10 minute read

Does Exness Work in Zimbabwe? A Comprehensive Guide for Traders

Forex trading has surged in popularity across Africa, and Zimbabwe is no exception. As more Zimbabweans explore opportunities in global financial markets, one question stands out: Does Exness work in Zimbabwe? For traders seeking a reliable, efficient, and accessible platform, Exness—a globally recognized forex broker—often comes to mind. In this detailed guide, we’ll explore whether Exness operates in Zimbabwe, how it caters to local traders, its features, regulatory status, and practical tips for getting started. By the end, you’ll have a clear understanding of whether Exness is the right choice for your trading journey in Zimbabwe.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? An Overview of the Platform

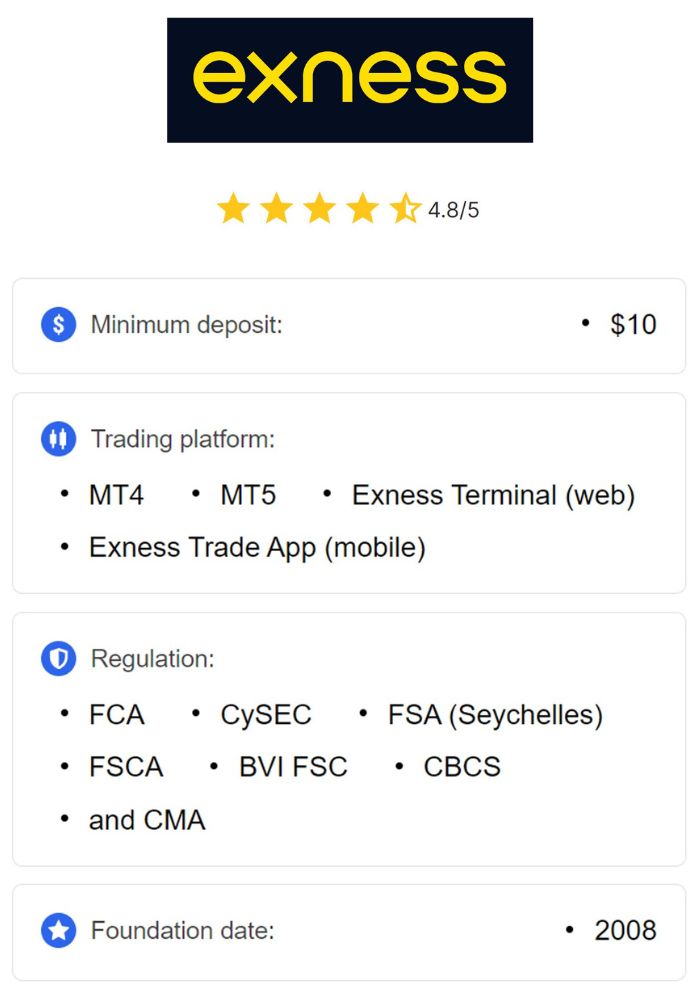

Before diving into its functionality in Zimbabwe, let’s establish what Exness is. Founded in 2008, Exness is an international forex and CFD (Contract for Difference) broker headquartered in Cyprus, with additional offices in Seychelles and other regions. It has built a reputation for offering competitive trading conditions, including tight spreads, high leverage, and a wide range of financial instruments. Traders can access forex pairs, cryptocurrencies, commodities, indices, and stocks through popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Exness serves millions of clients worldwide, boasting a monthly trading volume exceeding $4 trillion as of recent reports. Its appeal lies in its user-friendly interface, fast execution speeds, and commitment to transparency. But does this global reach extend to Zimbabwe, a country with unique economic challenges and regulatory nuances? Let’s find out.

Does Exness Work in Zimbabwe?

Yes, Exness works in Zimbabwe. The broker accepts clients from Zimbabwe and provides them with full access to its trading services. Zimbabwean traders can open accounts, deposit funds, trade various instruments, and withdraw profits using the Exness platform. Unlike some brokers that restrict services in certain regions due to regulatory or operational constraints, Exness has no such limitations for Zimbabwe.

This accessibility is a significant advantage for Zimbabwean traders, especially given the country’s economic landscape. With a history of hyperinflation, currency instability, and limited access to foreign exchange, many locals turn to forex trading as a means of generating income and preserving wealth. Exness steps in as a viable option, bridging the gap between Zimbabwean traders and global markets.

💥 Trade with Exness now: Open An Account or Visit Brokers

Why Exness Appeals to Zimbabwean Traders

Exness stands out for several reasons that align with the needs of traders in Zimbabwe. Here’s a closer look at why it’s a popular choice:

1. Low Minimum Deposit Requirements

One of the biggest barriers for new traders is the initial capital required to start trading. Exness addresses this by offering account types with low minimum deposits. For instance, the Standard Cent account requires as little as $10 to begin, making it ideal for beginners or those with limited funds—a common scenario in Zimbabwe.

2. Competitive Spreads and Fees

Exness is known for its tight spreads, starting from 0.0 pips on certain account types like the Raw Spread or Zero accounts. For Zimbabwean traders operating on slim margins, low trading costs can make a significant difference in profitability. Additionally, Exness doesn’t charge withdrawal fees for most methods, which is a boon in a country where every dollar counts.

3. High Leverage Options

Exness offers leverage up to 1:Unlimited on some accounts, allowing traders to control larger positions with minimal capital. While this amplifies both potential profits and risks, it’s particularly attractive in Zimbabwe, where access to substantial trading capital may be limited.

4. Diverse Payment Methods

Zimbabwe’s financial system has faced challenges, including restrictions on foreign currency transactions. Exness supports a variety of deposit and withdrawal methods tailored to local needs, such as bank cards, e-wallets (e.g., Skrill, Neteller), and even cryptocurrency options like Bitcoin. This flexibility ensures traders can fund their accounts and access profits with ease.

5. Robust Trading Platforms

Exness provides access to MT4, MT5, and its proprietary Exness Terminal, all of which are compatible with desktop and mobile devices. In Zimbabwe, where mobile internet usage is widespread, the ability to trade on the go is a game-changer.

6. 24/7 Customer Support

With support available in multiple languages and round-the-clock assistance via live chat, email, and phone, Exness ensures Zimbabwean traders can resolve issues promptly—an essential feature in a market where time is money.

The Legal Landscape: Is Forex Trading Allowed in Zimbabwe?

To fully answer whether Exness works in Zimbabwe, we must consider the legal context. Forex trading is not explicitly illegal in Zimbabwe, but it operates in a regulatory gray area. The Reserve Bank of Zimbabwe (RBZ) oversees financial activities, including foreign exchange transactions, under the Exchange Control Act. While the RBZ regulates banks and licensed financial institutions, online forex brokers like Exness fall outside its direct jurisdiction because they operate internationally.

For Zimbabwean traders, this means forex trading is permissible as long as they comply with local laws, such as declaring foreign earnings and adhering to capital control regulations. Exness, regulated by reputable bodies like the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority (FSA) in Seychelles, provides a layer of security that local oversight might not offer. However, traders should note that Exness’s investor protection schemes (e.g., under CySEC) may not apply to Zimbabwean clients, who typically register under the Seychelles entity.

How to Start Trading with Exness in Zimbabwe

If you’re a Zimbabwean trader eager to use Exness, the process is straightforward. Here’s a step-by-step guide:

Step 1: Register an Account

Visit the official Exness website: Open An Account or Visit Brokers. You’ll need to provide basic details like your email address, phone number, and country of residence (Zimbabwe). The registration takes just a few minutes.

Step 2: Verify Your Identity

Exness requires Know Your Customer (KYC) verification to comply with global anti-money laundering regulations. Upload a valid ID (e.g., passport or national ID card) and proof of address (e.g., utility bill or bank statement). This step ensures your account is secure and fully functional.

Step 3: Choose an Account Type

Exness offers several account types to suit different trading styles:

Standard Cent: Ideal for beginners, with micro-lot trading and a low entry barrier.

Standard: A versatile option for most traders, with no commission and stable spreads.

Pro: Designed for experienced traders, offering instant execution and low spreads.

Raw Spread: Features ultra-low spreads with a small commission per trade.

Zero: Provides zero spreads on select instruments, perfect for scalpers.

Choose based on your experience level and trading goals.

Step 4: Deposit Funds

Log into your Exness account, navigate to the “Deposit” section, and select a payment method. Options include:

Bank Cards: Visa or Mastercard (subject to local bank support).

E-Wallets: Skrill, Neteller, or Perfect Money.

Cryptocurrency: Bitcoin or Tether (USDT).

Local Payment Systems: Some Zimbabwean traders use mobile money or bank transfers via third-party services.

Deposits are typically instant, though processing times may vary.

Step 5: Start Trading

Download MT4, MT5, or the Exness Trade app, log in with your credentials, and begin trading. You can practice with a demo account first to test strategies without risking real money.

Step 6: Withdraw Profits

When ready, request a withdrawal through the same method used for deposits (a regulatory requirement). Exness is renowned for its instant withdrawals, though local banking delays in Zimbabwe might affect timing.

Challenges Zimbabwean Traders Might Face with Exness

While Exness works seamlessly in Zimbabwe, certain challenges could impact your experience:

1. Internet Connectivity

Zimbabwe’s internet infrastructure, especially in rural areas, can be unreliable. Slow speeds or outages may disrupt real-time trading, particularly for strategies like scalping that demand precision.

Solution: Use a reliable internet provider and consider a backup mobile data plan.

2. Currency and Payment Restrictions

The Zimbabwean Dollar (ZWL) is volatile, and foreign currency access is tightly controlled. Traders often need USD or other stable currencies to fund accounts, which may require navigating local exchange markets.

Solution: Leverage Exness’s cryptocurrency options or e-wallets to bypass traditional banking hurdles.

3. Limited Local Support

Exness doesn’t have a physical office in Zimbabwe, so all support is online or via phone. Time zone differences might delay responses for urgent queries.

Solution: Utilize the 24/7 live chat for immediate assistance.

4. Economic Volatility

Zimbabwe’s economic instability can affect trading capital and profit repatriation. High inflation might erode earnings if not converted to foreign currency quickly.

Solution: Withdraw profits regularly and store them in stable assets like USD or crypto.

Benefits of Using Exness in Zimbabwe

Despite these challenges, the benefits outweigh the drawbacks for most Zimbabwean traders:

Global Market Access: Trade forex, crypto, and commodities from anywhere in Zimbabwe.

Affordability: Low entry costs and fees make it accessible to a broad audience.

Flexibility: Multiple account types and payment methods cater to diverse needs.

Security: Regulation by top-tier authorities ensures funds are handled responsibly.

Education: Exness offers tutorials, webinars, and market analysis to help traders improve.

Exness vs. Other Brokers in Zimbabwe

How does Exness stack up against competitors like XM, FBS, or Deriv in Zimbabwe? Here’s a quick comparison:

Exness vs. XM: XM offers similar low spreads and account variety, but its minimum deposit ($5) is slightly lower than Exness’s Standard Cent ($10). However, Exness excels with instant withdrawals and unlimited leverage.

Exness vs. FBS: FBS targets beginners with bonuses and promotions, which Exness doesn’t offer. Exness counters with superior execution speeds and a broader instrument range.

Exness vs. Deriv: Deriv focuses on synthetic indices, a niche Exness doesn’t cover extensively. Exness, however, provides a more comprehensive forex and CFD experience.

For Zimbabweans, Exness’s combination of affordability, reliability, and global reach often makes it the preferred choice.

Tips for Successful Trading with Exness in Zimbabwe

To maximize your experience with Exness, consider these practical tips:

Start Small: Use the Standard Cent account to test the waters with minimal risk.

Leverage Wisely: High leverage can amplify gains but also losses—set strict risk management rules.

Stay Informed: Follow economic news affecting Zimbabwe and global markets via Exness’s analysis tools.

Secure Your Funds: Enable two-factor authentication (2FA) and withdraw profits regularly.

Practice First: Use a demo account to refine strategies before trading live.

Real Stories: Zimbabwean Traders on Exness

To bring this to life, let’s consider hypothetical experiences based on common trader feedback:

Tinashe from Harare: A university student, Tinashe started with $20 on a Standard Cent account. Within six months, he grew his capital to $150 by trading major forex pairs, thanks to Exness’s low spreads and mobile app.

Mai from Bulawayo: A single mother, Mai used Bitcoin deposits to bypass local banking issues. She now trades crypto pairs full-time, appreciating Exness’s instant withdrawals.

These stories reflect the platform’s adaptability to Zimbabwe’s unique conditions.

Is Exness Safe for Zimbabwean Traders?

Safety is a top concern for any trader. Exness’s regulation by the FCA, CySEC, and FSA provides assurance that it adheres to strict financial standards. Client funds are segregated from company assets, and negative balance protection prevents losses exceeding your deposit. While Zimbabwean traders fall under the Seychelles entity (less stringent than FCA or CySEC), Exness’s global reputation and transparency bolster its trustworthiness.

The Future of Exness in Zimbabwe

As Zimbabwe’s forex market grows, Exness is well-positioned to expand its presence. Potential improvements could include localized payment options (e.g., EcoCash integration) or educational workshops tailored to Zimbabwean traders. With the country’s youth increasingly embracing digital finance, Exness could become a cornerstone of Zimbabwe’s trading ecosystem.

Conclusion: Should You Trade with Exness in Zimbabwe?

So, does Exness work in Zimbabwe? Absolutely—it’s not only functional but also a compelling option for traders of all levels. Its low entry barriers, competitive conditions, and flexible payment methods make it a standout choice in a country facing economic hurdles. While challenges like internet reliability and currency access persist, Exness offers tools and features to navigate these issues effectively.

If you’re a Zimbabwean looking to enter the forex market, Exness provides a reliable gateway to global opportunities. Start with a demo account, explore its offerings, and see if it aligns with your goals. With the right strategy and discipline, Exness could be your ticket to financial empowerment in 2025 and beyond.

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: