6 minute read

How to Open Forex Account in India

from Exness Global

Forex trading, or foreign exchange trading, has gained significant popularity in India over the past decade. With the rise of online platforms and increased financial awareness, more Indians are exploring forex as a way to diversify their investments and potentially earn profits. However, forex trading in India comes with its own set of rules, regulations, and processes that can seem overwhelming to beginners. If you're wondering how to open a forex account in India, this guide will walk you through everything you need to know—from understanding the basics to completing the registration process.

Top 4 Best Forex Brokers in India

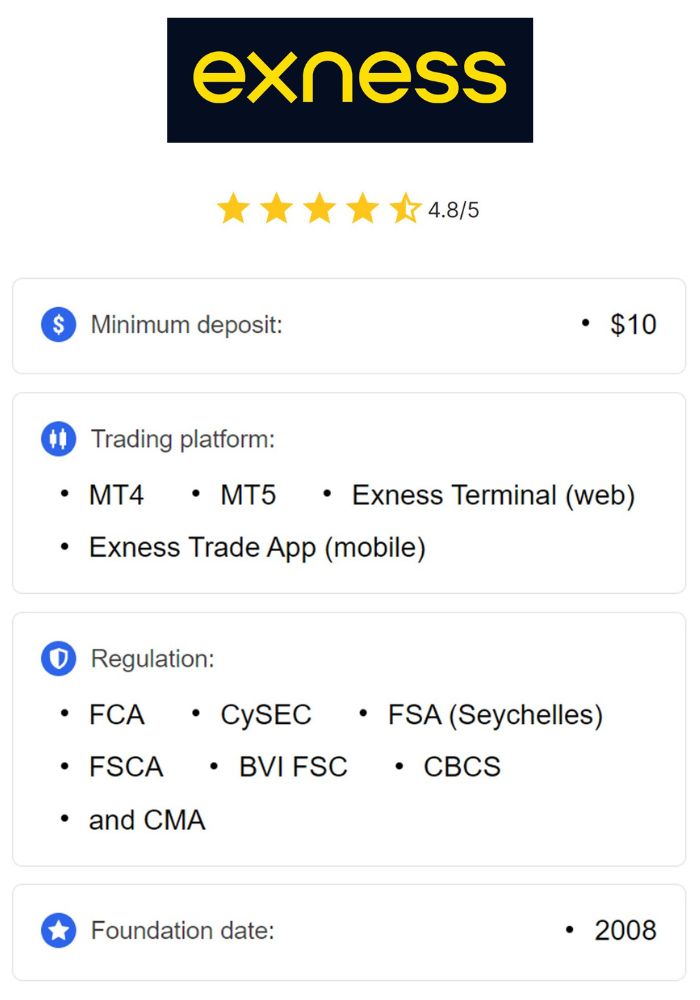

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

In this article, we’ll break down the steps to open a forex account, explain the legal framework in India, highlight the best platforms, and offer tips to get started safely. Whether you're a complete novice or someone with basic trading knowledge, this guide is designed to help you navigate the forex market confidently.

What is Forex Trading and Why Should You Care?

Forex trading involves buying and selling currencies in the global market to profit from fluctuations in exchange rates. For example, you might buy US dollars (USD) with Indian rupees (INR) and sell them later when the dollar strengthens. The forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion.

For Indians, forex trading offers a unique opportunity to hedge against currency risks, diversify portfolios, and participate in global financial markets. However, it’s not as straightforward as stock trading due to strict regulations imposed by the Reserve Bank of India (RBI). Understanding these rules is the first step to opening a forex account legally and safely.

Is Forex Trading Legal in India?

Before diving into the process, let’s address a common question: Is forex trading legal in India? The short answer is yes, but with limitations. The RBI regulates forex trading under the Foreign Exchange Management Act (FEMA), 1999. Here’s what you need to know:

Currency Pairs: In India, you can only trade currency pairs that include the INR (e.g., USD/INR, EUR/INR, GBP/INR, JPY/INR). Trading pairs like EUR/USD (without INR) is not permitted for retail traders.

Authorized Brokers: You must use brokers or platforms authorized by the RBI or registered with the Securities and Exchange Board of India (SEBI).

No Leverage Abuse: Leverage is allowed, but it’s capped by SEBI and RBI guidelines to protect traders from excessive risk.

Purpose: Retail forex trading for speculation is restricted. Most legal trading is tied to hedging or travel-related currency exchange.

To trade forex legally, you’ll need to open an account with a SEBI-regulated broker or an international broker complying with RBI rules. Violating these regulations can lead to penalties, so always ensure compliance.

How to Open Forex Account in India

Now that you understand the basics, let’s dive into the actionable steps to open a forex account in India.

Step 1: Research and Choose a Reliable Broker

The first step is selecting a forex broker. In India, you can choose between domestic brokers (regulated by SEBI) and international brokers that accept Indian clients. Some popular options include:

Exness: An international platform that complies with Indian regulations for forex trading.

Zerodha: Known for stock trading, Zerodha also offers forex trading via its currency derivatives segment.

Angel One: A SEBI-regulated broker offering forex trading options.

💥 Trade with Exness now: Open An Account or Visit Brokers

When choosing a broker, consider:

Regulation: Ensure the broker is SEBI- or RBI-approved.

Fees: Look for low spreads, commissions, and withdrawal fees.

Platform: Check if they offer user-friendly platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

Customer Support: Opt for brokers with responsive support, especially if you’re new to trading.

Spend time reading reviews and comparing features to find the best fit for your needs.

Step 2: Understand the Account Types

Forex brokers offer different account types, such as:

Micro Accounts: Ideal for beginners with small capital (e.g., $10–$100).

Standard Accounts: For experienced traders with larger investments.

Demo Accounts: Free accounts to practice trading with virtual money.

For beginners in India, starting with a demo account is highly recommended. It allows you to learn the ropes without risking real money.

Step 3: Complete the Registration Process

Once you’ve chosen a broker, visit their website and follow these steps:

Sign Up: Click the “Open Account” or “Register” button and provide your email, phone number, and personal details.

KYC Verification: Submit Know Your Customer (KYC) documents, including:

Aadhaar Card or Passport (for identity proof).

PAN Card (mandatory for financial transactions in India).

Bank statement or utility bill (for address proof).

Account Approval: The broker will verify your documents, which typically takes 1–3 business days.

Step 4: Fund Your Account

After approval, deposit funds into your forex account. In India, you can:

Use INR via bank transfers, UPI, or debit/credit cards.

Convert INR to USD or other currencies if required by the broker.

Note: Under RBI’s Liberalised Remittance Scheme (LRS), Indian residents can remit up to $250,000 per year for overseas investments, including forex trading. Ensure your deposits comply with this limit.

Step 5: Download the Trading Platform

Most brokers provide access to platforms like MT4 or MT5. Download the software on your desktop or mobile device, log in with your credentials, and familiarize yourself with the interface.

Step 6: Start Trading

Begin with a demo account to practice. Once confident, switch to a live account. Start small, use stop-loss orders to manage risks, and focus on INR-based currency pairs to stay within legal boundaries.

Best Forex Trading Platforms in India for 2025

To succeed in forex trading, you need a reliable platform. Here are some top options for Indian traders in 2025:

MetaTrader 4 (MT4): Widely used, customizable, and beginner-friendly.

MetaTrader 5 (MT5): An advanced version with more tools and features.

Zerodha Kite: A SEBI-regulated platform for currency derivatives.

TradingView: Great for charting and analysis, though it’s not a direct trading platform.

Each platform has its strengths, so choose based on your trading style and experience level.

Tips for Successful Forex Trading in India

Learn the Basics: Study forex terms like pips, leverage, and spreads.

Stay Updated: Follow global economic news affecting currency rates.

Manage Risks: Never invest more than you can afford to lose.

Use Demo Accounts: Practice extensively before going live.

Comply with Laws: Stick to INR-based pairs and authorized brokers.

Common Mistakes to Avoid

Ignoring Regulations: Trading with unregulated brokers can lead to legal trouble.

Overleveraging: High leverage can wipe out your account during volatile markets.

Emotional Trading: Avoid making decisions based on fear or greed.

Conclusion

Opening a forex account in India is a straightforward process if you follow the right steps and stay within legal boundaries. By choosing a regulated broker, completing KYC, and starting with a demo account, you can enter the exciting world of forex trading with confidence. While the market offers immense potential, it also carries risks, so educate yourself and trade responsibly.

Ready to take the plunge? Research your broker, set up your account, and start exploring forex trading today. With patience and practice, you could unlock a new avenue for financial growth in 2025 and beyond.

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: