10 minute read

Is Exness Regulated in Dubai? Is it Legal?

Dubai, a dazzling metropolis in the United Arab Emirates (UAE), has earned its reputation as a global financial powerhouse. With its towering skyscrapers, tax-free incentives, and strategic location bridging East and West, it’s no surprise that forex trading has flourished here. Among the many brokers vying for the attention of Dubai’s traders, Exness stands out as a popular choice. But a critical question looms large for anyone considering this platform: Is Exness regulated in Dubai? Is it legal to use? This article explores the regulatory status of Exness in Dubai, its legality under UAE laws, and what it means for traders in this vibrant city.

💥 Trade with Exness now: Open An Account or Visit Brokers

Whether you’re a seasoned forex enthusiast or a beginner dipping your toes into the world of currency trading, understanding the legal and regulatory framework of your broker is essential. Let’s unravel the complexities and provide you with a clear, actionable answer.

What is Exness? A Quick Overview

Before diving into the regulatory details, it’s worth understanding what Exness is and why it’s gained traction worldwide. Founded in 2008, Exness is a global forex and CFD (Contracts for Difference) broker headquartered in Cyprus. Over the years, it has expanded its reach, serving millions of traders across continents with a reputation for tight spreads, high leverage, and fast withdrawals.

Exness offers a variety of trading instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies. Its platforms—MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a proprietary mobile app—cater to traders of all levels. The broker’s appeal lies in its competitive trading conditions: spreads starting from 0.0 pips, leverage up to 1:Unlimited (depending on the account type), and instant execution. These features make it a compelling option for Dubai traders seeking flexibility and cost efficiency.

But popularity alone doesn’t guarantee legitimacy. To assess whether Exness is a safe and legal choice in Dubai, we need to examine its regulatory status and how it aligns with UAE laws.

The Importance of Regulation in Forex Trading

Forex trading involves significant risks—market volatility, leverage, and potential losses can quickly escalate. That’s why regulation matters. A regulated broker operates under the oversight of a financial authority, ensuring transparency, fund security, and fair practices. For traders, this provides peace of mind, knowing their investments are protected and disputes can be resolved through official channels.

In unregulated environments, traders face risks like fund mismanagement, fraud, or lack of recourse in case of issues. Regulation acts as a safety net, mandating practices such as:

Segregation of client funds: Keeping traders’ money separate from the broker’s operational capital.

Transparency: Clear disclosure of fees, spreads, and risks.

Compliance: Adherence to anti-money laundering (AML) and know-your-customer (KYC) standards.

In Dubai, where financial innovation meets strict governance, regulation is non-negotiable. So, how does Exness fit into this picture?

Forex Trading in Dubai: The Regulatory Landscape

To determine Exness’s status, we first need to understand how forex trading is governed in Dubai and the UAE. The UAE operates a dual regulatory system, reflecting its unique economic structure:

1. Dubai International Financial Centre (DIFC)

The DIFC is a financial free zone within Dubai, operating under its own legal and regulatory framework. The Dubai Financial Services Authority (DFSA) oversees all financial activities here, including forex trading. Brokers wishing to operate within the DIFC must obtain a DFSA license, which involves rigorous checks on financial stability, client fund protection, and operational transparency.

2. UAE Mainland

Outside the DIFC, the broader UAE mainland falls under the jurisdiction of the Securities and Commodities Authority (SCA) and the Central Bank of the UAE (CBUAE). The SCA regulates financial markets and brokers, while the CBUAE governs foreign exchange transactions and banking activities.

Forex trading is legal across the UAE, both in the DIFC and on the mainland, but brokers must comply with the relevant authority’s rules. A key nuance: UAE laws don’t explicitly prohibit residents from using offshore brokers—those regulated outside the UAE—provided they adhere to international standards and local financial regulations (e.g., AML/KYC compliance).

This framework sets the stage for evaluating Exness’s position in Dubai.

Is Exness Regulated in Dubai?

Now, let’s address the core question: Is Exness regulated in Dubai? The short answer is no, Exness is not directly regulated by the DFSA or the SCA. It doesn’t hold a local license to operate within the DIFC or the UAE mainland. However, this doesn’t automatically mean it’s illegal—there’s more to the story.

Exness operates as a global broker with a multi-tiered regulatory structure. It holds licenses from several reputable international authorities, including:

Cyprus Securities and Exchange Commission (CySEC): Regulates Exness (Cy) Ltd under EU financial laws, enforcing high standards for client protection and transparency.

Financial Conduct Authority (FCA): Oversees Exness (UK) Ltd in the United Kingdom, a Tier-1 regulator known for its stringent oversight.

Financial Services Authority (FSA): Licenses Exness (SC) Ltd in Seychelles, serving non-EU markets like the UAE.

Other regulators: Exness is also authorized by the Financial Sector Conduct Authority (FSCA) in South Africa, the Capital Markets Authority (CMA) in Kenya, and others.

For Dubai traders, Exness typically operates through its Seychelles entity (Exness SC Ltd), which is tailored for clients outside the European Economic Area (EEA). While the FSA in Seychelles is considered a Tier-3 regulator (less stringent than CySEC or FCA), it still imposes standards that align with global norms.

So, while Exness lacks a DFSA or SCA license, its international regulations provide a foundation of credibility. But does this make it legal in Dubai?

💥 Trade with Exness now: Open An Account or Visit Brokers

Is Exness Legal in Dubai?

The legality of using Exness in Dubai hinges on how UAE laws treat offshore brokers. Here’s the breakdown:

Legal Framework for Offshore Brokers

UAE regulations allow residents to trade with internationally licensed brokers, even if they aren’t locally regulated, as long as:

The broker holds valid licenses from recognized authorities.

Traders comply with local financial laws (e.g., tax reporting, if applicable, though Dubai is tax-free for individuals).

The broker doesn’t misrepresent its status or target DIFC clients without a DFSA license.

Exness meets these criteria. It’s regulated by CySEC, FCA, and FSA, among others, and doesn’t claim to operate under DFSA jurisdiction. Dubai traders access Exness as an offshore platform, typically through its Seychelles entity, which is standard practice for many international brokers serving the UAE.

Practical Implications

Outside the DIFC: Traders on the mainland or outside the DIFC can legally use Exness without violating UAE laws.

Within the DIFC: If you’re based in the DIFC and subject to its jurisdiction, using an unlicensed broker could pose risks, as DFSA rules apply more strictly.

Since most retail traders in Dubai operate outside the DIFC, Exness remains a viable, legal option for them. The UAE doesn’t block access to offshore brokers, and Exness enforces AML/KYC protocols, aligning with CBUAE and SCA expectations.

Verdict

Yes, Exness is legal for traders in Dubai to use as an offshore broker, provided they’re not within the DIFC’s regulatory scope. Its global licenses ensure a baseline of safety, even without local oversight.

How Safe is Exness for Dubai Traders?

Legality is one piece of the puzzle; safety is another. Here’s how Exness stacks up for Dubai traders:

1. Fund Security

Exness segregates client funds from its operational capital, holding them in top-tier banks. This practice, mandated by its regulators, ensures your money remains safe, even if the broker faces financial difficulties.

2. Negative Balance Protection

With leverage as high as 1:Unlimited, the risk of losing more than your deposit is real. Exness offers negative balance protection, capping losses at your account balance—a crucial safeguard for high-risk traders.

3. Regulatory Oversight

The FCA and CySEC are Tier-1 regulators with strict standards, while the FSA provides lighter but still credible oversight. Exness’s multi-regulatory status reduces the likelihood of unethical practices.

4. Financial Commission Membership

Exness is a member of the Financial Commission, an independent body that offers up to €20,000 in compensation per client in case of disputes. This adds an extra layer of protection.

5. Transparency

Real-time spread data, audited financial reports, and clear terms are publicly available on Exness’s website, fostering trust.

For Dubai traders, these measures mitigate risks, even without a local license. However, it’s worth comparing Exness to DFSA-regulated brokers for those prioritizing maximum local oversight.

Exness vs. DFSA-Regulated Brokers: A Comparison

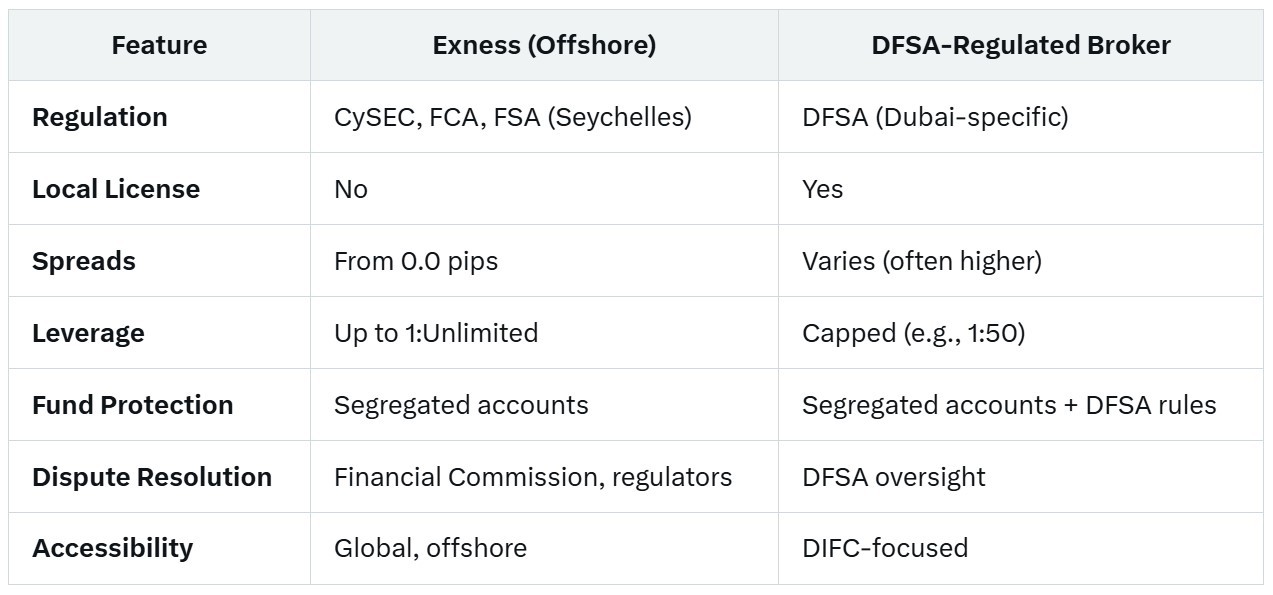

To put Exness’s status in context, let’s compare it to brokers regulated by the DFSA:

Key Takeaways

Cost and Flexibility: Exness offers lower spreads and higher leverage, appealing to cost-conscious or aggressive traders.

Local Assurance: DFSA brokers provide stronger local recourse and compliance with UAE-specific laws.

Risk Tolerance: Exness suits traders comfortable with offshore platforms; DFSA brokers appeal to those prioritizing local regulation.

Your choice depends on your priorities—cost savings or maximum regulatory protection.

How Dubai Traders Can Use Exness

If you’re in Dubai and considering Exness, here’s how to get started:

Step 1: Verify Eligibility

Confirm you’re outside the DIFC or not subject to its rules. Most retail traders fall under mainland jurisdiction, where offshore brokers are permissible.

Step 2: Open an Account

Visit the Exness website.

Register with your email and phone number.

Complete KYC verification (ID and proof of address).

Step 3: Deposit Funds

Exness supports UAE-friendly methods:

Bank cards: Visa and Mastercard.

Cryptocurrencies: Bitcoin, USDT, Ethereum (ideal given Dubai’s crypto-friendly stance).

E-wallets: Skrill, Neteller (availability may vary).

Note: Local bank transfers might face restrictions due to UAE forex rules, but third-party processors often bridge this gap.

Step 4: Start Trading

Download MT4, MT5, or the Exness app, choose your account type (Standard, Raw Spread, Zero), and begin trading.

Pros and Cons of Using Exness in Dubai

Pros

Competitive Conditions: Ultra-low spreads, high leverage, and instant withdrawals.

Global Regulation: Licensed by CySEC, FCA, and FSA, ensuring credibility.

Accessibility: Legal for mainland traders; supports crypto deposits.

User-Friendly: Intuitive platforms for beginners and pros alike.

Cons

No Local License: Lacks DFSA or SCA oversight, potentially limiting local recourse.

High Leverage Risks: Unlimited leverage can amplify losses.

Payment Limitations: Direct bank transfers may be restricted.

What Dubai Traders Say About Exness

Feedback from Dubai-based traders highlights Exness’s strengths and drawbacks:

Positive: Many praise the low spreads, fast withdrawals (often within minutes), and reliable platforms.

Concerns: Some note the lack of DFSA regulation as a hesitation, though they acknowledge the broker’s global reputation offsets this.

Overall, Exness enjoys a strong following in Dubai’s trading community, especially among those prioritizing cost and flexibility over local licensing.

Alternatives to Exness in Dubai

If Exness’s offshore status gives you pause, consider these DFSA-regulated alternatives:

IG Group: Known for robust regulation and a wide range of instruments.

Saxo Bank: Offers premium trading tools with DFSA oversight.

AvaTrade: Popular for its user-friendly interface and local license.

These brokers provide the comfort of local regulation but may lack Exness’s ultra-competitive spreads or leverage.

Final Verdict: Should You Trade with Exness in Dubai?

So, is Exness regulated in Dubai? No, it doesn’t hold a DFSA or SCA license. Is it legal? Yes, for traders outside the DIFC, it operates lawfully as an offshore broker under its international licenses.

Exness is a solid choice if you value:

Low trading costs.

High leverage options.

A globally trusted platform with strong safety measures.

However, if local regulation is your top priority, a DFSA-licensed broker might suit you better. Ultimately, your decision should align with your risk tolerance, trading goals, and comfort with offshore platforms.

Ready to explore Exness? Visit their website, weigh the pros and cons, and start trading with confidence in Dubai’s dynamic forex market.

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: