7 minute read

Is Exness Legal in Nigeria? A Comprehensive Guide for Traders

Forex trading has exploded in popularity across Nigeria, fueled by a youthful population, growing internet access, and a hunger for alternative income streams. Among the many brokers vying for Nigerian traders’ attention, Exness stands out as a global heavyweight. But a pressing question looms large: Is Exness legal in Nigeria? This article dives deep into the legal status of Exness in Nigeria, exploring its regulatory framework, operational legitimacy, and what it means for Nigerian traders. Whether you’re a beginner or a seasoned trader, this guide will equip you with the knowledge to make informed decisions.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? A Quick Overview

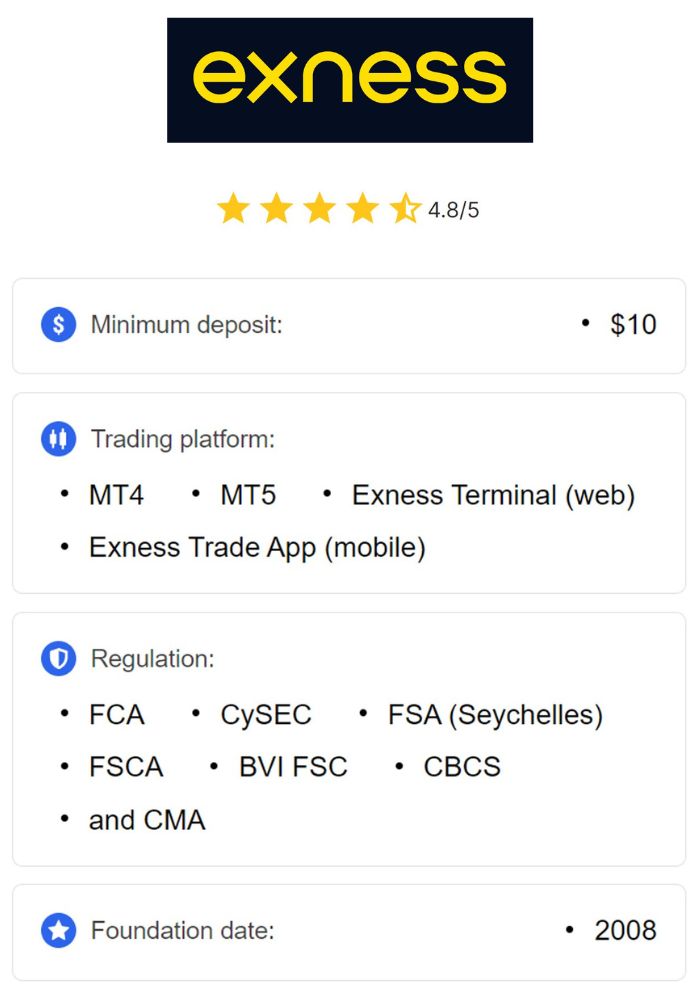

Before tackling the legality question, let’s understand what Exness is. Founded in 2008, Exness is a globally recognized forex and CFD (Contracts for Difference) broker headquartered in Limassol, Cyprus. With over a decade of experience, it has built a reputation for competitive spreads, high leverage options (up to 1:2000), and a user-friendly platform supporting MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Exness offers trading in forex pairs, commodities, indices, stocks, and cryptocurrencies, making it a versatile choice for traders worldwide.

In Nigeria, Exness has gained traction thanks to its low minimum deposit (starting at $1), support for Naira (NGN) accounts, and localized payment methods like bank transfers and e-wallets. But popularity doesn’t automatically equate to legality. To answer whether Exness is legal in Nigeria, we need to examine the country’s regulatory landscape and how Exness fits into it.

Forex Trading in Nigeria: The Legal Landscape

Forex trading itself is legal in Nigeria, but the regulatory environment is complex and evolving. Two primary institutions oversee financial activities in the country:

Central Bank of Nigeria (CBN)The CBN is the cornerstone of Nigeria’s financial system, responsible for monetary policy, currency stability, and regulating foreign exchange transactions. While it doesn’t directly license forex brokers, it imposes strict controls on forex flows to stabilize the Naira and curb illicit activities. For instance, the CBN has restricted speculative forex trading through unregulated platforms in the past to protect the economy.

Securities and Exchange Commission (SEC)The SEC regulates Nigeria’s capital markets, including investment schemes and securities. While its oversight traditionally focuses on stocks and bonds, it also monitors forex-related activities to ensure investor protection. However, the SEC’s jurisdiction over international forex brokers remains limited unless they establish a local presence.

Nigeria lacks a dedicated forex trading regulator, creating a gray area for international brokers like Exness. Forex trading is permitted, but brokers must comply with CBN and SEC guidelines if they operate locally. For offshore brokers, the question shifts to whether Nigerian laws allow citizens to trade with them and whether those brokers meet global standards.

Is Exness Regulated Globally?

Exness isn’t a fly-by-night operation. It operates under multiple regulatory licenses from respected authorities worldwide, which bolsters its credibility. Here’s a breakdown of its regulatory status:

Cyprus Securities and Exchange Commission (CySEC)CySEC regulates Exness in the European Union, ensuring compliance with strict financial standards, including client fund segregation and transparency.

Financial Conduct Authority (FCA) – United KingdomThe FCA, a top-tier regulator, oversees Exness (UK) Ltd., enforcing robust protections like negative balance protection and regular audits.

Financial Sector Conduct Authority (FSCA) – South AfricaThe FSCA regulates Exness in South Africa, a key market in Africa, adding regional credibility.

Financial Services Authority (FSA) – SeychellesNigerian traders are typically onboarded through Exness (SC) Ltd., regulated by the FSA in Seychelles. While Seychelles is considered an offshore jurisdiction with lighter regulations, Exness adheres to global best practices.

These licenses demonstrate Exness’s commitment to transparency and security. The broker undergoes audits by Deloitte, segregates client funds, and offers negative balance protection—meaning traders can’t lose more than their deposits. But does this global regulation translate to legality in Nigeria?

Is Exness Legal in Nigeria? The Core Answer

The short answer: Yes, Exness is legal for Nigerian traders to use, but with a caveat—it’s not directly regulated by Nigerian authorities like the CBN or SEC. Here’s why:

No Explicit Ban: Nigerian laws do not prohibit citizens from trading with international forex brokers like Exness, provided the broker complies with global standards and doesn’t violate local forex restrictions (e.g., illegal currency speculation).

Offshore Regulation: Exness operates in Nigeria under its Seychelles entity (FSA), which isn’t subject to Nigerian oversight. This places it in a regulatory gray area, but it doesn’t make it illegal. Many reputable brokers serve Nigerian clients this way due to the absence of a local forex licensing framework.

CBN and SEC Compliance: Exness doesn’t need a CBN or SEC license to offer services to Nigerians, as these bodies focus on locally registered entities. However, Nigerian traders must declare forex income and pay taxes, aligning with CBN’s broader forex policies.

💥 Trade with Exness now: Open An Account or Visit Brokers

In essence, Exness is legal to use in Nigeria as an offshore broker, but its lack of local regulation means traders assume some risk. The platform’s global licenses provide a safety net, but they don’t guarantee recourse under Nigerian law if disputes arise.

Benefits of Trading with Exness in Nigeria

Why do Nigerian traders flock to Exness despite the regulatory ambiguity? Here are some standout features:

Low Entry BarrierWith a $1 minimum deposit, Exness is accessible to beginners and low-income traders—a big plus in Nigeria’s economy.

Naira (NGN) SupportTraders can open accounts in Naira, deposit via local bank transfers, and avoid currency conversion fees, simplifying the process.

Competitive Trading ConditionsTight spreads (from 0.0 pips on some accounts), high leverage (up to 1:2000), and fast execution appeal to both scalpers and long-term traders.

Localized Payment OptionsExness supports Nigerian bank cards, e-wallets, and online banking, ensuring seamless deposits and withdrawals.

Educational ResourcesFrom webinars to tutorials, Exness offers tools to help Nigerian traders learn and grow, critical in a market where forex education is still developing.

These benefits make Exness a practical choice, but legality isn’t just about convenience—it’s about safety and trust.

Risks of Using Exness in Nigeria

While Exness is legal, the lack of local regulation introduces risks:

Limited Legal Recourse: If a dispute arises (e.g., withdrawal issues), Nigerian courts may not have jurisdiction over an offshore entity like Exness.

Regulatory Gaps: The CBN’s restrictions on forex flows could impact withdrawals or deposits, especially during economic crackdowns.

Trader Responsibility: Without local oversight, traders must vet Exness’s credibility themselves, relying on its global reputation rather than Nigerian safeguards.

To mitigate these risks, traders should verify Exness’s licenses, read user reviews, and test the platform with small deposits before committing significant funds.

User Experiences: What Nigerian Traders Say

Feedback from Nigerian traders offers real-world insight into Exness’s reliability:

Positive Reviews: Many praise the platform’s ease of use, fast withdrawals (often within 24 hours), and responsive customer support via live chat and email.

Complaints: Some report occasional delays in withdrawals during high volatility or technical glitches, though these are rare.

Overall, Exness enjoys a strong reputation among Nigerian users, bolstered by its transparency (e.g., monthly financial reports) and client-focused features.

How to Start Trading with Exness in Nigeria

Ready to try Exness? Here’s a step-by-step guide:

Sign Up: Visit the Exness website, click “Open Account,” and complete the registration with your details.

Verify Your Account: Submit ID and proof of address for KYC compliance.

Deposit Funds: Choose a local payment method (e.g., bank transfer) and fund your account in Naira.

Download MT4/MT5: Install the trading platform on your device.

Start Trading: Explore forex pairs, commodities, or crypto with a demo account first if you’re new.

Conclusion: Is Exness a Safe Choice for Nigerians?

Exness is legal in Nigeria as an offshore broker, operating under reputable global licenses rather than local ones. Its accessibility, competitive conditions, and support for Nigerian traders make it a compelling option. However, the absence of CBN or SEC regulation means traders must exercise caution, relying on Exness’s international credibility for security.

💥 Trade with Exness now: Open An Account or Visit Brokers

For Nigerians, Exness offers a gateway to global markets, but due diligence is key. Research, start small, and stay informed about Nigeria’s evolving forex regulations. If you value affordability and flexibility over local oversight, Exness could be your ideal trading partner.

Read more: