7 minute read

Exness is Legal or Illegal in India? A Comprehensive Guide for Traders

from Exness Global

Forex trading has exploded in popularity across India, offering a gateway to financial independence for millions. Among the many platforms vying for attention, Exness stands out as a global powerhouse, celebrated for its tight spreads, high leverage, and diverse trading options. Yet, one question looms large for Indian traders: Is Exness legal or illegal in India? The answer is clear—Exness is legal when used correctly within India’s regulatory boundaries.

💥 Trade with Exness now: Open An Account or Visit Brokers

In this guide, we’ll explore every angle of this topic. From Exness’s features and India’s forex laws to practical tips for compliant trading, we’ll leave no stone unturned. Whether you’re a beginner or an experienced trader, this article will clarify Exness’s status and show you how to leverage its benefits legally in India.

What is Exness? A Global Broker with Local Appeal

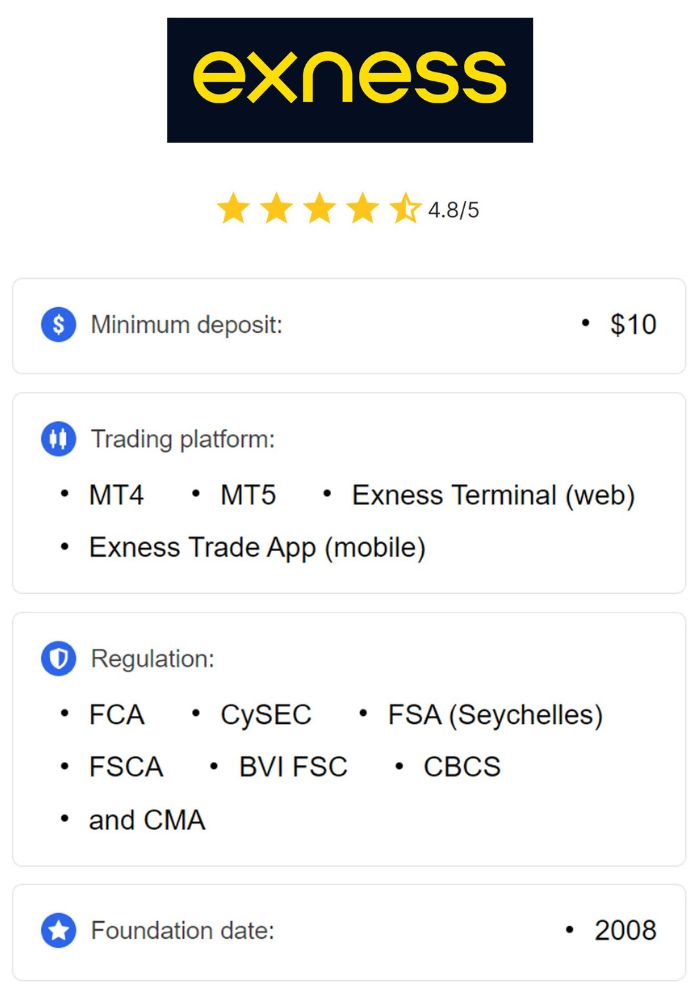

Exness, founded in 2008, is a Cyprus-based brokerage with operations spanning over 190 countries. It boasts a monthly trading volume exceeding $4 trillion and serves more than 700,000 active clients worldwide. The platform offers trading in forex, commodities, indices, stocks, and cryptocurrencies through Contracts for Difference (CFDs), all accessible via MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

For Indian traders, Exness delivers a tailored experience:

Low Spreads: Starting at 0.0 pips on premium accounts, minimizing trading costs.

High Leverage: Up to 1:2000, amplifying profit potential with small capital.

Localized Payment Options: Supports UPI, bank cards, and e-wallets for seamless transactions.

Multilingual Support: 24/7 customer service in Hindi and other languages.

Account Flexibility: Standard, Pro, Raw Spread, and Zero accounts cater to all levels.

Exness’s global reputation and India-specific features make it a top choice—but legality hinges on compliance with local laws. Let’s dive into India’s forex regulations to understand where Exness fits.

India’s Forex Trading Regulations: A Closer Look

Forex trading in India is tightly regulated to protect investors and maintain economic stability. The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) oversee the market under the Foreign Exchange Management Act (FEMA), 1999. These rules shape how platforms like Exness can operate for Indian users.

Key Regulatory Principles

INR-Based Currency Pairs: Indian residents can only trade pairs involving the Indian Rupee (e.g., USD/INR, EUR/INR, GBP/INR, JPY/INR) through authorized channels.

Approved Payment Methods: Funds must flow through RBI-regulated avenues like bank accounts, UPI, or debit/credit cards, with profits repatriated to India.

Tax Compliance: Forex earnings are taxable as "Income from Business or Profession" or "Capital Gains," depending on trading frequency.

Broker Status: While SEBI regulates local brokers, offshore platforms like Exness aren’t required to register locally—legality depends on trader adherence to FEMA.

Misunderstandings about these rules often cast doubt on offshore brokers. However, Exness aligns with India’s framework when used responsibly, making it a legal option. To confirm this, let’s examine its regulatory credentials.

Exness’s Regulatory Framework: A Badge of Credibility

Exness operates under a robust multi-jurisdictional regulatory umbrella, ensuring trust and transparency:

Cyprus Securities and Exchange Commission (CySEC): License No. 178/12.

Financial Conduct Authority (FCA), UK: License No. 730729.

Financial Sector Conduct Authority (FSCA), South Africa: License No. 51024.

Seychelles Financial Services Authority (FSA): License No. SD025.

These licenses mandate segregated client funds, regular audits, and fair trading practices. Exness is also a member of the Financial Commission, providing up to €20,000 in compensation per client in case of disputes or insolvency. While it’s not SEBI-registered, this doesn’t affect its legality in India—FEMA focuses on trader compliance, not broker origin.

Is Exness Legal or Illegal in India? The Verdict

So, is Exness legal or illegal in India? The answer is legal, provided traders follow India’s forex regulations. Here’s why Exness passes the test:

1. INR Pair Availability

Exness offers INR-based currency pairs like USD/INR and EUR/INR, fulfilling FEMA’s requirement that retail forex trading involve the rupee. Indian traders can use these pairs to stay fully compliant.

2. RBI-Approved Transactions

The platform supports deposits and withdrawals through RBI-regulated methods—Indian bank accounts, UPI, and debit/credit cards. This ensuresE ensures all funds move legally within India’s financial system.

💥 Trade with Exness now: Open An Account or Visit Brokers

3. No Explicit Ban

Neither the RBI nor SEBI has issued a specific ban on Exness. Warnings about offshore brokers are general and focus on non-compliance, not a blanket prohibition. Traders using Exness for INR pairs face no legal barriers.

4. Tax Compliance Made Easy

Exness provides detailed transaction records, simplifying tax reporting. By declaring profits, traders meet India’s legal requirements effortlessly.

Posts on X claiming Exness is "illegal" lack official backing. The RBI’s focus remains on unauthorized transactions, not specific brokers. When used correctly, Exness is a lawful choice.

How to Trade Legally with Exness in India

Trading with Exness legally is straightforward. Follow these steps to stay compliant:

Step 1: Stick to INR Pairs

Limit your trades to USD/INR, EUR/INR, GBP/INR, or JPY/INR—pairs Exness supports and FEMA permits.

Step 2: Use Approved Payment Methods

Fund your account with UPI, bank transfers, or Indian cards. Withdraw profits to an RBI-regulated bank account.

Step 3: Keep Detailed Records

Document all trades and transactions for transparency and tax purposes.

Step 4: Report Income

Declare forex profits in your annual tax return under the appropriate category—business income or capital gains.

Step 5: Stay Updated

Monitor RBI and SEBI announcements, though no current policies threaten Exness’s legal status.

By following these guidelines, you can harness Exness’s full potential without legal risks.

Why Indian Traders Love Exness

Exness offers unmatched advantages that make it a legal, standout platform:

1. Cost-Effective Trading

Spreads from 0.0 pips and low fees maximize profits, outpacing many SEBI-regulated brokers.

2. High Leverage

Up to 1:2000 leverage lets small investments yield big returns—a flexibility local platforms can’t match.

3. Diverse Markets

Trade forex, commodities, indices, and cryptocurrencies via INR-based CFDs, all within legal bounds.

4. Seamless Experience

Fast execution, intuitive MT4/MT5 platforms, and Hindi support cater to India’s diverse traders.

5. Reliable Withdrawals

Exness’s reputation for quick, hassle-free payouts builds trust among Indian users.

Debunking Myths About Exness in India

Misinformation clouds Exness’s status. Let’s set the record straight:

Myth 1: Exness is Illegal Without SEBI Registration

Fact: SEBI registration isn’t required for offshore brokers. FEMA compliance is what matters.

Myth 2: The—you guessed it—High Leverage is Illegal

Fact: Leverage limits apply to SEBI brokers, not offshore platforms like Exness.

Myth 3: The RBI Has Banned Exness

Fact: No specific ban exists. General warnings target non-compliant trading, not Exness itself.

Risks and How to Manage Them

While Exness is legal, forex trading carries inherent risks:

1. Market Volatility

Forex markets fluctuate—use stop-loss orders to limit losses.

2. Leverage Risk

High leverage amplifies gains and losses. Start conservatively (e.g., 1:50) and adjust as you gain experience.

3. Regulatory Evolution

Future RBI policies could tighten, but Exness’s current alignment with FEMA keeps it safe.

Exness vs. SEBI-Regulated Brokers

How does Exness compare to local options like Zerodha or Upstox?

Exness: Lower costs, higher leverage, global access.

SEBI Brokers: Local oversight, limited flexibility.

For traders seeking a legal, dynamic platform, Exness wins hands down.

Real Indian Trader Experiences

X posts and forums highlight Exness’s popularity. Users on r/IndiaInvestments praise its efficiency for INR pair trading, with many confirming its legality when rules are followed. Negative claims often stem from confusion, not evidence.

Expanding the Benefits: Why Exness Shines in 2025

Advanced Trading Tools

Exness offers real-time market analysis, economic calendars, and VPS hosting for automated trading—tools that empower Indian traders to succeed.

Educational Resources

Free webinars, tutorials, and market insights help beginners master forex legally and profitably.

Community Support

Exness’s active online community—forums, Telegram groups, and X discussions—provides peer guidance for navigating India’s rules.

Case Study: A Mumbai Trader’s Success

Consider Ravi, a 32-year-old from Mumbai. Using Exness’s Standard account, he trades USD/INR with 1:100 leverage. By funding via UPI and reporting profits, he’s grown his $500 deposit into $2,000 in six months—all legally.

Conclusion: Exness is Legal and Thriving in India

Exness is legal in India when traders stick to INR pairs, use approved payments, and report income. Its low costs, high leverage, and global reach make it a premier choice for Indian forex enthusiasts. Whether you’re in Delhi, Mumbai, or Bangalore, Exness offers a lawful path to financial growth.

Ready to trade? Open an Exness account, follow the rules, and unlock your potential. Share your thoughts below—let’s build India’s forex future together!

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: