funding options, legal considerations, and tips to succeed as a forex trader. Let’s dive in!

What Is Forex Trading and Why Is It Popular in Nigeria?

Forex trading, short for foreign exchange trading, involves buying and selling currencies to profit from changes in their exchange rates. The forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike stocks or commodities, forex trading operates 24 hours a day, five days a week, making it highly flexible for traders.

In Nigeria, forex trading has surged in popularity for several reasons:

Economic Opportunities: With the naira’s volatility and inflation challenges, many Nigerians turn to forex trading to earn in stronger currencies like the US dollar or euro.

Low Entry Barrier: You don’t need a massive capital investment to start—some brokers allow you to trade with as little as $10.

Accessibility: The proliferation of smartphones and affordable internet has made forex trading accessible to anyone with a device and a data plan.

Education and Awareness: Online resources, webinars, and communities have empowered Nigerians to learn and participate in forex trading.

However, success in forex trading requires knowledge, discipline, and the right tools—starting with opening a forex account. Let’s explore how to do that in Nigeria.

Step 1: Understand the Basics Before Opening an Account

Before jumping into the process, it’s crucial to grasp the fundamentals of forex trading. Here’s a quick overview:

Currency Pairs: Forex trading involves pairs like USD/NGN (US Dollar/Nigerian Naira), EUR/USD, or GBP/JPY. The first currency is the base, and the second is the quote.

Leverage: This allows you to control a large position with a small amount of money. For example, with 1:100 leverage, $100 can control $10,000 worth of trades.

Pips: A pip is the smallest price movement in a currency pair, typically 0.0001 for most pairs.

Brokers: These are platforms or companies that facilitate your trades in the forex market.

Having a basic understanding will help you make informed decisions when choosing a broker and setting up your account.

Step 2: Choose the Right Forex Broker in Nigeria

The broker you select is the foundation of your trading experience. A good broker ensures smooth transactions, security of funds, and access to the right tools. Here’s how to choose one:

Factors to Consider When Selecting a Broker

Regulation: Ensure the broker is regulated by a reputable authority like the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), or South Africa’s Financial Sector Conduct Authority (FSCA). While Nigeria’s Central Bank (CBN) doesn’t directly regulate forex brokers, choosing a globally regulated one adds a layer of safety.

Trading Platforms: Popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), or proprietary apps should be available. These platforms are user-friendly and widely used in Nigeria.

Minimum Deposit: Look for brokers with low minimum deposits (e.g., $5–$100) if you’re starting small.

Payment Methods: The broker should support funding and withdrawal options accessible in Nigeria, such as bank cards, local bank transfers, or e-wallets.

Customer Support: Opt for a broker with 24/5 support, preferably with local Nigerian contacts or live chat.

Spreads and Fees: Low spreads (the difference between buy and sell prices) and minimal commissions are ideal for cost-effective trading.

Top Forex Brokers Popular in Nigeria

Exness: Offers high leverage and instant withdrawals.

XM: Known for low spreads, a $5 minimum deposit, and MT4/MT5 support.

HotForex (HF Markets): Offers excellent customer support and local payment options.

FXTM (ForexTime): Popular for its educational resources and fast withdrawals.

OctaFX: Provides competitive spreads and a simple account setup process.

Research each broker’s reputation by reading reviews from Nigerian traders on forums, social media, or platforms like Nairaland.

💥 Trade with Exness now: Open An Account or Visit Brokers

Step 3: Gather the Required Documents

Opening a forex account requires identity verification to comply with anti-money laundering (AML) and Know Your Customer (KYC) regulations. Here’s what you’ll typically need:

Proof of Identity: A valid government-issued ID like a Nigerian passport, driver’s license, or National ID card.

Proof of Address: A utility bill (electricity, water), bank statement, or tenancy agreement showing your name and address, dated within the last three months.

Email and Phone Number: For account verification and communication.

Bank Details: If you’re funding via bank transfer or card, have your account or card details ready.

Ensure all documents are clear and up-to-date to avoid delays in the verification process.

Step 4: Open Your Forex Account Step-by-Step

Now that you’ve chosen a broker and prepared your documents, here’s the detailed process to open your account:

1. Visit the Broker’s Website or Download Their App

Go to the official website of your chosen broker (e.g., Exness, XM) or download their mobile app from the Google Play Store or Apple App Store. Avoid unofficial sources to prevent scams.

2. Register for an Account

Click on “Open Account” or “Register.”

Fill in your personal details: full name, email address, phone number, and country (Nigeria).

Create a strong password.

3. Choose Your Account Type

Brokers offer different account types based on experience and capital:

Micro Account: Ideal for beginners with small deposits (e.g., $5–$100).

Standard Account: For intermediate traders with higher capital.

ECN Account: For advanced traders seeking tighter spreads and direct market access. Select an account that matches your budget and goals.

4. Complete KYC Verification

Upload your ID and proof of address as requested.

Some brokers may ask you to answer a short questionnaire about your trading experience and financial status.

Verification usually takes 1–24 hours, depending on the broker.

5. Download the Trading Platform

Once approved, download the trading platform (e.g., MT4 or MT5) on your phone or computer. Log in using the credentials provided by the broker.

6. Fund Your Account

After verification, deposit funds to start trading. See the next section for funding options in Nigeria.

Step 5: Fund Your Forex Account in Nigeria

Funding your account is a critical step, and Nigerian traders have several options despite currency exchange challenges. Here’s how to do it:

Popular Funding Methods

Bank Cards (Visa/Mastercard):

Most brokers accept debit or credit cards.

Transactions are instant, but withdrawals may take 1–5 days.

Check for conversion fees from NGN to USD.

Local Bank Transfer:

Some brokers partner with Nigerian banks (e.g., GTBank, Zenith) for direct deposits.

Processing may take 1–3 days.

E-Wallets:

Platforms like Skrill, Neteller, or Perfect Money are fast and widely accepted.

Note that not all e-wallets are available for withdrawals in Nigeria.

Cryptocurrency:

Brokers like Exness and OctaFX accept Bitcoin or USDT deposits.

This is a quick option, but you’ll need a crypto wallet.

Third-Party Payment Agents:

Some brokers allow deposits via local agents who convert NGN to USD for you.

Verify the agent’s legitimacy to avoid scams.

Tips for Funding

Start with a small amount (e.g., $10–$50) to test the broker’s deposit and withdrawal process.

Be aware of CBN restrictions on forex transactions—using e-wallets or crypto can bypass some limitations.

Check the broker’s deposit fees and minimum requirements.

Step 6: Start Trading and Manage Risks

With your account funded, you’re ready to trade. Here’s how to begin:

1. Practice with a Demo Account

Most brokers offer free demo accounts with virtual funds. Use this to:

Learn how to place trades.

Test strategies without risking real money.

Familiarize yourself with the platform.

2. Develop a Trading Plan

Set clear goals (e.g., 5% monthly profit).

Decide your risk tolerance (e.g., risking 1–2% of your capital per trade).

Choose a strategy: scalping, day trading, or swing trading.

3. Place Your First Trade

Open your trading platform.

Select a currency pair (e.g., EUR/USD).

Analyze the market using technical indicators (e.g., Moving Averages, RSI) or news events.

Set your trade size, stop-loss, and take-profit levels.

Click “Buy” or “Sell” to execute.

4. Monitor and Learn

Track your trades and review your performance.

Avoid overtrading or emotional decisions.

Legal Considerations for Forex Trading in Nigeria

Forex trading is legal in Nigeria, but it operates in a gray area due to limited local regulation. Here’s what to know:

The Central Bank of Nigeria (CBN) oversees monetary policy but doesn’t regulate forex brokers directly.

The Securities and Exchange Commission (SEC) regulates financial markets, but its focus is more on stocks than forex.

To stay safe, use internationally regulated brokers and avoid unregistered platforms promising “guaranteed profits.”

Additionally, be cautious of scams. Warning signs include:

Promises of quick riches with no risk.

Pressure to deposit large sums immediately.

Unregistered brokers with no verifiable address.

Tips for Success as a Forex Trader in Nigeria

Educate Yourself: Read books like “Currency Trading for Dummies”, watch YouTube tutorials, or join Nigerian forex communities.

Start Small: Begin with a micro account to minimize losses while learning.

Use Risk Management: Never risk more than you can afford to lose.

Stay Updated: Follow global economic news (e.g., US Federal Reserve decisions) that affect currency pairs.

Be Patient: Forex trading is a skill that takes time to master—avoid chasing quick profits.

Common Challenges and Solutions

Challenge 1: Funding Restrictions

Solution: Use e-wallets or crypto to bypass CBN limits on forex purchases.

Challenge 2: High Internet Costs

Solution: Trade during off-peak hours or use affordable data plans from MTN, Airtel, or Glo.

Challenge 3: Scams

Solution: Verify brokers through reviews and regulatory bodies before depositing funds.

Conclusion: Your Forex Journey Starts Here

Opening a forex account in Nigeria is a straightforward process if you follow the right steps. By choosing a reliable broker, preparing your documents, funding your account wisely, and starting with a solid plan, you can unlock the potential of forex trading. While the journey may come with challenges, the rewards—financial independence, skill development, and global market exposure—are worth the effort.

💥 Trade with Exness now: Open An Account or Visit Brokers

Ready to take the plunge? Pick a broker, open your account, and start practicing today. The forex market waits for no one—your opportunity is now!

Read more: