11 minute read

Exness Review Bangladesh: Legit, Safe, Is a good broker?

Forex trading has surged in popularity across Bangladesh in recent years, driven by increasing internet access, a growing interest in financial markets, and the promise of financial independence. Among the numerous brokers vying for the attention of Bangladeshi traders, Exness stands out as a globally recognized name. But is Exness the right choice for traders in Bangladesh? In this detailed Exness review for Bangladesh, we’ll explore its features, benefits, drawbacks, and suitability for local traders, providing you with all the information you need to make an informed decision.

💥 Trade with Exness now: Open An Account or Visit Brokers

Whether you’re a beginner dipping your toes into forex trading or an experienced trader seeking a reliable broker, this article will break down everything you need to know about Exness in the Bangladeshi context. From account types and trading platforms to fees, regulation, and customer support, we’ll cover it all. Let’s dive in!

What Is Exness? An Overview of the Broker

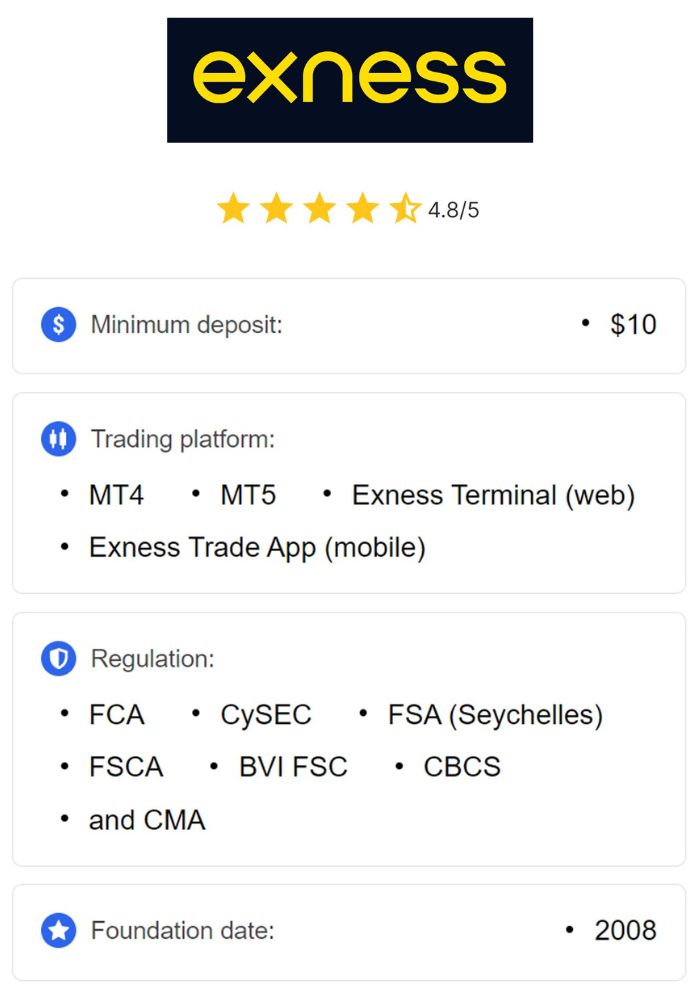

Exness is a globally acclaimed online forex and CFD (Contract for Difference) broker founded in 2008. Headquartered in Cyprus, it has grown into one of the most trusted names in the trading industry, serving millions of clients across more than 100 countries, including Bangladesh. Known for its competitive trading conditions, cutting-edge technology, and transparent operations, Exness has built a reputation as a broker that prioritizes client satisfaction.

For Bangladeshi traders, Exness offers access to a wide range of financial instruments, including forex pairs, commodities, cryptocurrencies, indices, and stocks. Its user-friendly platforms and low entry barriers make it appealing to both novices and seasoned traders. But what sets Exness apart from the competition, and how does it cater specifically to the needs of traders in Bangladesh? Let’s explore further.

Why Forex Trading Is Gaining Traction in Bangladesh

Before delving into the specifics of Exness, it’s worth understanding why forex trading is becoming a hot topic in Bangladesh. With a population exceeding 160 million and a rapidly growing digital economy, Bangladesh is witnessing a shift toward online income opportunities. Forex trading, with its potential for high returns, has caught the attention of many.

The Bangladeshi Taka (BDT) is not a freely convertible currency, and the Bangladesh Bank imposes restrictions on forex trading with local brokers. However, international brokers like Exness allow residents to trade globally, provided they comply with local laws and use international payment methods. This accessibility, combined with the rise of mobile banking and digital wallets in Bangladesh, has fueled the forex trading boom.

Exness taps into this trend by offering a platform that’s easy to use, affordable, and packed with features tailored to diverse trading needs. But how does it stack up in terms of regulation and safety? Let’s find out.

Is Exness Legit and Safe for Bangladeshi Traders?

One of the first questions any trader asks is whether a broker is legitimate and secure. For Bangladeshi traders, this is especially critical given the lack of local forex regulation for international brokers.

Regulation and Licensing

Exness operates under multiple regulatory bodies, ensuring a high level of transparency and security. It is licensed by:

Cyprus Securities and Exchange Commission (CySEC): A top-tier regulator in the European Union.

Financial Conduct Authority (FCA): The UK’s stringent financial watchdog.

Seychelles Financial Services Authority (FSA): A reputable offshore regulator.

While Exness is not regulated by the Bangladesh Bank, its compliance with these international authorities provides reassurance. These licenses mandate strict guidelines, such as segregating client funds from company assets, regular audits, and adherence to anti-money laundering (AML) policies.

Fund Security

Exness takes fund security seriously. Client funds are held in segregated accounts with top-tier banks, ensuring they’re separate from the broker’s operational funds. Additionally, Exness offers negative balance protection, meaning traders cannot lose more than their deposited amount—a crucial feature for risk management.

For Bangladeshi traders, this robust regulatory framework and focus on fund safety make Exness a trustworthy option, even without local oversight.

Exness Account Types: Which One Suits Bangladeshi Traders?

Exness offers a variety of account types to cater to different trading styles and experience levels. Here’s a breakdown of the options available and their suitability for Bangladeshi traders:

1. Standard Account

Minimum Deposit: $1

Spreads: Starting from 0.3 pips

Leverage: Up to 1:2000

Commission: None

The Standard Account is ideal for beginners in Bangladesh due to its low entry barrier. With just $1, you can start trading, making it accessible even for those with limited capital. The high leverage (up to 1:2000) allows traders to maximize potential returns, though it comes with increased risk.

2. Standard Cent Account

Minimum Deposit: $1

Spreads: Starting from 0.3 pips

Leverage: Up to 1:2000

Commission: None

Designed for novices, the Standard Cent Account uses cent-based lots, reducing risk significantly. It’s perfect for Bangladeshi traders who want to practice with real money without risking large sums.

3. Pro Account

Minimum Deposit: $200

Spreads: Starting from 0.1 pips

Leverage: Up to 1:2000

Commission: None

The Pro Account targets experienced traders who prioritize tight spreads and instant execution. While the $200 minimum deposit is higher, it’s still reasonable for serious traders in Bangladesh looking for professional-grade conditions.

4. Raw Spread Account

Minimum Deposit: $200

Spreads: Starting from 0.0 pips

Leverage: Up to 1:2000

Commission: Up to $3.5 per lot

This account offers ultra-low spreads with a small commission, making it suitable for scalpers and high-frequency traders. Bangladeshi traders with advanced strategies may find this option appealing.

5. Zero Account

Minimum Deposit: $200

Spreads: 0.0 pips on 95% of trading days

Leverage: Up to 1:2000

Commission: From $0.05 per lot

The Zero Account provides near-zero spreads on major instruments, ideal for expert traders in Bangladesh who trade large volumes and want minimal costs.

Verdict

For most Bangladeshi traders, the Standard or Standard Cent Accounts are excellent starting points due to their affordability and flexibility. More experienced traders might prefer the Pro, Raw Spread, or Zero Accounts for tighter spreads and advanced features.

💥 Trade with Exness now: Open An Account or Visit Brokers

Trading Platforms Offered by Exness

A reliable trading platform is the backbone of any forex experience. Exness provides industry-leading platforms that cater to Bangladeshi traders’ needs:

1. MetaTrader 4 (MT4)

MT4 remains a favorite among forex traders worldwide. Its intuitive interface, advanced charting tools, and support for automated trading via Expert Advisors (EAs) make it a go-to choice. Bangladeshi traders can download MT4 on desktop, mobile, or use the web version, ensuring flexibility.

2. MetaTrader 5 (MT5)

MT5 builds on MT4 with additional features like more timeframes, advanced order types, and an economic calendar. It’s ideal for traders in Bangladesh who want a more robust platform for multi-asset trading.

3. Exness Trading Terminal

Exness offers its proprietary web-based terminal, which is lightweight and accessible without downloads. It’s perfect for Bangladeshi traders with limited device storage or those who prefer trading on the go.

4. Exness Trade App

The Exness Trade mobile app is a standout feature, offering full account management, real-time quotes, and instant withdrawals. With mobile penetration high in Bangladesh, this app ensures traders can stay connected to the markets anytime, anywhere.

Why It Matters for Bangladesh

The availability of mobile-friendly platforms like the Exness Trade App aligns with Bangladesh’s growing reliance on smartphones. Whether you’re in Dhaka or a rural area, you can trade seamlessly as long as you have an internet connection.

Fees and Spreads: How Cost-Effective Is Exness?

Trading costs are a critical factor for Bangladeshi traders, many of whom operate with limited budgets. Here’s how Exness fares:

Spreads

Standard Accounts: Start at 0.3 pips, competitive for beginners.

Pro Accounts: Start at 0.1 pips, excellent for cost-conscious traders.

Raw Spread & Zero Accounts: Start at 0.0 pips, with commissions applied.

Exness’s variable spreads can widen during volatile periods, but they remain among the lowest in the industry, especially for major pairs like EUR/USD.

Commissions

Standard & Pro Accounts: No commissions.

Raw Spread Account: Up to $3.5 per lot.

Zero Account: From $0.05 per lot, depending on the instrument.

Deposits and Withdrawals

Exness offers fee-free deposits and withdrawals, a significant advantage for Bangladeshi traders. Popular payment methods include:

Bank Cards: Visa, Mastercard.

E-Wallets: Skrill, Neteller, Perfect Money.

Cryptocurrencies: Bitcoin, USDT.

Local Payment Systems: bKash, Nagad (via third-party exchangers).

Withdrawals are instant for most methods, a rare feature that sets Exness apart from competitors.

Verdict

Exness’s low spreads, zero deposit/withdrawal fees, and instant withdrawals make it highly cost-effective for Bangladeshi traders, especially those sensitive to transaction costs.

Leverage: High Potential, High Risk

Exness offers leverage up to 1:2000, one of the highest in the industry. For Bangladeshi traders, this means you can control large positions with a small deposit. For example, with $10 and 1:2000 leverage, you could trade a $20,000 position.

However, high leverage is a double-edged sword. While it amplifies profits, it also increases the risk of significant losses. Beginners in Bangladesh should use leverage cautiously and take advantage of Exness’s demo accounts to practice risk management.

Exness Features Tailored for Bangladeshi Traders

Exness offers several features that resonate with the needs of traders in Bangladesh:

1. Low Minimum Deposit

Starting at just $1, Exness removes financial barriers, making forex trading accessible to a wide audience in Bangladesh.

2. Islamic Accounts

As a Muslim-majority country, Bangladesh has a high demand for swap-free (Islamic) accounts. Exness provides these accounts, ensuring compliance with Sharia law by eliminating overnight interest charges.

3. Local Payment Options

While direct bKash or Nagad integration isn’t available, Bangladeshi traders can use third-party exchangers to fund accounts with local mobile money services, bridging the gap between local and international finance.

4. Multilingual Support

Exness offers customer support in multiple languages, including English and Bengali, ensuring Bangladeshi traders can communicate effectively.

5. Educational Resources

Exness provides webinars, tutorials, and market analysis, helping Bangladeshi beginners build their trading skills.

Pros and Cons of Exness for Bangladeshi Traders

Pros

Low Minimum Deposit: Start trading with just $1.

Competitive Spreads: Tight spreads reduce trading costs.

Instant Withdrawals: Access funds quickly, a rare feature.

High Leverage: Up to 1:2000 for maximizing potential.

Regulated and Safe: Multiple licenses ensure security.

User-Friendly Platforms: MT4, MT5, and mobile apps cater to all levels.

Cons

No Local Regulation: Not overseen by Bangladesh Bank.

Variable Spreads: Can widen during volatility.

Limited Local Payment Integration: No direct bKash/Nagad support.

Customer Support Delays: Some users report slow responses during peak times.

How Does Exness Compare to Other Brokers in Bangladesh?

To give you a clearer picture, let’s compare Exness to two popular competitors: XM and FBS.

Exness vs. XM

Minimum Deposit: Exness ($1) vs. XM ($5).

Spreads: Exness (0.3 pips) vs. XM (0.6 pips on Standard).

Leverage: Exness (1:2000) vs. XM (1:888).

Withdrawals: Exness (instant) vs. XM (24 hours).

Exness edges out XM with lower deposits, tighter spreads, and faster withdrawals, though XM offers more educational content.

Exness vs. FBS

Minimum Deposit: Exness ($1) vs. FBS ($1).

Spreads: Exness (0.3 pips) vs. FBS (0.7 pips on Standard).

Leverage: Exness (1:2000) vs. FBS (1:3000).

Regulation: Exness (CySEC, FCA) vs. FBS (IFSC, less stringent).

Exness offers better regulation and spreads, while FBS provides higher leverage but lacks the same level of international oversight.

How to Get Started with Exness in Bangladesh

Ready to try Exness? Here’s a step-by-step guide:

Sign Up: Visit the Exness website and click “Register.” Provide your email and phone number.

Verify Your Account: Upload a government-issued ID (e.g., NID) and proof of address.

Deposit Funds: Choose a payment method (e.g., Skrill or crypto) and deposit at least $1.

Download a Platform: Install MT4, MT5, or use the Exness Trade App.

Start Trading: Explore the demo account first, then switch to live trading.

Customer Support: Does Exness Deliver?

Exness provides 24/7 customer support via live chat, email, and phone. For Bangladeshi traders, the inclusion of Bengali support is a plus. However, some users report delays during high-traffic periods, so patience may be required.

Final Verdict: Is Exness Worth It for Bangladeshi Traders?

Exness is a compelling choice for forex traders in Bangladesh. Its low minimum deposit, competitive spreads, instant withdrawals, and robust platforms make it accessible and efficient. The high leverage and Islamic account options further enhance its appeal, while its global regulation ensures safety.

However, it’s not perfect. The lack of direct local payment integration and occasional support delays might frustrate some users. Still, for most Bangladeshi traders—whether beginners or pros—Exness offers a reliable, cost-effective, and feature-rich trading experience.

If you’re looking for a broker to kickstart or elevate your forex journey in Bangladesh, Exness is worth considering. Try it with a demo account first to see if it aligns with your goals.

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: