8 minute read

Is Exness an ECN Broker? A Deep Dive into Its Trading Model

When it comes to forex trading, choosing the right broker can make or break your success. Among the many factors traders consider, one stands out: the broker’s execution model. Specifically, whether a broker operates as an Electronic Communication Network (ECN) broker is a hot topic. If you’ve been researching Exness, a globally recognized forex and CFD broker, you might be wondering: Is Exness an ECN broker? In this comprehensive guide, we’ll explore Exness’s trading model, break down what an ECN broker is, analyze Exness’s offerings, and help you decide if it’s the right fit for your trading journey.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is an ECN Broker? Understanding the Basics

Before diving into whether Exness qualifies as an ECN broker, let’s clarify what an ECN broker actually is. An Electronic Communication Network (ECN) broker facilitates direct trading between market participants—think banks, financial institutions, and individual traders—through an electronic network. Unlike traditional brokers that might act as market makers (taking the opposite side of your trades), ECN brokers connect you straight to the interbank market.

Key Features of an ECN Broker

So, what sets an ECN broker apart? Here are the defining traits:

Direct Market Access: ECN brokers link traders to liquidity providers without intermediaries, ensuring trades are executed at real market prices.

Variable Spreads: Spreads fluctuate based on market conditions, often tightening during high liquidity and widening during volatility.

Transparency: You get real-time visibility into bid and ask prices from multiple sources, reducing the chance of price manipulation.

No Conflict of Interest: Since ECN brokers don’t trade against you, their profits come from commissions, not your losses.

Fast Execution: Orders are processed instantly, which is a boon for scalpers and high-frequency traders.

These features make ECN brokers a favorite among experienced traders who value transparency and speed. But does Exness fit this mold? Let’s find out.

Who Is Exness? A Quick Overview

Founded in 2008, Exness has grown into a powerhouse in the forex and CFD trading world. Headquartered in Cyprus, it serves millions of clients across 180+ countries, offering access to a wide range of instruments like forex pairs, commodities, indices, and cryptocurrencies. Known for its competitive spreads, fast execution, and robust regulation, Exness has earned a solid reputation among retail and professional traders alike.

Exness operates under multiple regulatory bodies, including the Cyprus Securities and Exchange Commission (CySEC), the UK’s Financial Conduct Authority (FCA), and others. This multi-jurisdictional oversight ensures a high level of trust and security—key factors for any trader evaluating a broker.

But reputation alone doesn’t answer our question. To determine if Exness is an ECN broker, we need to dig into its account types, execution methods, and trading conditions.

Exness’s Trading Model: Hybrid or Pure ECN?

Here’s where things get interesting. Exness doesn’t strictly label itself as a “pure ECN broker.” Instead, it operates a hybrid model, blending elements of both ECN and market maker systems. This approach allows Exness to cater to a diverse clientele—from beginners who prefer simplicity to pros seeking advanced execution.

How Does the Hybrid Model Work?

In a hybrid model, the broker adjusts its execution based on the account type you choose. Some accounts function like a market maker (where Exness might take the opposite side of your trade), while others offer ECN-like conditions with direct market access. This flexibility is one of Exness’s strengths, but it also muddies the waters when classifying it as an ECN broker.

Let’s break it down by examining Exness’s account offerings.

Exness Account Types: Where Does ECN Fit In?

Exness provides several account types, each with distinct features. To determine if it’s an ECN broker, we’ll focus on how orders are executed and whether they align with ECN principles.

1. Standard Accounts (Standard and Standard Cent)

Execution Type: Market Execution

Spreads: Floating, starting from 0.3 pips

Commission: None

Minimum Deposit: $1 (varies by region)

The Standard and Standard Cent accounts are designed for beginners and casual traders. They use market execution, meaning Exness processes your orders internally or through its liquidity pool. While spreads are competitive, there’s no direct market access here. This setup leans toward a market maker model, not ECN.

2. Professional Accounts (Pro, Raw Spread, Zero)

Exness’s Professional accounts are where things start resembling ECN territory. Let’s explore each:

Pro Account

Execution Type: Instant or Market Execution (varies by instrument)

Spreads: Floating, starting from 0.1 pips

Commission: None

Minimum Deposit: $200 (varies by region)

The Pro account offers tight spreads and fast execution, appealing to active traders. However, the lack of commissions and the use of instant execution for some instruments suggest it’s not a pure ECN account. It’s more of a hybrid with market maker tendencies.

Raw Spread Account

Execution Type: Market Execution

Spreads: Floating, starting from 0.0 pips

Commission: Up to $3.50 per lot per side

Minimum Deposit: $200 (varies by region)

Now we’re getting closer. The Raw Spread account offers ultra-low spreads and charges a commission—hallmarks of an ECN model. Orders are routed to liquidity providers, giving you direct market access. This account mimics ECN conditions, though Exness doesn’t explicitly call it an “ECN account.”

Zero Account

Execution Type: Market Execution

Spreads: 0.0 pips on 95% of the trading day for major pairs

Commission: From $0.05 per lot per side (varies by instrument)

Minimum Deposit: $200 (varies by region)

The Zero account takes it a step further with consistently zero spreads on major pairs and a commission structure. Like the Raw Spread account, it connects you to the interbank market, aligning closely with ECN principles.

💥 Trade with Exness now: Open An Account or Visit Brokers

Does Exness Offer a True ECN Account?

Exness used to offer an explicit “ECN Account” with a $300 minimum deposit, tight spreads, and commissions. However, as of 2025, this specific account is no longer listed on their website. Instead, the Raw Spread and Zero accounts have taken its place, offering ECN-like conditions without the ECN label. So, while Exness doesn’t currently advertise a standalone ECN account, its Professional accounts (especially Raw Spread and Zero) operate with ECN characteristics.

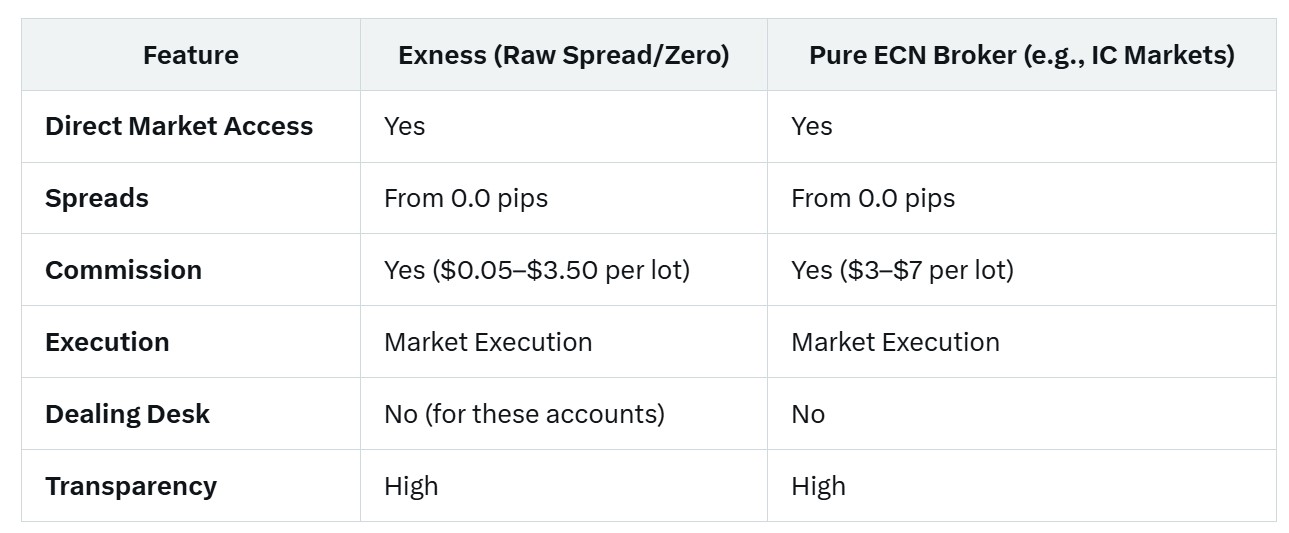

Comparing Exness to True ECN Brokers

To solidify our understanding, let’s compare Exness to brokers widely recognized as pure ECN providers, like IC Markets or Pepperstone.

Pros and Cons of Trading with Exness as an “ECN-Like” Broker

Pros

Competitive Spreads: Starting at 0.0 pips, Exness rivals top ECN brokers.

Low Commissions: Compared to pure ECN brokers, Exness’s fees are reasonable.

Fast Execution: Ideal for scalpers and day traders.

Flexibility: The hybrid model suits both novices and pros.

Regulation: Oversight from FCA, CySEC, and others ensures trust.

Cons

Not Pure ECN: The lack of a dedicated ECN account might disappoint purists.

Hybrid Confusion: Beginners may struggle to understand the execution differences.

Higher Minimum Deposits: Professional accounts require $200+, unlike the $1 Standard option.

Why Does It Matter If Exness Is an ECN Broker?

You might be wondering: why does this classification matter? It boils down to your trading style and priorities.

Scalpers and Day Traders: ECN-like conditions (low spreads, fast execution) are critical for quick, high-volume trades.

Long-Term Traders: A market maker model might suffice, as execution speed is less of a concern.

Transparency Seekers: If you hate hidden fees or broker interference, ECN execution offers peace of mind.

Exness’s hybrid approach gives you options. If you want ECN benefits, opt for Raw Spread or Zero. If simplicity is your goal, stick with Standard.

How to Verify Exness’s Execution Model Yourself

Still unsure? Here’s how to confirm Exness’s execution for yourself:

Check the Client Agreement: Exness’s terms outline execution methods by account type.

Review the Order Execution Policy: Available on their website, this details how trades are processed.

Contact Support: Exness’s 24/7 customer service can clarify any doubts.

Test with a Demo Account: Open a Raw Spread or Zero demo to experience the execution firsthand.

Exness’s Technology: Supporting ECN-Like Trading

Exness invests heavily in technology, a key factor in delivering ECN-like performance. Its servers are strategically located near major financial hubs, minimizing latency. The broker also offers MT4, MT5, and its proprietary Exness Terminal, all of which support fast, reliable order processing—crucial for ECN-style trading.

What Traders Say About Exness

User feedback provides real-world insight. On platforms like Trustpilot and Forex Peace Army, Exness scores high for spreads, execution speed, and withdrawals. Some traders praise the Raw Spread account’s ECN-like conditions, while others note the hybrid model’s versatility. However, a few criticize the lack of a clear “ECN” label, reflecting the purist debate.

Is Exness Right for You?

So, is Exness an ECN broker? The answer is yes and no. It’s not a pure ECN broker across the board, but its Raw Spread and Zero accounts offer ECN-like execution with direct market access, tight spreads, and commissions. This hybrid setup makes Exness a versatile choice, bridging the gap between market maker simplicity and ECN precision.

💥 Trade with Exness now: Open An Account or Visit Brokers

If you’re a scalper or high-frequency trader, the Professional accounts align with your needs. If you’re new to trading or prefer a no-fuss approach, the Standard accounts are a better fit. Ultimately, Exness’s blend of reliability, technology, and flexibility makes it worth considering—ECN or not.

Ready to explore Exness for yourself? Sign up for a demo account and test its trading conditions firsthand. Whether you’re chasing ECN perfection or just a solid broker, Exness might just be the partner you need.

Read more: