10 minute read

Does Exness Work in Rwanda? A Comprehensive Guide for Traders

Forex trading has gained significant traction across the globe, and Rwanda is no exception. As the country continues to embrace digital financial solutions, many Rwandan traders are exploring online platforms to participate in the global currency market. Among the many brokers available, Exness stands out as a globally recognized name. But the question on many traders’ minds is: Does Exness work in Rwanda? In this in-depth article, we’ll explore Exness’s operations, its accessibility in Rwanda, the regulatory landscape, trading conditions, and everything else Rwandan traders need to know to make an informed decision.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? A Quick Overview

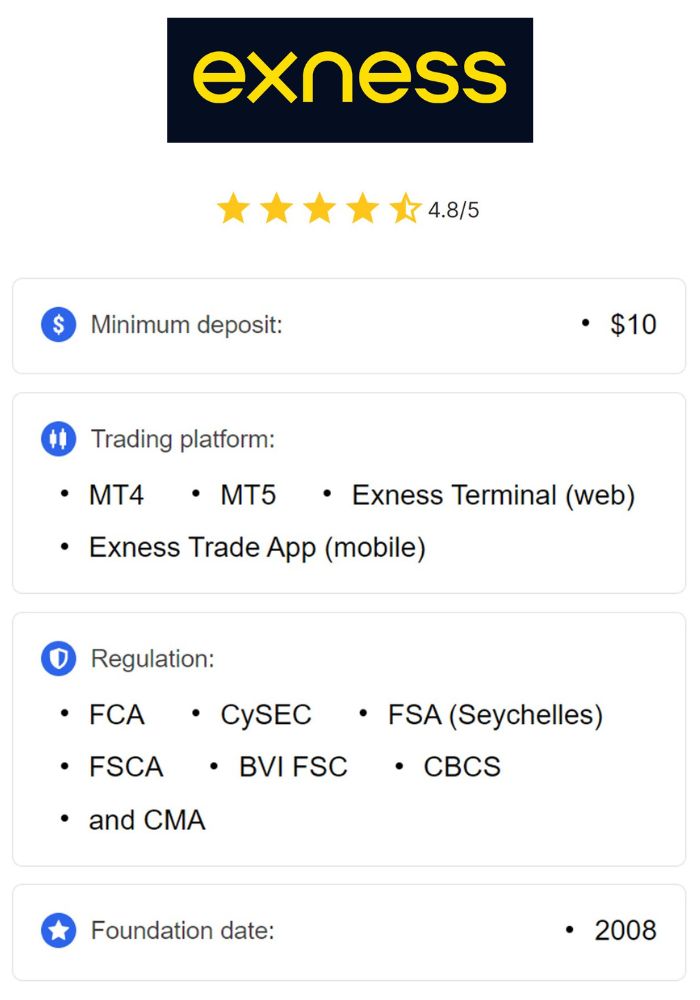

Before diving into whether Exness works in Rwanda, let’s first understand what Exness is. Founded in 2008, Exness is a multi-asset broker that has grown into one of the largest retail forex brokers worldwide. Known for its competitive spreads, lightning-fast execution, and a variety of trading instruments, Exness caters to both beginner and experienced traders. The broker offers access to forex pairs, commodities, indices, stocks, and cryptocurrencies, all tradable through popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Exness has built a reputation for transparency, reliability, and innovation. With a monthly trading volume exceeding $1 trillion and a presence in over 100 countries, it’s no surprise that Rwandan traders are curious about its services. But does Exness truly operate in Rwanda, and is it a viable option for local traders? Let’s find out.

Does Exness work in Rwanda?

The short answer is yes, Exness operates in Rwanda. As a global broker, Exness provides its services to traders in numerous countries, including Rwanda, through its online platform. There are no explicit restrictions preventing Rwandan residents from signing up, depositing funds, and trading with Exness. However, the details of how it works in Rwanda require a closer look.

Exness does not have a physical office in Rwanda, which is typical for international forex brokers serving smaller markets. Instead, it relies on its robust digital infrastructure to deliver services. Rwandan traders can access the Exness website, register an account, and start trading seamlessly, provided they have an internet connection and meet the basic requirements, such as completing the Know Your Customer (KYC) verification process.

Is Exness Legal in Rwanda?

Legality is a critical concern for traders choosing a forex broker. In Rwanda, forex trading itself is legal, but the regulatory framework surrounding it is still developing. The National Bank of Rwanda (BNR) oversees the country’s financial system, while the Rwanda Capital Market Authority (CMA) regulates capital markets. However, neither body has established specific regulations for retail forex brokers operating online.

This lack of local regulation doesn’t mean forex trading is prohibited. Rwandan traders are free to use international brokers like Exness, provided the broker complies with its own regulatory standards. Exness is regulated by several reputable authorities worldwide, including:

Financial Conduct Authority (FCA) in the UK

Cyprus Securities and Exchange Commission (CySEC) in Cyprus

Financial Sector Conduct Authority (FSCA) in South Africa

Financial Services Authority (FSA) in Seychelles

These licenses ensure that Exness adheres to strict standards for client fund protection, transparency, and fair trading practices. For Rwandan traders, this international oversight provides a layer of security, even though Exness isn’t directly regulated by Rwandan authorities. As long as traders comply with local financial laws—such as declaring profits for tax purposes—using Exness is a legal and legitimate option.

How to Sign Up with Exness from Rwanda

Getting started with Exness in Rwanda is straightforward. Here’s a step-by-step guide:

Visit the Exness Website: Head to the official Exness site: Open An Account or Visit Brokers

Register an Account: Click on the “Register” button and provide your email address, phone number, and country of residence (select Rwanda).

Complete KYC Verification: Upload a government-issued ID (like a passport or national ID) and proof of address (e.g., a utility bill) to verify your identity.

Choose an Account Type: Exness offers various account types, such as Standard, Pro, Raw Spread, and Zero accounts, each with different features like spreads and leverage.

Deposit Funds: Select a payment method (more on this later) and fund your account.

Start Trading: Download MT4 or MT5, log in with your credentials, and begin trading.

The entire process typically takes just a few minutes, making it accessible even for beginners in Rwanda.

Payment Methods for Rwandan Traders

One of the key factors determining whether a broker “works” in a country is the availability of convenient payment methods. Exness excels in this area by offering a wide range of deposit and withdrawal options suitable for Rwandan traders. These include:

Bank Cards: Visa and Mastercard are widely accepted for instant deposits.

Mobile Money: While Exness doesn’t directly list Rwanda-specific mobile money options like MTN Mobile Money or Airtel Money, traders can use third-party e-wallets that integrate with local services.

E-Wallets: Options like Skrill, Neteller, and Perfect Money are available and can act as intermediaries for Rwandan users.

Bank Transfers: Local bank transfers are supported, though processing times may vary depending on the bank.

Cryptocurrency: Exness accepts deposits in Bitcoin and other cryptocurrencies, which is ideal for tech-savvy traders.

Deposits are usually processed instantly, while withdrawals can take anywhere from a few hours to a couple of days, depending on the method. Importantly, Exness doesn’t charge fees for deposits or withdrawals, which is a significant advantage for cost-conscious traders in Rwanda.

Trading Conditions on Exness: What Rwandan Traders Can Expect

Exness is renowned for its competitive trading conditions, making it an attractive choice for Rwandan traders. Here’s what you can expect:

Spreads and Fees

Exness offers some of the tightest spreads in the industry, starting from 0.0 pips on certain account types like the Zero and Raw Spread accounts. For the Standard account, spreads are slightly higher but still competitive, averaging around 0.7-1.0 pips on major pairs like EUR/USD. There are no hidden fees, and commissions (where applicable) are clearly outlined.

Leverage

One of Exness’s standout features is its unlimited leverage option, available on select accounts. This allows traders to maximize their positions with minimal capital—a boon for those in Rwanda looking to grow small investments. However, high leverage comes with increased risk, so it’s essential to use it wisely.

Trading Platforms

Rwandan traders can choose between MT4 and MT5, both of which are available as desktop, web, and mobile apps. The Exness Trader app also provides a user-friendly alternative for managing accounts and executing trades on the go—a perfect fit for Rwanda’s growing mobile-first population.

Instruments

Exness offers a diverse range of tradable assets, including:

Forex pairs (e.g., USD/RWF, EUR/USD)

Commodities (gold, oil)

Indices (S&P 500, FTSE 100)

Cryptocurrencies (Bitcoin, Ethereum)

Stocks (Apple, Tesla)

This variety ensures Rwandan traders can diversify their portfolios beyond forex, tapping into global markets.

💥 Trade with Exness now: Open An Account or Visit Brokers

Internet and Infrastructure in Rwanda: Does It Support Exness?

For Exness to “work” effectively in Rwanda, reliable internet access is crucial. Fortunately, Rwanda has made remarkable strides in digital infrastructure. The country boasts one of the highest internet penetration rates in East Africa, with over 60% of the population connected as of 2025. Mobile broadband is widely available through providers like MTN Rwanda and Airtel, while initiatives like the National Broadband Policy aim to expand high-speed internet nationwide.

This infrastructure supports seamless trading on Exness. Whether you’re in Kigali or a rural area with decent coverage, you can access real-time market data, execute trades, and manage your account without significant delays. However, traders in remote regions should ensure a stable connection to avoid disruptions during volatile market conditions.

Advantages of Using Exness in Rwanda

Why should Rwandan traders consider Exness? Here are some key benefits:

Global Regulation: Multiple licenses from top-tier authorities enhance trust and security.

Low Costs: Tight spreads, no deposit/withdrawal fees, and a low minimum deposit ($10) make it affordable.

Flexible Leverage: Unlimited leverage offers opportunities for high returns, though it requires caution.

User-Friendly Platforms: MT4, MT5, and the Exness Trader app cater to all skill levels.

Fast Execution: Orders are processed in milliseconds, minimizing slippage.

Multilingual Support: Customer service is available 24/7 in multiple languages, including English, which is widely spoken in Rwanda.

Challenges Rwandan Traders Might Face with Exness

While Exness works well in Rwanda, there are potential challenges to consider:

Lack of Local Regulation: Without oversight from the CMA or BNR, traders rely solely on Exness’s international compliance.

Payment Limitations: Direct mobile money integration for Rwanda-specific services is limited, requiring workarounds via e-wallets.

Currency Conversion: The Rwandan Franc (RWF) isn’t supported as a base currency, so traders may incur conversion fees when depositing or withdrawing in USD or EUR.

Education Gaps: While Exness offers resources, beginners in Rwanda may need additional local support to master forex trading.

Exness vs. Other Brokers in Rwanda

How does Exness stack up against competitors like XM, HotForex, or OctaFX in Rwanda? Here’s a quick comparison:

Spreads: Exness offers tighter spreads (0.0 pips on premium accounts) than XM (0.6 pips) or HotForex (0.1 pips).

Leverage: Exness’s unlimited leverage surpasses XM’s 1:888 and HotForex’s 1:1000 caps.

Minimum Deposit: Exness’s $10 minimum is competitive with OctaFX ($5) and lower than HotForex ($100).

Regulation: All are well-regulated, but Exness’s multi-jurisdictional licenses give it an edge.

For Rwandan traders prioritizing low costs and flexibility, Exness often comes out ahead.

Tips for Rwandan Traders Using Exness

To maximize your experience with Exness, consider these tips:

Start with a Demo Account: Practice trading risk-free to build confidence.

Use Low Leverage Initially: Avoid the temptation of unlimited leverage until you’re experienced.

Monitor Currency Costs: Account for conversion fees when funding your account.

Stay Informed: Leverage Exness’s educational resources and market analysis tools.

Secure Your Connection: Use a reliable internet source to prevent trade disruptions.

Success Stories: Rwandan Traders on Exness

While specific testimonials are anecdotal, Rwanda’s growing forex community has seen success with Exness. For example, a trader from Kigali reportedly turned a $50 deposit into $500 within three months by trading major forex pairs with disciplined risk management. Another from Gisenyi used Exness’s cryptocurrency offerings to profit from Bitcoin’s volatility. These stories highlight the potential for Rwandan traders to thrive with the right strategy and tools.

The Future of Exness in Rwanda

As Rwanda’s economy grows and its financial sector modernizes, Exness is well-positioned to expand its presence. The broker has already shown interest in Africa, with initiatives like STEM scholarships in South Africa and partnerships in Kenya. While no specific plans for Rwanda have been announced, Exness’s digital-first approach aligns with the country’s push toward fintech innovation. Future developments, such as localized payment options or partnerships with Rwandan financial institutions, could further enhance its appeal.

Conclusion: Does Exness Work in Rwanda?

Yes, Exness works in Rwanda—and it works well. With its global reach, competitive trading conditions, and accessible platform, Exness offers Rwandan traders a reliable gateway to the forex market. While challenges like local regulation and payment integration exist, they don’t overshadow the broker’s strengths. For beginners and seasoned traders alike, Exness provides the tools, flexibility, and security needed to succeed.

If you’re a Rwandan trader wondering whether to try Exness, the answer is clear: it’s a solid choice worth exploring. Sign up today, start with a demo account, and see how Exness can fit into your trading journey. Have questions or experiences to share? Drop a comment below—I’d love to hear from you!

Read more: